Digitisation & the retail investor

Retail investor participation in equity markets is undergoing rapid change, a trend that has accelerated throughout COVID-19. Retail investors have always been a category of investor on most listed companies’ registers however, the recent ‘GameStop frenzy’ in the US has showcased the power of retail investors.

Australia has always been a nation of investors with 46% of Australian adults currently holding investments other than their primary residence (including SMSFs but excluding other superannuation). Despite this, the ASX Investor Survey for 2020 highlights the changes occurring within the retail investor landscape. The last two years have seen an influx of younger investors into the market. According to the survey, close to a quarter of current investors surveyed (23%) noted they had begun investing less than two years ago. Among those who invest, more than half invest in direct equities. This has cemented the place of direct equities as Australia’s most accessible and widely used investment option, especially for younger investors. (1)

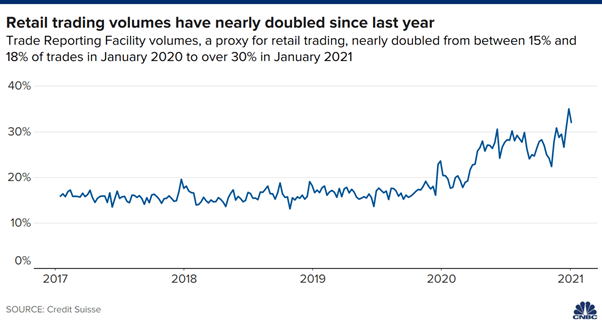

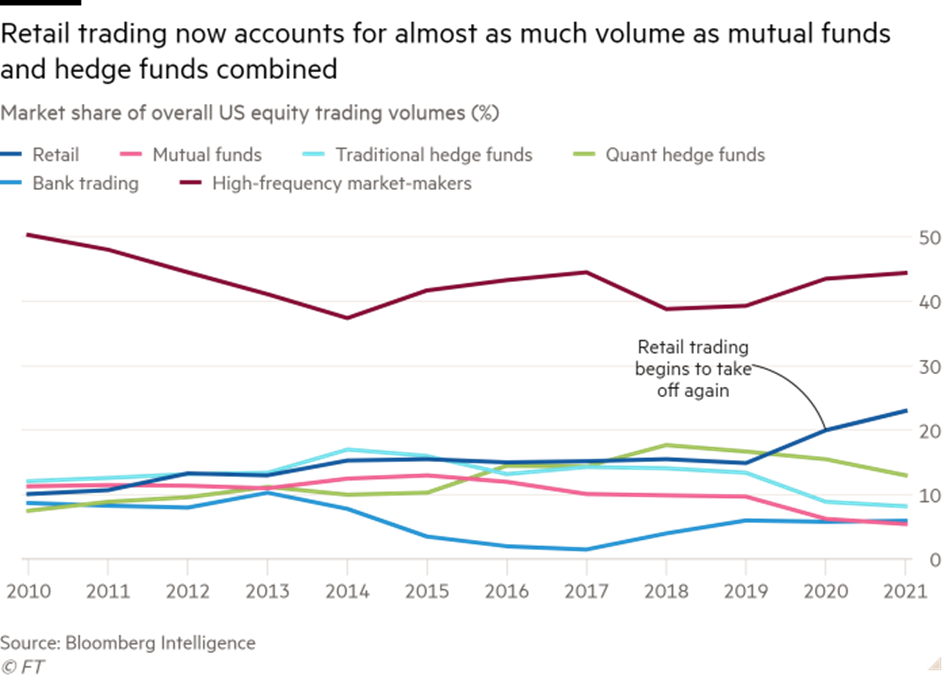

Interestingly, the Commonwealth Bank recently reported a doubling of trade volumes in the first half of 2021 compared to the prior year with more than 230,000 new accounts opened to trade stocks on its CommSec platform (2). In the US, Credit Suisse estimates that at times during 2021, retail investors have accounted for a third of all US stock market trading.

As is the way in almost all industries, technology is playing a big part in these winds of change. The new generation of retail investors is different. Retail investors can now easily trade on the bus, at home, or over lunch breaks all via their smartphone, whereas the dotcom boom happened in the pre-broadband era and almost a decade before the birth of the iPhone.

“There is no question that digitisation and technology is expanding access, and the expansion of that access breeds more participation ” - David Solomon, CEO, Goldman Sachs Inc (Mar-21)

These changes all point to many believing that this heightened retail investor participation is likely to prove more durable than previous periods. Equities trading is becoming cheaper, more accessible and investors are generating ideas from non-traditional sources, with social media being a huge influence. Look no further than ‘r/wallstreetbets’ on Reddit earlier this year.

While GameStop shares were the most publicised example, we have seen other examples such as AMC Entertainment, Bed, Bath & Beyond and even in commodities such as silver. The combination of social media and new retail investors have a level of influence which is far greater than just a few investment ideas. The rise of the digital retail investor is a global phenomenon.

For traditional equity market participants, what the above examples demonstrate is the potential difficulty in identifying and understanding the investor risk appetite, time horizons, and drivers and motivations of this new breed of retail investors. A by-product of this is a general increase in volatility.

Retail investors have demonstrated an optimism about the economic outlook that was often lacking among some professional fund managers. In this current interest rate environment, deposit rates are close to 0% and investors can access margin loans easily. Cheap money and a lack of investment returns from other asset classes have led to elevated risk-taking by this investor group. With lockdowns easing across the world, will the surge of retail investor demand caused by COVID-19 begin to slow? Only time will tell.

Although many listed company registers are still heavily weighted towards institutional investors, the recent pickup in retail investor trading has sparked the attention of many companies to recognise the importance of this component of their shareholder base. Over the long term, this is a good thing if it provides a more balanced focus, understanding and consideration of all shareholders.

Invest for the long-term

NAOS Asset Management is a specialist fund manager providing genuine long-term, concentrated exposure to Australian Listed Industrial Companies outside of the ASX-50.

For more of our insights, click the 'FOLLOW' button below.

Footnotes

- ASX Australian Investor Study 2020

- CBA 1H21 Results Presentation