Copper prices are soaring but there's plenty of upside left in the tank: Tribeca

Copper prices are headed towards two-year highs amid a raft of tailwinds including constrained supply, record low inventories and growing demand from renewable sectors.

The red metal has been trading largely sideways since February 2021 because the slump in China's crucial property and construction sector, inflation, and rising interest rates have offset the above tailwinds.

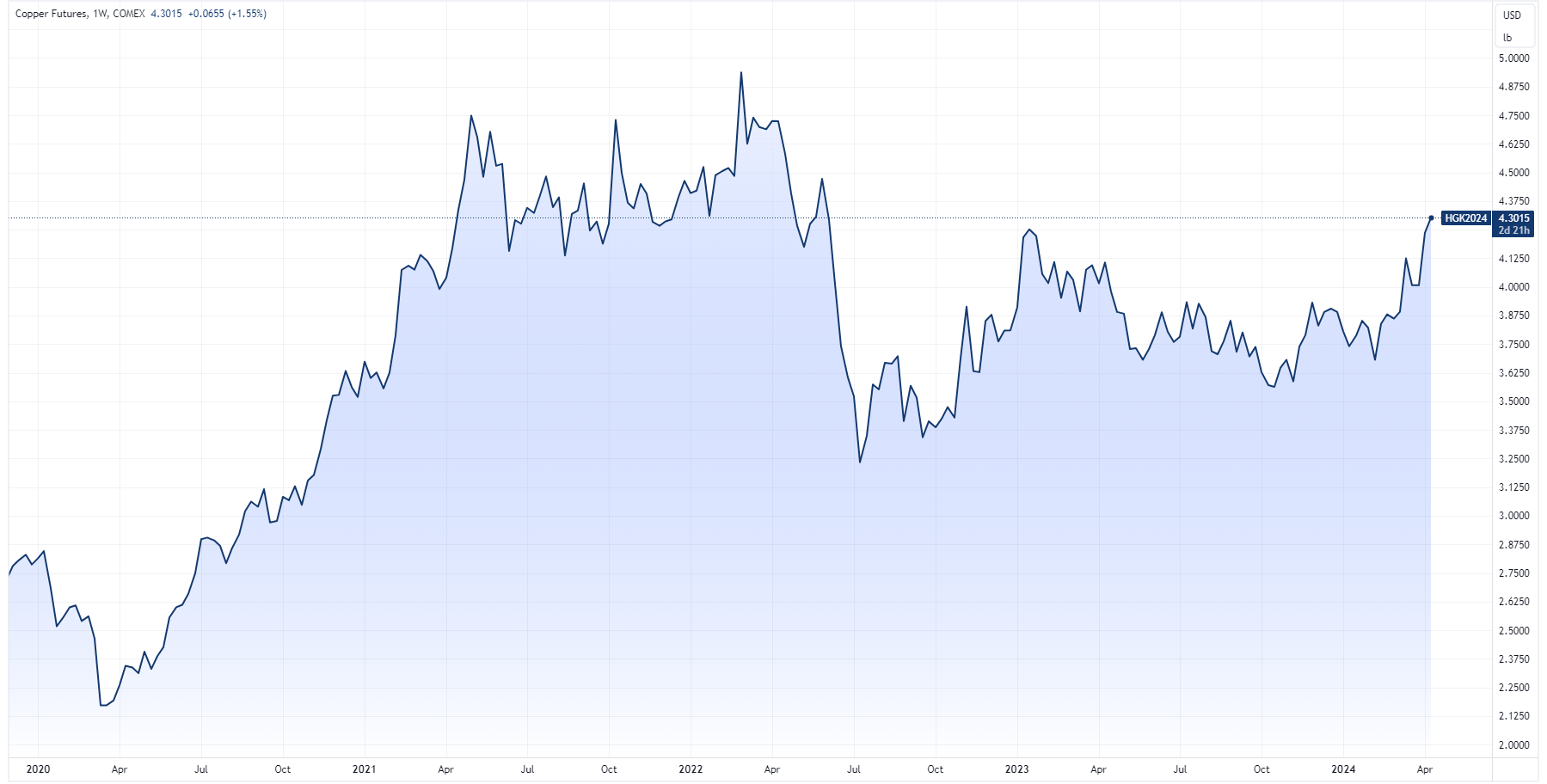

Copper futures are currently trading around US$4.3/lb, the highest since June 2022 and up more than 12% since March. The rally has brought life back into local copper stocks, which have spent the past three years grappling with surging costs and operational issues.

