Data drop: uptick in job vacancies while retail takes a nap

Livewire Markets

It's the start of a new quarter and optimism abounds. Brisbane has been released from lockdown, vaccines are on their way (albeit slowly) and the latest data drop from the ABS (Australian Bureau of Statistics) is looking mighty fine.

Today, the ABS released a number of key economic indicators which we think will help you keep up to date on the health of the economy - and the health of some of your favourite stocks.

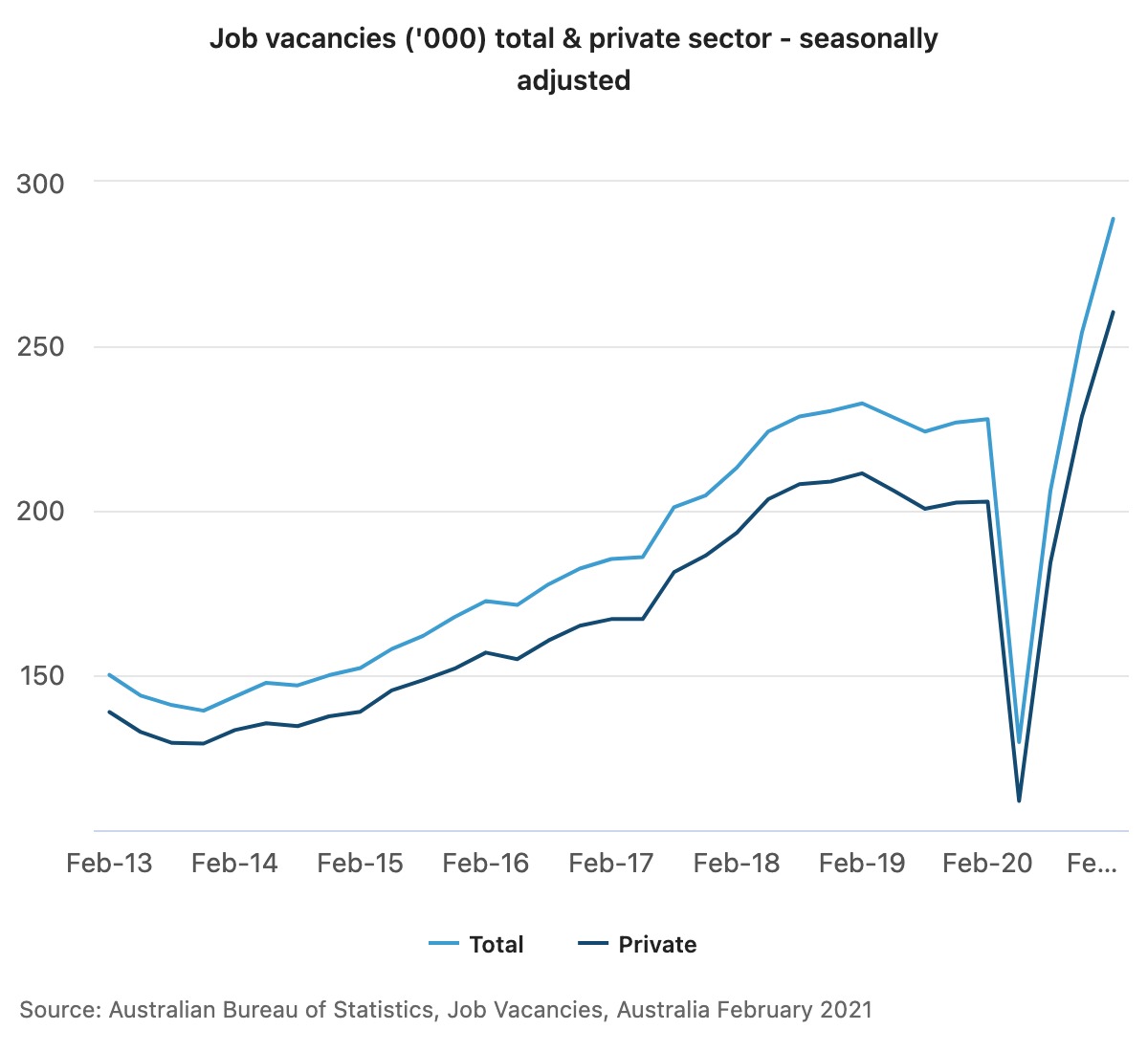

#1 Job vacancies are way up

With JobKeeper ending it's great to see the jobs market running hot - all those extra vacancies will be needed now the stimulus tap has been turned off for the bulk of industries. Job vacancies in the public sector are up 12% YoY, while the private sector is up 28% on February last year (that was the pre-COVID anaemic economy).

