Country Garden - Not your garden-variety kind of crisis

Well done, Country Garden. Default averted.

Over the past week, the property developer, once China’s largest, has returned from the brink - renegotiating with onshore creditors, as well as make coupon payments on US dollar-denominated bonds, just in the nick of time.

The debt extension deal has meant that Country Garden will now be able to repay a remaining principal worth approximately US$530 million over a period of three years, with the bulk of repayment to occur in the final year.

Meanwhile, the US dollar coupon payment, worth $22.5 million, due on August 6, was made just before the 30-day grace period ended.

It appears that Country Garden has avoided a messy default event, at least for now.

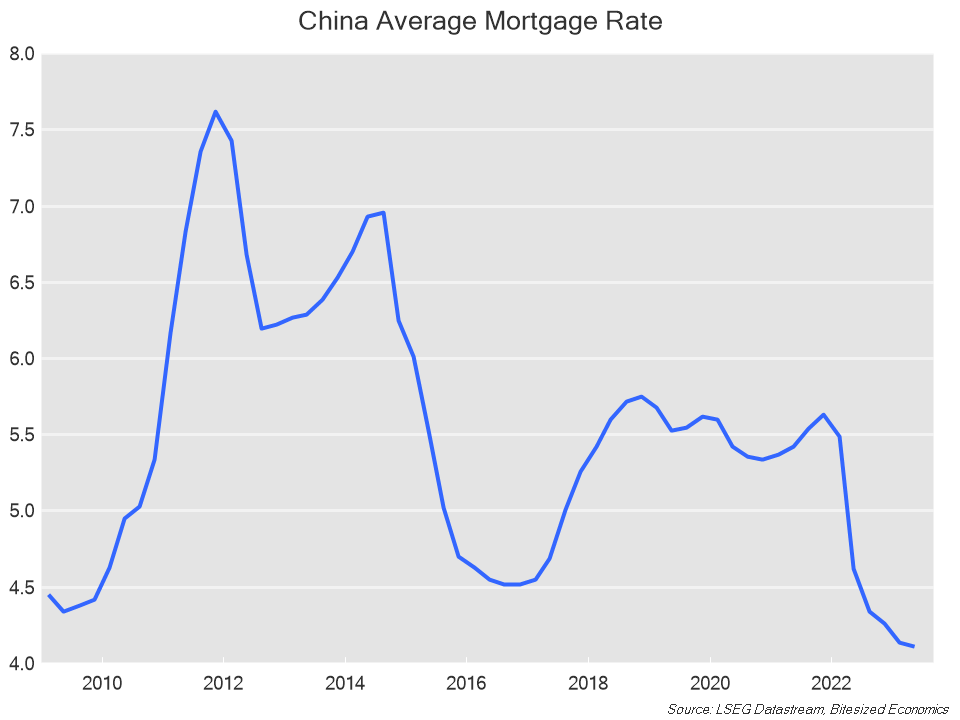

What’s more is that China’s regulators have recently implemented a range of measures, lowered mortgage rates and cut required down payments for first and second-time home buyers.

It has been a positive week of news, indeed.

However, there are still some major question marks regarding Country Garden and the property sector over the next few months. Very likely, further restructuring of its debt is likely, or default will be back on the cards again.

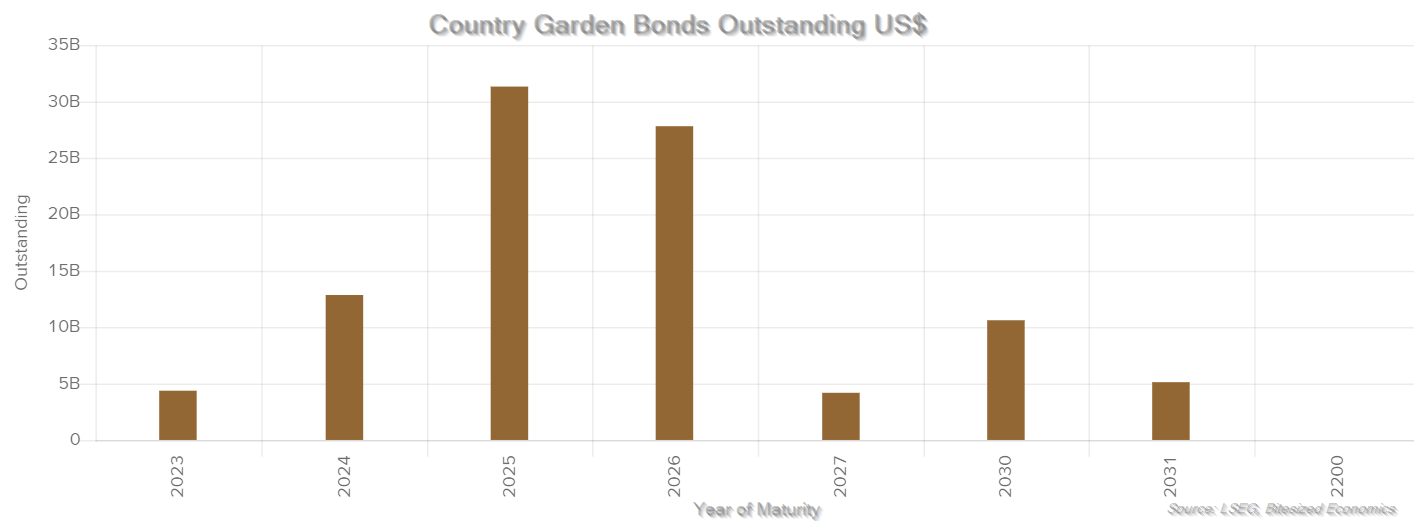

There are some bonds with big maturities due for Country Garden in coming months, including US dollar-denominated bonds worth $1 billion maturing January 27, and $550 million maturing April 8.

