Delving into the realities of Non-Bank RMBS performance - Why the details matter

When assessing the arrears performance of Australian mortgage originators, we must compare apples with apples. What this means is that investors need to group risk appropriately when attempting to assess the performance of one group of issuers versus another.

For example, comparing Banks to Non-Banks as a group is unhelpful, as Non-Banks tend to write a higher proportion of Non-Conforming Risk versus the Banks, who tend to only write Prime mortgages.

If we want to compare relative performance, we must make this comparison within more specific product types – for example, comparing prime bank loans to prime non-bank loans. When we do this, we can start to get a clearer sense of how various issuers perform.

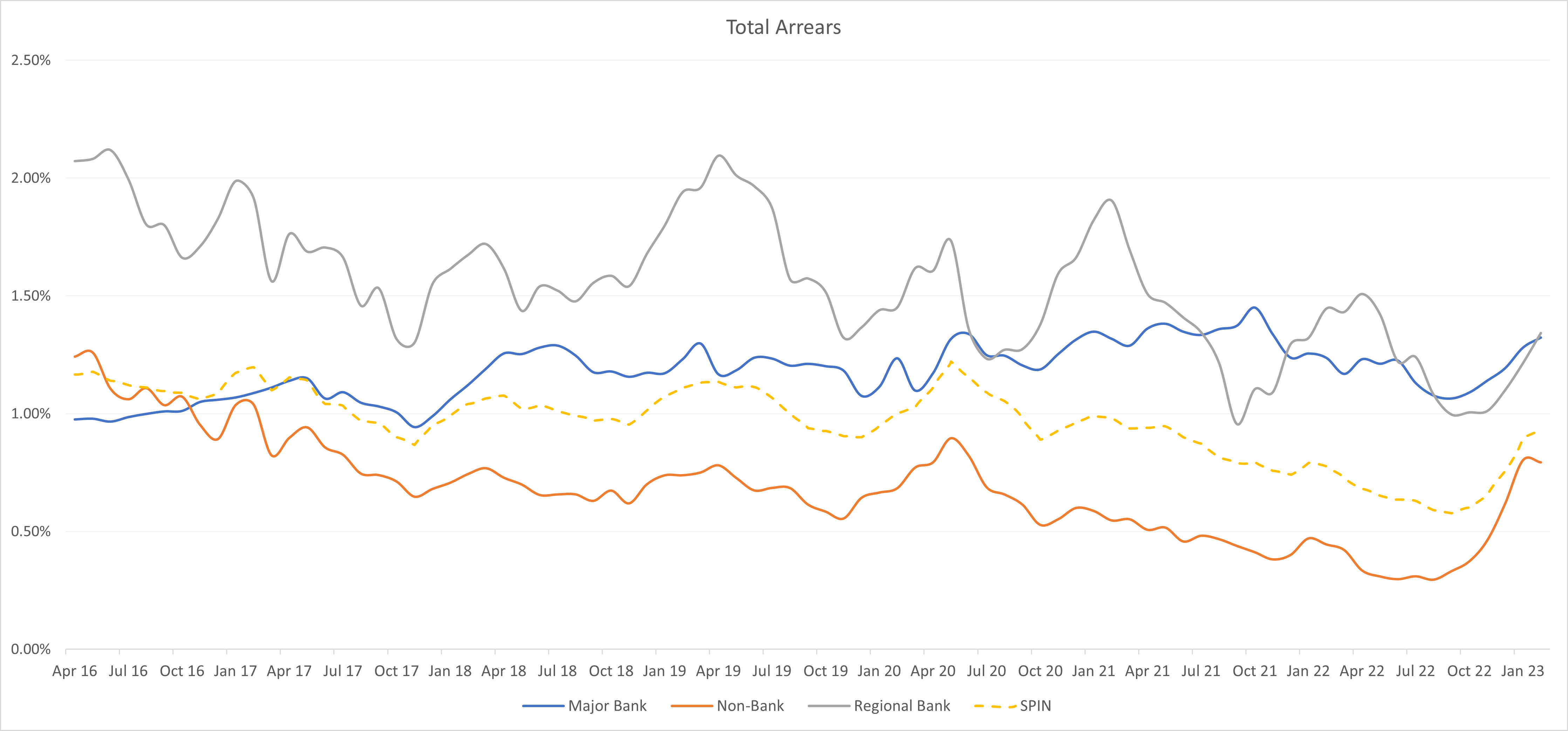

As an example, the chart below compares the total arrears for prime programs for Major banks and regional banks, to prime programs from Non-Banks, against the S&P arrears index (SPIN index) for prime loans using data published by S&P each month.

Over the last 5 years, total arrears by non-bank lenders have consistently outperformed major bank, regional bank arrears and the SPIN index.

This fact generally tends to surprise end investors, in fact it’s something that many fixed-income investors seem to be unaware of. It seems that the market instinctively wants to think of bank risk as good and non-bank risk as bad.

