Thinner, stronger, greener: the "Fibre" you need to know about.

Nanollose Limited (NC6.ASX $NC6) has risen

280% (5c to 19c) since the announcement of their joint patent with Grasim Industries. We shared our thoughts with clients last Friday, and despite the rise, the market cap stood out in the current market vs the potential for the company, and their new fibres. Despite the continued run, the market cap is still relatively small (in this market), so we think it is well worth looking at their technology. And despite the

price rise and turnover, its worth understanding what they are trying to

achieve.

NC6 – What they do.

Unknown a week ago. A biomaterials company, commercialising scalable technology to create fibres and fabrics with minimal environmental impact. The short layman’s version is they are creating fibre’s from waste products that have a minimal environmental impact from cellulose and/or waste products (fibres that can be woven). Think about it as naturally produced fibres (not petroleum-based) that can outperform many natural and synthetic fibres. A more detailed breakdown at the end of the note.

Why the stock Launched – Lodged Joint Patent with Grasim Industries.

On

the 13th NC6 announce – “NANOLLOSE AND GRASIM FILE JOINT PATENT APPLICATION FOR HIGH

TENACITY LYOCELL”. So what is lyocell? Lyocell is a widely

used man-made fibre usually made from wood or bamboo pulps that are commonly

used to make wearable fabrics (Tencel is an example of a Lyocell fabric). They are more “breathable” than synthetics

performing more like cotton. Less shrinkage than cotton. NC6/Grasim has

lodged a patent for a form of Lyocell “nullarbor™”

that is finer than silk and significantly stronger than conventional lyocell

(made from wood pulp). Add to this that Nullabor is also wood-free, the fibre

is both functionally better and has a lower environmental footprint than the traditional

Lyocell.

Potential? The first vertical is enormous. (better, stronger and greener).

The cheat sheet for the nullarbor™ fibre looks something like this -

- Thinner than silk (the width of the fibre is important for use in fabrics - how it drapes and looks etc)

- Stronger than traditional Lyocell – has superior comfort and strength characteristics

- Does not use wood pulp

- Closed-loop production process uses significantly less water and chemicals, less waste

- Field to yield comparison between NC6’s microbial cellulose and cotton, trees and bamboo – NC6’s yield is greater by many times (see here on yield efficiency)

- Possibly allows it to be marketed as one of the most eco-friendly sustainable fibres available.

Sounds great! There are numerous verticals that

this type of fabric could be used in (wipes, nappies, mattresses, clothing etc)

the logical start though is to target the high-end women garments market, which can pay a

premium for the product, whilst being produced at a smaller scale. Thus NC6

targets fashion brands initially that will be less price-sensitive.

