Consistency and sustainability: the two most important factors for yield

The Martin Currie Australian Equity Income Fund was born out of necessity – and love. The fund, originally designed for retirees, was established because of a gap in the market that existed in the early 2000s when the parents of Martin Currie team members couldn’t find a suitable product to meet their needs.

Most traditional products at the time were focused only on capital value and growing net asset value (NAV) over time. Few were focused on capital preservation, stability of income, concentration risk, and what Martin Currie calls “a sufficient income for life”.

In this wire, Reece Birtles, CIO at Martin Currie Australia, shares how the current macro environment impacts the outlook for income investing, how he and his team fulfil their objectives and a couple of stocks that are favourable right now.

One key differentiator of the fund is that it is index unaware (it does not track a benchmark). Instead, the intent is purely to generate a growing dollar equity income stream by protecting the capital base.

To achieve this outcome, the focus is on high-quality companies which have a low probability of cutting dividends, a focus on franking credits for the zero tax payer, and low turnover. All whilst maintaining strict criteria ensuring there is not too much exposure to any one stock or sector.

"Even if we believe in the strength of our focus on sustainable dividends and picking the right stocks, we want to ensure there is a built-in diversity of income so that no single stock can cause a significant impact on the funds overall level of income. If you look at ASX 200, about five or six stocks make up over 60% of the index yield, whereas we don't have anywhere near that concentration. We don't have that risk” says Birtles.

CONSISTENCY IS KEY

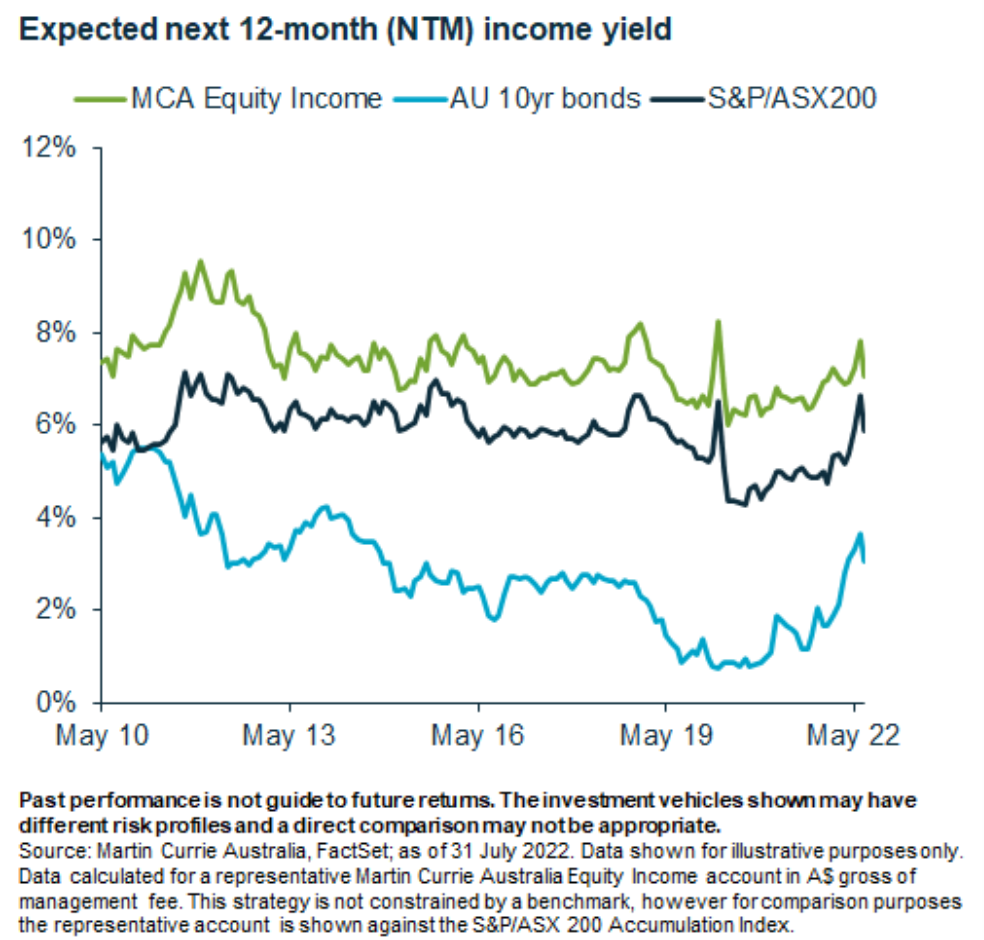

We live in volatile times. The surge in bond yields since the start of the year and the dramatic shifts in inflation expectations – to say nothing of the moves in equity markets – have caught many off guard. You wouldn’t know it talking to Birtles. And with a historical average of 7% over the past decade, and a forward dividend yield of around 7% for new investors, you can understand why.

