Don't buy the lithium dip: Morgan Stanley

China's lithium carbonate prices have ticked up 7% year-to-date, reflecting robust cathode demand and domestic supply disruptions. The sharp drop in prices during 2023 has also limited the supply coming onto the market.

That's according to analysts at Morgan Stanley, which publishes a weekly report covering some of the key data, charts and comparables for the global mining sector. The latest report focuses on the headwinds for lithium and downside risks to current prices.

From here, the analysts expect prices to weaken as a number of factors come together, which could quickly reverse year-to-date gains. Here are some of the key headwinds.

Supply is rebounding

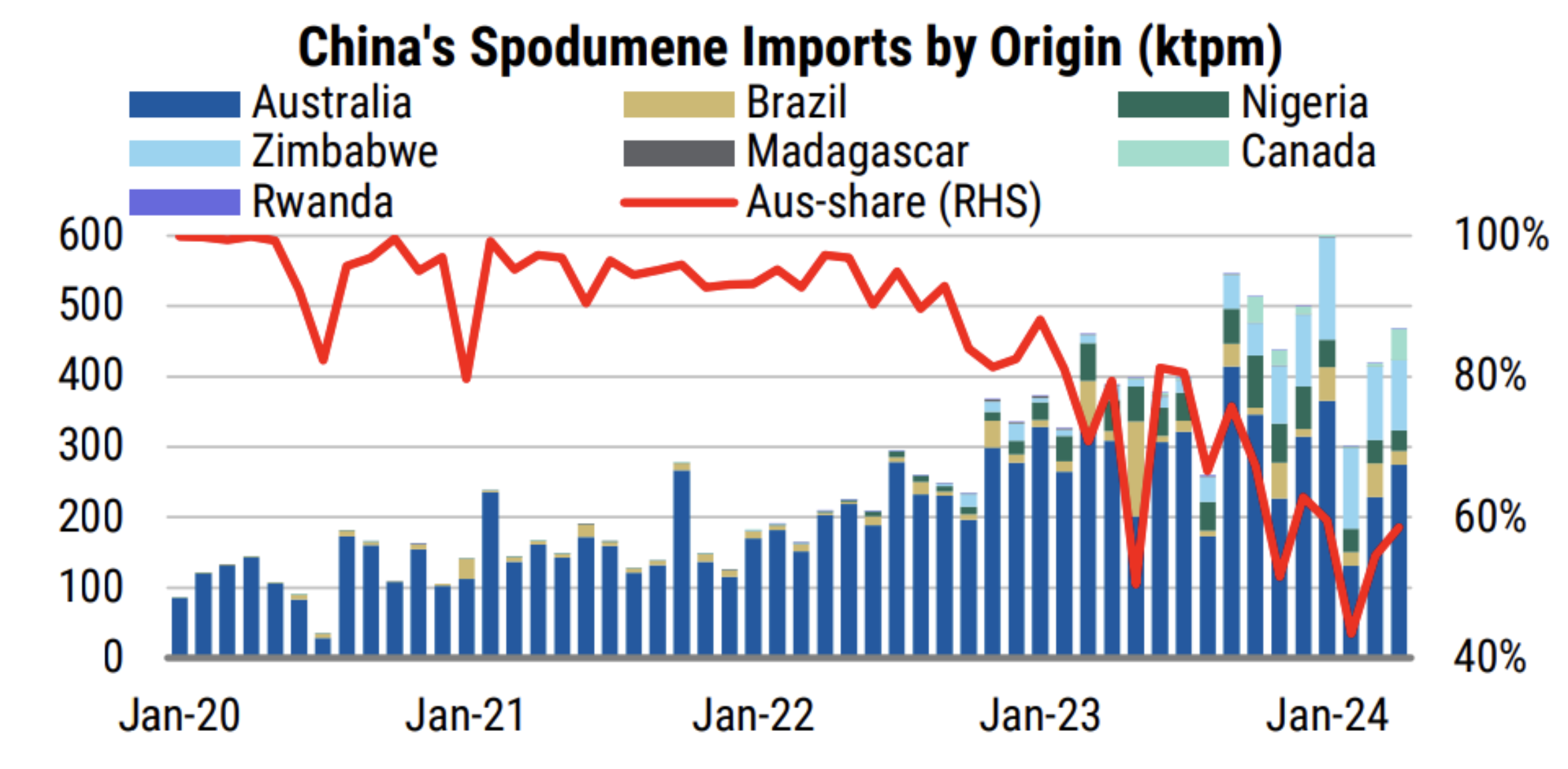

Morgan Stanley expects Australian spodumene shipments to improve in the coming months, with "Greenbushes returning to full production quicker than we had modelled while other mines have been seeing improvements too."

The table below shows a notable rebound in Australian spodumene exports to China following a 21% year-on-year drop in the March quarter.

Supply from Africa is also expected to recover as the region exits its wet season, and easing environmental restrictions in China should also result in higher output.

