Don’t fear growth – stay with it

Clime Investment Management

Warren Buffett recently gave an interview where he reiterated his firm belief in the US economy, which justifies Berkshire Hathaway’s investment focus on quality US companies. In doing so, he emphasised the long-term investment horizon, bemoaned the focus on short-term forecasting but defended his right to receive quarterly updates.

A particularly enlightening comment was his response to a question on the quarterly reporting by US companies. The interviewer quoted a tweet from President Trump regarding quarterly reporting. The full dialogue is worth reviewing – particularly from an Australian context.

Quarterly reporting

Q. The president also tweeted that he would like to stop reporting every quarter, maybe do it on a six month basis. What do you think of that idea?

Buffett: Yeah. Jamie Dimon and I came out a while back, but I’ve always focused on the idea that I like to read quarterly reports as an investor, and we’ve got a couple hundred billion dollars’ worth of common stock. So I like to get those quarterly reports. I do not like guidance, I think that guidance leads to lots of bad things, I’m seeing it lead to loads of bad things. I don’t think quarterly reporting is the problem itself. It’s when you get into promising people what you’ll do every quarter. I can’t promise what’ll happen next quarter. We’re in hurricane season now, and it could change our earnings dramatically with a storm or something of the sorts. So I think it’s a very bad practice to be in the game of earnings guidance, and it is a game. People play it as a game, and then people adjust the numbers and all that. But I like to get the figures quarterly, and I hope that stays.

We agree with Buffett and suggest that Australia’s major companies should be required to produce quarterly updates, pay quarterly dividends (if possible), stop private briefings and refrain from market guidance or forecasts which expose them to class actions.

Quarterly reporting does not promote short-termism at all. It is the right of the owners of a company to be informed on a regular basis as to how their company is performing. More information is good, and less short-term forecasting is better! An informed market is better than an un-informed market and facts are better than speculation.

Buffet also explained in very clear terms why he is investing in US shares and not US bonds. Given that US thirty-year bonds are yielding just 3.1% (per annum) and that after 30 years you get your money back “then why would I consider bonds as a superior investment to US equities?”

Over decades US equities have delivered an 8% per annum compound return. The returns have not been straight line or even predictable over short periods. There have also been many short periods of negative returns. However, looking forward from this point, it is hard to see how the US equity market could fail to outperform the US bond market over the next ten, twenty or thirty years. Further, quality growth companies – those that can reinvest in themselves for growth – will do even better.

Buffett’s rhetorical question and explanation highlights the current conundrum for pension fund investors as they attempt to structure a balanced portfolio across asset classes.

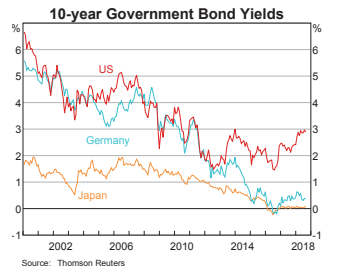

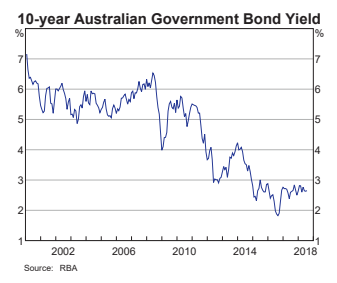

Government bond yields are simply too low. The bond market has become a very poor returning asset class in most places in the world (except in emerging economies) and their yields hardly justify a place in a balanced fund seeking a desired return of 5% to 6% above inflation.

An allocation to government bonds in the US, Europe, Japan or Australia can only be justified if an investor believes that asset markets are about to encounter a severe price correction caused by an economic or financial calamity. With the GFC still in recent memory, it is easy for investors to become consumed with the risks of equity investing. However, risks (and price volatility) must be taken in the endeavour to generate returns well above inflation or the passive yield on a bond. Further, to draw a conclusion of imminent danger today ignores economic reality (and we will analyse this environment later in this report).

The hurdles to beat inflation or passive government bond returns are not high at present. That is important to understand. Balanced investment returns should be appropriately targeted at around 6% to 8% per annum. By moving away from bonds, a higher return can be generated. Government bonds - like cash - are a drag on returns, particularly when they are crazy expensive and yielding next to nothing.

