Dogs of the ASX for the 2022 financial year

The last 12 months have been a tale of two halves for investors in Australian equities. The first six months to December 2021 saw the market slowly grind upwards, gaining +4%, mirroring the steady gains seen since mid-2020.

Conversely, the last six months have been very stormy, starting with a selloff in January based on concerns about global banks raising rates and then a recovery in March and April. The year ended with a large fall in June as the US Federal Reserve and the RBA raised rates aggressively to combat inflation.

Over the past financial year, the ASX 200 has declined by -6.5%, including dividends.

The market volatility and rising interest rates so far in 2022 have impacted the high price-to-earnings (PE) companies the most, with many of these former market darlings and the mainstays of growth manager portfolios appearing in the bargain bin for the first time.

In this piece, we will look at the "Dogs of the ASX" in 2022, like the black bear in the picture sifting through the market's trash looking for treasure, see how the 2021 Dogs performed and review how accurate Atlas's predictions were in July 2021 for the coming year.

Dogs of the Dow/ASX 100

Michael O'Higgins popularised a systematic investment strategy of investing in underperforming companies named "Dogs of the Dow" in his 1991 book Beating the Dow. This approach seeks to invest in the same manner as do deep value and contrarian investors.

O'Higgins advocated buying the ten worst-performing stocks over the past 12 months from the Dow Jones Industrial Average (DJIA) at the beginning of the year but restricting the stocks selected to those still paying a dividend.

Restricting the investment universe to a large capitalisation index like the DJIA or ASX 100 improves the unloved company's chance of recovery in the following year.

Larger companies are more likely to have the financial strength –or understanding capital providers (such as existing shareholders and banks) – that can provide additional capital to allow recovery from corporate missteps or unfriendly economic conditions.

Conversely, smaller companies in the Dogs of the ASX 200 for 2022, such as ZIP Money (-94%), appear to be fighting for their corporate lives and are likely to face a much greater challenge to still be around in 2023.

Retail investors have an advantage

One of the reasons this strategy persists is that institutional fund managers often report their portfolios' contents to asset consultants as part of their annual reviews. This process incentivises fund managers to sell the "dogs" in their portfolio towards the end of the year as part of "window dressing" their portfolio before being evaluated.

For example, in July 2021, fund managers would have seen some pretty stern questioning from asset consultants about why they owned an energy company with production issues that had downgraded the size of reserves (Beach Energy +41%). Similarly, many fund managers would have found it hard to justify having a utility in their portfolio that had reported a $2 billion loss (AGLEnergy (ASX:AGL) +7%)!

Here retail investors can have an advantage over institutional investors, picking up companies whose share prices have been under pressure from the tax-loss selling around the end of the financial year.

Furthermore, retail investors can afford to take a longer-term view on the investment merits of any company that may have hit a speed bump, as retail investors are not swayed by asset consultants questioning short-term underperformance.

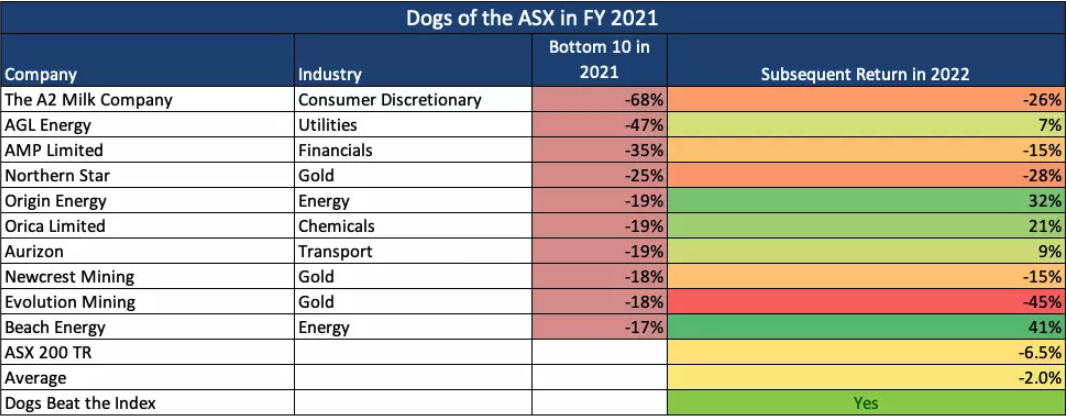

Dogs of the ASX in 2021

Over the past year, the Dogs from 2021 fell -2%, significantly outperforming the ASX 200 index's return of -6.5%.

This makes this the seventh time in the past decade that the Dogs of the ASX 100 strategy has outperformed the index.

From the table below, five out of the 10 "dogs" of 2021 outperformed the ASX 200, with Beach Energy (ASX: BPT), Origin Energy (ASX: ORG) and Orica (ASX: ORI) leading the charge.

Beach Energy exceeded pessimistic market expectations after resolving operational issues in the Western Flank oil field and enjoying the benefits of a 53% increase in the oil price.

Over the past year, Origin Energy has benefited from significant increases in the price of liquefied natural gas (LNG) as supplies from Russia have been curtailed.

The share price of explosives manufacturer Orica has recovered on higher profits from high ammonium nitrate prices and the sale of the company's troubled Minova subsidiary.

Conversely, the pain continued in FY22 for gold miner Evolution (ASX: EVN) after cutting production estimates in April and then again in late June, which was poorly received by the market.

