DeepSeek – AI’s Sputnik moment?

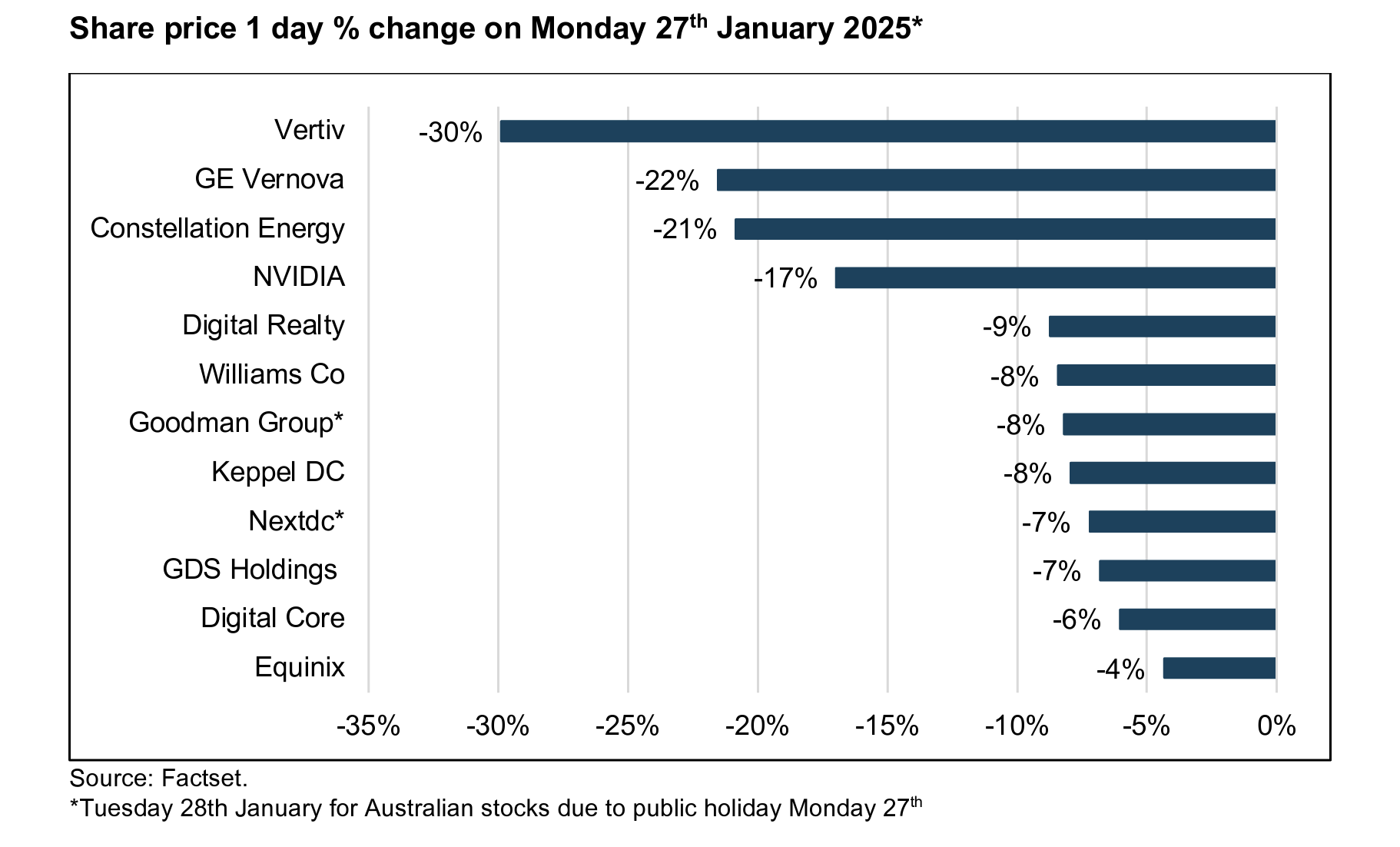

AI-related stocks sold off heavily on Monday 27th January 2025 as news emerged about DeepSeek R1, a Chinese developed AI large language model (LLM). DeepSeek has asserted it could deliver performance comparable to U.S. developed AI models, such as ChatGPT, but at a fraction of the cost and with much less physical computing power required.

While there is some healthy scepticism towards certain aspects surrounding DeepSeek, advancement in its algorithm has been widely recognised by the tech community including the leaders of NVIDIA, OpenAI and Meta.

