Citi is buying stocks again (and it’s all thanks to AI)

"AI may continue to remain a kicker, given that it is not far enough developed [sic] to disappoint expectations yet. Given that AI is mostly a US mega large cap theme, this should also reduce the risk of any US underperformance."

In this wire, I’ll share the latest changes to Citigroup’s model portfolio which includes some major changes in favour of risk assets.

Key changes:

- Upgrading US equities from underweight to neutral, favouring tech, healthcare, consumer staples, industrials, and energy stocks.

- Downgrading its view on Chinese and Eurozone equities.

- Closing its long position on precious metals, maintaining a neutral rating on energy and base metal investments.

Macro disappointments

For starters, Chinese data has been very soft. The Xi administration is targeting a 5% growth rate but it may find it difficult to achieve that if youth unemployment remains where it is at the moment - 20.4%. And although industrial output is rising, corporate profits fell 20% between January and April this year.

What does it all mean for asset allocation?

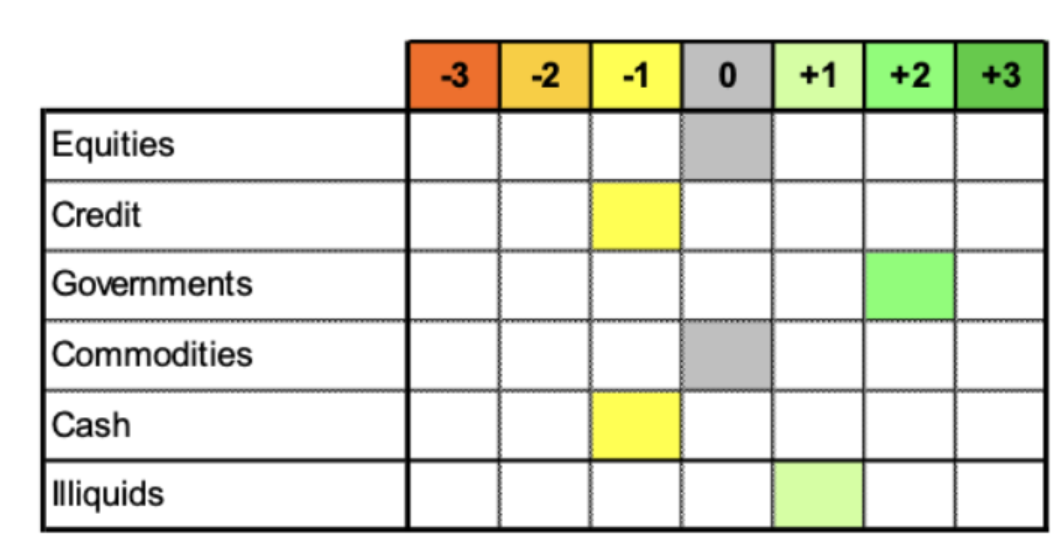

The all-important overweight/underweight table. (Source: Citi)

In short, the disappointing data from economies abroad has given the team a green light to reallocate capital towards the US. They remain overweight US real rates, which is in turn, an overweight position on nominal rates (these are the US yield prints you see on TV).

“Given widely held bearish views, and the fact that we are still in the bad news is good news regime, we would imagine that an end of the Fed hiking cycle, not driven by a crisis situation, would be bullish for US equities.”

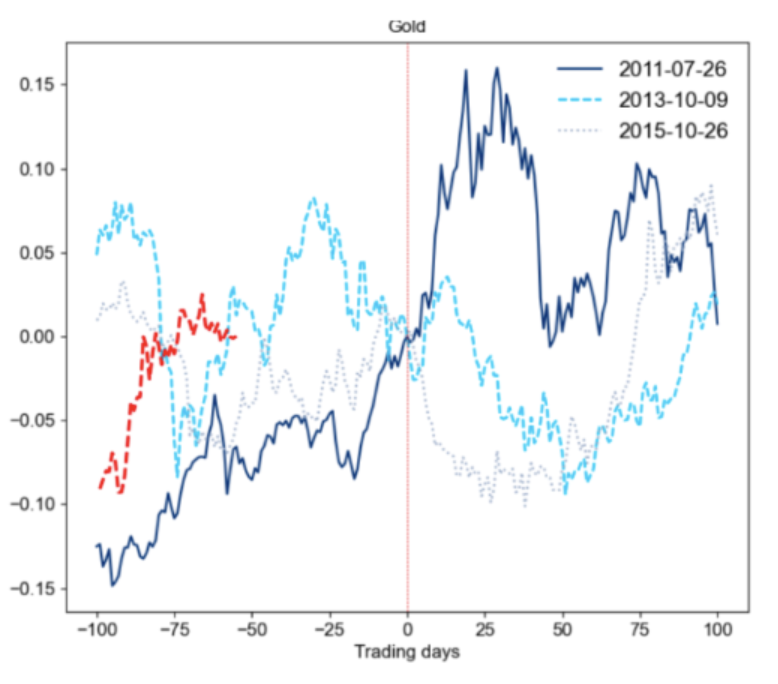

Gold is not a strong performer, following the resolution of debt ceiling debates. (Source: Citi)

“There is a risk that further Fed cuts get priced out of the front-end, resulting in a stronger USD which will continue to weigh on gold in the short-term, especially in a context where both Chinese and European growth have been disappointing.”

Finally, the team continues to remain long government bonds and underweight on most parts of the corporate credit market. Over the last few months, credit investments have not benefited as much as equities from the perceived fading of the banking turmoil, and the more dovish Fed.

The AI trade

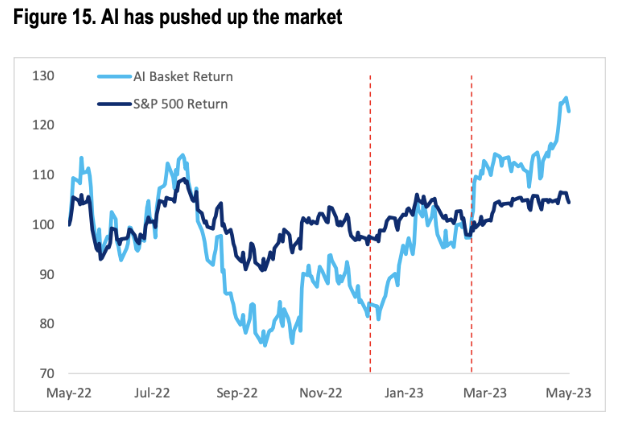

It is this chart that explains why analysts have moved US equities back to NEUTRAL. The huge weight of AI and tech stocks on US indices means you cannot afford to miss the rally.

“While price moves for AI related stocks have clearly been extreme, especially at a time when monetised use cases are still in the future, and with barriers to entry not overly high, we would still expect that it is too early to fade the moves before AI has even developed far enough to be able to disappoint expectations.”

There is also, in true 2023 fashion, a stock with the ticker code AI (NASDAQ: AI) but Citi does not cover it.

3 topics

7 stocks mentioned