Shares in the market’s largest pure-play copper exposure Sandfire Resources (ASX: SFR) have rallied almost 20% since March and trading at levels not seen since June 2018. The Global X Copper Miners ETF (ASX: WIRE) – which might provide a more holistic view of the copper sector – is up 25% over the same period.

If the past year or two has taught us anything about commodities, it’s that once prices start moving, they tend to run pretty hot. While copper remains exactly where it was three years ago, Michael Orphanides from Tribeca Investment Partners says the latest breakout marks the start of a multi-year rally.

Everything you need to know about the copper rally

Why has copper only now begun to move, despite well-documented and long-standing bullish demand and supply issues?

For the past couple of years, copper bulls have been sticking to their guns, advocating the same thesis. Here are a few headlines from Bloomberg spanning this period.

- October 2021 – Global Copper Inventories Are Getting Critically Low

- June 2022 – Copper May Be the Tightest Commodity Market Ever

- September 2022 – Surging Copper Demand Will Complicate the Clean Energy Boom

- April 2023 – Tightest Supply in 18 Years Boosts Copper Ahead of Industry Show

- December 2023 – The World’s Copper Supply Is Suddenly Looking Scarce

- January 2024 – Copper Ready to Explode on Fed Rate Cut

So why has copper only now started to move out?

Orphanides says ongoing disruptions in supply, stemming from operational, regulatory and inflationary challenges have been steadily mounting over the past 18 months. The recent issues surrounding Chinese smelters appear to be the match that has lit the fire.

More specifically, he attributes the rally to the following issues:

- Low inventories and stronger-than-expected global demand from electrification

- Global grades are getting lower and lower, and ore bodies are getting deeper and deeper, resulting in operating issues and production downgrades from major mines

- Social license issues are becoming more of an issue in both emerging and developed economies. None more so than Cobre Panama which has cut approximately 2% of global copper production

- Inflation issues from tight labour markets and higher energy prices have lifted production costs. Energy shortages in many emerging markets also resulted in reduced production e.g. Ivanhoe last week

Why is copper reaching a 52-week high while iron ore is nearing 52-week lows?

The year-to-date performance for copper (+11%) and iron ore (-22.5%) paint two dramatically different narratives for commodity markets.

“The current move is more about copper strength than iron ore weakness. An iron ore price above US$100 a tonne is still a strong price for the industry. Copper’s current production issues have been felt in iron ore markets for many years, leading to significantly higher average prices over the past five years compared to initial forecasts,” says Orphanides.

“These production issues are not transitory, they are very sticky and like the iron ore market, copper prices will need to rise substantially beyond current spot prices to incentivise production.”

Copper inventories have been grinding lower for the past couple of years. Could this ever result in an abrupt squeeze in copper prices?

"We think one of the better indicators for future copper price direction is treatment charges which have tightened significantly year to date. This tightening highlights a strong physical market that major producers such as Freeport McMoran (NYSE: FCX) and Glencore (LON: GLEN) have been emphasising for the past 12 months," says Orphanides.

AI has emerged as another demand growth driver for copper. How will this impact future copper demand?