DeepSeek’s open-source program allows it to be quickly studied and adopted globally, and therefore, it could represent a step-change in resource intensity required for the continued development of AI. This has led investors to re-assess the bullish trajectory of demand for advanced computer chips (GPUs), physical infrastructure and power required for the build-out and training of AI models.

As a result, stocks ranging from chip manufacturers, utilities, data centre equipment manufacturers and data centre landlords experienced significant share price declines following the DeepSeek news.

Data centre implications

Given the Resolution Capital Global Property Securities Fund (ASX: RCAP) portfolio's overweight position and broader interest in data centres, we provide here an outline of our current thoughts on the potential implications for the data centre real estate sector, with the caveat that there are still a lot of unknowns.

Potential negatives:

- AI-related demand for data centres may not live up to previous bullish expectations as future AI model developments could become more resource efficient, requiring fewer advanced chips, less power and cooling, and less data centre capacity than previously anticipated.

- The potential reduction in demand could eventually lead to oversupply conditions in data centres - although this is not anticipated in the near-term given significant supply bottlenecks and lengthy lead times for electricity grid upgrades, electrical transformers and air-conditioning components required to satisfy current demand levels.

- Big tech companies could reduce capex on data centre build outs. While previously-announced capex might continue in the short term, it may be re-oriented towards software development rather than hardware (AI training infrastructure). Nevertheless, on its earnings call on 29th January, Meta re-iterated its plans to increase total capex spending to US$60-$65B this year – including increased investment in generative AI.

