Defensive stocks aren't the only ones that can beat the market in a correction

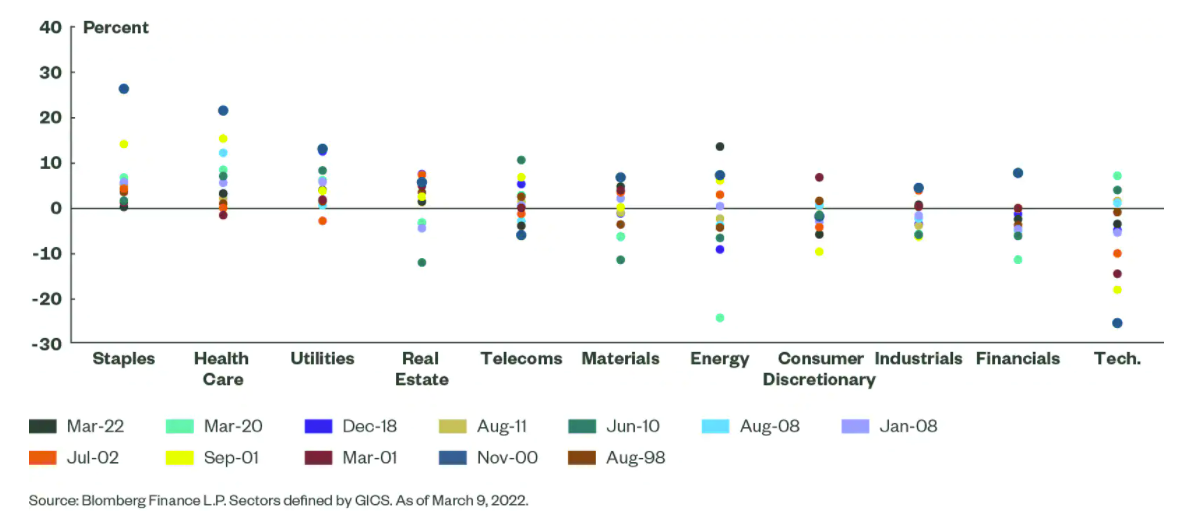

It might be tempting to think that all substantial market drawdowns look pretty much the same. Historically, in drawdowns of more than 10%, certain typically defensive segments tend to perform better than the market overall, and other typically cyclical segments tend to do worse. Materials- and energy-sector performance tend to be mixed and, in the case of energy, highly variable. But in the drawdown triggered by Russia’s recent invasion of Ukraine, materials and energy have been the strongest-performing sectors. In short: Not all drawdowns are alike.

In fact, energy stocks were the worst-performing sector during the March 2020 COVID drawdown, the end-of-2018 market selloff, and the Asia crisis in 1998; energy underperformed the overall market by 24%, 9%, and 6% in these drawdowns, respectively. However, so far this year the energy sector has outperformed the rest of the market by more than 15%. This sector also outperformed in the aftermath of the TMT bubble collapse in 2000 and 2001.

Figure 1 : Sector Performance During Equity-Market Corrections in the Past 25 Years