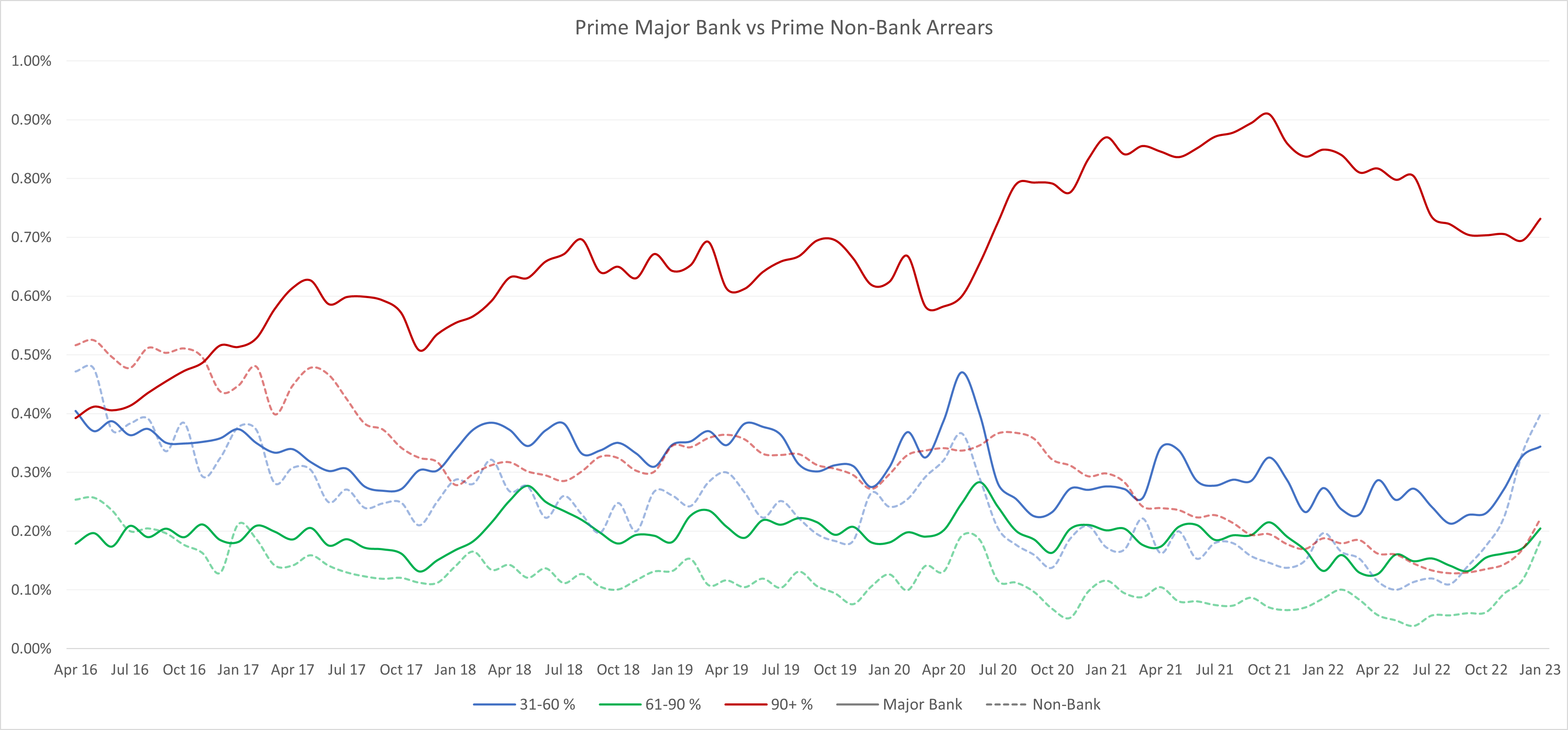

Decomposition around the numbers starts to tell the story of why non-bank prime risk seems to outperform.

For example, when we break down arrears into their respective 30/60/90 days we begin to notice non-banks are substantially better at managing their 90-day plus bucket. This is illustrated in the graphic below.

Our base assessment confirms that the quality of prime written by non-banks versus banks is not dissimilar, which begs the question, why do these pools outperform given they are largely homogenous compositionally?

Non-banks are more active in servicing arrears

One of the reasons that there is such a significant divergence in arrears performance beyond the 90 days is that non-banks generally take a more active approach in servicing mortgage books.

There are two main regimes for servicing a mortgage book and identifying a stressed borrower, the scheduled balance regime, and the missed payment regime.

Under a scheduled balance regime, stressed borrowers are actively managed after their loan’s current balance – what is owed on the mortgage – increases above the mortgage’s scheduled balance – what should be owed on the mortgage given its age and interest rate characteristics. This is a less punitive approach that allows those that are ahead on the mortgage some breathing space around arrears. While these borrowers are tracked and monitored, the interaction will generally take the form of a light passive notification (a text message for example).

On the other hand, a missed payment regime sees the loan move into active management, regardless of whether a loan is current or even ahead of its obligations, if any payment is missed, the loan is queried by the non-bank.

Non-banks will typically service their loan portfolio on both a scheduled balance and missed payment basis, which differs from banks with larger books who generally operate on a scheduled balance basis only. This allows non-banks to more actively manage loans, allowing for remediation before arrears technically occurs.