It is a benign growth period with most of the world’s largest economies navigating through moderate growth and low inflation. In the main their respective bond yields reflect this outlook. A scan across the world’s 10-year bond markets shows that yields are very low in most economies. The ten-year yield is a proxy for the “risk free rate” of return and so other asset classes – equities, corporate debt, property and infrastructure – don’t have to do too much to generate a superior return (adjusted for risk) in this current period.

Long-term bond yields

The major economy bond yields and our comments are as follows:

- United States 2.9% - Economy growing well with a slightly heightened risk of inflation stemming from trade barriers being implemented and a tightening job market.

- United Kingdom 1.5% - Waiting upon a “hard” or “soft” Brexit decision. A challenge in political leadership seems likely.

- Japan 0.12% - bond yields still 1% below inflation and the central bank acknowledges that these yields need to go higher. No population growth so outlook is benign.

- Germany 0.4% - bond yields still 1% below inflation despite reasonable economic growth being recorded with euro weak against surging USD.

- France 0.7% - A beneficiary of European QE and German economic growth.

- India 8.0% - Strong economic growth (7%) but elevated inflation (4%).

- Switzerland – 0.1% - negative real and actual yields. How will this be unwound?

- Canada 2.3% - Issues developing with trade with US. Economy weakening slightly.

- Spain 1.5% - A beneficiary of European QE. Has had a strong trade turnaround.

- Italy 2.8% - Bond yields belie the economic risks. Another beneficiary of European QE.

- China 3.7% - Yields are positive against inflation and economy growing against trade pressures from US. Stock market under severe pressure with 20% decline, but China remains in a multi-decade growth cycle.

- Australia 2.6% - Economy growing from population growth, trade surplus and tourism. Inflation under control and credit growth checked. Consumer confidence weak as residential property declines, plus uncertainty created by risk of change in government next year.

Across the developed world long-term bond yields still present as being affected by direct or indirect QE. Australian bond yields and the current cash rate settings of the RBA are determined and/or supported by capital flows seeking to flee hideously low bond yields in Europe and Japan. Importantly we believe that these offshore influences will endure for a few more years and it appears unlikely that the RBA will lift cash rates in the next 6 months.

Economic growth everywhere

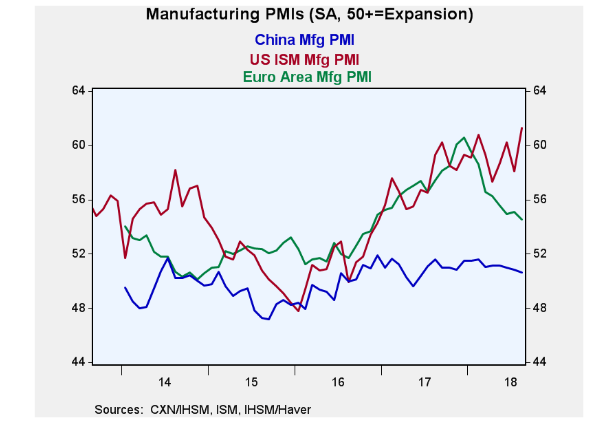

Whilst some may suggest that low long-term bond yields suggest calamity or that a negative yielding bond curve predicts recession, the observable fact is that the world economy is growing. Further, on close examination some economies are lifting noticeably.

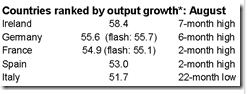

Across Europe, the following table highlights that sections of the Eurozone are quite buoyant with production or output growth. This is despite the whole of Eurozone (19 nation members) growing at a fairly moderate rate to be 0.4% larger in the second quarter than in the first, and 2.1% up on the same period a year earlier.

Across the world, manufacturing/production expansion is still being seen almost everywhere. Notably, growth is slowing in China while the US is on a tear!

