Citi turns bearish on the Big Four Banks. Here's why.

Citi says the share price performance of the Big Four Banks will be increasingly pressured by a myriad of hazards including higher funding costs, elevated cost growth and declining earnings.

“We believe the current set of price-to-earnings are not reflective of the growth and risk profile and, thus we no longer have any Buy recommendations amongst the Major Banks,” analysts including Brendan Sproules and Thomas Strong said in a note last Friday.

Bank Reporting Season Summary

Banks have displayed remarkable resilience in share price performance, outperforming the ASX 200 by approximately 5% over the past six months. Citi analysts attribute this strength to strong capital returns and “surprisingly benign asset quality.”

“Near-term strong capital returns seem to be supporting the share prices — During this reporting season, we witnessed better than expected ordinary dividends from WBC and NAB, an unexpected unfranked special dividend from ANZ, as well as both Macquarie and WBC announcing $2bn and $1.5bn new on-market buybacks, respectively,” the analysts said.

You can check out some of our bank reporting season coverage here:

- Everything you need to know about Westpac’s FY23 results

- NAB FY23 profits top analyst expectations, growth to slow

- ANZ shares tumble as full-year profit misses expectations

- CBA first quarter profit flat on weaker margins and deposit competition

Reporting Season Takeaways

#1 – Dividends, buybacks and low bad debts

Unexpected capital returns have been the primary driver of outperformance for the banking sector, according to Citi. Both current and forward-looking metrics have defied the anticipated impact after ~400 bps in interest rate hikes.

In contrast, other traditional high dividend-paying sectors like resources, REITs, and retail have lagged behind, with many underperforming due to slowing economic growth, rising borrowing costs, and restrained consumer spending.

“For retail investors, we expect there has been a switch towards the banking sector as a producer of strong and, for now seemingly stable distributions of capital, away from these other sectors as the market has stalled,” the analysts said.

#2 – Rising rates make bank yields unattractive

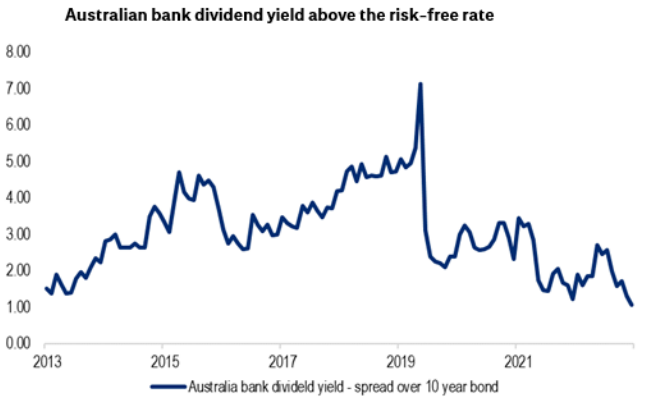

“The recent increase in the long end of the yield curve, a proxy for bank deposit pricing, has approached the ~5% level … this is the highest risk-free rate achievable in the Australian market for more than a decade,” note the analysts.

The difference between term deposits and Australian bank dividend yields has fallen to levels not seen since 2013 – at just 100 bps.

“At this juncture, we expect a range of investors would be examining the risk/reward dynamics, particularly the narrow compensation for taking equity risk at this juncture in the cycle … we expect the recent flow of funds towards this sector will start to slow as we enter the new year,” the analysts said.

#3 Revenue growth to decline for longer than expected

The banking sector faces a significant challenge in the form of subdued revenue growth, according to Citi. This challenge stems from the current competitive pricing environment known as the ‘mortgage war’ to win new borrowers, which is taking place against a backdrop of rising deposit and funding costs.

ANZ’s second-half performance "succinctly" highlights the revenue challenge (the below figures compare the September 2023 half versus March 2023 half):

- Mortgage lending rose 4.0% as ANZ continued its market share strategy

- Customer deposits rose 5% on competitive term deposits and growth in their new ANZ Plus product

- But total revenue down 7% and cash profit down 17%

"In time, we think the oligopoly will begin to restore itself. However, for the time being, the current mortgage pricing dynamic is set to keep revenue weak or in some cases declining," the analysts said.

Putting It All Together

For the first time since March 2020, there are no Buy recommendations amongst the Big Four Banks. “The current set of PEs are just not reflective of the growth and risk profile of these stocks on a 12-month view,” the analysts said.

Citi is Neutral rated on: Westpac Bank (ASX: WBC) and ANZ (ASX: ANZ).

While Sell rated on: NAB (ASX: NAB) and Commonwealth Bank (ASX: CBA).

This article was first published on Market Index.

4 topics

4 stocks mentioned