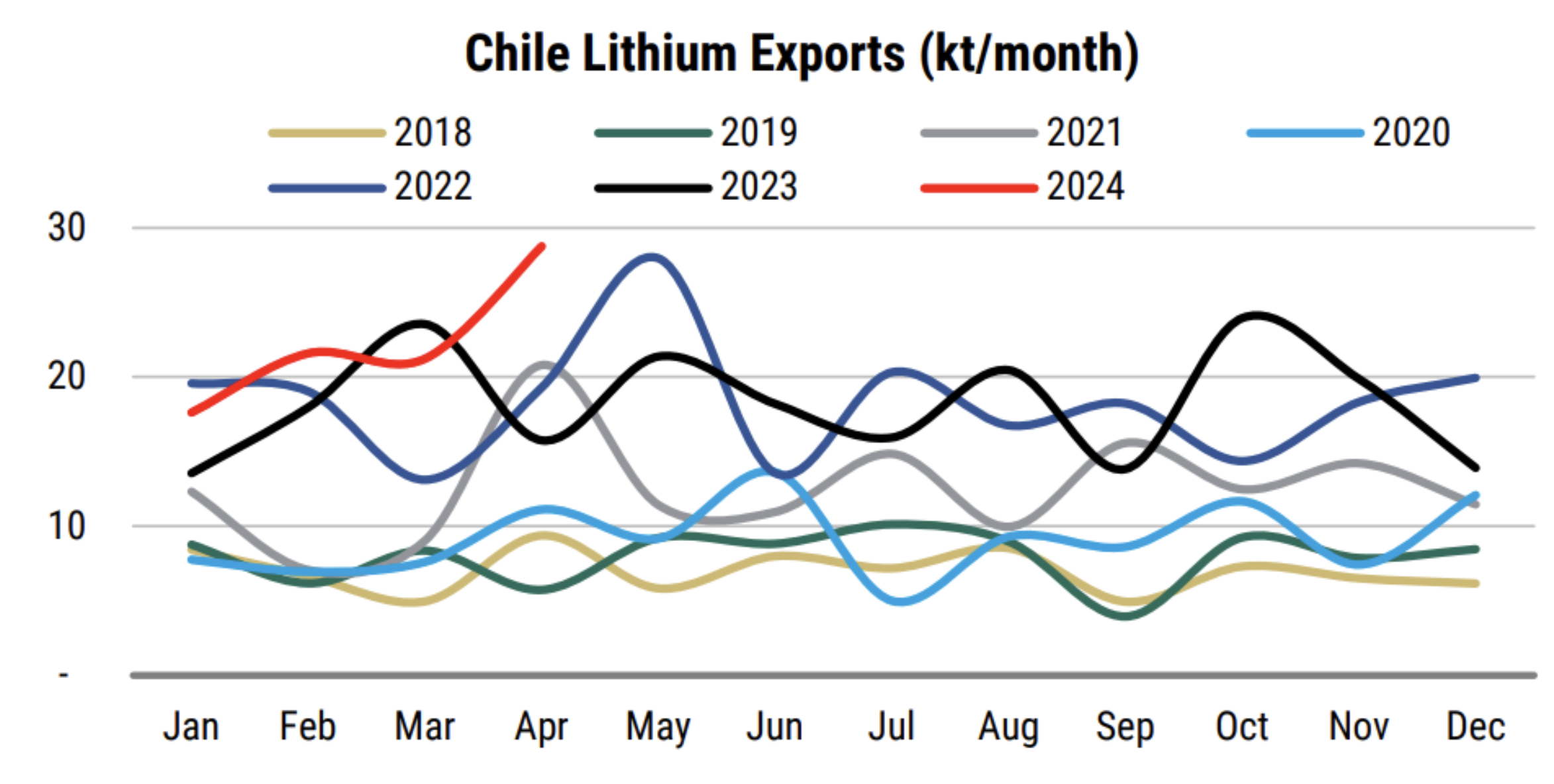

"Chile's exports are also touching all-time highs, with SQM recently raising their sales targets," the analysts warned. Chile's lithium exports hit a record 29,000 tonnes in April, up 36% month-on-month and 83% year-on-year.

Demand "continues to see some headwinds"