Click to watch the

2-minute video below that explains yield and benefits

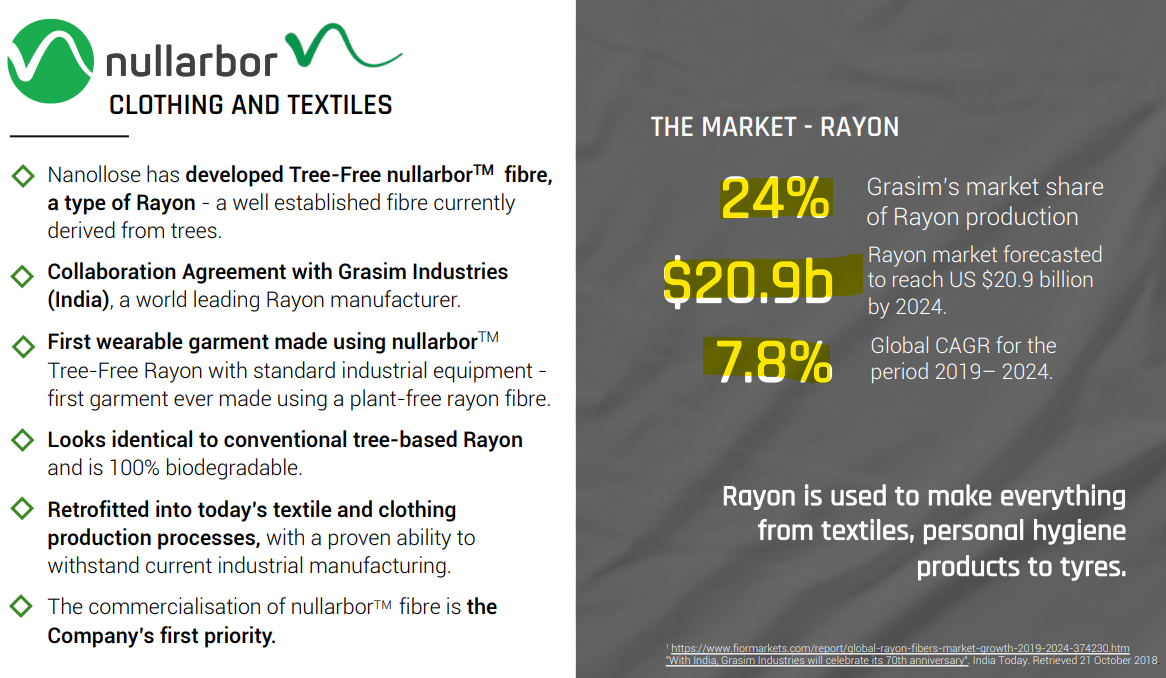

Market Size ( yes it's huge).

Pretty

standard to cite large market opportunities in presentations these days.

However given we all see, use, wear, buy fabrics in our daily lives, perhaps

this is the one time you don’t need to be convinced about the numbers. (Source

NC6 presentation)

