Chinese policy brings cobalt into focus

Electric Vehicles (EVs) and their mass-market rollout plans continue unabated, with nearly all the major auto manufacturers either ramping up, building or expediting plans for large scale EV roll out. Fourteen megafactories are being built globally, with more planned by Tesla, VW and others across the globe. The global EV battery market is set to grow strongly to $40b+ by 2025, where China’s EV battery market is likely to triple to represent half of this at $20b+ by 2025. In 2016, ~777k Electric and Hybrid vehicles were sold, up over 40% on 2015 and still representing a mere <1% of the ~82m new cars sold globally in 2016.

Tesla is important and grabs most of the EV headlines, but it’s much more about China. China, the world’s largest auto market (#1 selling ~27m cars in 2016 vs. #2 the USA at ~18m) is driving a material move towards EV as part of its efforts to combat pollution. Driven by demand for EV and government support via its aggressive subsidy programs, China EV sales alone are well placed to rise from 507k in 2016 to 3m p.a. by 2025.

China policy shift set to bring Cobalt to the fore

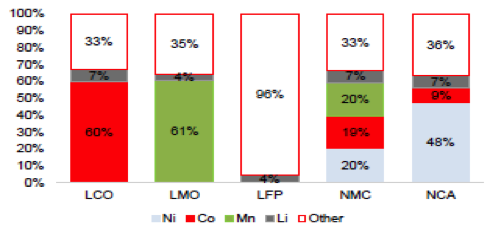

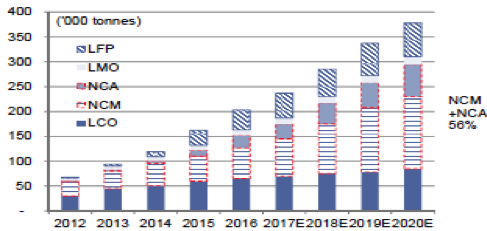

Recent China EV & E-bus policies set out in January 2017 confirmed and prioritised higher battery quality technologies - specifying high specific energy and better driving range. This should see a decline in use of Lithium-Iron-Phosphate (LFP) - the current prevailing EV battery in China. The major opportunity as we see it is the subsequent move toward Nickel-Cobalt-Aluminium (NCA) and Nickel-Cobalt-Manganese (NCM) battery chemistries. Cobalt is set to become as integral in the battery Cathodes as Lithium, as shown in Figure 1 below.

Figure 1: Composition of major battery Cathodes

Source: Avicenne, Macquarie

Note NCA and NCM battery technologies are already being used by Tesla, BMW and other leading car manufacturers.

Figure 2. Lithium & cobalt-rich NCM & NCA batteries to gain market share

Source: B3, Easpring, Gao Hua Securities Research, Goldman Sachs

Push to secure critical raw materials supply

Many leading economic groups forecast EV annual global sales to achieve 8-10% market share by 2025. This would require the current ~200ktpa Lithium market (~US$2b p.a.) to triple and the current ~100ktpa Cobalt market (~US$3b p.a.) to more than double. The race for securing these key raw materials is on. We have seen several major Lithium-ion battery players across the value chain pursue positions in related resource projects so as to secure critical raw materials supply. With the Lithium market looking to go into deficit first, we invested in various Lithium stocks ahead of the Lithium contract price more than doubling to US$12,000/t.

The Lithium market has remained undersupplied, with the supply response not satisfying the strong demand growth. Many new projects struggle to achieve target production (as evidenced by Orocobre’s Olaroz and Neometals/Mineral Resources/Ganfeng’s Mt Marion recent production downgrades). Other new supply-side hopefuls remain unfunded and uncommitted. With Cobalt industry deficits now anticipated well before the end of the decade, it has followed Lithium’s price dynamic. The Cobalt price has come off historic lows and since December 2016 has doubled to US$50,000/t+, already high enough to incentive new supply. Note Cobalt’s previous high was in 2007 at US$110,000/t.

Cobalt is primarily produced as a by-product from nickel or copper deposits. There are limited new supply projects globally. Of the list of new hopefuls, very few will be financed and built as will fail on the usual resource development issues – resources lacking scale, complex resource geology and processing requiring outsized capex, making most uneconomic or lacking the management credibility to finance and develop. With limited equity exposures, financial investors are taking physical positions in the metal, adding to the upside pressure in Cobalt prices.

Clean TeQ the stand-out Cobalt exposure

Clean TeQ is developing its world class Nickel, Cobalt & Scandium Syerston project in NSW, a bonus given around 2/3 of global Cobalt supply comes from the DRC. End users are busily pursuing security of supply, preferably outside of the DRC where mining concerns over social and environment impacts are large, and sovereign risk are high. Clean TeQ management is first class. (For those of you not familiar with Robert Friedland, we highly recommend reading “The Big Score: Robert Friedland, INCO, And The Voisey's Bay Hustle”). Clean TeQ is set to become one of the largest and lowest cost suppliers of key cathode raw materials to the lithium-ion battery market, where Syerston will produce a Nickel and Cobalt Sulphates, key ingredients to NCM and NCA batteries. Scandium will also be produced, a critical lightweight alloy required in Aerospace industries. We invested in Clean TeQ at the start of December at $0.50/sh and our investment case (base-case NPV of ~$2/sh fully diluted for all funding) was materially derisked recently. They secured an $81m placement at $0.88/sh to Pengxin Mining of China (Shanghai-listed, ~US$3b market cap), who will help Clean TeQ secure project funding for its Syerston development.

4 topics

4 stocks mentioned