Down under & out

Key Points:

• Australia's economic performance has deteriorated since mid-2022. Strong population growth is papering over the cracks, but the average household is still going backwards.

• Some of this is due to high interest rates, but productivity growth has been too weak.

• Government spending has increased substantially as a share of the economy and the regulatory burden on business is high. This, combined with our housing and mining focussed economy could be weighing on productivity growth.

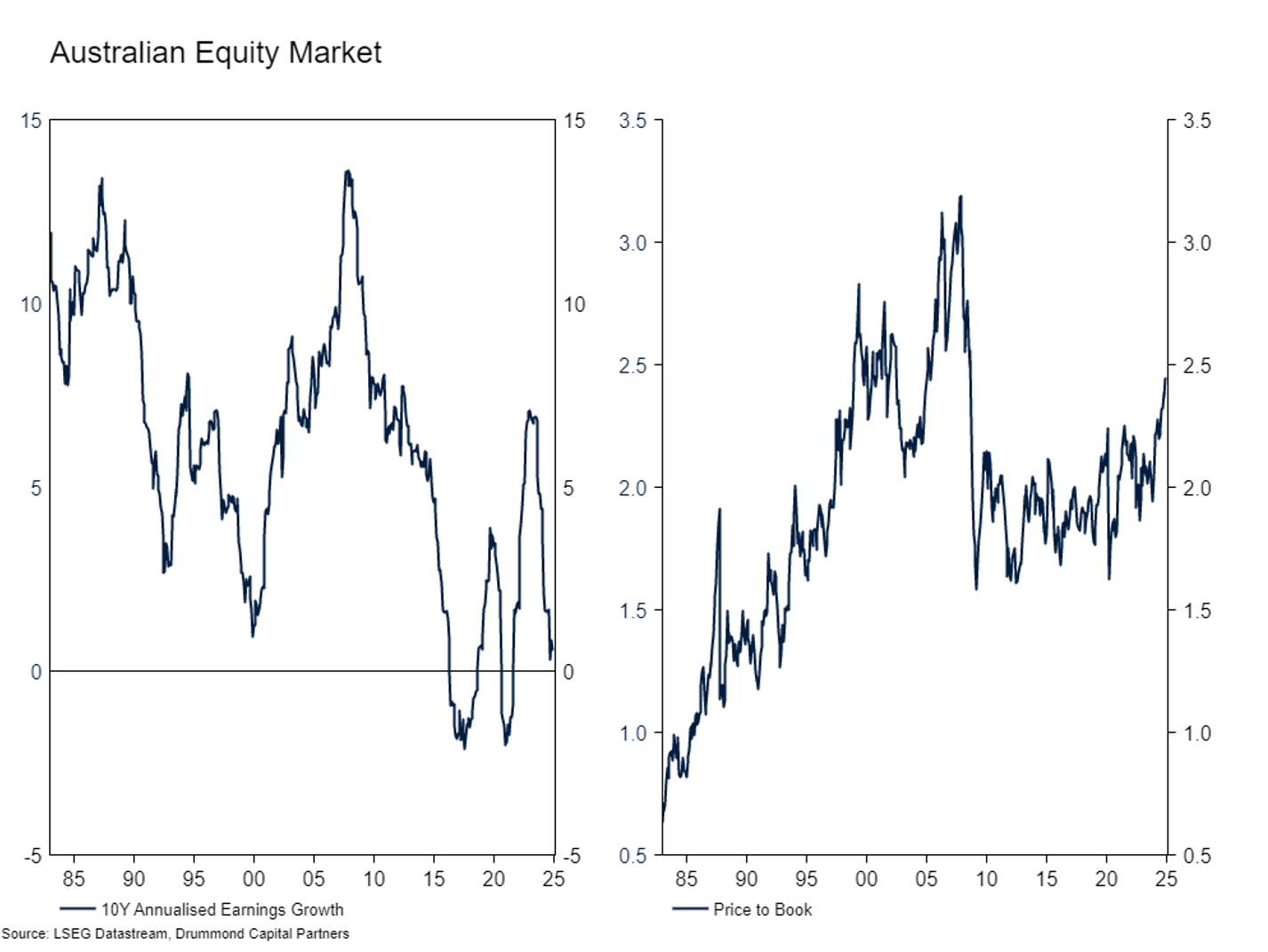

• Despite these economic headwinds, Australian equities remain expensive relative to their earnings growth, which has been close to flat for 10 years.

There has been a lot of negativity about the Australian economy in the media in recent years. Our once miracle economy which had avoided a recession for decades and enjoyed strong growth in household incomes has stagnated for two years. Is the negativity justified? Who should we blame? The Government? The RBA? Millennials? In this month’s Market Insight, we provide an update on the Australian economy and review whether our equity market is still as attractive as it was previously.