The key focus of the non-bank lender is ensuring that loans do not eat into the equity buffer which in turn increases the risk to the lender.

Our sector reviews have seen us conduct in excess of 80 meetings with a focus on the resourcing and management of accounts in arrears. This has given us a clear view of what adequate resourcing looks like in terms of file coverage, the process around using allowable contact effectively and the tools available to assist in mitigating risk through forbearance.

While every lender is different, it is clear that those issuers who have a non-conforming background exhibit a strong awareness in what needs to be done to minimise loss on loans outstanding.

Indeed, the exercise highlights how critical it is for investors to understand the minutia as it relates to loan management and more specifically and importantly the assets that are in arrears.

Looking through the data

The ability to dig deeper into datasets and identify the characteristics of a loan that are of the highest concern is the most important stage of examining pools of data for an investor.

This process allows an investor to build a clearer picture of where problems are emerging, which can in turn provide insight into how arrears are developing.

Being able to put a story around missed payments can assist in building a template for understanding which can in turn instruct portfolio positioning and portfolio stress testing.

This means that investors need to know exactly what loans they are secured against, and continuously monitor those pools for signs of deterioration. Data in each of the pools is comprehensive and each loan can have up to 150 unique characteristics, each of which are updated monthly.

For example, a loan which has been well serviced for a number of years, sits at a Loan to value ratio (LVR) of 40% and has a substantial amount of homeowner equity built up within the property, will not be of as much concern to an investor as a loan which sits at a 90% LVR with very little homeowner equity built up within the mortgage. Investor concern should always centre around loans where the ability to recover is the lowest.