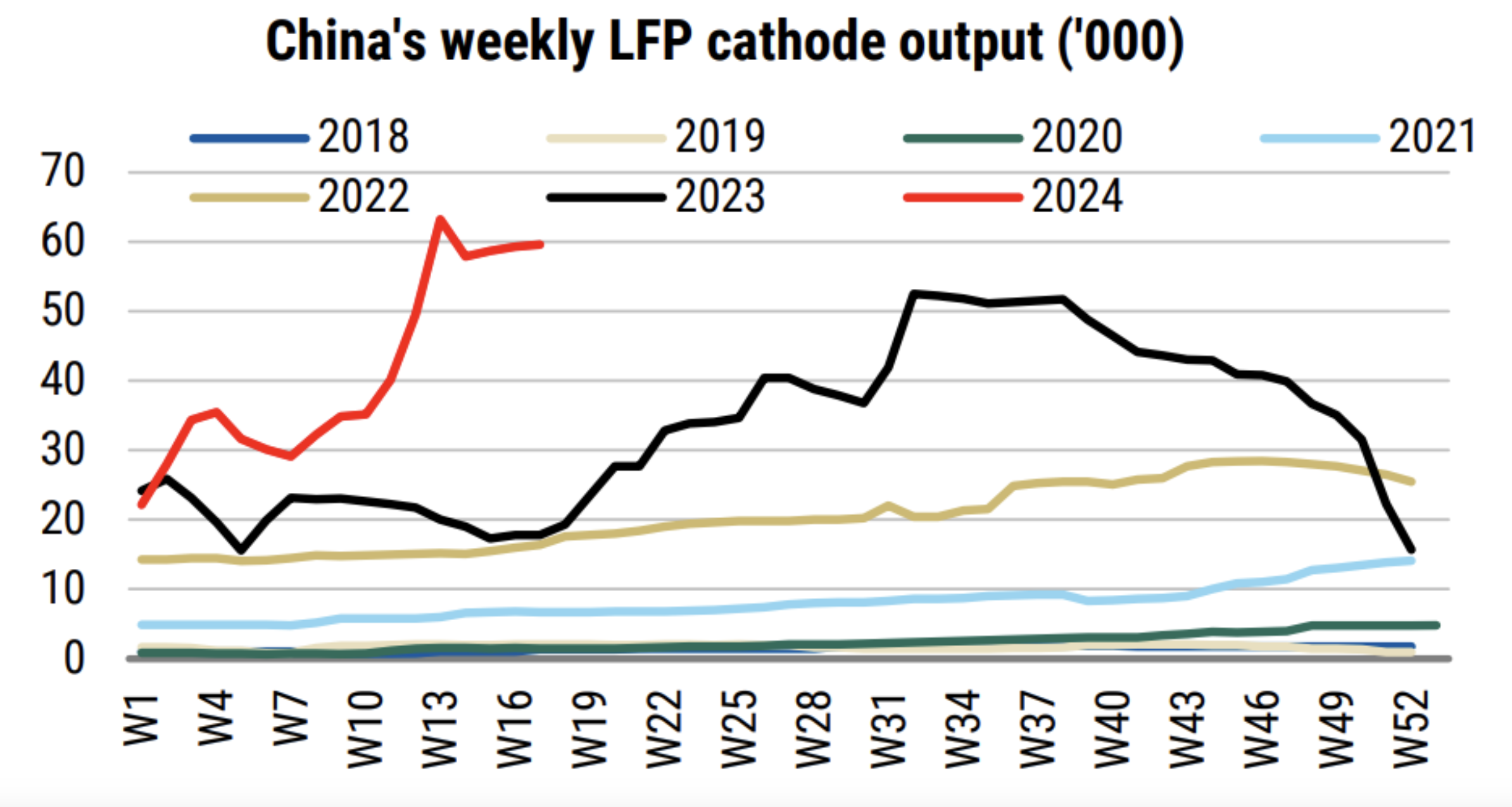

China's cathode demand in the March quarter has surprised to the upside, with cathode output almost doubling year-to-date.

The analysts point out the ongoing shift in demand, where consumers have started to favour hybrids over regular EVs. "China's NEV sales have started well, this has been led by hybrids, which now account for 14% of total vehicles sales and 39% of NEV sales."

The average hybrid vehicle in China has an average battery capacity of 24 kWh compared to 56 kWh for a regular EV, which reduces lithium demand.

A similar trend was noted in Tesla's first-quarter result, where its investor presentation flagged that "global EV sales continue to be under pressure as many carmakers prioritise hybrids of EVs."

Where to from here

Chinese lithium carbonate prices are trading close to the analyst's base case of US$13,500 a tonne, but a loosening supply and demand balance could bring downside risks to prices.

"Whilst demand from China's NEV market remains robust, driven by hybrids and supportive trade-in schemes, lithium intensity is falling as hybrids gain share, while the rest of the world EV market remains a drag."

From a stock perspective, the report reiterated an Underweight rating for Pilbara Minerals (ASX: PLS) with a $3.35 target price due further capex/cost increases as the P1000 expansion project ramps up. As well as an Underweight rating for IGO (ASX: IGO) with a $6.05 target price as it faces several risk factors such as higher capex, slower ramp-up of its Kwinana plant and inventory build at Greenbushes.

Mineral Resources (ASX: MIN) was the only name to attract an Overweight rating as lithium only accounts for 20% of its forecasted FY25 revenue. "We mainly like it for its iron ore exposure (55% of FY25e revenue) as well as an improving balance sheet driven by the potential Onslow toll road sale."

This article was first published on Marketindex.com.au on Thursday 30 May 2024.

1 topic

3 stocks mentioned