Deep Value & Positive Catalysts

After extensive research (detailed below) we believe Invex Therapeutics (IXC AU) will pass its upcoming phase 2 trial in Idiopathic Intracranial Hypertension (IIH) which will result in a material re-rating of the company’s share price.

We believe that Invex is undervalued and post a successful trial result the company should trade at a valuation of $160m to $200m (which is a share price of $2.90 to $3.60 per share on current issued capital). We believe that as the company de-risks further there is upside to this valuation which may be realised through a commercial transaction with a pharma company.

Key Points

- Invex is repurposing a known drug (Exenatide) which we believe has a high probability of success in their lead indication of IIH due to the known method of action (MOA) and anecdotal off label use we have uncovered.

- Risk of failure in the current phase 2 study we believe is low, with likely registration trial to be initiated soon after. This will result in a lower level of equity dilution and a fast path to revenues that should see the value of the shares re-rate significantly.

- Orphan designation has been granted on lead indication (IIH) which gives Invex an exclusivity period where no competitor can register alternate forms of Exenatide; the company also has patents (pending) which will likely add further protections.

- Lack of current standard of care medication could result in increased pricing power and reimbursement for Presendin™ which is the name Invex has trademarked for their drug.

- IIH is a misunderstood indication and we believe the incidence and prevalence rates are significantly higher - making the total addressable market for Invex significantly larger.

- Invex has the ability to expand into other indications with similar symptoms which adds material blue sky to the valuation that can be explored with further studies.

At a current valuation of ~A$44m at a share price of $0.80 (~$10m cash) we believe Invex is undervalued relative to the opportunities that lie ahead. With a tight register, great product and competent management, we believe the company will see material upside in the coming years. Success in their upcoming trial provides a near term catalyst, while future valuation inflection will be driven from approval of a registration trial by the FDA/EMA, strengthening of the patent portfolio, commercialisation of Presendin™ and the likelihood of pharmaceutical deals in progressing this treatment in IIH or other indications.

Overview

Invex Therapeutics (IXC AU) is an ASX listed biotechnology company repurposing the injectable drug Exenatide (currently used in type 2 diabetes in leading drug Byetta and Bydureon) for use in neurological conditions that involve raised intracranial pressure. The lead indication for Invex is in an orphan indication called idiopathic intracranial hypertension (IIH) – which currently has limited effective treatment alternatives and is classified as an orphan indication.

The reason we are bullish on Invex is that we believe the IIH market opportunity is significantly bigger than what the broader investment community thinks. We are also confident that with strong science behind the company’s method of action that it is also potentially the gateway to far larger indications with bigger markets that have similar symptoms (increased pressure in skull/headaches). These include larger indications such as acute stroke and traumatic brain injury.

Invex has finished treating 16 patients in a Phase 2 double-blinded trial which is expected to read out soon. Based on our work and learning more about the off-label use of Byetta (Exenatide) to treat IIH along with the method of action studies that have been undertaken, we are confident that Invex will be able to show a positive trial result in the forthcoming readout (guidance for readout in early 2Q of 2020).

This will be invaluable data for the company who we expect will then proceed with a single Phase 3 pivotal (registration trial) with their improved formulation of called Presendin™. With orphan drug designation granted and patents filed (Japan granted, others pending) Invex will have a quicker pathway to commercialisation than with novel drug development.

Should Invex successfully be able to regulate pressure in the brain using a repurposed and reformulated Exenatide it will generate significant interest in the company and the underlying shares. We would expect the shares should start re-rating to a valuation of conservatively between ~$160m to $200m.

With the increased likelihood of a pharmaceutical deal or take over once the registration trial is approved, and patents granted this could end up pushing the valuation materially higher.

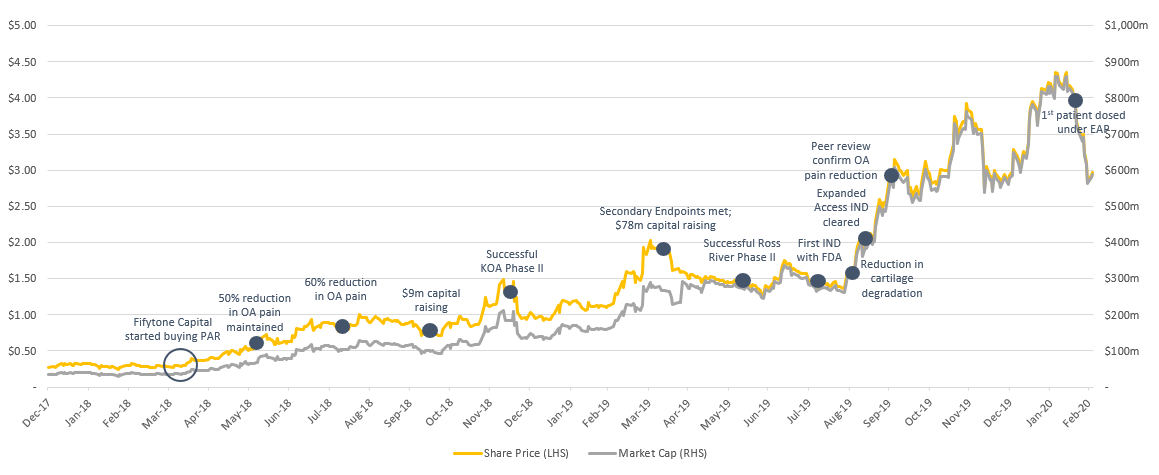

Drug Repurposing

As many of our investors will know, we are fans of repurposed drugs and previously discovered Paradigm at a $30m market capitalisation – currently around A$500m (Paradigm are repurposing PPS for Osteoarthritis and other indications that have similar symptoms). The reason we were so confident Paradigm would pass their clinical trials was that we could see real-world evidence that showed the drug was already working outside of a trial setting. People who were taking the drug were raving about it over the current standards of care. When we see things like this, we take notice. We are seeing similar things with Invex.