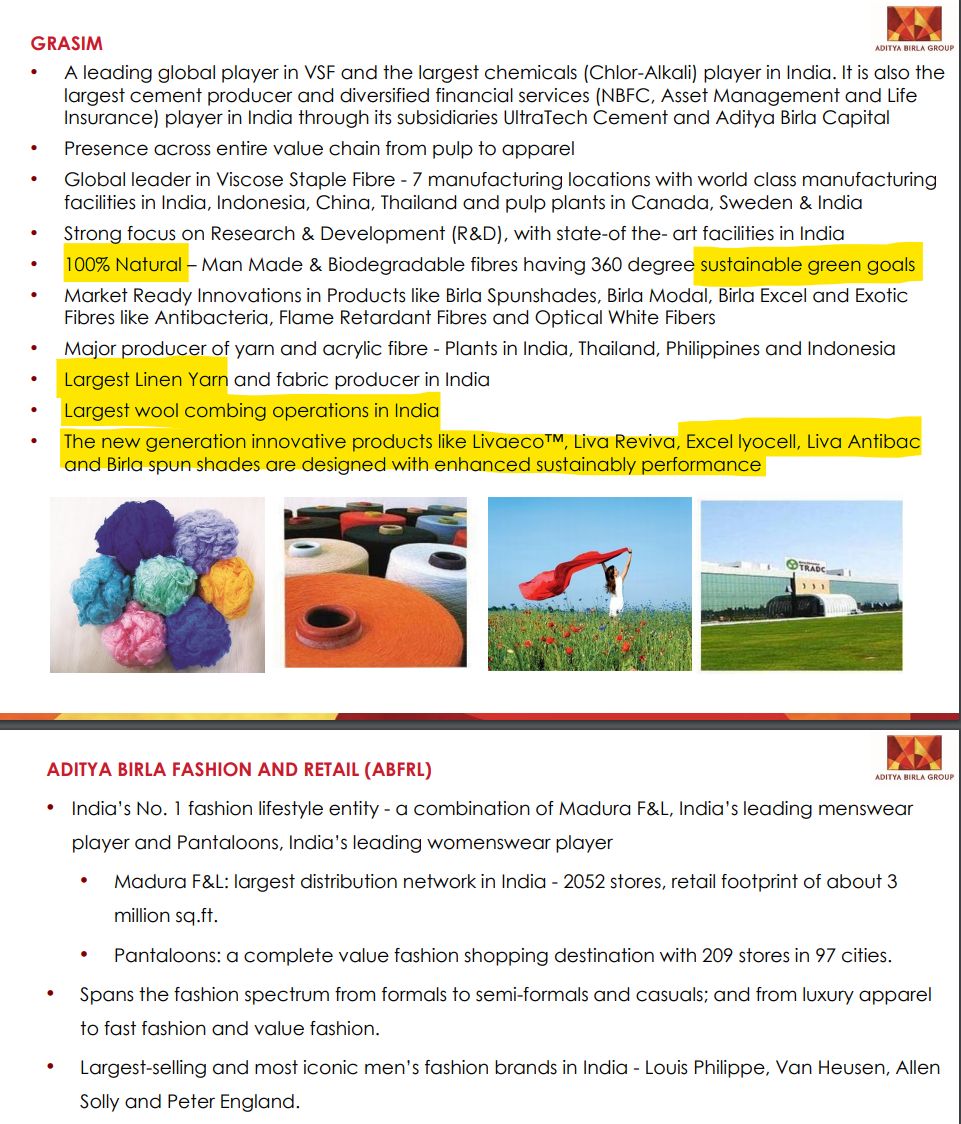

Who is Grasim Industries? (is there a better partner?)

Really

important. Grasim Industries is a subsidiary of Aditya Birla Group which turned

over ~$48.5 billion in 2019, was India’s first global conglomerate, operates in

34 countries (See their Nov 2020 Group

Presentation HERE).

Huge in fabrics and retail fashion. Hard to think of a better collaboration

partner for NC6 and it is a non-Chinese partner which has many advantages

when working on new tech (and not giving it away). Spend two minutes researching Grasim and you will

notice the focus on environmental sustainability, another plus. They have an

R&D facility focused on the development of new fibres and in particular

green fibres. If you are going to develop, look to pilot production, introduce

your product to fashion brands, then Grasim brings credibility and ability to

these functions. A key to note is that while they have jointly lodged a patent,

they have not finalised commercial terms as yet (at the current market cap this does

not really concern me as yet). More interesting is how cheaply the technology

could be acquired, by taking out NC6, a rounding error for Grasim. Does Grasim

invest in NC6 to hold a stake (if that happens this is not a $25m company)?

(image

below from Aditya Birla Group Nov Group Presentation)

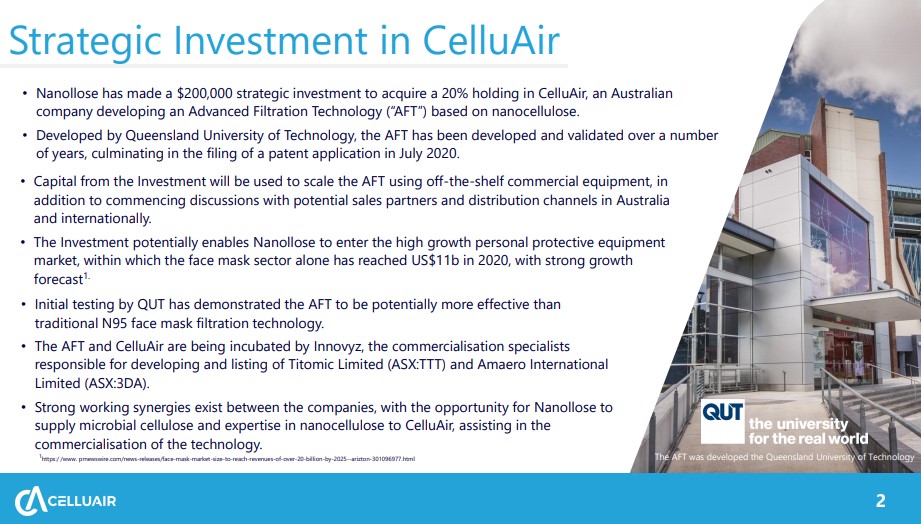

And then there is Celluair.

In Sept 2020, NC6 invested in CelluAir, taking a 20% holding for $200k. CelluAir, an Australian company developing an Advanced Filtration Technology (“AFT”) based on nanocellulose. (I declare an interest in Celluair as a founding shareholder). CelluAir has developed a filtration technology using nanocellulose. Developed at Queensland University, they have produced a filtration fibre made naturally, which meets the requirements of N95 masks for instance, but is more breathable, and not synthetic, more environmentally friendly. They are going through scaling trials and testing currently. And the production of the material can be done with off the shelf manufacturing processes. CelluAir is being incubated by Innovyz, the commercialisation specialists responsible for developing and listing of Titomic Limited (ASX:TTT) and Amaero International Limited (ASX:3DA).