%20total%20&%20private%20sector%20-%20seasonally%20adjusted.jpeg)

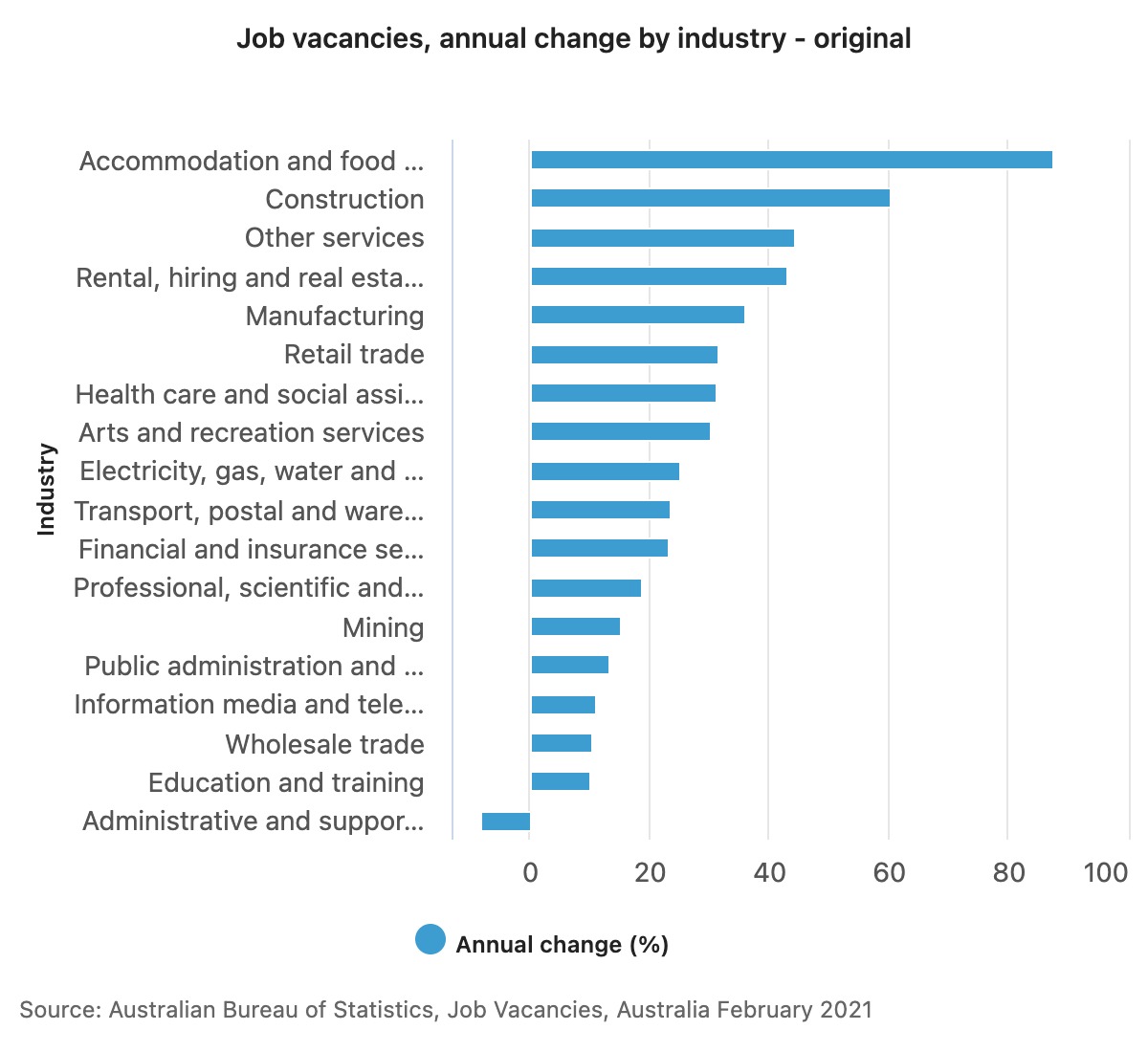

#2 Not all industries are the same

ABS notes that this historically high vacancy is driven in part by labour shortages in certain industries. With immigration turned off, we know we're short on chefs, fruit pickers and a range of skilled and unskilled workers to fill the gaps in Australia's employment landscape.

#3 Is retail open for business?

Retail trade fell 0.8% month-on-month (Jan-Feb 21), as the COVID-recovery surge levelled out. Australian turnover increased by 9.1% through the year.

