Closing our underweight to domestic equities

Following a 30% fall in the S&P/ASX 200 index, Crestone has moved moving its underweight domestic equities allocation (-2%) to neutral (0%). This has been funded from our recent overweight to cash (+2% to 0%). Despite the significant uncertainty that the COVID-19 outbreak is causing consumers, small businesses and governments, this current pullback is now the fastest ‘bear market’ in history (defined as a 20% fall from a market peak). Although investors have seen bigger drawdowns, it is now around 60% of the way to a GFC-style drawdown. Significantly, for investors who have been adhering to Crestone’s tactical asset allocation (TAA), those investors would have seen their domestic equity allocation drift to 8-9 percentage points below the prescribed benchmark if they have not been averaging into this correction.

At this point in time, given the balance sheet strength of Australian corporates (deleveraging into this crisis, with net debt to EBITDA of ~1.8x versus re-leveraging into the GFC with net debt to EBITDA of ~2.1; interest coverage ratios of ~5.8x versus ~4.8x at the time of the GFC) and the ‘unquestionably strong’ capital levels of the Australian banking system, it seems reasonable to suggest that, whilst a short recession is increasingly likely, a more severe (and potentially long drawn out) financial crisis does not look probable. Furthermore, Australia moved relatively quickly to contain the virus, was quick to announce and launch a fiscal stimulus response and has the ability to embark on extraordinary monetary policy measures for the first time.

It should be noted, however, that this decision does not necessarily imply we believe the trough in domestic equities (nor global) has been reached. What it does suggest is that, as we approach the point of maximum pessimism, investor psychology will likely make it difficult for them to add to equity exposure. But we believe selectively adding exposure to high quality, lowly geared domestic equity names with stable earnings streams over the next three to six months will result in attractive longer-term returns.

Although the earnings outlook remains uncertain, one-year forward valuations are now at ~13x, back to June 2013 levels. Although still well above crisis lows (such as the 10x during the Eurozone crisis), there is scope for valuations to trough above previous lows given much lower interest rates (10-year bond yields at 1% versus 4% in 2013). The S&P/ASX 200 dividend yield is now at 5.5%, peak levels this decade. The current price to book of 1.54 is marginally above the 1.5x Eurozone trough and 1.43x GFC low. All these valuation metrics suggest that, although the outlook is uncertain, equity markets have quickly moved to price in a very negative scenario. Clarity on a number of the issues listed below would go a long way to supporting a more aggressive stance towards domestic equities. At a sector level, there are a number of industries that, although affected to some degree, will nonetheless prove either a beneficiary of current conditions (e.g. supermarkets, Australian exporters of consumer goods to China, such as infant milk formula and healthcare companies), or more prone to a strong rebound once conditions return to some level of normality (e.g. toll road operators, gaming companies, mining companies).

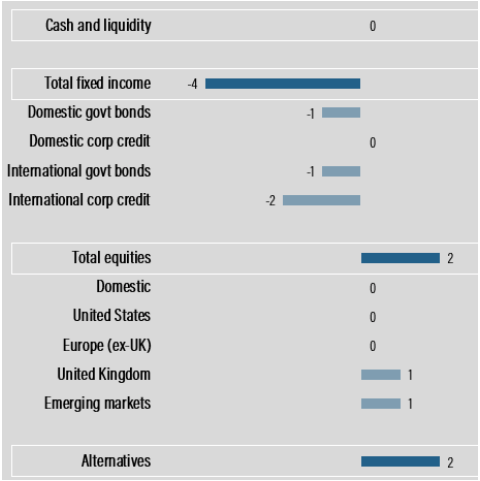

Overall, Crestone’s TAA is now modestly overweight equities, consistent with progressively adding to risk assets during periods of uncertainty and stress. In large part, this also reflects the protection afforded to portfolios during times such as this by other asset classes, such as bonds and alternatives. We remain underweight international credit where there is potential for stress to be further reflected in coming weeks.

What should investors be looking for?

So, what should investors be looking for in terms of adding more aggressively to their domestic and international equity exposures:

1. Central bank ‘panic’—This is already occurring, with the US Federal Reserve (Fed) having conducted two emergency inter-meeting interest rate cuts of 50bps and 100bps and announcing further quantitative easing. Other central banks have also eased policy (the Reserve Bank of Australia has cut rates to 50bps and announced that it stands ready to buy bonds) and promised specific action to ensure the availability of credit to industries most at risk during the COVID-19 outbreak.

2. Government ‘panic’—This is already occurring, with calls overnight from both Democrats (Chuck Schumer) and Republicans (Mitt Romney) for large scale fiscal stimulus. The International Monetary Fund has also pledged to use its USD 1 trillion in lending facilities to backstop the world economy. In Australia, the Morrison-led government has already announced a first round of fiscal stimulus, totalling AUD 17.6 billion or 1.2% of GDP and is said to be preparing a second package over coming weeks.

3. A stabilisation or reduction in credit spreads, particularly high yield—Credit spreads have widened on both investment grade and high yield but remain below previous crisis levels. Central banks are taking actions to specifically lower spreads to corporates, and success on this front would significantly limit downside risk for equities.

4. A reduction in volatility—Overnight the market’s key volatility index (VIX) closed above 80, higher than where it did during the GFC. In itself, this has not marked a trough in equities. As volatility subsides investors will be looking for the subsequent spike in volatility to be less than it is now, which would be suggestive that the market is more easily absorbing negative news.

5. The market does not fall on negative economic data—Unfortunately, we are yet to see the extent of the supply and demand side impact of COVID-19 (nor the oil price crash) on economic data. As this comes through over the next few months the reaction function of investors will be an important signal as to whether this data has been priced by markets.

6. COVID-19—Clearly this is the most immediate source for a change in investor sentiment. China and South Korea have proven that, once the number of new cases is contained, economies are quick to resume to some sense of normality. For now, given the speed of pre-emptive containment through Europe and the US, it is likely that we continue to see the number infected increase. If countries like Italy, Spain, France and, in particular, the US, are able to contain the spread it will be a positive backdrop for risk assets. Alternatively, news that a viable vaccine or drug combination is successful in treating or managing the virus would be viewed positively by markets.

7. Oil—Equity markets have suffered from two ‘black swan’ events in the space of a few months, with the inability of OPEC+ to reach an agreement on production cutbacks resulting in a 50% correction to Brent crude. This has significant ramifications for sovereign fiscal balances and credit markets. Evidence that Saudi Arabia and Russia are willing to stabilise the oil market would help to cushion stresses in the energy credit market.

This list is by no means exhaustive and indeed, the ‘panic’ by governments and central banks now seems to be in train. As the other indicators evolve, our equity allocation will be adjusted accordingly.

Our new tactical asset allocations

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offer one of the most comprehensive and global product and service offerings in Australian wealth management. Click 'contact' below to find out more.

1 contributor mentioned