Charts and caffeine: Why Citi has a buy on these 10 ASX retailers

Welcome to Charts and Caffeine - our daily markets wrap featuring the best charts and reads from across Livewire's team of expert editors. Let's get you caught up on the overnight session.

markets wrap

US MARKETS CLOSED FOR THE MEMORIAL DAY LONG WEEKEND

- FTSE 100 - 7,600 (+0.19%)

- STOXX 600 - 3,841 (+0.86%)

- USD INDEX - 101.34 (-0.33%)

- US 10YR - 2.74% (unch)

- GOLD - US$1,857.30/oz

- BRENT CRUDE - US$117.70 (+0.09%)

stocks wrap

US stocks were closed for the Memorial Day long weekend but the reopening of the Chinese economy (along with light trading volumes) allowed luxury and tech names in Europe to lead the gains.

the calendar

It's a fairly quiet day on the data docket locally but for those who watch GDP as much as I do, there will be some key statistics (or as my good friend Annette Beacher would call it, puzzle pieces) for tomorrow's print at 11:30 am.

There are also some minor inflation prints out of Europe - including France, Italy, and indeed, the flash estimate for the entire Eurozone.

In Germany, the inflation problem is already well entrenched. The May flash print, released last night, showed an 8.7% month-on-month increase. The print is the highest since 1974 and came in well ahead of expectations. Talk about pressure on the ECB!

Speaking of the Eurozone, ANZ Chief Economist Richard Yetsenga had this to write in his weekly note yesterday which caught my attention.

Accelerating inflation suggests the European Central Bank is likely to begin its rate cycle in July and increase rates by 100bp by year end. There is even upside risk on this.

Upside risk to a 100 basis point tightening cycle? Talk about this time is different!

stocks to watch

Today, I thought we'd take a deep dive into the retailers. Friday's retail sales print in Australia showcased the strength (and resilience) of consumer pockets. But as you'll see in our next section, while the theme is global, not all companies are ready to respond.

In a recent note, Citi's Adrian Lemme and James Wang noted there are headwinds for the Australian consumer however the strength of said consumer is also understated.

Going forward, both analysts believe food retailing will normalise (sustained work from home demand to be offset by input inflation) while fewer lockdowns should mean the sustainable return of brick and mortar retail (although foot traffic has stalled).

That bullish reasoning must explain why they have a buy rating on ten (yes, you read that right) retailers. They are:

- Coles (ASX: COL)

- Woolworths (ASX: WOW)

- Super Retail (ASX: SUL)

- Harvey Norman (ASX: HVN)

- Nick Scali (ASX: NCK)

- Beacon Lighting (ASX: BLX)

- Premier Investments (ASX: PMV)

- City Chic (ASX: CCX)

- Lovisa (ASX: LOV)

- Michael Hill (ASX: MHJ)

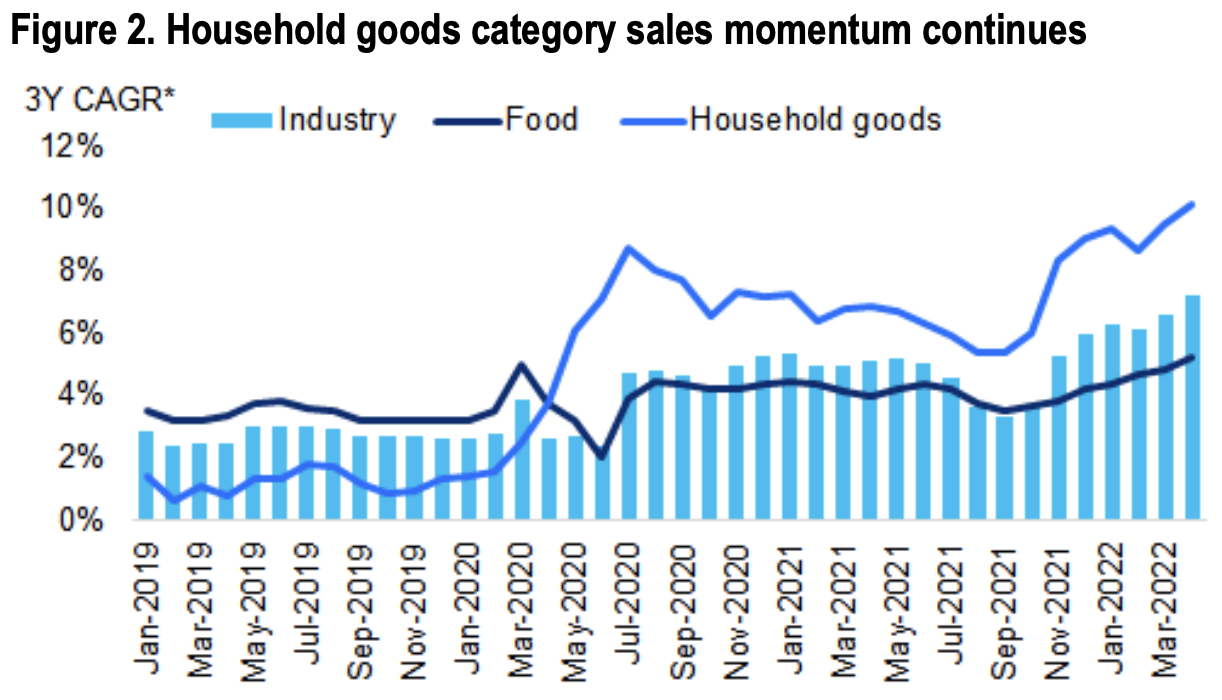

On the points around HVN, NCK, and BLX, they point to continued sales momentum for household goods relative to the industry as a whole. This chart backs up their thesis.