Paradigm Biopharmaceuticals (PAR) share price performance chart

The story with Invex we believe could follow a similar trajectory to Paradigm as they are taking a known compound (Exenatide), which is currently used to treat type 2 diabetes and reformulating it to treat IIH & other indications. The reason we like repurposed drugs is that the inherent risks are significantly lower as you can see real world evidence if they are working. Not only this, but they are already approved and typically have a well-known safety profile.

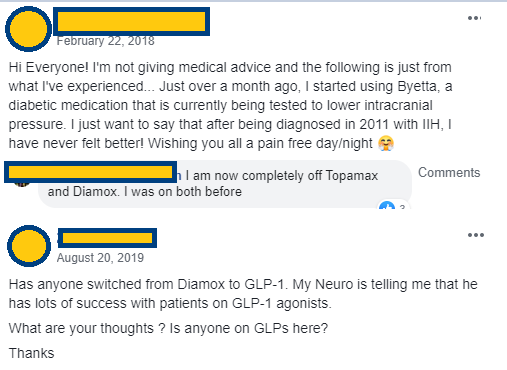

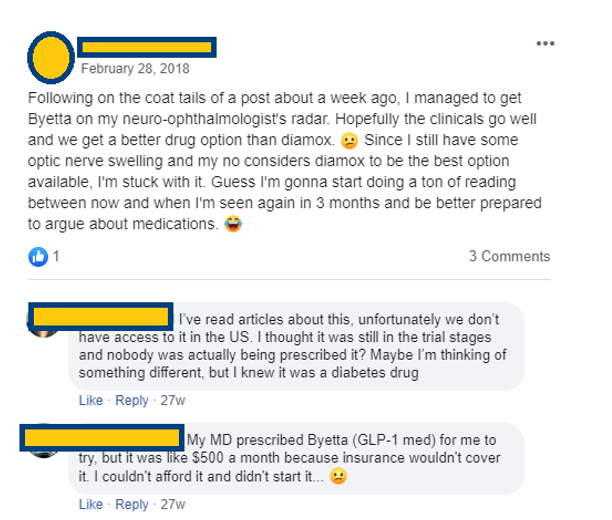

As we delved into deep research on Invex we noticed there was a small group of people able to access Byetta (Exenatide/GLP-1 receptor agonist) off label. The feedback from these patients was extremely positive and backed up the pre-clinical work done by the University of Birmingham showing its potential for treating this indication.

Anecdotal

evidence of people using Byetta (Exenatide) off label to treat their IIH –

While extremely hard to get access to off label, it shows the lengths people

are willing to go to get the drug

While this is anecdotal evidence and it needs to stand up against a placebo, we saw similar things with Paradigm. Based on the pre-clinical evidence and case studies like this we are confident Invex will show statistical differences between Exenatide and Placebo constituting a successful trial readout. This should result in a re-rating of their share price as the company moves one step closer to commercialisation of Presendin™.