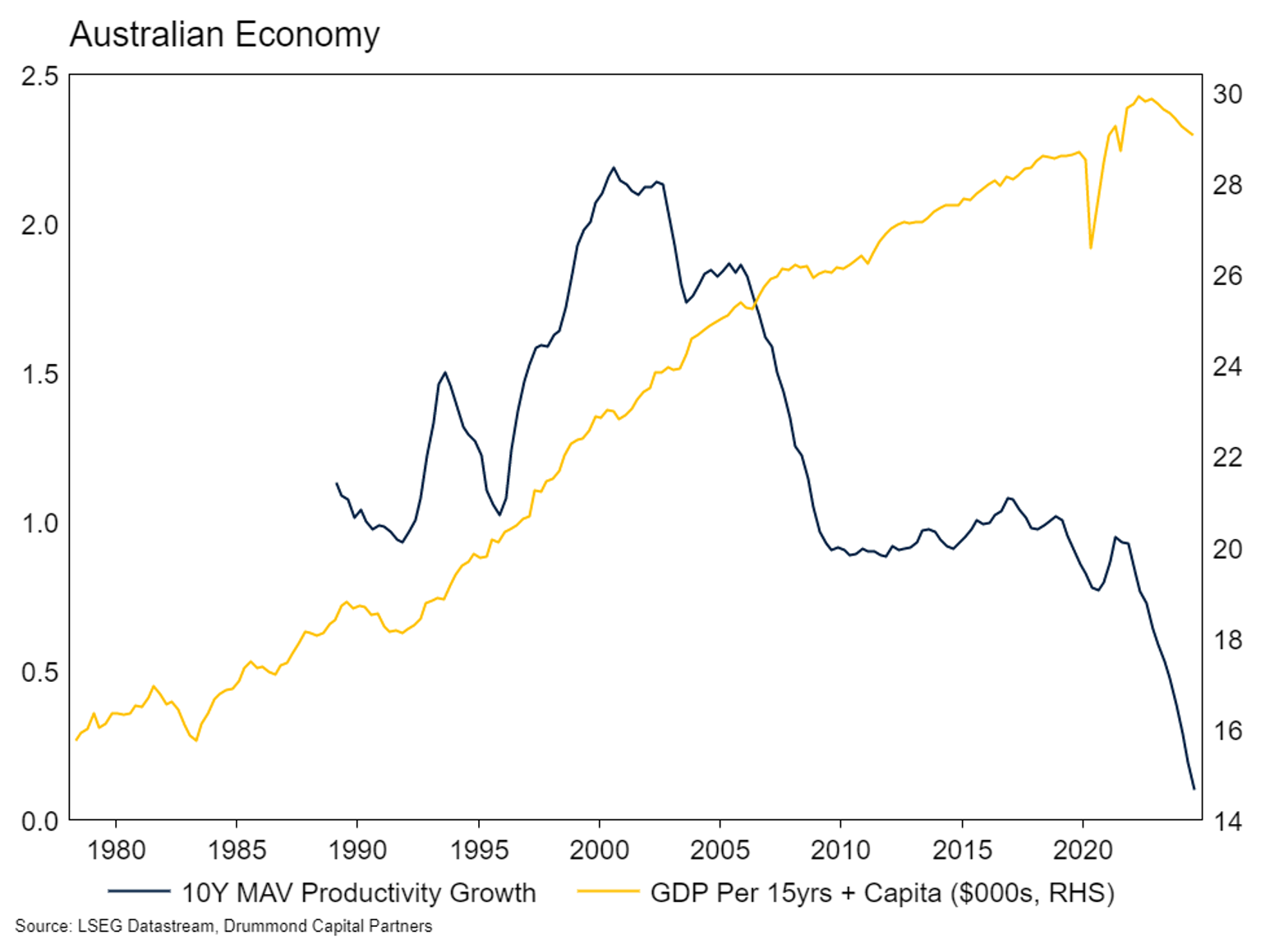

Dig Up, Stupid

Australian gross domestic product per capita (GDP, the aggregate goods and services produced by the economy) peaked in the middle of 2022. Since then, household consumption, dwelling investment and net exports per capita have fallen. This has been partly offset by rising business investment and very strong government spending. The primary reason for this decline has been a collapse in productivity growth. The amount of GDP each person has generated per hour of work has barely budged in 10 years (blue line in the chart below). While the overall economy has been growing, this has been entirely due to strong migration. The size of the economy is completely irrelevant for the individual person, what matters for your standard of living is how fast your share of the pie is growing (or shrinking). For the average person, their share of the pie has been shrinking.

Pointing Fingers

While it would be convenient to point the blame for Australia’s decline on a single factor, there are probably a number of reasons for our malaise. Like most major economies, excess Covid stimulus spending, combined with a post lock-down economic reopening boom and the global commodity price shock due to the Ukraine invasion saw inflation spike in 2021 and 2022. Interest rates were hiked sharply in response, and we are still feeling the effects of that today. Keeping the economy soggy in order to regain control over inflation is the RBA doing its job.

In an environment of sluggish private sector growth, Australian governments (Federal and state) have been spending like the next election depends on it. Some of this has been on infrastructure projects, aiming to keep cities liveable in an environment of historically high population growth. Notionally, these should be productivity enhancing, but their mind-boggling cost calls this into question. They have also had the secondary effects of apparently sucking up every available tradie in the country, resetting wages higher and contributing significantly to the increased cost of constructing other things, such as dwellings and commercial projects. Rising building costs have been a substantial contributor to inflation in Australia, keeping interest rates higher than they otherwise would be. There has also been increased government spending on unproductive initiatives, such as energy rebates, and the NDIS threatens to swallow the entire budget unless growth in the program is somehow contained.