In addition, investors need to cut through the “noise” of arrears data. This includes loans with very small dollar balances that are nearing the end of their lives and may fall into arrears as they are finalised.

The ability to track the degree of monthly missed payments each month is also important. Borrowers that miss high proportions of their required monthly payment must be prioritised over those that miss small portions (<$100) of their total monthly mortgage payment.

Tracking this data also acts as a point of enquiry for investment managers as it allows us to ask specific questions which get to the root of the problem, it also allows the manager to effectively track the relative mortgage performance of like programs and issuers.

What loans does an investor need to worry about?

Rather than look at arrears, loans that continually miss large portions of their monthly required payments, have high dollar balances and have high leverage (i.e. high LVR) to the Australian financial system should be the ones of most concern.

Screening for these particular cohorts amongst the various pools brings investors to the realisation that current pools of Australian RMBS are not in dire circumstances as headlines would suggest.

Rather than arrears, the chart below shows Realm’s coverage universe of non-bank prime loans in the Australian market that have missed portions >$500 of their monthly repayment for 3 consecutive months.

It shows the percentage of mortgage holders in the Australian mortgage system have begun to miss portions of payments has risen as interest rates have increased. This number includes all borrowers, whether classified as within arrears or not, who have missed consecutive monthly repayments.

This distinction is important, missed payments allow insight into a borrower’s repayment habits and allow the identification of which loans may become problematic, which in turn may provide insight into how arrears are likely to evolve.

Missed payments tend to rise due to seasonal factors around the Christmas period, these missed payments in turn result in an increase to arrears data reported over the next two periods. For context, during normal cycles missed payments generally track between 2-3% for prime loans. As missed payments increase above this threshold, it results in upward pressure on arrears. In the chart below missed payments are mapped on the left axis, with arrears as reported by S&P’s SPIN Index on the right.

Missed payments have moderated from the seasonal peaks seen in December, which led to the increase in arrears in January. This suggests that while seasonal Christmas period spending has taken its toll on households, they have begun to readjust spending habits to resume making full monthly repayments.

This data also suggests that arrears are likely to continue to rise. This reinforces the need to dig further into the data and understand which loans may be problematic.

To do this, the screen is refined for high LVR loans (>85%), which have outstanding dollar balances higher than $25,000 and have missed more than a $500 portion of their total monthly repayment more than once, as shown below.

It shows that there are an insignificant number of loans within the conforming universe that exhibit very high-risk characteristics.

Once loans of concern have been identified and quantified, it is clear to see the numbers are insignificant.

As a base case stress test, assume each of these problematic loans are completely written off (i.e. property value is reduced to 0). The average profit produced by prime transactions within the Australian market is approximately 0.8%, with a threshold rate mechanism in each structure to ensure that profit cannot fall below 0.25%. Total losses on all problematic loans within the screen would only impair a portion of the profit coming through each of the trades. If we were to assume 100% default and 50% property price losses on these assets, you would essentially wipe off about a month’s worth of net interest profit.

Each structure also has a level of equity that is held by the sponsor, generally ranging from 0.30% to 1%, depending on how the trade is structured. This additional equity buffer adds to the protection of all investors. In the event that this buffer is impaired in a given month, it is restated the next month by new profit coming through the trust by the remaining performing loans. As a result, it is not enough to have a one-off shock to a pool, the event severity needed to impair an RMBS structure must be severe and sustained for a prolonged period.

When the universe is screened for higher LVR loans (>90%), potentially problematic loans form an even smaller proportion of the total universe – currently 0.08% across the monitored data set, represented in the chart below.

When foreclosure is required

When faced with a borrower in arrears, the focus of the lender will be on whether the person can maintain their existing equity buffer and plausibly return to a current state. Where a borrower exhibits the ability to resume payments, lenders generally look to assist the borrower in getting back on track, in these situations foreclosure is unlikely (this is generally the case for low LVR loans which have a very low risk of losses).