.jpeg)

#4 The darlings still performed well

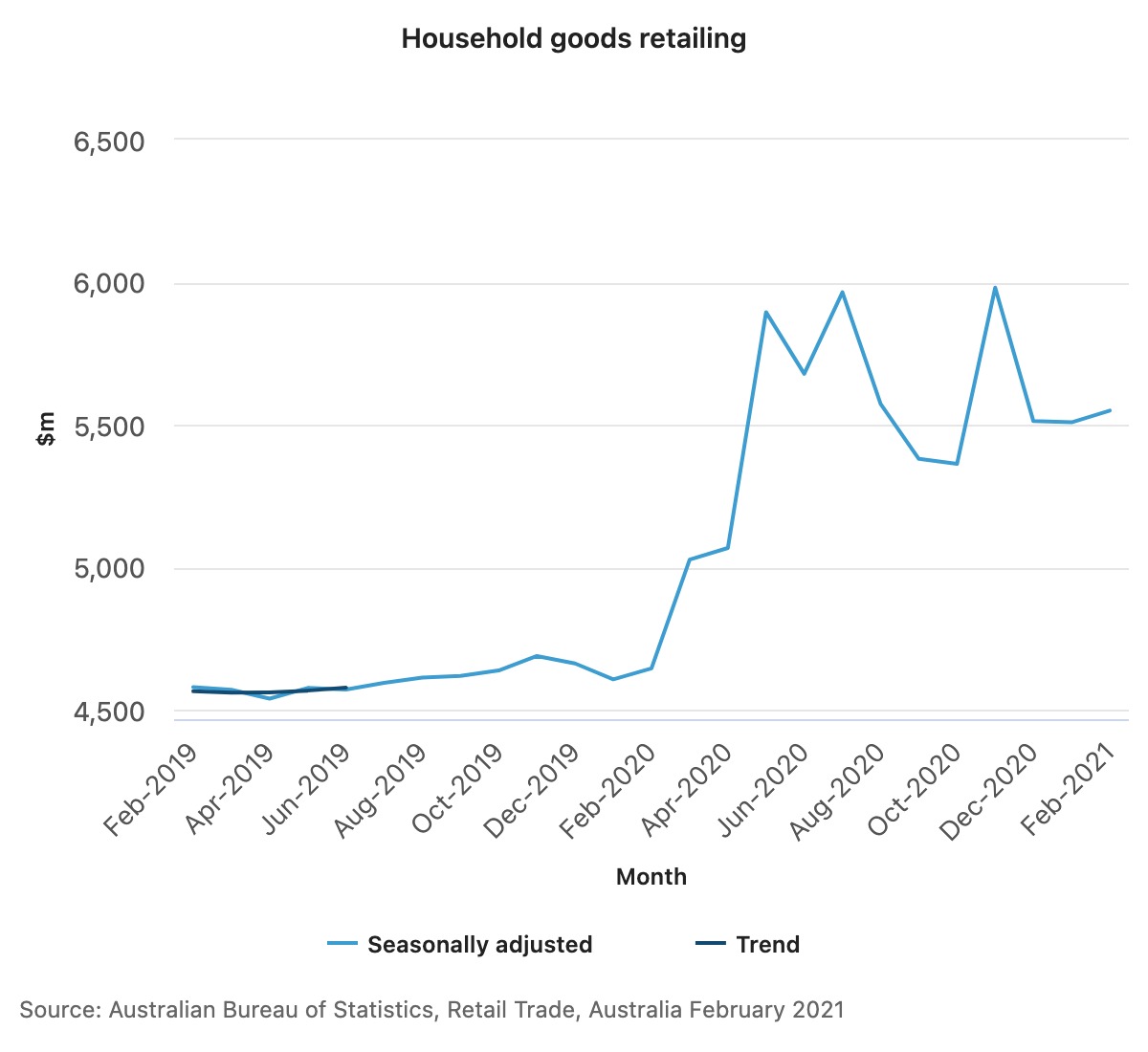

Household goods bucked the trend during COVID-19. Where most retailers fell flat (or in the case of cafes and food services, disappeared altogether), household goods reigned supreme. Think, your Harvey Normans, Super Retail Group and JB Hi-Fi.

Household goods have been the favourites among stock pickers and dividend hunters alike. You would have been able to easily anticipate today's data if you followed the earnings upgrades in the Feb reporting season. But now... here's the data.

Household goods retailing rose 0.7% ($40.9 million) in February 2021 (seasonally adjusted). The biggest jump was in electrical goods (up 2.4%), followed by furniture, houseware and floorings (up 1.8%). Hardware, building and gardening supplies fell 1.8%.