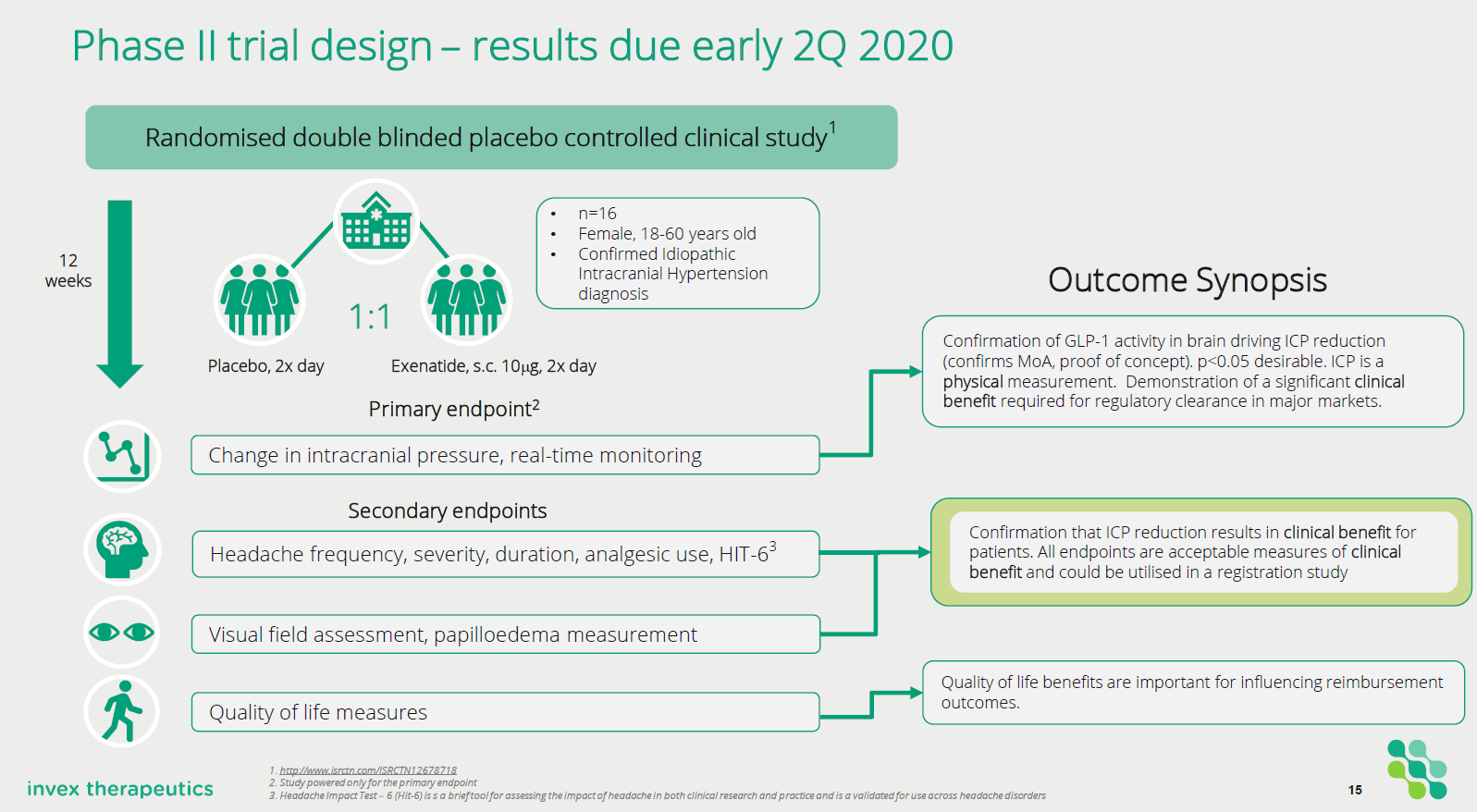

Trial

Invex has now fully recruited the patients being treated in their Phase 2 clinical trial and plans on reading out the results in early 2Q of 2020 (very soon). This trial involves 16 patients being treated with Exenatide or a placebo randomised 1:1. The patients are being treated under the care of Professor Alex Sinclair (who is the Executive Director and Chief Scientific Officer for Invex).

All the patients have a real-time intracranial pressure monitoring device implanted within their brain which provides real-time feedback about intracranial pressure. This is a unique and difficult to replicate method by which to monitor the effects of increased intracranial pressure as a result of IIH and provides a very dense and uniquely informative dataset.

Invex

Trial Design of Phase 2a study in IIH

The trial is focusing on patients who have a clinical diagnosis of IIH (diagnosed by modified Dandy criteria) and are being treated with either placebo or Exenatide (10mcg BID subcutaneously twice per day) for 12 weeks. The primary endpoint of the study is a change in intracranial pressure (ICP) between baseline and 24 hours post drug administration.

• Change in ICP baseline and 24 hours post drug administration

• Change in ICP baseline vs 2.5 hours post-administration

• Change in ICP between baseline and end of trial visit

The intracranial pressure is being measured in real-time through a surgically implanted monitor. The secondary endpoints in the study are measuring symptoms that effect people with IIH. These include:

• Headache measures (severity, duration, analgesic use, Hit-6)

• Visual assessments (visual field papilloedema, intraocular pressure as measured by optical coherence tomography, ICP variability)

• Quality of life measures.

Other exploratory endpoints that are being evaluated include: Serum and cerebrospinal fluid exenatide levels, modulation of serum and biomarkers.

The key function of the study is to demonstrate that Exenatide can significantly reduce intracranial pressure in IIH patients. It will also gather necessary data that will be used to design a subsequent Phase 3 registration trial using the company’s reformulated Exenatide in IIH.

What is IIH & What are the current treatment options?

So, what is Idiopathic intracranial hypertension (IIH)?

IIH is a disorder that relates to high pressure in the brain. It is typically more commonly found in obese women of childbearing age. The symptoms typically include; headaches, ringing in the ears and blurred vision or partial loss of vision due to the increased pressure inside the skull. The pressure is caused from excess production of cerebrospinal fluid which can’t be treated effectively with existing medication.

The elevated pressure in the skull is caused by alterations in the volume of the cerebrospinal fluid so if this can be successfully treated/regulated with a drug it would be a breakthrough for the treatment of IIH.