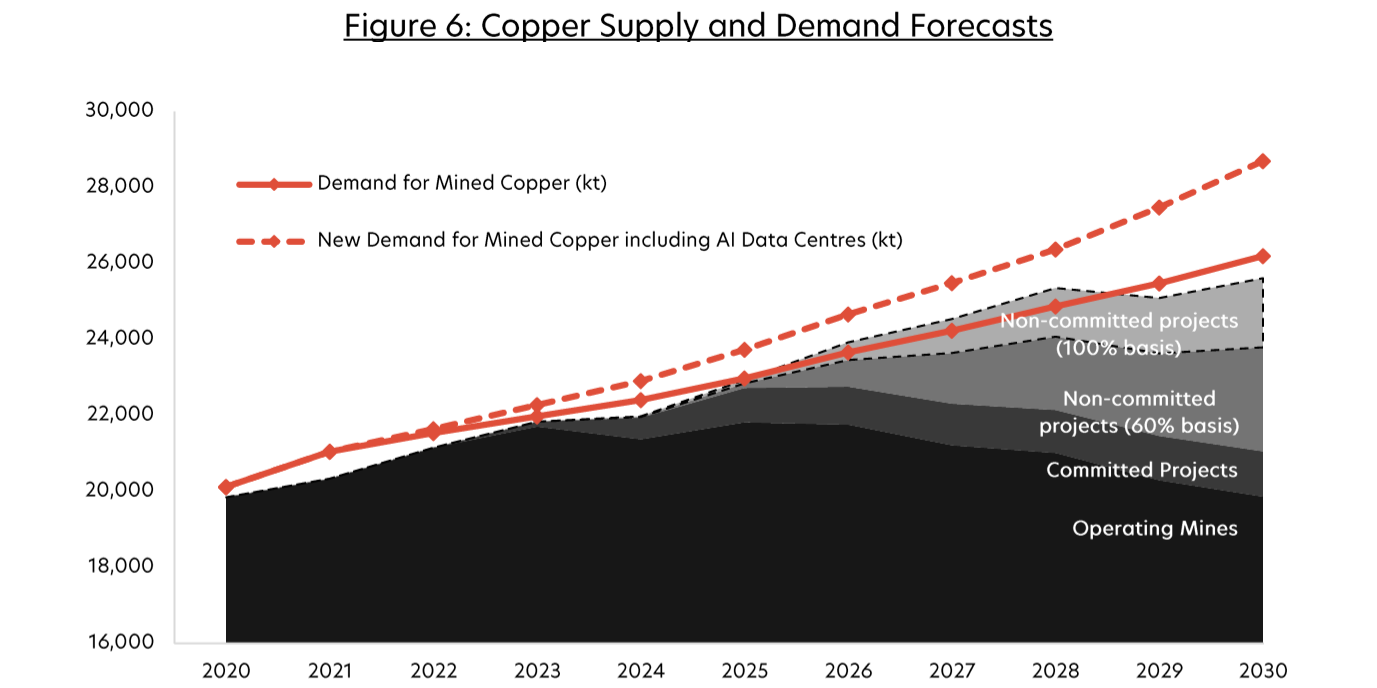

Copper remains one of the largest exposures to Tribeca's Global Natural Resources Fund, with more than 40% of net long positions to various global producers and developers. The fund recently published a copper note that expects a growing deficit through 2030 and beyond.

"If you use Nvidia (NASDAQ: NVDA)'s assumption on AI demand for 2030, it implies we could eventually be at a level where data centres require an additional ~10% of copper demand to that currently forecasted."

Why isn’t copper trading at >US$5.0 given all the above?

Copper is currently trading exactly where it was three years ago. To add some perspective, BHP's (ASX: BHP) Escondida has seen unit costs soar from US$1.00/lb in FY21 to US$1.51/lb in the first-half of FY24.

Orphanides expects copper prices to rise above the US$5 level in the coming months and potentially much higher given the incentive price needed for greenfield projects.

"All of the operational, regulatory and inflationary cost issues plaguing the copper sector has pushed the incentive price to US$5/lb, if not closer to US$6/lb."

What are your favourite copper picks right now and why?

"Globally we like Freeport McMoran (NYSE: FCX), Teck Resources (NYSE: TECK) and Glencore (LON: GLEN), which should remain the go-to names for global asset allocators, are catalyst rich and whose valuations are undemanding," he says.

Learn more

Tribeca’s global natural resources investment team is one of the largest in the Asia Pacific region, with decades of deep investment and technical expertise. The team manage several specialised, actively managed strategies investing across metals & mining, energy, soft commodities and carbon markets, leveraging Tribeca’s unique position as a preferred capital partner to companies in the resources sector.

1 topic

7 stocks mentioned

3 funds mentioned

1 contributor mentioned