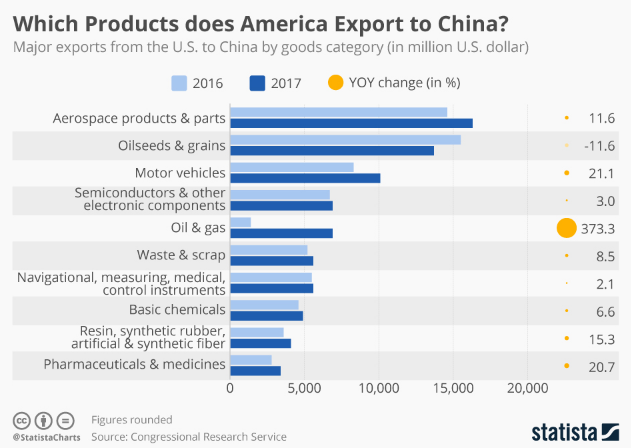

Whilst the US/China trade dispute is moving through its negotiations, the chart above suggests that the US economy was doing just fine without imposing tariffs on Chinese imports. However, the US trade account deteriorated again in July as US importers ratcheted up orders to beat the tariffs on US$50 billion of Chinese goods.

The deficit hit US$50 billion in the month up from US$47 billion in June. Importantly, the deficit was determined by import growth because US exports declined by 1% over the previous month. The specific trade deficit with China rose to US$31 billion (or 65% of the deficit) and the European deficit was US$17 billion. The US -ROW trade was a small surplus and hence Trump’s focus on China and Europe.

At the end of August, Chinese foreign reserves were estimated at US$3.1 trillion which have barely moved over recent months. Thus China has immense foreign exchange power to influence its growth and engagement in its trade partners’ capital markets.

The overall annual Chinese trade surplus currently is approximately US$300 billion, with the bulk of this represented by the surplus with the US. In August, China reported that while total exports rose by 10% (on pcm), imports were 20% higher than a year earlier. Therefore, China’s growth is driving world growth. President Trump needs to acknowledge that the US does not produce a lot that China needs or wants at present and that world growth is good for the US.

The US trade account is currently represented by approximately US$3 trillion of imports that exceed the US$2.5 trillion of exports. The annualised trade deficit of US$0.5 trillion represents 2.5% of GDP.

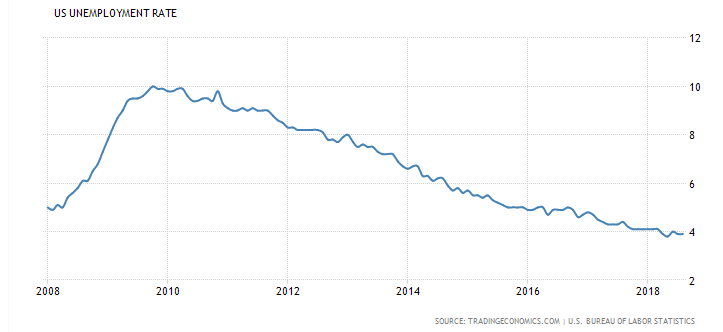

Other US economic statistics also point to continued economic buoyancy. Average hourly earnings for private workers increased 2.9% from a year earlier and nonfarm payrolls rose 201,000 from the prior month. The unemployment rate was unchanged at 3.9%, still near the lowest since the 1960s as over 500,000 jobs were created over the last 3 months.

The US growth is clearly real and exemplified by the fact that layoffs reached a fifty year low in August. The productivity of non-farm workers, measured as the output of goods and services for each hour on the job, increased at an annualized and seasonally adjusted rate of 2.9% in the June quarter from the prior three months.

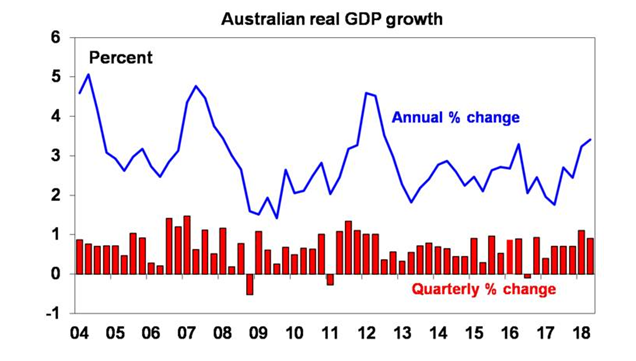

In Australia, GDP growth is also lifting and the RBA last week forecast growth to be above 3% in both 2018 and 2019.

