Crypto a must-have in a balanced investment portfolio

Cosmos Asset Management

It’s no secret that achieving outsized returns with a traditional asset management approach has become more and more difficult in recent years.

At the same time, we saw the total cryptocurrency market cap grow 185% to $2.2 trillion, fuelled predominantly by an uptick in both retail and institutional investor interest. The two largest cryptocurrencies by market cap, Bitcoin (BTC) and ether (ETH), outperformed traditional macroeconomic assets, gaining 60% and 407%, respectively.

Of course - as is the same with any asset class - past performance is not a guarantee of future returns. Cryptocurrencies are notoriously volatile and trading in crypto can be unpredictable.

Before entering any investment, we’d always recommend investors identify their own investment targets and goals, tolerance for risk and appetite for returns, which will point towards the strategy best suited for them when considering any investment opportunity.

And while investing in crypto is no silver bullet, we’re seeing more and more high-profile and well-respected investors and economists recommend crypto assets as a must-have as part of a balanced investment portfolio. And with good reason.

We’ve seen the coming of age of cryptocurrencies not only globally but locally here in Australia. Crypto has really hit the mainstream as an asset class and continues to gain momentum with new and innovative products such as ETFs hitting the market and providing greater investment opportunities for Australian investors and institutions.

2021 was a milestone year for crypto in Australia. In October, a Senate inquiry recommended changes to taxation laws, licensing and regulation to encourage establishment of digital assets businesses in Australia, in an attempt to set the nation up as a global hub for cryptocurrencies.

Following this, in what was a significant step towards the integration of crypto-assets into Australia’s financial ecosystem, the corporate regulator, the Australian Securities and Investment Commission (ASIC), introduced licences for crypto-asset holders.

ASIC also paved the way by proving guidance for Bitcoin and Ethereum-backed investment funds to begin trading on the Australian Securities Exchange (ASX) and Cboe Australia (formerly, Chi-X) exchange, providing investors with new and different investment options.

Achieving exposure to crypto assets via an exchange-traded fund gives investors access to crypto via an institutional vetted platform without having to directly hold cryptocurrency.

So, what’s the right balance of cryptocurrency in a portfolio?

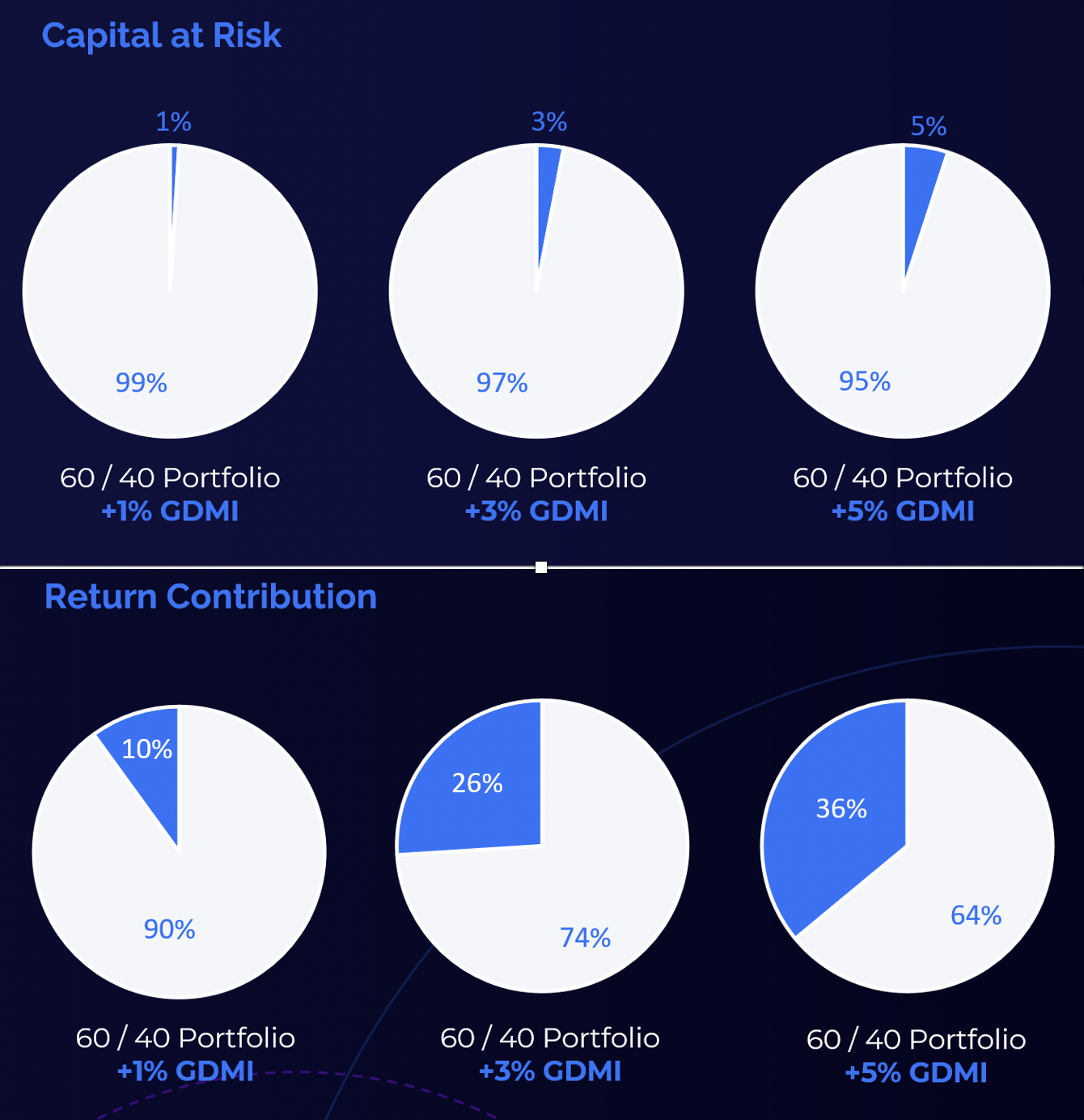

In our analysis, a small allocation of cryptocurrency - between 1% - 5% - has the potential to dramatically contribute to the returns of a traditional 60/40 portfolio.

As at 31 January 2022.

Source: S&P, Bloomberg and Cosmos. The GDMI Index launch date is 16 July 2021. All information for an index prior to its Launch Date is hypothetical based on the index methodology in effect on the launch date. This simulated portfolio takes hypothetical allocation of 60% Equities (30% Australian Equities, 30% Global Equities) and 40% Fixed Interest (37% Global Agg and 3% Cash). Past performance is not an indication of future results. For illustrated purposes only and not a recommendation to buy or sell the fund.

According to renowned Yale economist, Aleh Tsyvinski, the optimal allocation of crypto is around 6% of a diversified portfolio. Tsyvinski’s study found that the low correlation of bitcoin performance to traditional asset classes such as stocks, bonds and real estate meant that even crypto cynics would be better off investing 1% of their assets in crypto to reap the benefits of a truly diversified portfolio.

Whichever way you look at it, balancing an investment portfolio is a uniquely individual process, and decisions are always better made in consultation with an advisor who can not only help you define your investment goals and objectives, but put you on the right path to achieving them.

5 topics

Dan is the CEO of Cosmos Asset Management and is responsible for leading the business operations and strategic direction. He has extensive experience in the local and global funds management industry, with over 15 years dedicated to Exchange...

Dan is the CEO of Cosmos Asset Management and is responsible for leading the business operations and strategic direction. He has extensive experience in the local and global funds management industry, with over 15 years dedicated to Exchange...