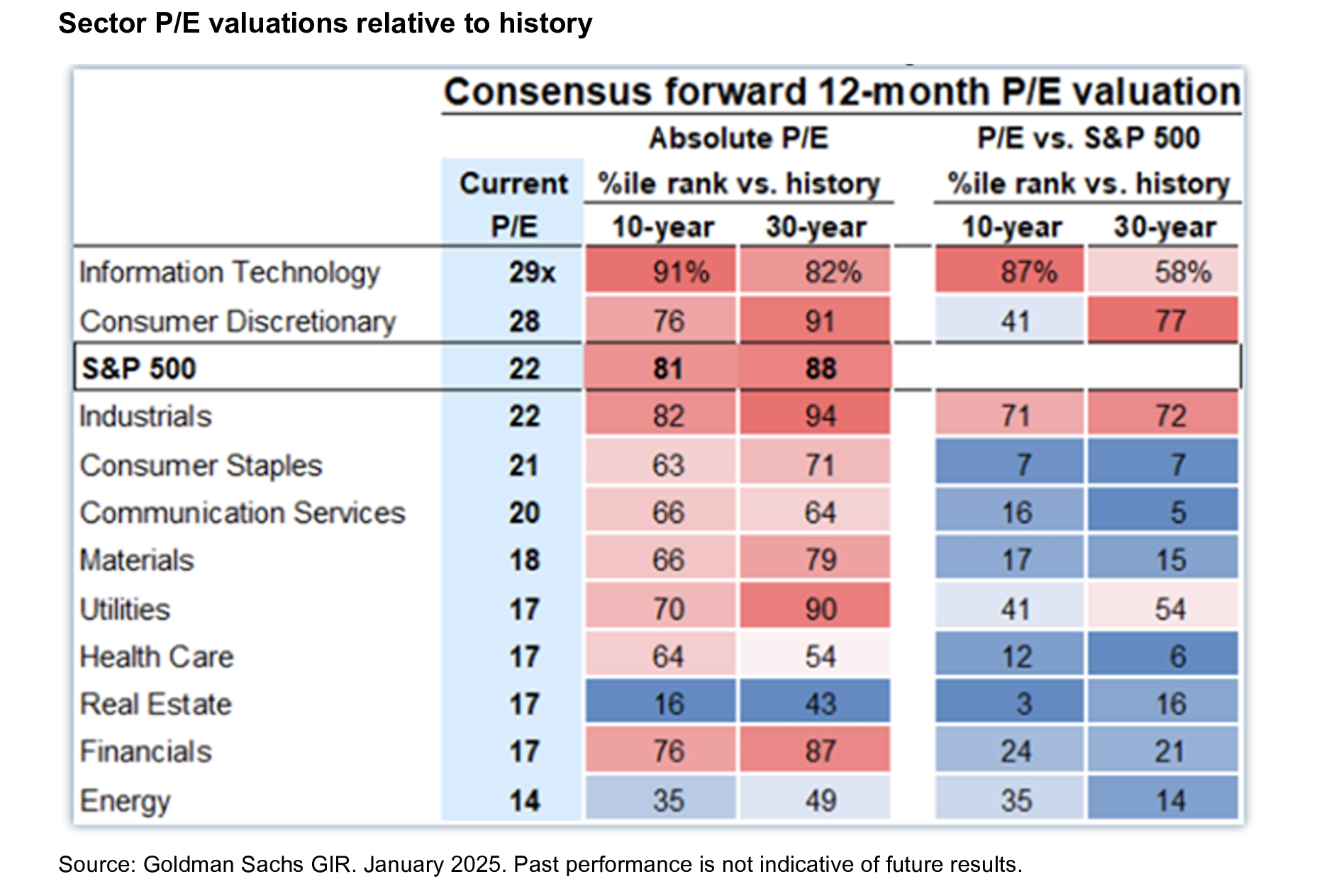

- Investor enthusiasm for AI-related stocks (GPU’s, data centres, utilities etc) since AI emerged as a significant demand driver two years ago, has pushed valuation multiples to elevated levels relative to other sectors.

Potential positives:

- DeepSeek may have over-stated its efficiency, and as such, it may not prove to be as great a departure from current AI infrastructure needs as initially feared. DeepSeek’s capabilities benefited from US developed large language models, which muddies the claim that DeepSeek R1 was trained for <US$6m. If R1 had to be trained from scratch, the cost would have been significantly higher.

- There is a long history of technology efficiencies driving increased adoption and ultimately growing the total demand pool. Microsoft's CEO was quick to reference Jevons Paradox, the observation that improvements in resource efficiency often leads to increased, rather than decreased, overall consumption of that resource.

- The emergence of cheaper and more efficient AI models could potentially spawn new entrants (previously precluded due to the significant upfront costs, sometimes referred to as the ‘money moat’ that benefited incumbent big-tech companies).

- Cheaper AI development could speed up AI adoption. Greater adoption could drive greater AI inference1 demand, benefiting existing data centre owners located in major population centres, as they cater to endusers requiring strong network connectivity and lower latency.

- While DeepSeek is more efficient and its advancements are likely to be widely adopted, major tech companies remain focused on developing more sophisticated artificial general intelligence (AGI), which will likely still require increased computing power for both training and inference.

- National security concerns and geopolitics could drive duplication of AI investment. DeepSeek's emergence may compel tech companies and governments globally to increase capex to further improve AI capabilities.

Portfolio positioning

The Portfolio has 15% exposure to specialist data centres via Equinix Inc. (NASDAQ: EQIX) and Digital Realty Trust Inc (NYSE: LDR), which represents an overweight position relative to the 8.5% benchmark weight.

That said various other benchmark constituents outside of the specialist sector have varying degrees of exposure to the data centre thematic such as Goodman Group (ASX: GMG), Iron Mountain (ASX: IRM), Segro (LON: SGRO), Merlin (BME: MRL), and Prologis (NYSE: PLD) which have made much of their strategy to develop data centre facilities, some of which will be aimed at hyper-scale tenants which could include AI training uses. We have limited exposure to these REITs.

Our conviction in data centres is predicated on the expansion of the digital economy across a broad range of use cases, not just AI. Admittedly AI has attracted a disproportionate amount of attention in recent years thanks to the potential impact it could have on the economy and society.

It is part of the digitalisation trend. The data centre industry is presently supply constrained for a multitude of reasons mentioned herein. That said, we acknowledge that many players are trying to get entitlements (real estate planning and power) to bring on material supply in future years. No doubt those with current capacity are enjoying pricing power, and the question now is how long this will last if the more immediate demand side has been dampened.

Our exposures are focused on superior in place platforms that provide space to a multitude of users for a variety of IT use cases, located in major metropolitan areas where there is deep tenant demand and dense fibre connectivity.

This is in contrast to some of the more recent wave of proposed AI training data centres that are mostly being developed by private capital and, by necessity, are often located in more remote locations where there is available land, cheap power, and typically oriented to a single tenant user.

If there were a reduction in AI training demand, we believe the more remote data centres would be more negatively impacted.