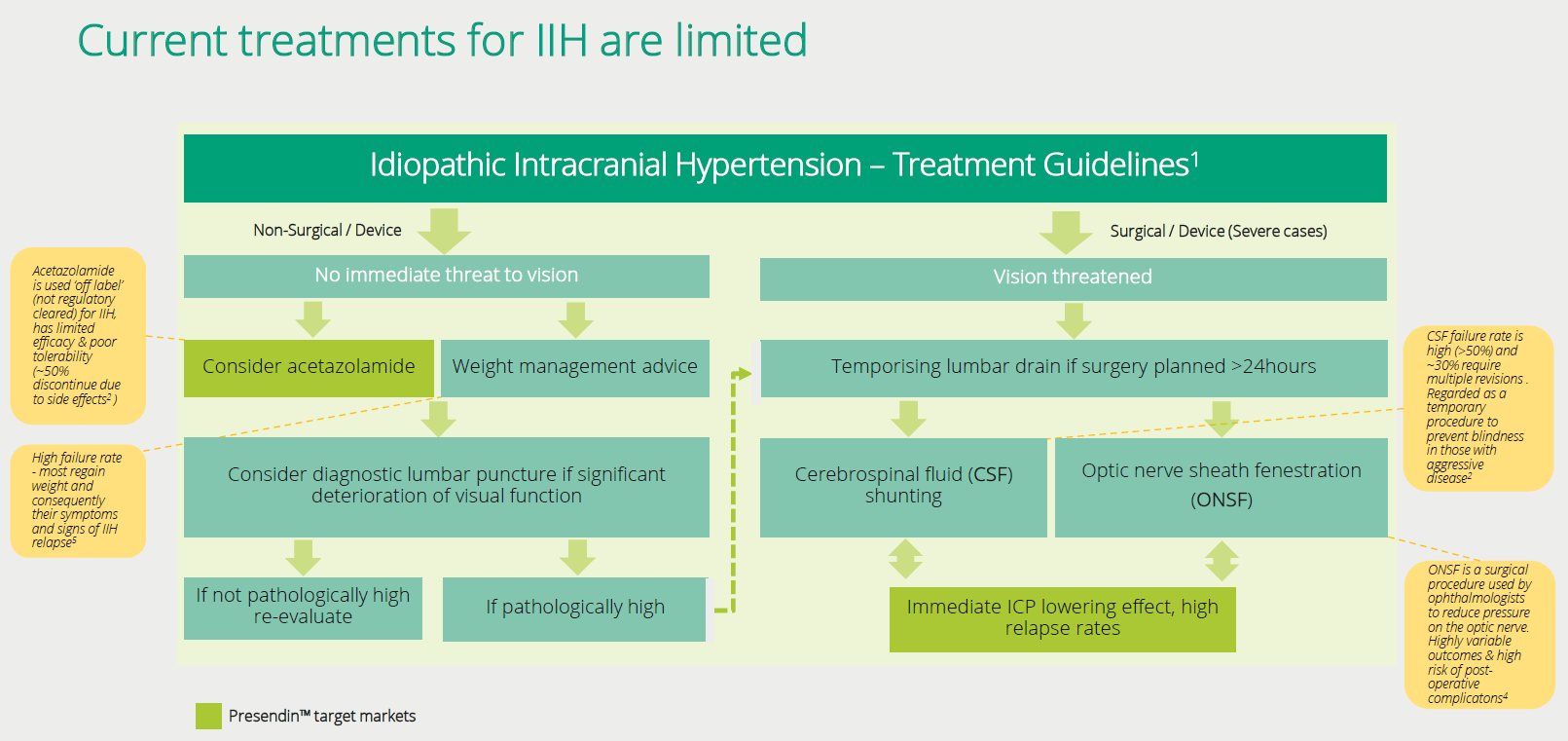

The underlying cause of IIH is not understood but does correlate highly to being overweight/obese and is more common in females. The current treatment options are not very effective and typically have negative side effects. That said, typically the first treatment recommendation is to lose weight - which unfortunately is normally very difficult for people suffering from the condition. In speaking to clinicians on the topic, only a very small percentage manage to lose the weight and keep it off.

Another method to try reducing the pressure in the skull is to do a lumbar puncture. This is done to drain the cerebrospinal fluid from the lower back which sometimes will control the painful symptoms in the short term. If they persist (most cases) then it's likely further treatment is necessary.

The next most common treatment is a drug called Acetazolamide (Diamox) which from existing studies does not show significant effect for treating the disease and is not currently approved by regulatory authorities or widely accepted by clinicians as the standard of care. In fact, the side effects (typically nausea, vomiting, and depression) are so severe with Acetazolamide that most patients elect not to continue with taking it (along with the fact it isn’t good to take long term).

The lack of effective drugs means that neurosurgery to reduce the brain pressure and prevent blindness is the last step which involves either a shunt procedure or decompression of the optic nerve (depending on the primary problem). A shunt surgery generally creates a conduit where the cerebrospinal fluid can drain to another body cavity. Neither is very effective and typically the shunts only work for a period before blocking. The poor efficacy over the long term and the risks that are associated with surgery need to also be taken into consideration.

Unfortunately for these patients none of these treatment options are very effective. On a case by case basis, there are some people who can manage their condition, but from our discussions, the vast majority are left with limited options for treatment.

As such, we believe if Invex passes their upcoming trial and can replicate that success in a registration trial their drug Presendin™ is likely to become the standard of care and frontline medical treatment option.

Current

treatments don’t provide much relief for suffers from IIH and show little benefit

over and above a placebo

Method of Action

Professor Alex Sinclair is a thought leader and well-respected physician within the IIH community as well as being the Executive Director and Chief Scientific Officer (CSO) for Invex. Professor Sinclair was inspired to evaluate the role of Exenatide (which is a GLP-1 receptor agonist) in regulating intracranial pressure from data highlighting the class of drugs’ ability to regulate fluid transport to the kidney. Through this research, they discovered in-vitro (lab) and in-vivo (animals) that GLP-1 receptor agonists did successfully regulate and reduce the secretion of cerebrospinal fluid. If the cerebrospinal fluid could be down-regulated, then it could potentially reduce pressure within the skull and alleviate the symptoms associated with IIH.

Exenatide was then chosen as the preferred GLP-1 receptor agonist because of the excellent safety profile of the compound, its expiring patent status and the fast onset of action.

While overall Exenatide is a safe and widely used drug. It does have some minor side effects such as nausea, vomiting or dizziness that typically disappear after about a month of treatment as the body becomes tolerant to the drug. However, one of the other side effects is a loss of appetite which results in weight loss (which is the primary treatment option for patients with IIH) adding to the appeal of using this drug for treatment.

