Commodities are in a bullish supercycle now

Trovio

The ongoing global pandemic caused by the COVID-19 virus has led market participants to re-evaluate their portfolios and market strategies, especially as global equity markets have witnessed a lot of uncertainty since the onset of the pandemic in December 2019.

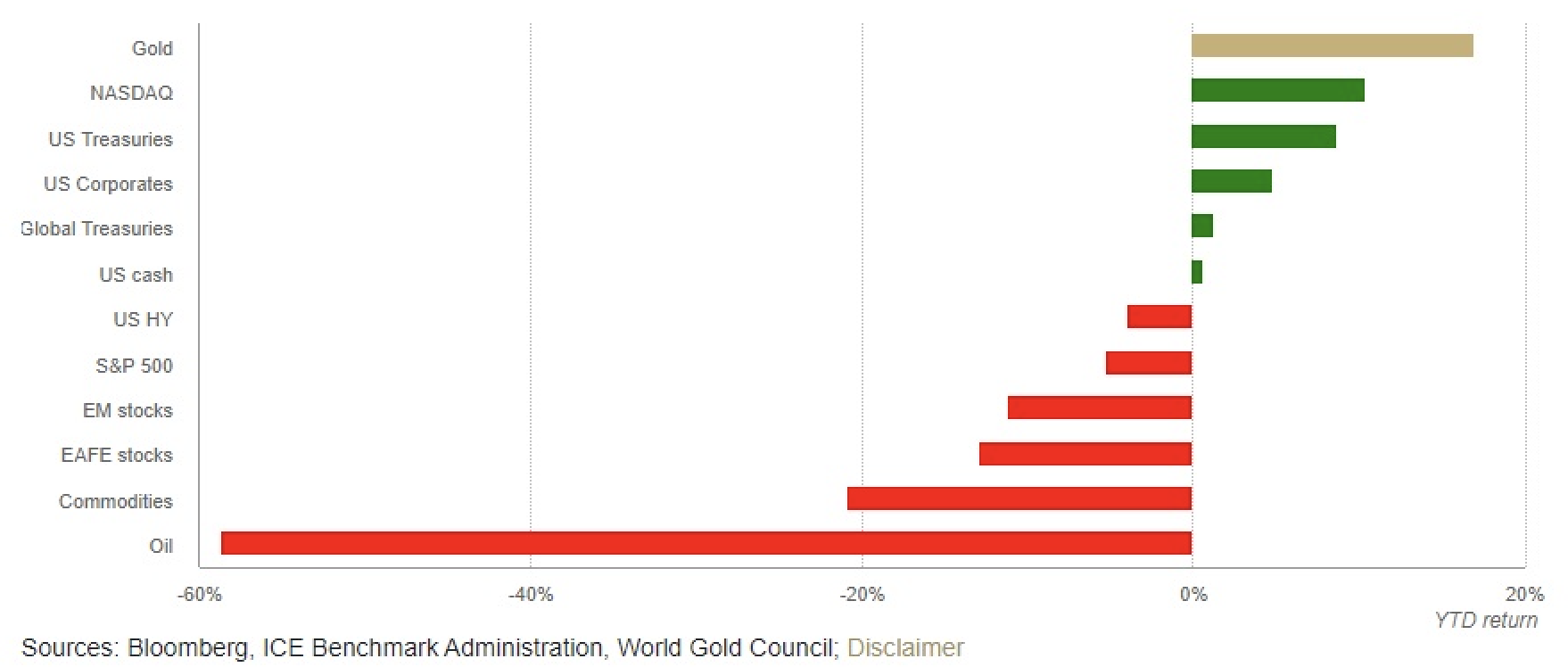

In contrast, 2020 was not a bad year to invest in commodities. Gold is an asset often seen as a reserve store of value, and even had the US-dollar pegged to it under the Bretton Woods System, but is still seen as a safe haven asset for conservative investors. After the virus started to spread, gold hit its 12-month low in March due to the widespread market volatility. As indicated in the graph below, in August, gold rebounded to reach its all-time high of US$2063 per ounce, increasing 16.8% in the process. This outperformed several major asset classes and indices, including the Nasdaq, S&P 500 and even US Treasuries, which had lower returns due to low interest rates.

Gold as a safe haven further acts as an insurance hedge against monetary devaluation, due to a weakening U.S. dollar as seen throughout 2020 continuing into 2021. In 2020, gold has seen the second-best annual return since the financial crisis of 2008. Historically, a weakening US dollar has led to gold prices rising. And in the current scenario, with the global devaluation of major fiat currencies, we would expect gold prices to increase in Q1 2020.

Apart from gold, silver is another precious metal that witnessed noteworthy gains over the previous year. Its price reached the $30 per ounce mark early in August — this level had not been reached in over five years. The numerous industrial applications of silver make it a highly underrated investment opportunity. A major application is its use in solar panels, demand for which is bound to grow with large countries like India pushing towards clean energy initiatives and the incoming Biden-Harris democratic administration promising a more aggressive approach to the reduction in the widespread usage of fossil fuels.

