Charts and caffeine: What the RBA's 50bp hike means for Big Four and REIT investors

Welcome to another edition of Charts and Caffeine - our daily markets wrap featuring the best charts and reads from across Livewire's team of experienced journalists and editors. Let's get you caught up on the overnight session.

MARKETS WRAP

- S&P 500 - 4,116 (-1.08%)

- NASDAQ - 12,615 (-0.76%)

- CBOE VIX - 24.79

Shares of Credit Suisse rose nearly 4% in Zurich despite the bank issuing a profit warning for the second quarter, citing tighter monetary policy and the war in Ukraine. Alibaba ADRs in New York were up 15%, due in large part to a boost in sentiment around Chinese tech regulation.

In contrast, Intel dropped more than 5% after management warned of weakening demand for semiconductors at an industry conference. Citi analysts took an even more bearish view - arguing this is exactly what's happening in their "bear case".

- STOXX 600 - 440.36 (-0.57%)

- US10YR - 3.025%

- GOLD - US$1855/oz

- WTI Crude - US$122/bbl (+2.5%)

- NATURAL GAS - US$8.65 (-6.9%)

ECB PREVIEW

It's a huge week for macro and the European Central Bank meeting held later tonight will kick things up a notch. Inflation is extremely hot in the Eurozone (8.1% in May alone, if you believe the preliminary figures released last week.) The latest read on unemployment on the continent was a relatively healthy 6.8%. Now that you know that, I pose you this question:

Why is the ECB continuing to flood the market with stimulus?

Yes, that's right. The European monetary authority is still buying bonds through its PEPP program. It's not given a clear sign as to when it will also end that program. Having said this, if it ends the buying scheme tonight, then a rate hike is coming in July.

There is an even bigger uncertainty brewing - ECB Chief Economist Philip Lane has stated that the first rate hike should be be a 25 basis point rise. However, Deutsche Bank, Bank of America and even board member Klass Knot argue rates should be raised by 50 basis points because of rampant inflation. We should get some clues on that this evening.

THE STAT

US$140/bbl: The new price forecast for Brent crude through the June to September quarter from Goldman Sachs

The biggest headache for the ECB is soaring producer prices - which in turn, are affected by the cost of necessities like energy and food. Remember, these are things that a central bank cannot control. This forecast from Goldman Sachs won't help the cause.

THE CHART

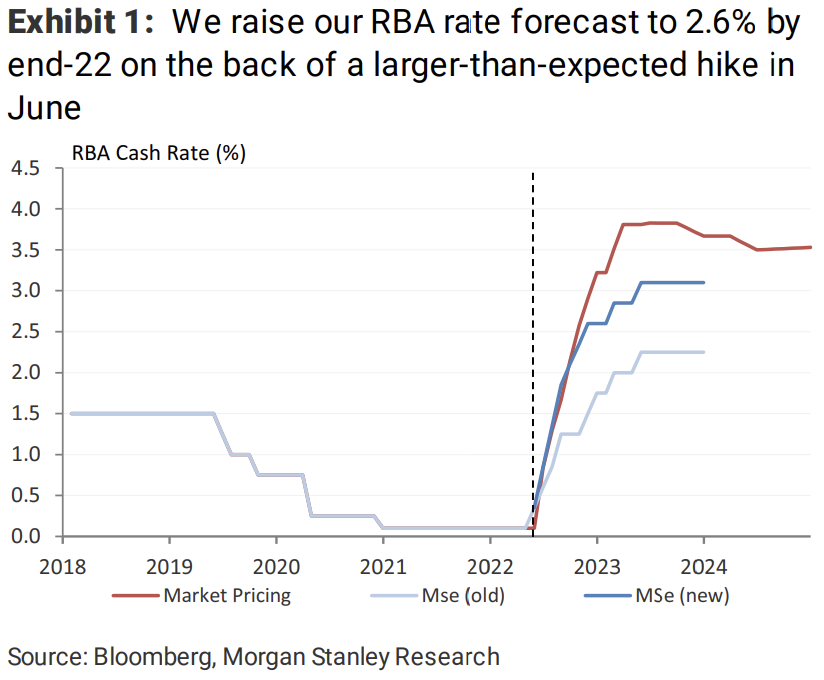

Speaking of central banks, the RBA's own outsized hike shocked just about every economist including Chris Read at Morgan Stanley. As a result of the 50bp hike and the retirement of the bank's "steady" narrative, the team has sharply moved up its end-of-year rate forecast to a level much closer to market pricing. Now THAT's punchy!

STOCKS TO WATCH

The larger-than-expected rate hike from Martin Place sent cash rate-sensitive share prices far south. All the Big Four bank share prices struggled in the aftermath, as did the REITs.

On the Big Four banks, Morgan Stanley moved to a cautious stance in April flagging the possibility of such outsized moves. In short, they see more challenges for the major banks ahead from a quick and aggressive tightening cycle compared to a gradual and measured tightening cycle. They neatly summarised their view this way:

We recently took our bank model portfolio positioning from overweight to underweight... While the start of the RBA hiking cycle should present a margin expansion opportunity, the quantum and pace of hikes make this a small prize against the risks that we see potentially building in the economy.

The brokers have an underweight on Commonwealth Bank (ASX:CBA), equal weights on ANZ (ASX:ANZ) and NAB (ASX:NAB), and overweight on Westpac (ASX:WBC).

UBS flagged that their view towards the sector had ‘evolved’ since 1H22 – in other words, they’ve changed their mind and have now turned more cautious. You can read more about that in James Gerrish's The Match Out from yesterday.

And we all thought rate rises would be great for bank margins, right?

Macquarie's team in contrast has pulled the rug from under part of the REITs sector - launching three downgrades and three upgrades.

Arena REIT (ASX:ARF) gets an overweight on policy tailwinds from cheaper childcare under the Albanese government. With the return of more foot traffic to physical retail, the brokers have upgraded Scentre Group (ASX:SCG) and Vicinity Centres (ASX:VCX). However, they did not apply the same love to GPT Group (ASX:GPT) - arguing their interest payments will be a bigger headwind. Finally, Charter Hall Long WALE REIT (ASX:CLW) receives a downgrade on valuation grounds despite it being called best in class.

THE QUOTE

The pain of that will become great and that will force the central banks to ease again, probably somewhere close to the next presidential elections in 2024. (Bridgewater Associates' Ray Dalio speaking to Matthew Cranston of the AFR.)

So with all this chatter around rate hikes, is it too soon to be talking about rate cuts? Not for Ray Dalio if you believe his comments in the AFR. He argues the tightening cycle is creating an environment of stagflation - which in turn, will have to mean central banks cutting rates again by 2024.

Someone who does agree with Mr Dalio is Gareth Aird at the CBA. Aird argues we'll see rate cuts from the RBA by the end of 2023. Too soon?

BEST READS IN BUSINESS NEWS

Better.com CEO Who Fired Workers in Zoom Call Now Faces Whistle-Blower Lawsuit (Bloomberg): The company that told 900 workers they were fired over a zoom call has now received a bombshell with a former senior executive alleging that CEO Vishal Garg misled investors in financial filings and other representations it made as it attempts to go public. This is the same company that told its employees that they were "TOO DAMN SLOW" and raised hundreds of millions via a SPAC deal.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

11 stocks mentioned

1 contributor mentioned