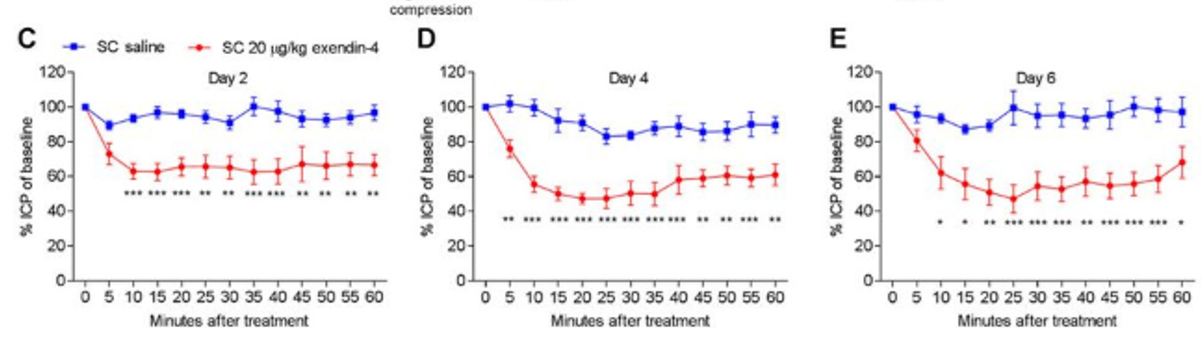

Professor Sinclair then began further studies in-vivo & in-vitro which confirmed her thesis of Exenatide’s potential to down regulation of the secretion of cerebrospinal fluid. As the graphs below show there is a clear difference between the saline (placebo) and Exenatide. The benefit of Exenatide is it also appears to be very fast-acting in reducing the cerebrospinal fluid and pressure associated with it.

Results

from In Vivo studies undertaken prior to first in human study

After understanding the method of action for Exenatide and the side effects of weight loss which could help patients, it seems it would be an obvious drug to test in a clinical trial. With strong pre-clinical evidence of the efficacy against a placebo, we were interested in learning more.

As we conducted more research, we discovered anecdotal evidence of off label use of Byetta (Exenatide) for people with IIH (previously mentioned). This, along with the demand for it due to the lack of effective treatments. In our research, we also discovered an online petition calling for the approval of this medicine - which only added to the weight of evidence that this upcoming trial is likely to be successful. Not only this but if Presendin™ is commercialised there is clearly a demand for from patients for effective treatment options. Therefore, we believe Presendin™ becomes the leading treatment option for IIH should it become commercially available.

Petition

on Change.org calling for the approval of GLP-1 Drugs for patients with IIH

Economics of IIH

So, if we believe the drug works and people want it? How do we value it?

As demonstrated above, we are very confident that Invex will be able to show clinical effect in their Phase 2 study. With this data, they should be able to take their reformulated Exenatide into a Phase 3 registration trial (after conducting some necessary Pharmacokinetic (PK) studies). It’s likely the regulators will want to see an endpoint that focuses on clinical outcomes for patients - but the links between elevated intracranial pressure and headaches (pain) are well known. With orphan indications, regulators are also more supportive towards effective treatments (especially those with good safety profile) in order to expedite the process of getting these treatments to market.

Worst case, with an orphan indication Invex will have a window of 7 years in the US and 10 years in the EU without competition from Exenatide formulations

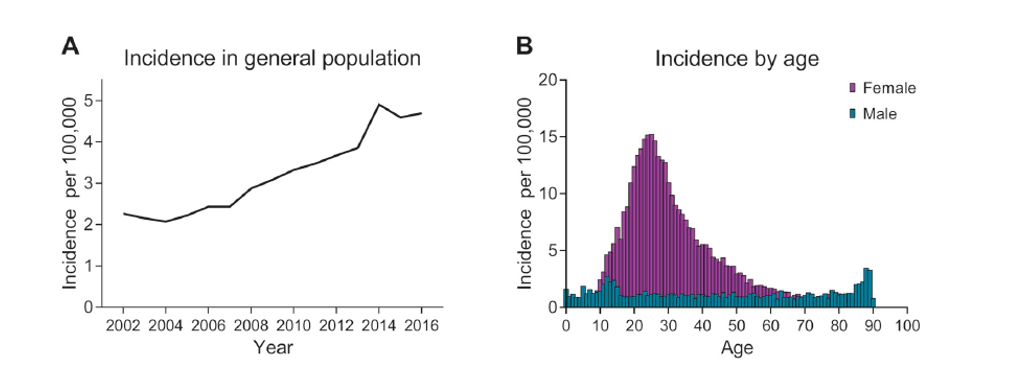

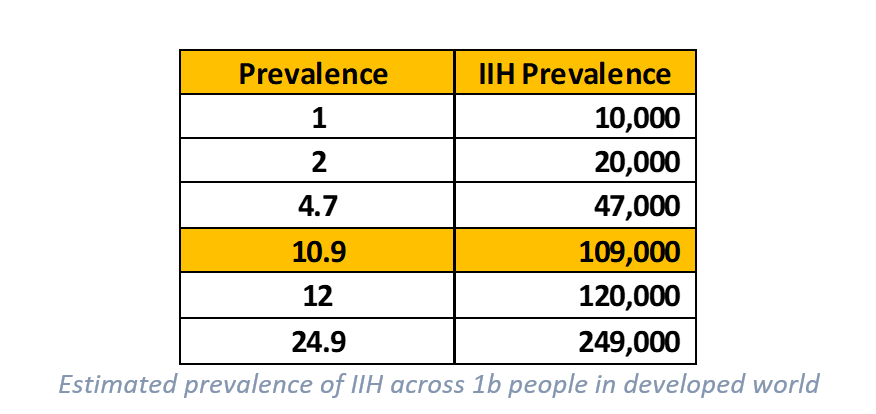

IIH is classed as an orphan indication as it affects a small patient population (designation of less than 200k people in US). But how common is this disease? When we first started looking into it there didn’t seem to be a high incidence of patients (Dr. Google said 2:100,000 people suffer from IIH). However, after discussions with key opinion leaders (KOL’s) and reading papers on the topic, we believe the patient population is significantly higher than what is reported.