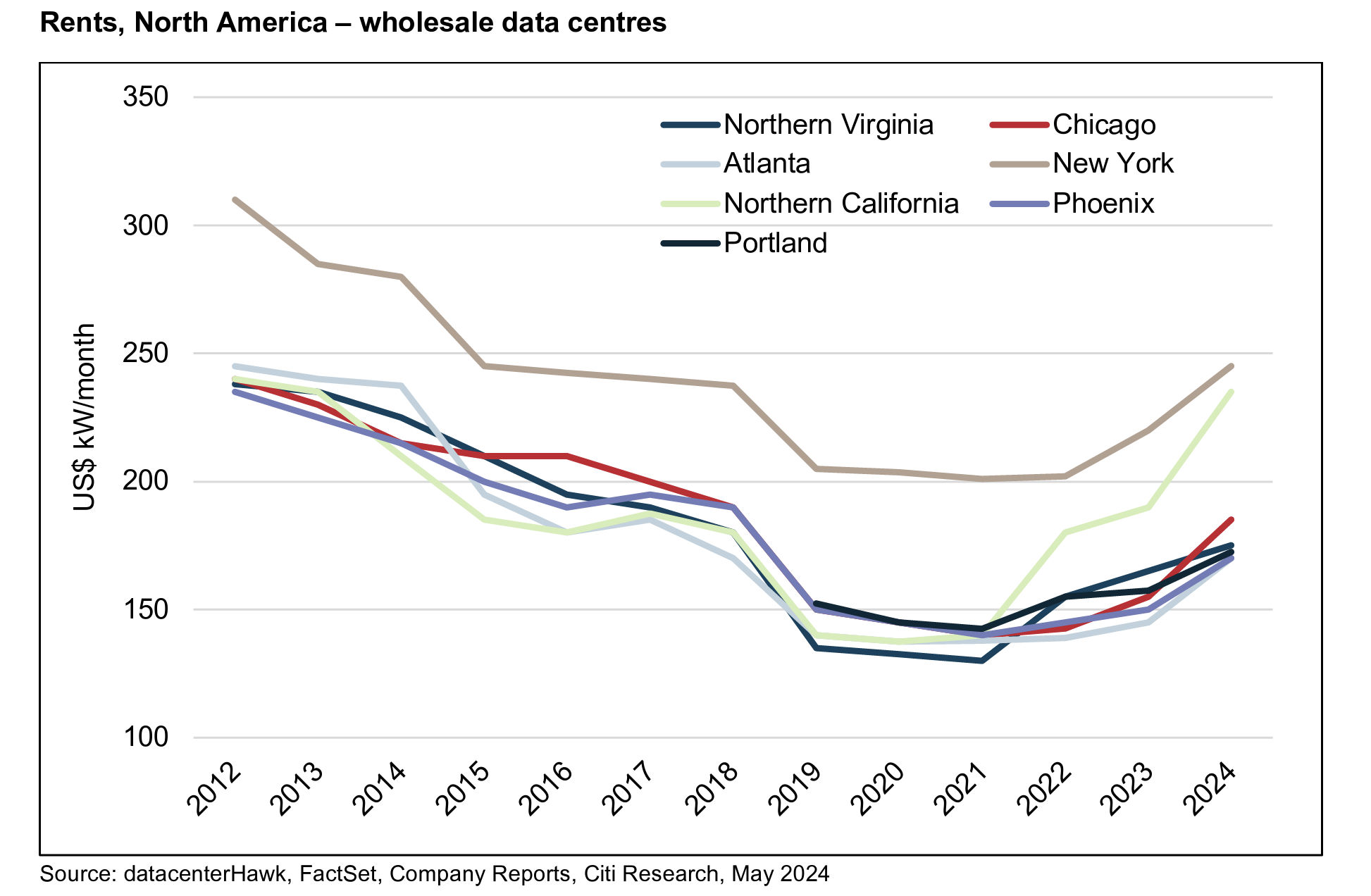

As illustrated in the following chart, wholesale2 data centre rents inflected positively in 2022, after a decade of declining rents. Context is important here as it is important to note that rents declined during that period despite solid demand from broader digitalisation trends including the shift to cloud computing.

The rental decline can be mostly be attributed to conditions that were conducive to profitable data centre development including benign construction cost inflation, declining interest rates and, tangentially, declining real estate cap rates. Despite a competitive rental market, these conditions allowed data centre developers to maintain healthy profit margins even as rents were falling.

Wholesale data centre rents inflected positively in 2022 as most of these conditions reversed (construction cost inflation spiked, interest rates rose dramatically and real estate cap rates increased), coinciding with the emergence of large-scale AI as an additional demand driver, together with significant supply bottlenecks in securing power to data centre sites and lengthy lead times for certain building components including electrical transformers and air conditioning equipment.