The chart below shows the likelihood of borrowers who are in arrears by greater than 90 days to cure themselves and transition back to a performing state. The graphic illustrates that the vast majority (approximately 60% of people) with LVRs < 80% are able to cure themselves, usually by cutting non-essential spending.

Approximately 30% sell the property at a realised gain outside of foreclosure, given the equity that has built up in the home, or is foreclosed on by the lender, given the LVR, these foreclosures do not lead to an impairment to the lender.

As LVRs increase, lenders are focused on maintaining the equity buffer and minimising the probability of loss, the focus in such cases is to resolve the loan and be repaid as quickly as possible. The two drivers for this are that missed payments send the LVR of the loan higher (e.g. debt grows by interest and compounds when it isn’t being serviced) and the lender becomes more reliant on property prices for recovery (this is undesirable to lenders).

Non-conforming loans

Within the Non-conforming universe, the story is similar. At a system level, consecutive missed payments represent a larger proportion of the universe than in prime loans as shown in the chart below. This is expected, as the borrowers within these pools are of lower quality, have higher interest rates and as a result have higher required monthly payments.

Within non-conforming markets, the correlation between arrears and missed payments becomes much closer, and the ability to use missed payments as a leading indicator of arrears becomes much clearer.

Missed payments across the sector continue to increase, which is likely to lead to a rise in arrears. Missed payments generally track at a rate of 3-5% for non-conforming loans. As they begin to increase through this level, arrears rates also begin to increase.

The tighter relationship between higher missed payments and arrears speaks to a weaker capacity for non-conforming borrowers to maintain their equity buffer, however, it may also speak to the more active approach taken by servicers in dealing with these loans.

While the loan quality and performance of non-conforming risk is weaker than prime risk, investors need to understand that pool composition and structuring tend to act as significant equalisers of risk. This is primarily driven by the rating agencies and underlying investors.

Applying similar screens to this universe (i.e. LVR > 85%, minimum balance >$25,000, underpaid by more than $500 for three consecutive months), problematic loans again become an insignificant portion of the universe.

The key driver of this is that the leverage of the underlying loans on an LTV basis tend to be a lot lower, meaning that much higher property value declines are required to get into the belly of the pools.

In addition, Non-conforming markets exhibit higher net profits than prime loans. Currently, the profit produced from these structures sits around 1.4%, having reached as high as 2% when market yields were at the tightest point in the cycle in early 2022.

In a stress scenario, assuming problem loans are completely written off with no recoveries, the story is identical to that of prime loans. Losses do not completely impair the profit of the trusts, let alone the contributed equity by the issuer (which is generally 2-3x higher than the equity contributed to prime loans) or investor capital.

When the dataset is screened for LVRs > 90%, the proportion of the universe that is of high concern to investors reduces almost completely.

In Australia, house prices have not yet fallen enough to undermine the equity contributed by borrowers, future unemployment rate expectations have not increased substantially, and lenders will not show a willingness to actively foreclose on mortgages unless required.

Arrears within the system for both Prime and Non-Conforming continue to track at levels that are low in comparison to historic averages, and while they are increasing, they are unlikely to get to the very high levels required to create sustained losses within structures without Australian macroeconomic conditions deteriorating to a deep sustained recessionary level.

Furthermore, as such a scenario began to emerge it could be anticipated that in most scenarios the monetary response would be particularly supportive.

As a firm with a deep level of expertise within the market, it is always fascinating to view the comments of the partially involved, and occasionally interested. The sub-sector always provides an easy headline given the systemic issues it created during the GFC, not to mention its direct link to the real economy and of course the property market, however, the reality is that in these markets the little details matter more than the big headlines...

Realm is your partner

Our clients are our lifeblood. With deep experience investing in Australian credit and fixed-income markets, Realm is results-oriented in being always focused on delivering client outcomes.

3 topics

2 funds mentioned