In a study (The Expanding Burden of IIH Sept 2018) undertaken in the UK it showed the prevalence rate for IIH to be as high as 10.9:100,000 people within the general population (prevalence being the number of people within the population who suffer from the disease). In this case, 10.9 people in every 100,000 would be diagnosed with IIH. Within western countries, especially those with higher rates of obesity this rate is perhaps even higher. This notion is supported by another study titled The Prevalence of IIH and associated co-morbidities in central-western NSW which showed an even higher prevalence at 24.9:100,000! There was also a strong correlation between IIH prevalence and obesity in females which is common to most studies.

Incidence

rate of IIH is closely linked to obesity. With the US having close to 10%

higher rate of obesity it means the incidence rate is likely to be ~10% higher

The incidence rate (the number of new cases diagnosed with the disease within a year) of the disease is also increasing along with the increased rate of obesity (which has increased significantly). In the UK study, it showed that the incidence rate increased by 108% over the period taking the rate to 4.69 per 100,000 people. Importantly patients admitted to hospital increased significantly over the period (23,182 cases over 14 years) showing the increasing burden on the health care system for this disease.

However, using the published incidence rate of 4.7 from the UK study it would mean that within the US there are around 15,000 patients who are potentially diagnosed with IIH each year. Using the 10.9 prevalence figure on the US population (327m) means that there could be over 35,000 people currently in the US who suffer from IIH.

Incidence

of IIH has increased significantly

So, looking at the incidence and prevalence of IIH it’s clear that there is a very wide range of possibilities when considering the literature that will drastically impact the economics of the addressable market.

How we approach this is we will only look at the developed markets of the UK/US/EU/AUS as we believe these are the likely markets Invex will target. Within these countries there is a total population of an estimated ~1 billion people. With elevated obesity rates within most of these countries, it’s likely the prevalence and incidence figures posted from the aforementioned studies are a reasonable proxy (if not conservative). Therefore, we will use prevalence rates similar to the UK study to work out what we believe the potential addressable market is from this.

Our view is that prevalence probably sits somewhere between 8 – 12 per 100,000 in the general population of these countries. As the 10.9 figure is quoted for the UK, we will use a slightly reduced 10 per 100,000 in our modeling to estimate what the addressable market could be across these jurisdictions (which gives 100,000 people). It’s important to note that prevalence will grow from new incidences and an increasingly obese population.

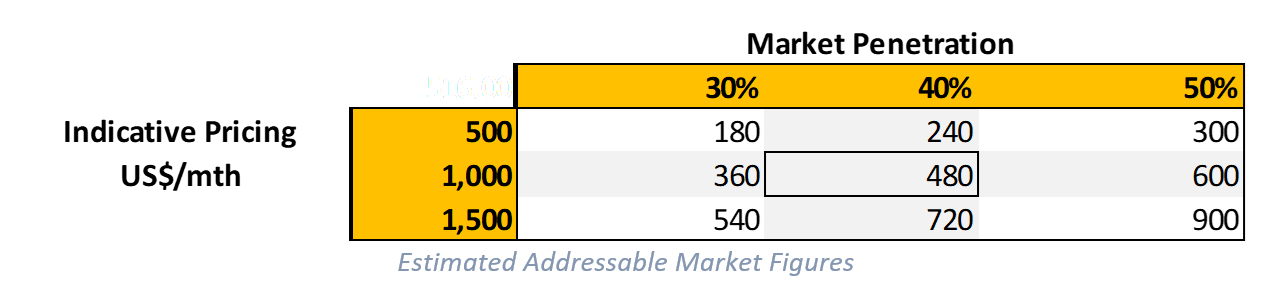

So, with an IIH population of around 100,000 people, we next consider the potential market penetration. As existing patients may already be taking medication (Diamox), have shunts or believe there is no further treatment available to help them, the penetration into this existing patient population is likely lower than new patients being diagnosed (incidence). As such, we estimate that at peak sales, market penetration to be 20% of existing patients, but as high as 50% for new cases. Combined, we estimate that at peak sales, the market penetration to be ~40,000 patients per year, equivalent to ~40% existing IIH market.

The next major consideration is the price. While orphan indications can typically achieve significantly higher price points, we will look at what the likely unit economics for Invex could be. As they are repurposing an existing drug, it’s likely that the price point could be lower than other more novel orphan drugs. This is not always the case as the reimbursement and insurance around the economic benefit will be taken into consideration (e.g. if this significantly lowers hospital visits what is the cost-saving as a result). As outlined in the paper (The expanding burden of IIH), by 2030 it’s projected that IIH could cost hospitals in England over £467.2m – which could be significantly reduced should Invex be able to develop an effective treatment.

The current price for Exenatide is around US$500 per month or about US$6,000 per year. This formulation is for type 2 diabetes which is far more common than IIH. As mentioned, we believe Invex will achieve a higher price given the orphan designation and likely reimbursement available should it become the standard of care for the indication. As such, we will use 3 different prices to formulate our view on the market economics.

As indicated above, we believe at the base case pricing of $1,000 per month that the total addressable market for Invex’s IIH drug is ~US$480m per year at a 40% overall penetration. On the conservative side, it could be as low as US$180m at lower prices and penetration but as high as US$900m on the higher side. These figures could also vary depending on the uptake in the market (existing patients & new) and may prove too conservative. However, we consider this to be a reasonable estimate of the end market value for the drug should it be successfully commercialised.

Applying a typical 3-4x peak sales multiple on a base case US$480m addressable market size gives a potential derisked valuation of US$1.4 - 1.9bn (relative to Invex current market cap of ~$45m). Needless to say, there are a lot of hurdles to jump over for this to occur and is highly dependent on a large number of factors including the chosen commercialisation path, however, what we are trying to illustrate is the immense upside potential on offer in this lead indication alone. As the company progress through key commercialisation milestones and derisk this asset, we expect to see the share price re-rate higher over time.