Importantly, it was a confluence of factors that drove the inflection, not only the emergence of AI demand. Nevertheless, Digital Realty benefited from this upward inflection in rents as its portfolio is dominated by wholesale data centres.

In contrast, our Portfolio’s larger exposure, Equinix is predominantly focused on retail3 (co-lo) data centres, which did not experience the same dip in rents in the decade up to 2022, nor the positive inflection thereafter.

Rather, Equinix has enjoyed steady earnings growth and positive pricing power for many years due to its network density, where its multi-tenant customers interconnect with telcos and each-other, thus creating an ecosystem which is more difficult to replicate. For this reason, we have long favoured Equinix as it has displayed greater pricing power over time.

Since Equinix’s portfolio does not cater to large-scale AI deployments, it was not a direct beneficiary of the investor enthusiasm towards AI over the past two years. For this reason, it should be less impacted by any diminution in AI demand that may occur as a result of the emergence of more resource efficient AI tools such as DeepSeek.

In fact, as mentioned above, we believe Equinix should benefit from the acceleration in AI adoption as its data centres are more oriented to the inferencing phase of AI - where end-users interact with AI models and prefer lower latency that is inherent in EQIX’s network dense portfolio. Hence, we continue to favour Equinix as our preferred data centre exposure.

While Digtial Realty is more exposed to the potential downside if (emphasis on ‘if’) AI demand were to be curtailed relative to prior expectations, we believe DLR is still relatively well insulated compared to private developers.

DLR’s portfolio and its development sites are located in core data centre markets catering to a broad variety of technology use-cases, and if AI demand were to atrophy, DLR’s sites could pivot to other important and growing technology functions including cloud deployment. This stands in contrast to many private developers who have committed to large-scale landbanks of future data centre development sites that are primarily suited to AI training and are located in more remote locations, some of which will not have secured power for several years.

While our overweight exposure to data centres detracted from performance relative to the benchmark on the day, the global sell-off in AI-related stocks is a reminder of the benefits of broader portfolio diversification. It should be noted that the Resolution Capital Portfolio has higher absolute exposure to the retail, healthcare and residential sectors where we also see solid operating fundamentals, and fewer technology related unknowns.

More broadly, it was notable that REITs were amongst the better performing equity sectors during the DeepSeek-induced selloff.

As we highlighted in our recent quarterly report, the REIT underperformance is mostly relating to issues not of the sector’s own doing, the increase in bond yields perhaps chief among them.

Real estate operating fundamentals remain generally sound, and valuations appear attractive versus longer term metrics as highlighted in the following table of US REIT P/E multiples compared to other S&P500 sectors.

We reiterate the ramifications of more resource-efficient AI models is no doubt not yet fully understood, but it does mean the industry is being challenged to consider the technology more rationally and hopefully alleviate some of the extraordinary pressure on the need to develop supporting infrastructure.

We believe this should result in a more disciplined supply response for an industry that is still in its relative infancy.

The path will not be without hurdles.

Our investment thesis is not premised only on the growth of AI. We believe our Portfolio is appropriately positioned based on the overall trend toward digitalisation of the economy.

Invest in Global REITs with Resolution Capital

The Resolution Capital Global Property Securities Fund (ASX: RCAP) provides exposure to the underlying returns of some of the world’s highest quality real estate assets through a select portfolio of global real estate investment trusts (‘REITs’) and property companies.

Click here to learn more about the Fund.

Footnotes

1 AI development can be broadly divided into two phases: First, AI Training is the process of teaching an AI model to interpret data, which typically involves exposing the model to vast amounts of data to help it recognise patterns and improve its understanding. The second phase, AI inferencing, is where the trained AI Model analyses new data (data not included in the training set) to make decisions based on what it learned during training.

2Wholesale data centres (also referred to as ‘hyper-scale’) are large-scale data centres often with high power needs typically leased in their entirety to a single tenant, typically a large organisation (including big-tech companies or ‘hyper-scalers’) on long-term lease commitments (10+ years) where the tenant has complete autonomy over the data centre environment.

3Retail data centres (also referred to as co-lo data centres) cater to smaller-scale needs in a multi-tenant environment, offering more flexible solutions, shorter-term leases (circa 3 years) and lower power requirements compared to wholesale data centres.

3 topics

4 stocks mentioned

2 funds mentioned