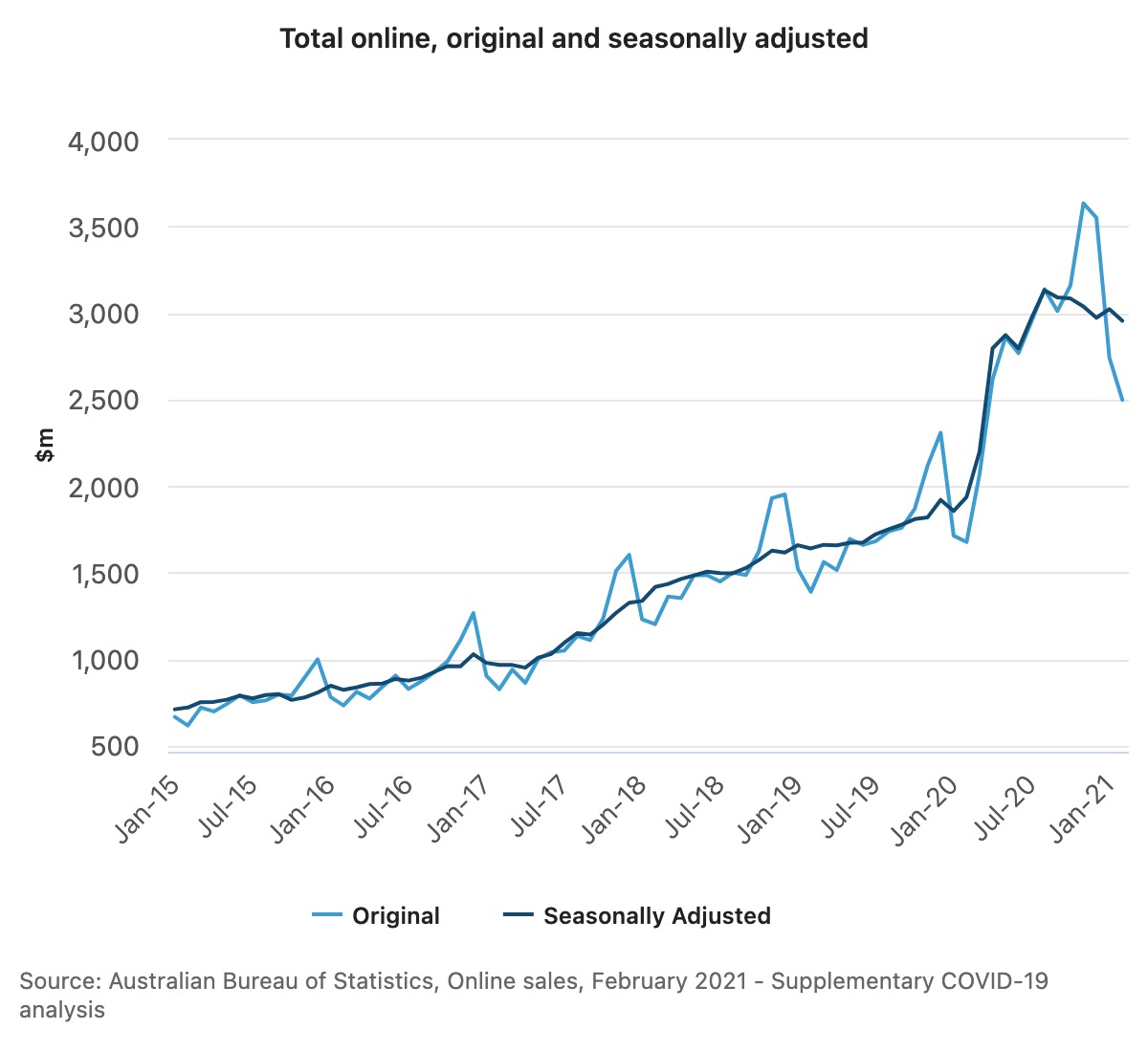

#4 But online sales might be in for an adjustment

Total online sales fell 2.2% in February 2021, in seasonally adjusted terms, following a rise of 1.7% in January 2021, and a fall of 2.1% in December 2020.

But that big, old dip in the chart below isn't necessarily bad news. Just a settling down of the big spenders. Online sales in February 2021 are still up 52% compared to February 2020 (seasonally adjusted).

Conclusion

These figures are great to check in on the health economy. The ABS sales and retail trade figures are ideal for monitoring overall spending, while the jobs vacancies are really critical to employment figures. Solid job vacancy figures, as we have seen here, in February will dictate the ongoing impact of COVID-19 on unemployment over the coming months, particularly as the federal JobKeeper stimulus rolls back.

As we have reported before, the unemployment figures will underpin wage growth and the spare capacity in the market. Ultimately if you're an inflation bull this will the one to watch.

You can access the ABS report here:

Let us know what else you'd like us to keep you updated on.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

3 stocks mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...