Even if recent measures do have the desired impact on the housing market, it is unlikely to provide a major turnaround in Country Garden’s balance sheet before some of these debts come due. If the developer has been struggling with around a half a billion dollars’ worth of repayment, it is hard to see how the developer can find almost three times that much within a few months’ time.

Over the longer term, the fate of Country Garden and other developers rests on a recovery in the property market. Measures by regulators suggests that the government does want to provide the sector with support.

Lower mortgage rates could help at the margin, particularly in the bigger cities. But there are two major issues that have not been addressed.

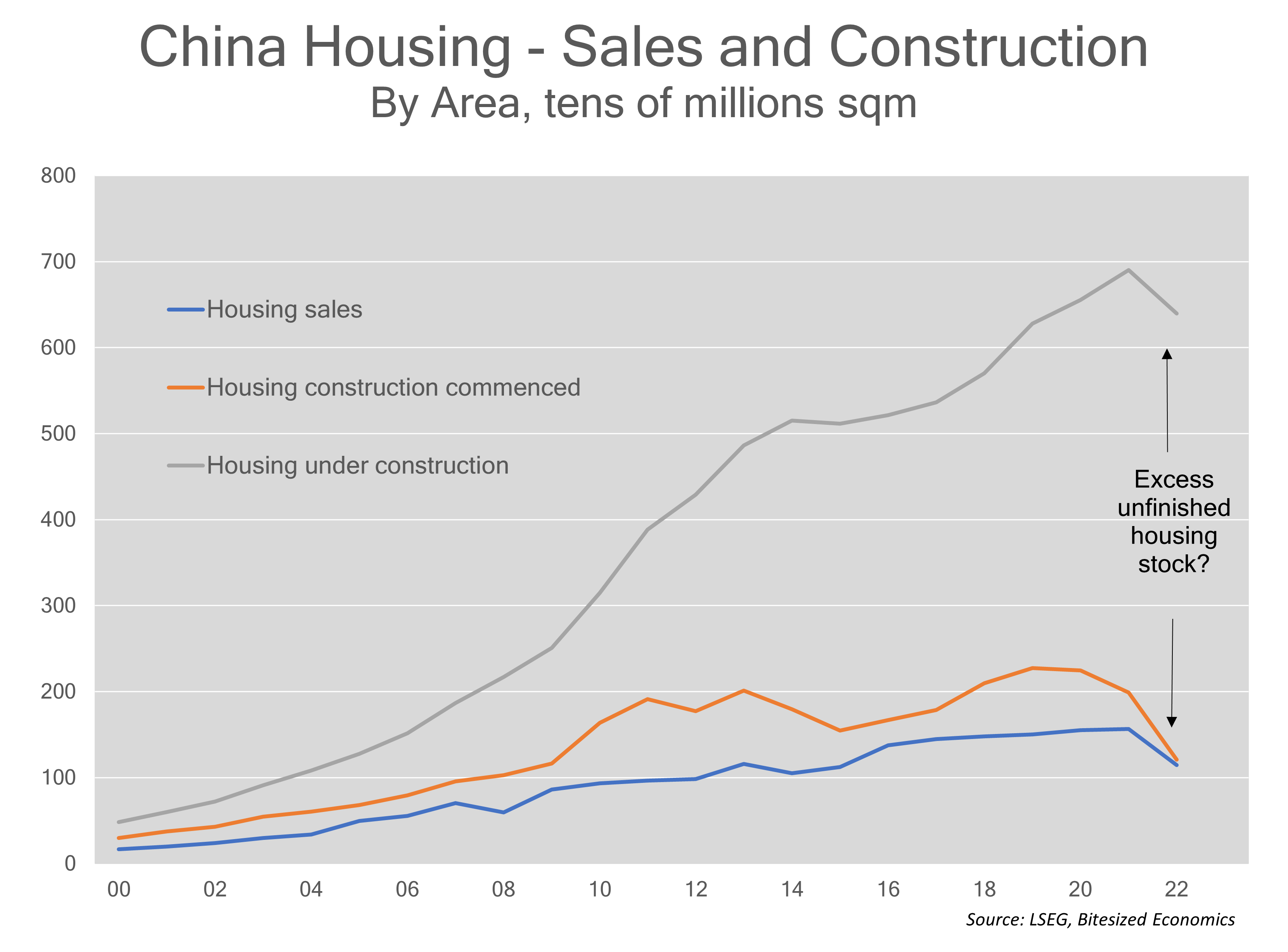

The first is the large pool of unfinished apartments. Cash-strapped developers can’t pay suppliers to complete builds – they aren’t getting the same revenue streams from home sales and financing has become more difficult. It undermines confidence among potential homebuyers, therefore they weigh on home sales further.

The second issue is that developers have been prevented from bringing down prices for their apartments. Local governments say it is to prevent financial instability. But by not allowing prices to fall, it leaves developers with still large quantities of unsold stock, and less revenue at the end of the day.

Allowing large scale price falls may cause some pain for existing property owners, but it would boost sales and help bring the housing market back into balance, particularly in the smaller cities, where there are higher levels of unsold housing stock.

There are also structural shifts weighing on the economy and housing demand such as China’s declining population, geopolitical tensions and limitations on infrastructure spending, which has been China’s key driver of economic growth of the past decade. A bit of a reduction in interest rates aren’t going to be enough to bring back buyers if households are uncertain about their employment and incomes.

It may have been great news this past week for Country Garden. But developers and China’s property sector are not out of the woods yet. In fact, there is very likely more pain to come.

5 topics