Few are discussing this potential, however, they should be. If the fabric scales, they can move to licence to various producers in various countries. The COVID crisis highlighted that the world was dependent on N95 filters (oil-based/made of plastic) coming largely from China. Prices spiked ridiculously, and countries had to queue up for supplies initially. Countries are likely to mandate domestic production of certain essential supplies going forward, and PPE filtration is likely to be a big part of that. Again, if Celluair can show it scales, it will have a better, more environmentally friendly material, that would have minimal price differential when at scale. And it would suit multiple licencing deals, so no one producer is dependent on a few producers of the key N95 layer. But beyond the PPE/Mask market, the industry uses for these filters is huge. It was originally targeting industrial applications. We expect an update soon on development progress.

Note as an aside - Grasim gave 1m N95 masks to the community over the COVID period so far... Wonder if a textile company of this size would have an interest in PPE for India?

CelluAir/NC6

Joint Presentation

The Market Cap (small), despite the price action.

When I updated clients last week it was 12c, and I used the word "tiny", I think "small" is still appropriate at 19c. It is always hard to write about stocks that have run hard and turned over so much volume. Traders vs investors - are two different animals, so I am not pretending to know where the price will move next in the short term. Despite the run, NC6 is only now trading around its rights adjusted IPO price ($0.1810). Perhaps NC6 listed too early along the development path, but it's tech got the market excited initially, hitting 34.5c high. Also, the price pre-announcement was unjustifiably low in my view, at 5c, it was only $6.5m fully diluted!!!.

The

market cap at 19c is $22.5m and if all options were converted and paid for

along with performance rights then the Mkt Cap is $23.6m. And whilst earnings are not near term, the

size of the partners and markets their products can possibly apply to, and time along the development pathway; we are finding it hard to find opportunities of this scale with this size market cap in the current market (I acknowledge there

are still many risks to development, scaling and commercialisation that need to be considered).

