Companies are shifting to growth focused raises: this week in capital markets

Investors have been spoilt for choice in recent weeks. The ASX200 raises have slowed down (for now) but there's still been plenty at the small/mid cap end for followers to chase. From what we've observed, there's been record levels bidding from all types of investors - funds looking to lock in their "relative" returns, professional investors re-deploying capital and individual HNWs looking to beef up positions. Although it's also worth noting that not all this bidding has led to deployed funds. Allocations have been hard to come by for most deals. An investor's "existing holder" status has become much more important for determining allocations, but even so, most are "bought deals" (underwritten) and the preference seems to be going to the fundies that are in early.

In any case, the recent run of deal activity is slowing and this week was a good sign that our economic recovery is beginning to look more "W" shaped than "V" shaped. Whichever it is, there will always be companies raising capital, the only difference will be what they are raising for...

Growth is becoming the new theme in capital raising, this means more targets for investors.

The early raises largely came from sectors that were hit hard by the COVID crisis - tourism, travel etc. Why else raise in such a volatile time? But now that the market is more comfortable with the new COVID reality, we are seeing more growth focused raises appear. If 2007-08 was anything to go by, once this storm passes M&A activity will resume with force. Insolvency/administration will rise, and companies with a war chest will look to consolidate and grow at once in a decade prices.

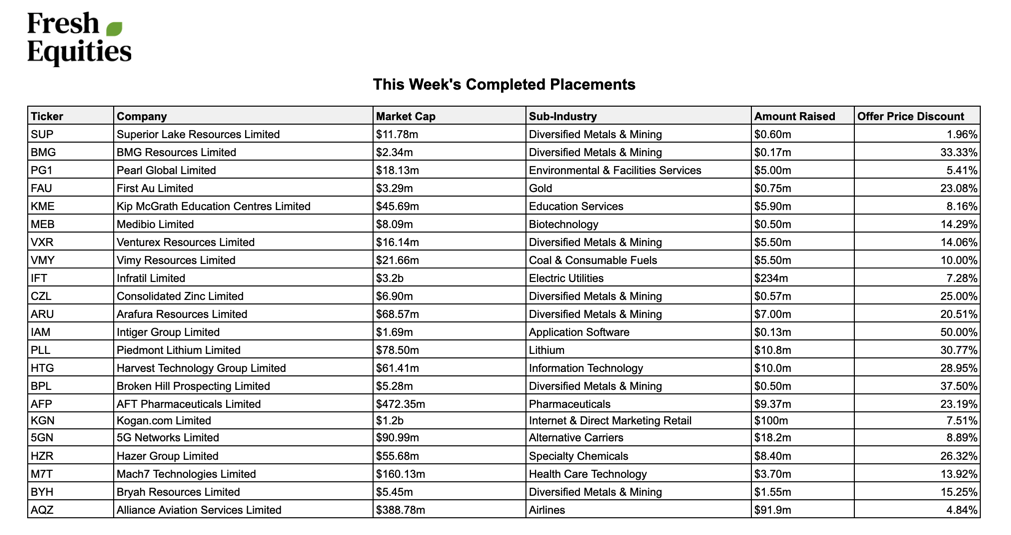

This week we saw the first of the growth raises.

5G Networks raised $18.3m via placement with funds largely earmarked for M&A opportunities. The telco is looking to expand its fibre network footprint in Melbourne/Sydney and establish a foothold in Adelaide and Brisbane.

Kogan hit the market for a $100m equity injection, closing quickly and scaling most bidders back aggressively. The online retailer has been on a tear recently and chose to capitalise on market interest and build capacity for growth. Kogan will want to be well placed to swallow some of the ailing retailers that won't make it through COVID, at the right price of course. Their founder, Ruslan Kogan, was quoted in the media this week describing his team as M&A "tight-arses". The recent Matt Blatt acquisition will surely be just one of many.

Infratil took home $233m and also pitched a growth story to investors. The fresh capital was to be used to fund growth in their portfolio companies (which includes Wellington Airport and Vodafone New Zealand among others) and for any other new investment opportunities that arise during this period.

We anticipate that even if the market starts turning, growth raises will continue to become more common. If the market does dip again, the re-cap raises will return on the way back up.

It's not just struggling companies that should be considered cum-raise, investors should now be watching any business with M&A capacity for a potential capital raise.

Get investment ideas from industry insiders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

3 topics

22 stocks mentioned