Dogs of the ASX in FY20

The last 12 months have been bruising and emotional for equity investors enjoying the market grinding higher from July to early February based on FOMO (fear of missing out) and TINA (there is no alternative to equities). The ASX then collapsed -35% in March as panic selling set in on CV-19 fears. Since the depths of despair in March the market rallied 30% as investors stepped in to buy stocks at a fraction of the price that they were trading a few months before, perhaps spurred on by the negative real rate of return being earned on cash deposits. High levels of volatility can often create opportunities as the market can be excessively pessimistic as to a company’s prospects.

In this piece, we are going to look at the Dogs of the ASX in the 2020 financial year, see how 2019 Dogs performed and review how accurate Atlas’ predictions were in July 2019.

Unloved mutts

The “Dogs of the Dow” is an investment strategy made famous by O’Higgins in his 1991 book “Beating the Dow" and seeks to invest in the same manner as deep value, and contrarian investors do. Namely, invest in companies that are currently being ignored or even hated by the market; but because they are included in a large capitalisation index and paying a dividend like the DJIA or ASX 100, these companies are unlikely to be permanently broken.

Inclusion in a large capitalisation index such as the ASX100 indicates that the unloved company may have the financial strength or understanding capital providers (such as existing shareholders and banks) that can provide additional capital to allow the company to recover over time. Additionally, if it is still paying a distribution, the company’s business model is unlikely to be permanently broken, as the company's directors are unlikely to authorise a dividend if insolvency is imminent. Smaller companies tend to face a harder road to recovery with a higher chance on bankruptcy when they make it onto the “Dogs” list. Over the last seven years on the ASX, the Dogs have outperformed the index on five occasions, but the strategy of investing the Dogs did not work very well in the 2020 financial year.

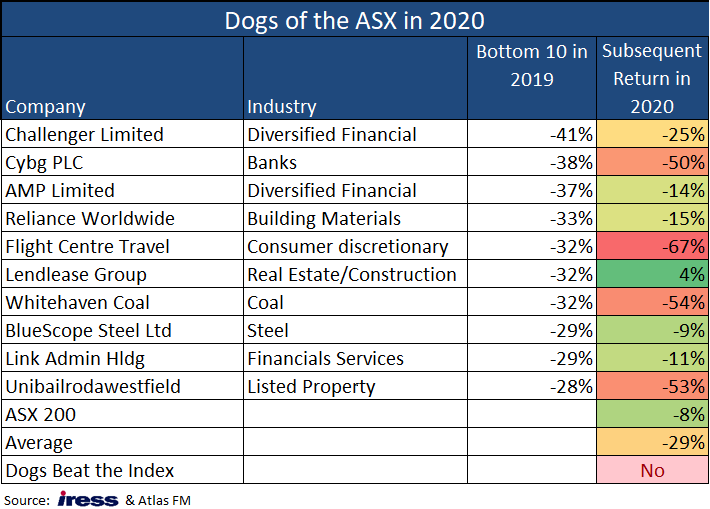

Investing in an equal-weighted portfolio of the dogs from 2019 would have resulted in an investor underperforming the ASX200 by close to 20%, as the majority of these stocks continued their downward trajectory in 2020. The sole bright spot among last year’s unloved mutts was Lend Lease that delivered a modest gain over the past year as the company progressed in their moves to divest their troubled engineering division.

Our picks from July 2019

When we looked this list last July in Dogs of the ASX from FY'19, we correctly speculated that AMP was unlikely to bounce back in 2020, as the new CEO’s strategy to turn around sprawling financial services company would take longer and be more expensive than forecasted. Our caution towards Challenger proved to be correct, though for the wrong reasons. Atlas saw that falling interest rates would continue to reduce the attractiveness of Challenger’s annuities; however, market declines in 2020 necessitated a $300 million capital raising to top up Challenger’s regulatory capital. Similarly, our view that Lend Lease would recover in 2020 looks accurate. The company’s funds management and global residential development businesses performed well, and in December 2019 Lend Lease announced that they had sold their troubled engineering business to Spain’s Acciona.