Bulls go long on the commodities market

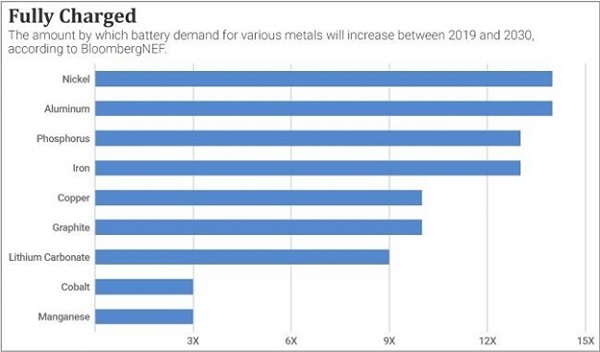

Various studies have indicated that the metal and agriculture sectors are expected to have significant gains this year. This may be due to falling interest rates and multiple stimulus packages issued by governments all over the world causing inflationary fears in the global markets. Due to this, monies are expected to have an increased inflow into commodities with investors boosting their long positions, especially in the metals and agriculture space. Innovations and technologies like lithium ion batteries, solar energies and electric vehicles are heavily dependent on base metals, leading to a “base metal boom” that is evident in the demand forecasts provided by Bloomberg.

Considering the post-Covid push for a greener future, the demand for metals like iron ore, zinc, lithium, copper, aluminium and silver is bound to rise significantly. This will mostly be driven by industrial demand and will revive on customer-focused stimulus and higher infrastructure investment. Enormous projects like China’s Belt and Road Initiative (BRI), also known as the New Silk Road, plan to connect Eastern Asia to Europe through a land route passing over 60 countries. It’s estimated that through the entire construction of this route there could be $1.2 to $1.3 trillion spent by China by 2027.

Oil also saw speculative interest from investors — the speculation is around how long it will take for the price of oil to rebound. Goldman Sachs predicted a rebound to $65 by summer, along with other commodities also soaring due to the incoming vaccines and resumption of global travel leading to an instant demand surge. A JP Morgan executive has been the latest to state that an “oil supercycle” is incoming.

Is a commodity supercycle close?

A commodity supercycle is a phase in the commodities markets when the prices of base metals are higher than historical trendlines for elongated periods of time, in some cases even decades. Two older generation examples of this cycle are the Industrial Revolution in the United States in the 1800s and the post World War 2 reconstruction of European nations and Japan in the 1950s. A more recent example of such a supercycle is the significant rise of the manufacturing industry in the BRIC nations (Brazil, Russia, India and China) through the 2000s till date.

A weakening dollar and the global ongoing pandemic themselves have had a global synchronization amongst how the world’s largest economies are functioning, acting as a precursor to a commodities supercycle. When copper topped US$8000 per tonne, a seven-year high, analysts at Goldman Sachs indicated that the commodities supercycle might be beginning. The stimulus approved in the United States for US$ 900billion goes on to contribute to the inflationary fears fueling possibilities of a supercycle. Commodity prices being higher leads to inflation rising, also seen in indicators like the Consumer Price Index (CPI).

The rise of the price of crude oil to US$50 per barrel, coupled with precious metals like gold and silver achieving multi-year highs in 2020, are more factors indicative of the incoming commodities supercycle.

New ways to access the commodities market

One of the big changes in 2021 for the commodities markets can be brought about by the technological innovations that the blockchain technology provides through tokenization of commodities. This allows the market to be opened up to a whole new sector of investors who have never before invested in the commodities market due to the formality of the structure involved. Tokenization is essentially the creation of a digital version of an asset that is backed by the value of the underlying product. This is being done increasingly in the financial markets, with countries like China, Sweden and Thailand running advanced CBDC (Central Bank Digital Currency) projects to digitise their own country’s currency.

In addition to increased investor adoption, an advantage of the digitisation of commodities is that blockchains enable easier tracing and trading of assets. And this can be done 24/7, instead of adhering to the timing of traditional exchanges such as the Chicago Mercantile Exchange (CME). This benefits investors and the industry at large by increasing activity, liquidity and depth in the market.

Digitisation also eliminates the need for structured products or other investment alternatives made available via third-party intermediaries, which, in turn, significantly reduces operational, clearing and settlement costs and risks.

Using blockchains and digitisation also enables instant settlements. 2020 witnessed blockchain and cryptocurrency receive the most attention they ever have due to the massive bull runs witnessed across cryptocurrencies and the validation the industry has received as a whole with players like PayPal, JPMorgan and Grayscale getting heavily involved. The tokenisation of the commodities markets allows real-world assets like iron ore, copper, silver, gold and lithium to be digitised on a blockchain, enabling tracing, moving and trading of the assets with much more ease, bringing in a real transformation of these markets.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

Trovio is a leading technology provider to the commodities industry. Providing provenance & ESG solutions to the commodities industry alongside digitisation & tokenization services to the sector. Working alongside leading precious metal...

Trovio is a leading technology provider to the commodities industry. Providing provenance & ESG solutions to the commodities industry alongside digitisation & tokenization services to the sector. Working alongside leading precious metal...