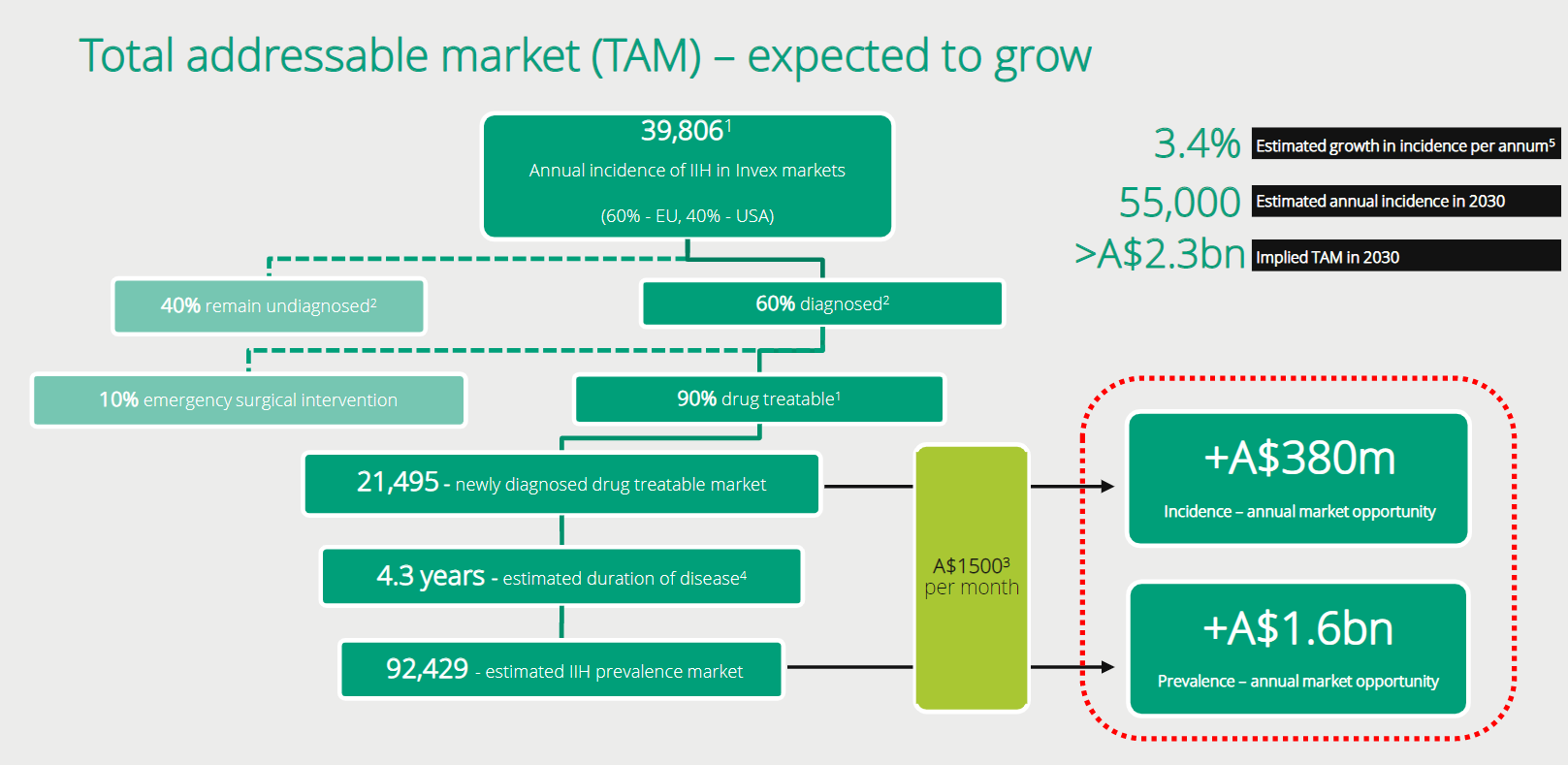

Invex recently put a new presentation out which shows similar figures to our own (only EU/US markets). Again, the size of this market opportunity is significant!

Slide

from recent Invex presentation showing addressable market in US/EU which is

similar to our conclusions.

Commercialisation Strategy & Unlocking Value

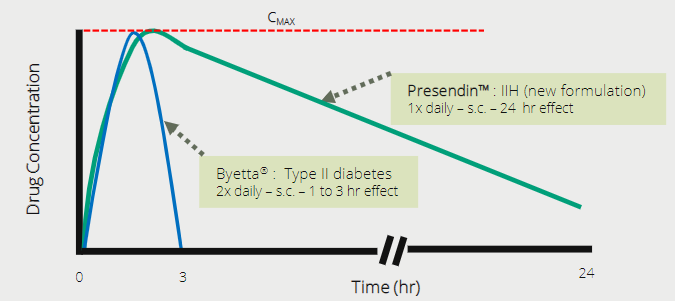

As indicated, we are confident that the current trial will be successful. This data will then be used for designing a Phase 3 registration trial. The company has indicated they are looking at reformulating the drug to be better suited to patients with IIH (slow release over 24 hours). If they can do so successfully, this will then potentially further strengthen their intellectual property and patents around the drug (of which some are yet to be granted).

Reformulated

Exenatide would see a slow release over 24 hour period

Our view is that the company would more than likely partner with a pharmaceutical company to further develop this drug or partner for distribution.