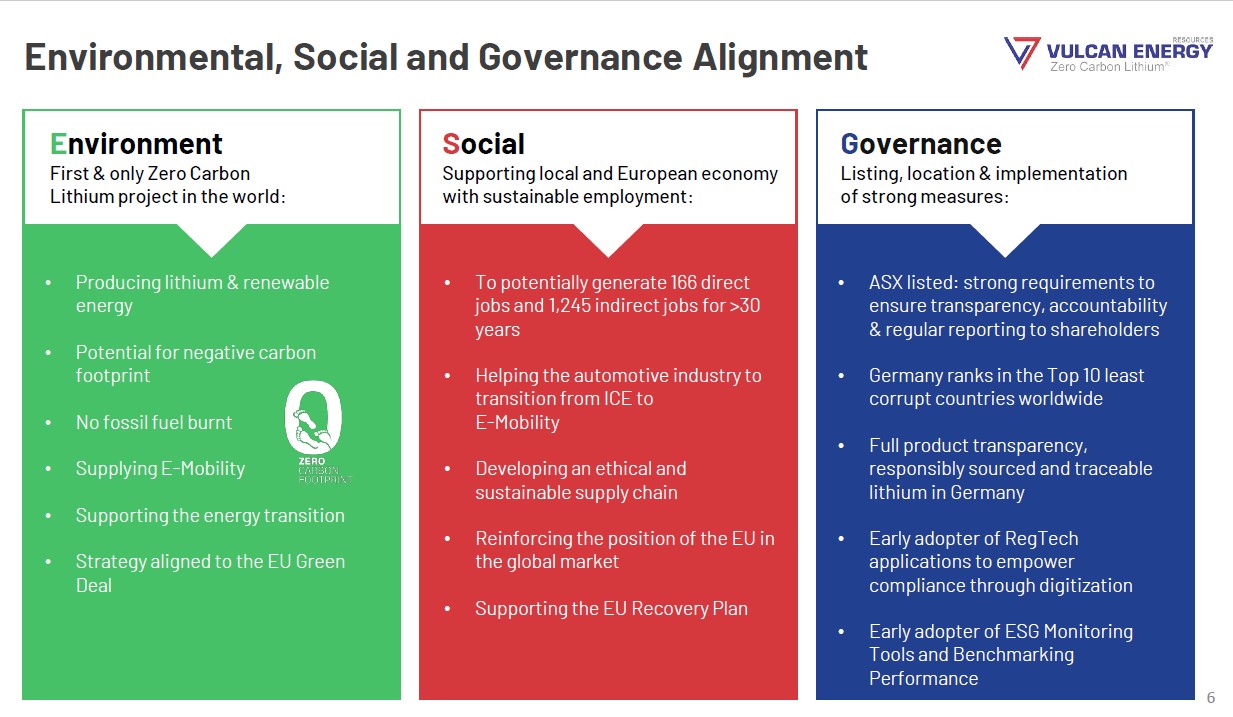

ESG Investing? The next Leg?

Environmental, Social and Governance (ESG) factors are extremely important to a growing cohort of investors, so they are now important to corporates. This technology is an ideal ESG company, it fits a circular economy (CE) focus and increases companies green credentials. CelluAir also fits ESG. This dynamic is yet to be realised on the NC6 register or at a commercial level with end users. But the opportunity is large. (as an example - look at Vulcan Energy VUL.ASX Market cap - trading 20c a year ago - now $10.11 or $865m - it's key - first carbon-neutral lithium project - not producing - will use geothermal energy - phasing out coal in Germany - 2024 start - note the ESG slide below).

(Image below - Source. VUL.ASX Presentation 15.01.2021

Summary

Since

Wednesday’s announcement, NC6 has turned over a huge amount of free float. It was averaging about 5-20 trades a day prior to the announcement and last Thursday there

were 1,936 trades alone. So trading money is in, and it may well want to find a

way out. My view is that the prize is sufficiently large to follow the company through and see how it progresses, given the cap in a market that is willing to trade

growth opportunities on far greater market caps than we see here. I like the Celluair opportunity, and I think there is a very good fit

and opportunity to collaborate between them and NC6, and the market has not

really cottoned on to the potential of that market either. One to follow closely.

Author: Tom Schoenmaker

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

About Nanollose. (Source - Nanollose NC6)

Nanollose Limited (ASX:NC6) is a leading biomaterials company, commercialising scalable technology to create fibres and fabrics with minimal environmental impact.

The Company has developed the patented tree-free nullarborTM fibre for clothing and textiles and nufoliumTM for non-woven textile applications, including personal wipes. The Company is currently working with globally recognised industrial partners, to accelerate the development and commercialisation Nanollose’s Tree-Free fibres.

NULLARBOR FIBRE - CLOTHING & TEXTILES

- Nanollose has developed the patent pending tree-free nullarborTM fibre, a substitute for Rayon - a well established fibre currently derived from trees.

- Collaboration Agreement with Grasim Industries (India), a globally recognised industrial partner, to accelerate development and commercialisation Nanollose’s Tree-Free fibres.

- First wearable garment made using nullarborTM Tree-Free Rayon with standard industrial equipment - First garment ever made using a plant-free rayon fibre.

- nullarborTM feels and looks almost identical to Rayon.

- Can be retrofitted into existing infrastructure in textile and clothing production processes.

- The commercialisation of nullarborTM fibre is the Company’s first priority.

- Rayon fibre market worth US$16.3 Billion in 2019 and growing to an estimated US$24 billion in 2025.

NUFOLIUM FIBRE - NON-WOVEN TEXTILE APPLICATIONS

- Nanollose also developed nufoliumTM for non-woven textile applications, including personal wipes.

- Collaboration Agreement with Grasim Industries, also extends to the commericalisation of nufoliumTM fibres.

- Collaboration agreement with Codi Group, Europe’s leading producer of personal wipes, to develop a viable consumer wipe product, using Nanollose’s TreeFree nufoliumTM nonwoven fibre.

- The personal wipes market estimated to grow to US$23.1b by 2025, at a CAGR of 5.6%.

A key driver for this market is growing concerns

regarding personal hygiene and sustainability, with growing pressure to move

away from single use products.

Disclosure.

The author is a shareholder in NC6. The author is a shareholder of Celluair. Wentworth and the

Author participated in the NC6 Capital raise at $0.055 for which Wentworth was

paid a fee. NC6 has no relationship with Wentworth and Wentworth receives no

fee for this note. NC6 has had no involvement in the note.

1 topic

1 stock mentioned