Similarly, the share price of former market darling A2 Milk (ASX: A2M) continued its downward trajectory after reporting falling profit margins and a collapse in sales to China amid regulatory issues and Chinese consumers favouring domestic baby formula brands.

Our picks from July 2021??

When deciding 12 months which of the Dogs from FY 2021 would rebound over the coming year, Atlas' strike rate was better than in previous years.

We correctly predicted that AMP Group's (ASX: AMP) woes would continue as the vertically-integrated financial services company continued to break itself into smaller pieces.

Similarly, we viewed China's attitude towards certain imported foods from Australia and New Zealand would not soften and that A2 Milk would continue to struggle.

Our pessimism towards AGL Energy(ASX:AGL) and Origin Energy was less successful based on the assumption of low wholesale electricity prices and continued government meddling in the National Energy Market, with both companies seeing their share prices recover. However, a large part of Origin's outperformance can be traced to soaring natural gas prices.

Atlas correctly picked that Beach Energy (the top-performing FY21 Dog of the ASX) would rebound in the following year based on improving production and a sustained recovery in energy prices.

Our other pick for the coming year was that Newcrest (ASX: NCM) would outperform the other gold stocks on the list due to its low-cost operations, growth potential and conservative balance sheet. While technically correct, as Newcrest was the top-performing gold miner over the past 12 months, given that the company's share price fell by -15% and underperformed the ASX 200, it is hard to categorise that as a win for Atlas.

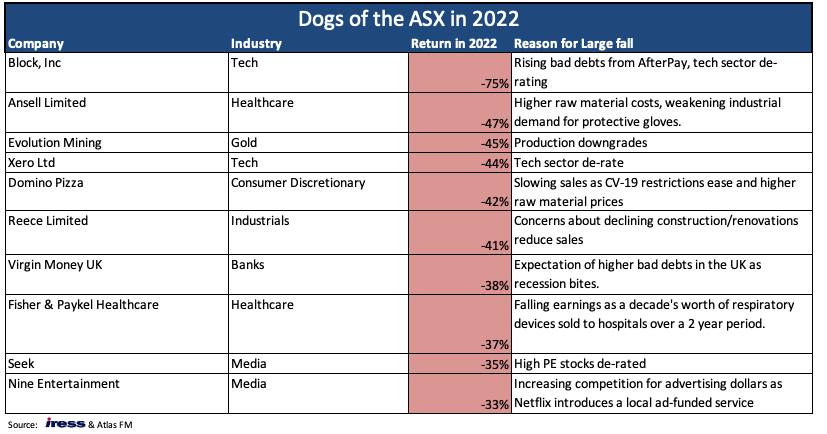

What does the class of 2022 look like?

Looking through the list of the underperformers of 2022, there are many new faces, with Virgin Money UK (ASX: VUK) the only company to have previously been on this list of ASX 100 Dogs over the past 10 years.

Indeed the bulk of this list would have been the backbone of any top-performing growth style fund from 2020!

What is also unusual about the below list is the preponderance of high-quality companies whose share prices have fallen not due to self-inflicted wounds but rather because they have fallen out of favour with the market.

The three key themes in the list of the Dogs of FY 2022 are:

- COVID-19 winners coming back to earth after enjoying two years of abnormal growth - such as Ansell (ASX: ANN), Domino's (ASX: DMP) and Fisher & Paykel Health (ASX: FPH),

- highly valued tech companies marked down as rising interest rates reduce the present value of profits in the distant future - such as Xero (ASX: XRO), Seek (ASX: SEK) and Block (ASX: SQ2), and

- companies impacted by a slowing economy - such as Virgin UK, Reece (ASX: REH) and Nine Entertainment Co (ASX: NEC).

Our Picks for 2022

Every year, three or four companies in the Dogs of the ASX look like a poor addition to an investor's portfolio on 1 July but will significantly outperform the market over the following year.

In selecting a share price recovery candidate for the following year, we generally look at companies whose current woes are company-specific rather than caused by factors outside the control of their management team.

Based on this, Atlas see that Virgin Money and Block are unlikely to significantly outperform over the coming year, with both companies weighed down by news of rising bad debts.

Similarly, high price-to-earnings companies such as Xero and Seek are unlikely to be re-rated upwards, given the rising trajectory of interest rates.

Plumbing and plumbing and bathroom products company Reece is a high-quality building materials company that enjoys consistently higher margins than commodity producers of bricks and tiles. However, over the next year, many of Reece's customers will face significant mortgage payment increases, dampening the demand for $30 to 50 thousand dollar bathroom renovations.

While not a fan of their pizzas, Atlas see that Dominos Pizza is the most likely candidate in the above Doghouse to stage a recovery over the next 12 months.

As rising mortgage payments curtail discretionary spending, Dominos should see higher sales than expected from budget-conscious consumers substituting a night out at a local restaurant for three large pizzas, garlic bread and chocolate lava cake delivered for $29.95!

With lesser confidence, Atlas also puts forward gold miner Evolution as a recovery candidate, based on the statistic that no company has appeared on the list of Dogs for three consecutive years. Evolution's share price is languishing at five-year lows, but the company's production issues are not permanently unsolvable. The gold miner's share price may rebound in 2023 either by improving production, higher gold prices or by being subject to a takeover offer.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics

10 stocks mentioned