Given the size of the potential end market and orphan status giving a monopoly over and above patents, it should appeal to a potential pharma partner. Not only this, but it shows the potential for the drug to work in other, larger indications. If these are not designated as orphan, then it will be important to obtain granted patents. But our view is that the company could likely achieve a deal on this asset somewhere between US$300m to US$500m depending on deal structure and timing.

Anecdotal evidence of demand for Byetta (Exenatide) which would receive reimbursement and become more affordable for patients once a label is granted specifically for use in IIH

There is a clear demand for this drug to be approved, and once commercialised is likely to be covered under insurance and reimbursement schemes allowing higher prices to be achieved on sales as well as making the cost to the end-user affordable. As such, we think $1,000 is a conservative estimate for monthly pricing once commercialised.

Board & Management

Currently Invex runs a very lean team with very low overhead costs. We like this as it means the cash is being focused towards developing their key asset. The company is led by Non-Executive Chairman, Dr. Jason Loveridge who has over 30 years of experience across listed and private pharmaceutical businesses. He has been involved in several sales and partnering deals involving biotechnology assets. Dr. Loveridge currently owns around 9.2% of IXC AU.

Professor Alex Sinclair is a very accomplished and well-known thought leader in the medical community who treat IIH. She is the Executive Director and CSO at Invex and a practicing clinician with valuable knowledge about the shortfalls and lack of treatment options for IIH. Prof. Sinclair has led the clinical trials and was involved in vending in the intellectual property that is currently owned by Invex. Prof. Sinclair currently owns around 4.5% of IXC AU.

Mr David McAuliffe who is a non-executive director also owns around 6% of the company.

Invex has a very tightly held register with management holding a significant portion of the register totaling ~20% of the free float. This aligns the interest of shareholders to those running the company. We also note there is a significant number of shares placed to parties who are likely to remain strong holders such as Minderoo (Andrew Forrest) who also owns ~9% of the shares on issue. In total the substantial holders retain over 46% of the float.

We expect that should the company pass the upcoming clinical trial that this team will expand as the drug moves towards clinical development and a registration trial. As at the end of the December 2019 quarter, the company held ~$10.8m cash in the bank. We have estimated a further ~20m shares to take the total issued capital up to ~75m shares on issue will be needed to get the drug through a registration trial (depending on partnership discussions also). This would obviously increase the cash balance available to the company and improve the liquidity of the shares tradeable on the ASX.

Risks

The major risks we see are:

Trial failure: If Invex fail their existing trial the shares would re-rate significantly lower. Risk probability we rate as low as discussed throughout the note.

Patents not being granted: Invex currently has a granted patent only in Japan with broader patents still under review. If their IP is not patented the value of the business is reduced and may limit further pharma transactions. Risk probability we rate as low given the company is likely trying to capture a very broad amount of data within the patents. With orphan status, they will have a period of exclusivity but having patent protection will extend this out significantly further. If it was not an orphan indication, we would rate this risk as moderate.

Inability to successfully reformulate and achieve manufacturing: As the company is seeking to reformulate the drug it will require more studies and manufacturing expertise. There is likely risk of additional delays as the product is reformulated. The regulators may also request further studies should the formulation change materially. We rate this risk as moderate given it may cause delays in the commercialisation of the product, however, having a better formulation specific for the indication would improve the overall economics and protections for the drug and limit potential off label use. This risk will be driven mostly from regulators (FDA/EMA).

Other risks we see are around trial design and regulatory filings. These may involve larger or more expensive trials, or delays in filings which could prolong the strategy for commercialisation. Biotech investing typically requires a long timeline and pathway for development and should regulators delay the progress it may impact timelines, shares on issue and overall economics.

Our view is that at the current valuation the risks relative to the rewards are skewed in favour of incoming investors who have a longer time horizon. Like Paradigm, this company could re-rate significantly over time as they continue to de-risk the asset and expand into other indications. If a drug works and there is an unmet need from patients, it is a good indication the company could trade at valuations relative to future commercial sales.

Conclusion

Our view is that Invex appears undervalued and remains relatively unknown by the market after what was a hot IPO in 2019 reaching a peak of $1.69 per share. With strong clinical and anecdotal evidence, we believe the company has an excellent chance of passing their upcoming Phase 2 clinical trial. Being an orphan indication is favourable to the overall economics of the drug in development and means the company should be able to bring their drug through to commercialisation after one (further) registration trial.

This limits potential future equity dilution and places the company in a favourable position to execute on potential pharmaceutical transactions (either selling company or partnering on this asset). We believe the market also underestimates the size and value of the potential market in IIH further adding to the potential value that can be realised from a sale. Given the strong science behind the method of action, it’s also likely that Invex will be able to further develop their drug into other indications with similar symptoms. While we haven’t valued these given their early stage, these provide some additional blue sky to our valuation and assumptions should the company be able to develop these further.

With low overheads and a strongly aligned management team we are confident Invex will see significant share price appreciation in the future.

As such we believe Invex is a great asymmetric investment opportunity where the downside risk appears limited when compared to the potential upside.

Disclosure: This information has been produced as part of our internal research on Invex. While extensive research has been conducted, please cross check the facts and sources of this information. All information presented is publicly available and as such we cannot speak to the accuracy of this information or studies and should be considered potentially incomplete. The assumptions that have been made from this data is our own opinion and should not be taken as fact. This note is not a recommendation nor is it advice and should be considered general in nature. Please do your own research on the company and seek financial advice as required. The Progressive Global Fund, which is managed by Fiftyone Capital owns shares and unlisted options in Invex Therapeutics (IXC.ASX) and will benefit from an increase in the share price. We take no liability and any potential financial losses that may be incurred should you act on any of the information contained within this report.

4 topics

2 stocks mentioned