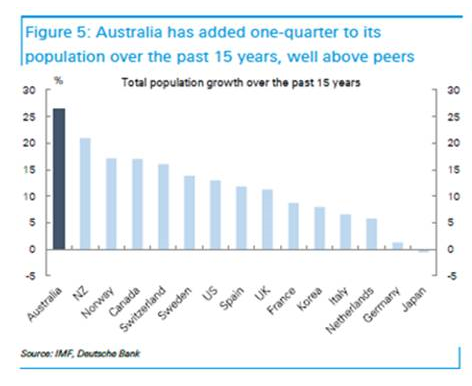

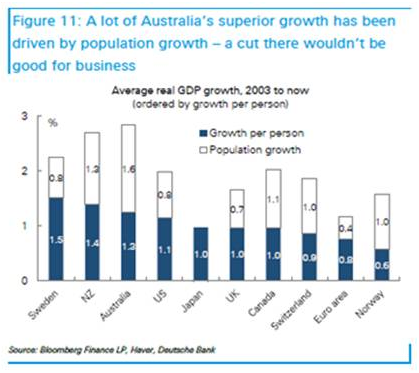

The explanation for Australia’s continued growth is partly the result of trade with China, but it should also be acknowledged that Australia has unique growth generated from the population increasing via inward migration.

The chart below shows that over the last 15 years, Australia’s population has grown much faster than other developed economies.

However, this growth is not supplemented by strong productivity growth. The chart below suggests that less than half of Australia’s economic growth is generated by production, but it is relatively superior to that noted in the US, Japan or Europe… although lower than New Zealand!

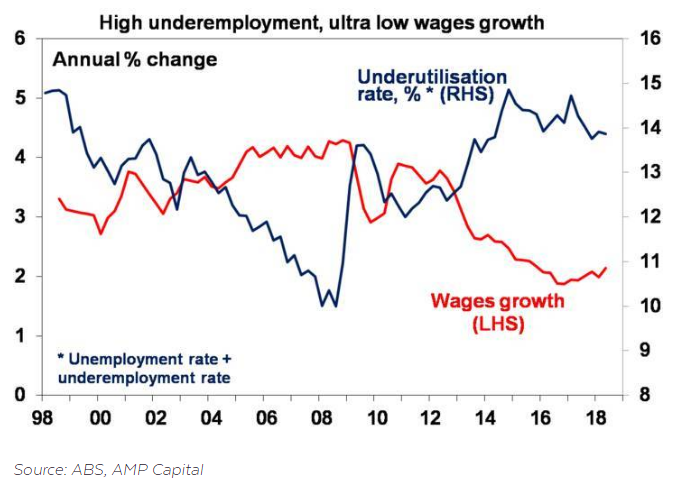

A direct result of moderate productivity growth is that wages growth will (and has) moderated. Further, the large population growth has clearly balanced the significant employment growth seen over the last 18 months. Therefore, employment growth is not resulting in a fall in the unemployment rate or a significant drop in the employment underutilisation rate. Wages growth is thus sitting at twenty-year lows.

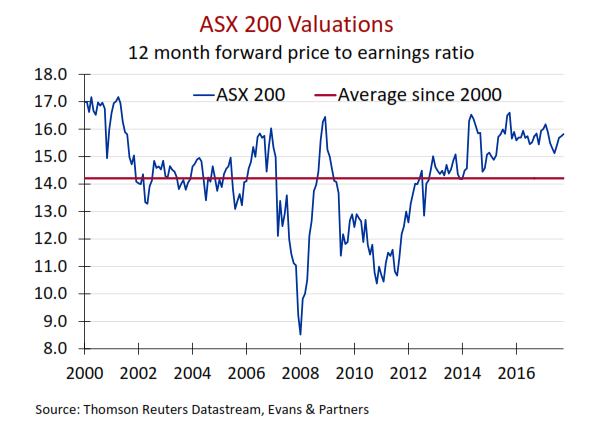

In summary, we maintain our view that economic growth across the world is supportive of growth assets. However, a balanced approach requires a healthy allocation to yield investments, more so because growth assets (mainly equities, see ASX200 valuations chart below) are expensive.

A balanced portfolio needs to be monitored and dynamically reviewed as events unfold. A tilt to low volatility unlisted investments, with higher yields, remains a useful option for mature stage pension portfolios – but this should be considered in terms of investments outside super.

5 topics

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.

Expertise

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.