Three-Month Performance During Market Corrections of 10% or Larger

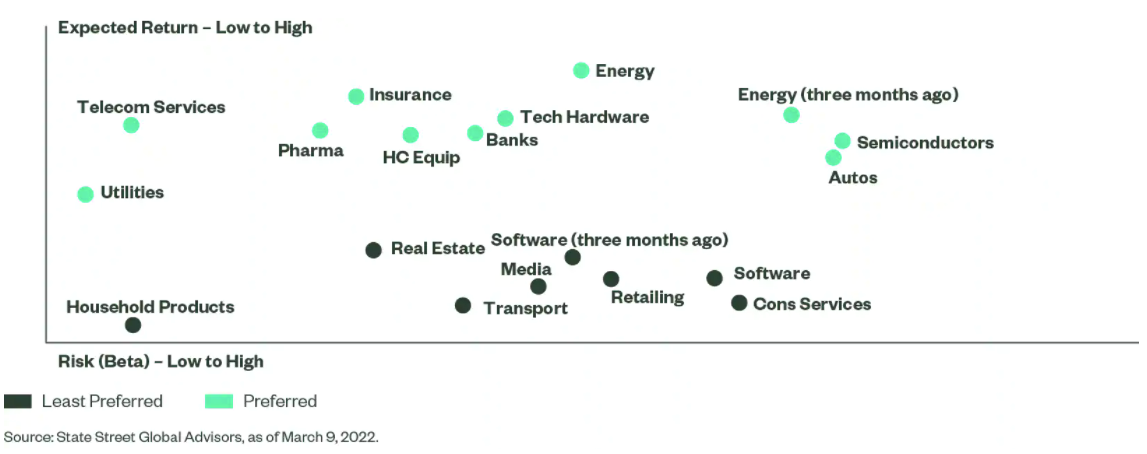

Energy stocks have become more attractive from both a risk and return perspective. We have seen the expected return on energy stocks increase and have also seen their average beta fall. This means that adding energy stocks to a portfolio improves that portfolio’s overall risk and return attributes.

We began to see an improvement in our estimates of energy stock returns in the second half of 2021, which were reflected in improved quality and sentiment measures. These themes continued in 2022, and they persisted through the drawdown that took shape earlier this year. Since the Russia-Ukraine war began, these trends have accelerated further.

Technology stocks have travelled the opposite risk and return path. Expected returns have dropped, and risk as measured by beta has increased, particularly in the software industry. Tech stocks have remained very expensive in our view, and sentiment measures — which declined precipitously over 2021 — have continued on the same trajectory during recent market events. The changes in the risk and return attributes for energy and technology stocks over the last three months are highlighted in Figure 2.

Figure 2 : Expected Risk and Return Attributes, by Segment

Developed Markets

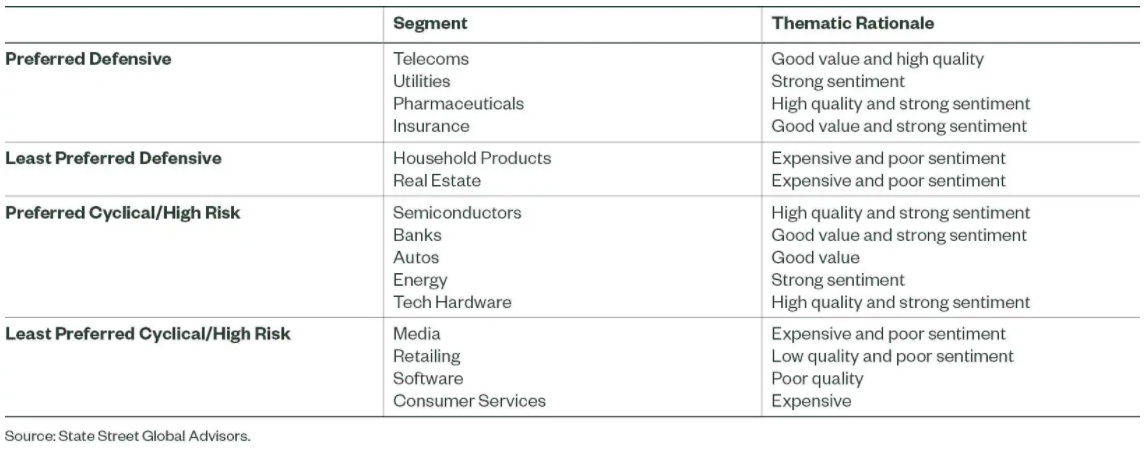

Looking through the risk/defensive lens, there are segments that we currently prefer, and segments that we currently don’t like, which are shown in Figure 3.

Figure 3 : Preferred and Least Preferred Defensive and Cyclical/High Risk Segments

Bottom Line

The conventional wisdom that defensive segments consistently outperform and cyclical segments consistently falter during drawdowns is not correct. Typical defensive segments are not the only segments that outperform the market when there is a correction; not all defensive segments outperform, and not all risky segments underperform during drawdowns. We see attractive stocks in both defensive and cyclical segments of the market at this time.

The segments that we currently find attractive reflect market trends that have been evident for the last six to nine months. These trends have not reversed so far in 2022, despite global events that are roiling markets. In fact, the latest market correction has provided an opportunity to benefit from high-risk segments like energy. Even in the course of a deep drawdown, it’s important to remember that some trends are powerful enough to persist, even through extreme market conditions.

Access high quality companies at attractive prices

Rather than building portfolios around the stocks weights represented in the benchmark index, our approach explores the market’s full opportunity set, constructing a portfolio based on stocks total return and total risk characteristics. To learn more, please visit our website.