Does the weakness in Pinnacle (ASX:PNI) shares present a long-term opportunity?

There was a lot to like in first half results from Pinnacle Investment Management (ASX: PNI).

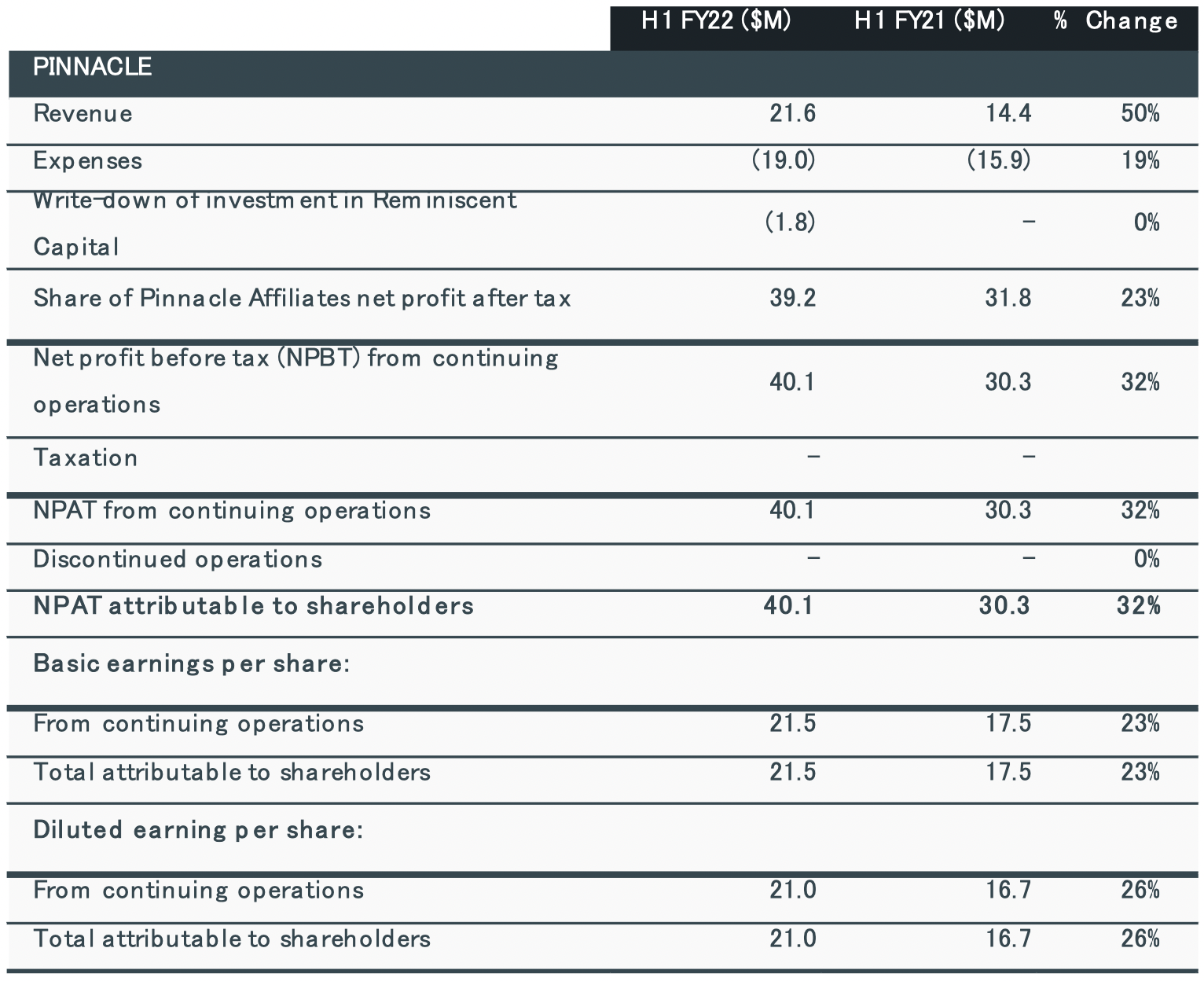

NPAT hit 40.1 million, a 32% improvement on the first half of FY21.

Earnings per share also lifted 23%, to 17.5 cents, while the dividend came in at 17.5 cents – up 23% on this time last year.

Despite this, the share price is largely unchanged from where it was before the results dropped. With some shenanigans in between, mind you - it lifted to $12.28 before settling at $11.47.

Does that short term volatility matter? Not really, according to ST Wong from Prime Value. As you'll read below, it's a long-term play with solid fundamentals and strong leadership who own a large stake in the company (always a good sign when the interests of the company and leadership are aligned).

PNI was also one of the best performing small caps in FY20. Livewire's Patrick Poke interviewed its founder and managing director Ian Macoun in July last year. It's worth a read - Macoun is quite candid about the company's history and investment process.

Pinnacle has become a well-regarded stock for small-cap investors and was recently pitched at the prestigious Sohn Hearts and Minds Conference on the 3rd of December. The stock is down 26% since then and has fallen nearly 40% since the recent high in early November 2021.

Read on to get Wong's read on the results and how the investment house is placed for the long-term.

Source: Pinnacle Investment Management

What were the key takeaways from the result?

The headline numbers were pretty good. We had four takeaways from the results. Firstly, NPAT of $40 million. This is due to better than expected retail inflows into the business. The second takeaway is a strong appetite for offshore acquisitions. The third point is, again, the offshore pipeline of opportunities for FUM is quite strong. The final point to make is that the company is improving the quality and diversity of its distance throws.

What was the market’s reaction?

The share price is trading roughly broad to slightly down in early trading post results.

Although the net profit went up, the market is cautious at the moment and so I’m not surprised by the soft share price reaction.

Pinnacle is quite leveraged to equity markets – roughly 57% FUM is in Australian and global equities at the end of December 2021. Having said that, day one reaction is rarely the best reflection of a company.

Were there any major surprises in the result?

From our perspective, the results are an affirmation of two things. One, confidence in the investment pipeline is quite positive despite market volatility. Pinnacle continues to expand its client base, and at this juncture has over 260 institutional clients as of December 2021. We appreciate the additional disclosure coming through on the pipeline and from the business perspective, it looks pretty positive for the long term.

Buy, Hold or Sell?

Pinnacle is trading at 22 times FY23 and if you strip out performance fees it’s about 28 times. We think with the price coming off by about 35% since October 2021, this is probably a decent price for the longer term.

In the near term it will be captured by market volatility, so it’s a Buy over the long term.

What are your expectations and outlook for this company and industry?

There’s a lot to like about Pinnacle for the long term. We like the fact management is investing for the long term, tackling the evolving market and investing in different asset classes. It is also still a strong product distribution platform, and as it scales up it should be able to leverage its institutional platform for growth in the medium to long term. Third, it’s diversifying into different asset classes – private markets, infrastructure – this gives growth options and is the reason why we’re buying into Pinnacle for the long-term.

We invested in Pinnacle about 4 years back – we invested for the management team vision to build out to become a much larger funds management entity.

So we like that management has some skin in the game, the CEO has about 7% of the company.

Never miss an update

Enjoy this wire?

Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

3 topics

1 stock mentioned

1 contributor mentioned