Finally, a quick note on Bubs (ASX: BUB) whose share price soared yesterday on news it had secured a supply deal with the Biden administration. I noted this as a stock to watch in the very first edition of Charts and Caffeine - and look at it go now!

the charts

Now that we have talked about Australian retail companies, it's only right that we expand the conversation to the retailers themselves. To do this, I've borrowed two charts that demonstrate how difficult it is to keep up with soaring demand. In a previous article, I noted that supply chains continue to remain strained for just about anything from cars to furniture. The effects of that could manifest in higher capital costs - or as Fidelity has called it, reglobalisation.

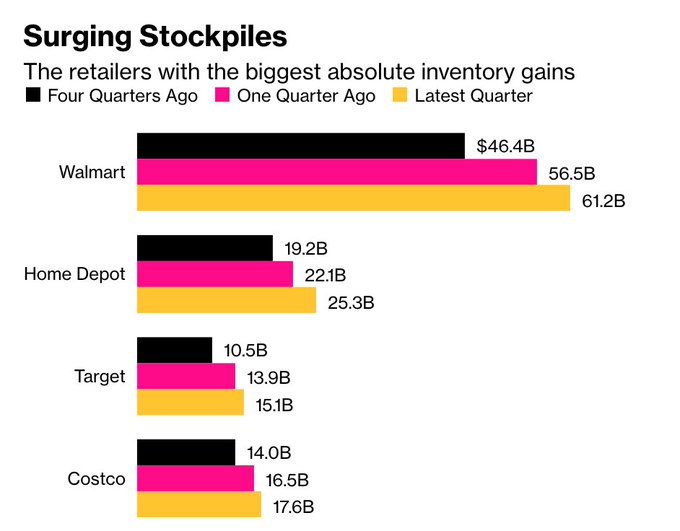

With that in mind, let's take a look at two charts that tell the whole story - starting with American retailers and their inventory levels. The bar chart below shows the four largest in their respective fields - and the value of the stock they are holding onto. Unfortunately, these purchases were made with the consumer of three months or even a year ago in mind.

Now the consumer has moved on, there may be an impact on earnings on the way as these companies offload that same stock.

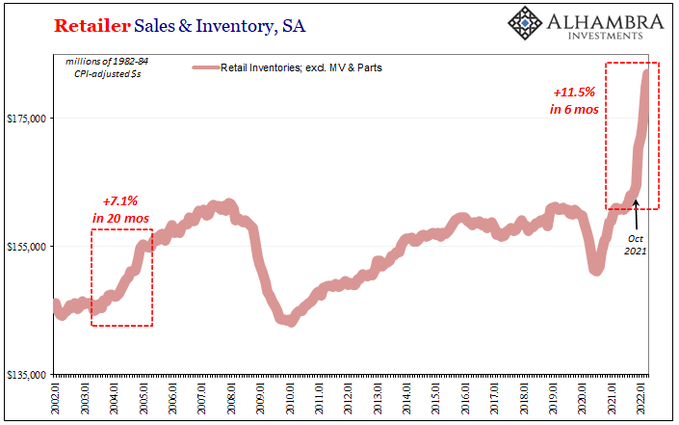

Now, take a look at the second chart. The same theme can be seen here, but as Jeffrey Snider of Alhambra Investments points out, it's not all about prices. It's also about volume - and most importantly, timing.

As Jeffrey points out:

While goods continue to surge into the US supply chain, more and more it looks like consumers just may have exhausted themselves ... Americans are earning more in their paychecks, collectively among the fewer who are working (compared to 2019), but it’s not keeping up with prices. Earning somewhat more, paying a lot more, all to get slightly less for the round trip.

His entire reasoning can be followed through this link. I highly recommend the read.

the tweet

Carl's not wrong, is he? Musk did the bulk of his promoting cryptocurrencies during the boom (remember Shiba Inu?) and Tesla was hot until the great valuation reset of 2022. The Shanghai lockdowns have only added to the challenge of delivering on vehicle promises. It will be fascinating to see how Elon turns this story around, but now in a borderline recession.

the best in business news

Five maps that show why China’s Pacific pivot is alarming (AFR): I love an explainer and these five maps tell me a lot of the biggest story of our times. Not just why the experts have called this century the "Asian Century" but more importantly, how we are going to have to learn to live with it all.

Is the 60-40 portfolio model still relevant? (Livewire - Glenn Freeman): This piece from my colleague Glenn is dedicated to challenging a theme that has been around for a long time. Is the simple recipe for constructing a portfolio no longer applicable?

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

5 topics

11 stocks mentioned

1 contributor mentioned