Less successful was our prediction that both Unibal-Westfield and Flight Centre were candidates to outperform in 2020. These two companies were dealing with company-specific issues with Unibal-Westfield under pressure from concerns about retail sales in Europe and the USA and Flight Centre from restructuring their Australian leisure business. However, in 2020 their share prices took a further leg down as shopping centres and travel agencies were two of the industries most affected by CV-19 lockdowns.

The Dogs of 2020

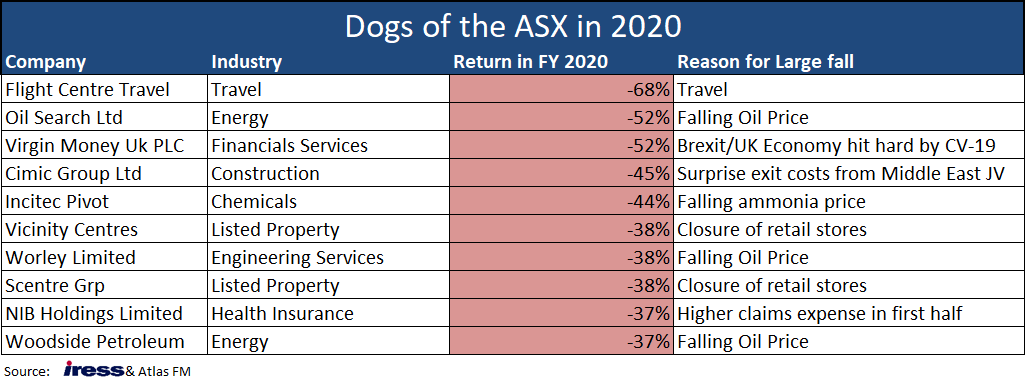

The table below shows the bottom ten performing stocks ASX 100 stocks over the past twelve months, and there will undoubtedly be some fallen angles that will outperform in the 2020 financial year. The key themes in the list of the bottom 10 of 2020 are companies exposed to either oil prices or heavily impacted by travel and shopping restrictions.

Rabid hounds best avoided

Picking potential winners from the list of last years “Dogs” is arguably harder in July 2020 than during other periods. The principal reason for the falls over the past year was not a company-specific issue that is in management’s power to fix during a period of otherwise benign markets, but rather due to an external shock that the company has no influence over. The two Listed Property Trusts on the list, Scentre and Vicinity, own the best retail assets in Australia and have recovered some of their losses from March, but have little control over further lockdowns and the impact that the potential removal of JobKeeper in September will have on retail sales.

Flight Centre is well capitalised after raising $700 million in April. Still, management has no visibility over when travel restrictions will be lifted and how eager consumers and businesses will be to book travel when they can do so. The energy companies all had a poor 2020 courtesy of a 35% fall in the oil price stemming both from falling demand and the curious decision of Russia and Saudi Arabia to engage in a price war right in the middle of the CV-19 crisis.

While Virgin Money has fallen 69% over the past two years and is deeply unloved by the market, it is difficult to forecast a sharp bounce in the bank’s share price over the next year. The economy in the UK has both been hit hard by CV-19 (44,220 deaths so far) and is concurrently seeking to extricate itself from the European Union. In May the Bank of England forecasted that the UK economy faces the fastest and deepest recession since the “great frost” of 1709. The trajectory of bad debts incurred by a British bank will undoubtedly be complicated for investors in Australia to accurately forecast.

Rescued pooches just in need of a good home

Construction company CIMIC stands out in the above list of the Dogs of 2020 as being a candidate that could outperform in 2021, as the reason for its share price fall was not due to CV-19, but rather due to the exit costs of their Middle Eastern joint venture revealed in January. Operationally, CV-19 has had a minimal impact on CIMIC’s business as construction has continued throughout 2020, and the company will benefit from increased infrastructure spending. Additionally, in 2020 the company has repurchased $147 million of their stock on-market, a move that appears to presage a takeover from major shareholder Hochtief. Health Insurer NIB could well surprise in 2021, as CV-19 restrictions reduce the number of elective private hospital procedures and healthcare premiums are paid upfront.

1 topic

18 stocks mentioned