As the chart above shows, the 7% plus inflation protection income stream from dividends with franking credits for the zero tax payer is very attractive compared to the S&P ASX 200 and the Aussie 10-year yield.

Birtles also points out an important characterisation when making such comparisons, reiterating the importance of finding stocks generating an inflation-protected and growing income stream.

"The important thing to not misunderstand is that equities, dividend paying equities, haven't re-rated with lower bond yields. Whilst that 7% forward yield for equities has held and bonds have been falling, the spread has been getting wider. Essentially, it's different ways of saying there's a low sensitivity of the portfolios return to changes in bond yields", says Birtles.

SUSTAINABILITY

Consistency goes hand in hand with sustainability. After all, there is no point in having a stock that pays you a yield of 10% one year, and 2% the next. If Martin Currie owns resource stocks, for example, it’s always well under typical weight. Resources are cyclical and whilst they have been paying historically strong dividends in recent years, everyone knows they are not sustainable moving forward.

More broadly, Birtles and his team view the portfolio's objective as having a risk profile or beta less than the broader market.

"Over time, the portfolio has had a beta that has ranged from 0.8 to 0.95 - it's always less risky than the market. We're looking for the companies that are less volatile. They're not early stage, they're not startups, they're not dependent on one asset or one commodity. We're looking for those safer names in the market".

Using a quality filter based on a scale from 1 to 5, with one the best and five the worst, Birtles is adamant that they won’t own fives. And fours will only get a look in if they are a small weight in the portfolio and they're reasonably mature style businesses, rather than early stage.

We're avoiding the 25-30% of the riskiest stocks in the market. The idea is that's the best way to avoid companies with significant dividend cuts.

NAVIGATING OF THE CURRENT ENVIRONMENT

In navigating the current high inflation, and the higher interest rate environment, Birtles notes several key elements that he and his team are mindful of in the hunt for opportunities.

First, he notes a return to normal spending patterns post the pandemic-induced stimulus and very high savings rates which supported demand. According to Birtles, that likely means fewer goods and more services purchased moving forward.

He and his team are also paying close attention to demand driven by the transition in the economy to net zero, with the construction and CAPEX spending a big tailwind for some industrials that are exposed to the space.

Finally, there is a focus on real assets with inflation-protected revenue streams. And the common thread, tying all of these ideas together?

"It's all about that pricing power and inflation protection to ensure that we get the best growing dividends through this period".

WHERE THE RUBBER MEETS THE ROAD

Whilst the fund isn’t particularly active, with a strong focus on quality, Birtles shared with me a few names that the team likes, and one that they have divested in recent times.

"In the leverage to net zero, we own names like Monadelphous (ASX: MND), Downer (ASX: DOW), and Worley (ASX: WOR). These names should see increased demand for their services, be it from miners transitioning to net zero or the electricity grid transitioning. They’ve got a massive demand tailwind and they've got the pricing power".

Birtles also likes the insurers, highlighting QBE Insurance (ASX: QBE), and noting that whilst higher premiums are not good for consumers, once again the pricing power allows margins to be protected. Higher interest rates also generate better returns on their investment portfolios. Finally, Birtles nominates haulage company Aurizon (ASX: AZJ) as a favourite in the real asset space.

"Demand for their products, and the goods they move is very strong given what's happening in global markets. As inflation and interest rates rise, their regulated asset base grows faster with inflation and the return on the regulated asset base rises with higher interest rates through the weighted average cost of capital mechanism".

As for what the Martin Currie team has divested of late, Birtles identifies ASX (ASX: ASX). Whilst the stock has done well over a long period and is still a monopoly business, the yield has moved a long way and the stock no longer meets the team's criteria.

LOOKING AHEAD

Investing will never provide smooth sailing, all of the time. There will always be volatility, regardless of your strategy. In recognising this, Birtles understands that accepting the reality of volatility and then identifying the forward-looking opportunities is the best way to approach things.

Birtles notes that in the current demand inflationary environment, with rates rising quickly, the economy will eventually slow and unemployment will rise, relieving pressure.

"That will see a big transition in the stocks that are doing well in the environment. Some companies right now are really suffering from labour cost pressure. As that rolls over, that will become a tailwind. We're really looking for that point and how that plays out in the companies into next year".

3 topics

6 stocks mentioned

1 fund mentioned

1 contributor mentioned