The net of all of the above has been a substantial increase in total government spending as a share of the economy (see below). Anyone who has ever spent time working for the Government would likely agree that the public sector is less productive than the private sector. Productivity is notoriously hard to measure – the ABS doesn’t even estimate public sector productivity growth in Australia. The June 2024 Productivity Commission Quarterly productivity bulletin estimated public sector productivity fell around 4% over the last ten years versus around a 7% increase for the private sector over the same period. Public sector employment has grown substantially so it seems likely that the increase in public sector activity versus private sector activity is at least in part responsible for declining living standards.

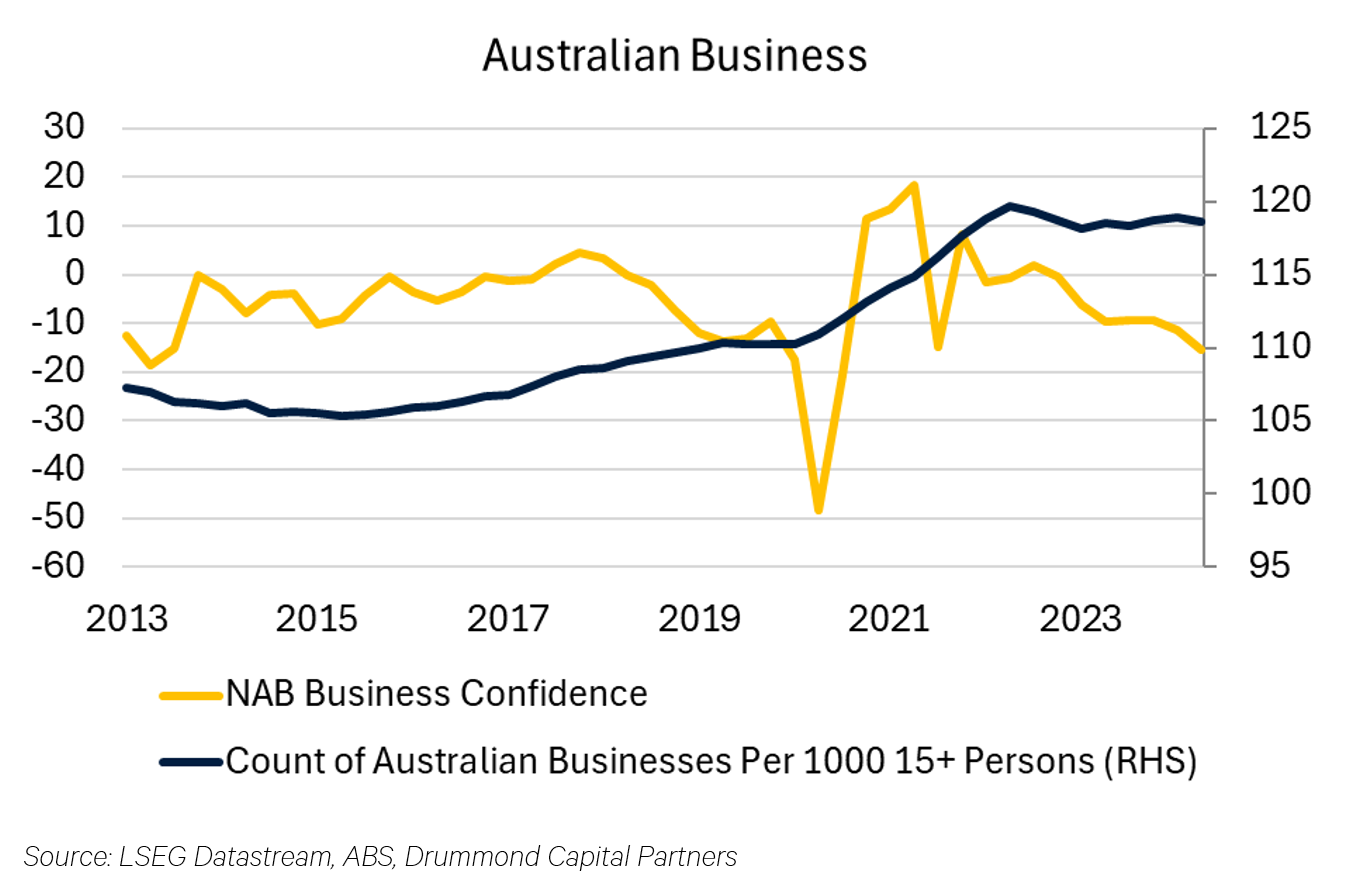

Another interesting data point is a fall in net per capita business formation in Australia. The number of Australian businesses per person peaked at the same time as GDP per capita. Since then, overall business confidence has also fallen to below average levels. It is difficult to identify whether business formation and confidence is poor because of the state of the economy being weak, or the economy is weak (at least in part) because of a lack of dynamism in the business sector.

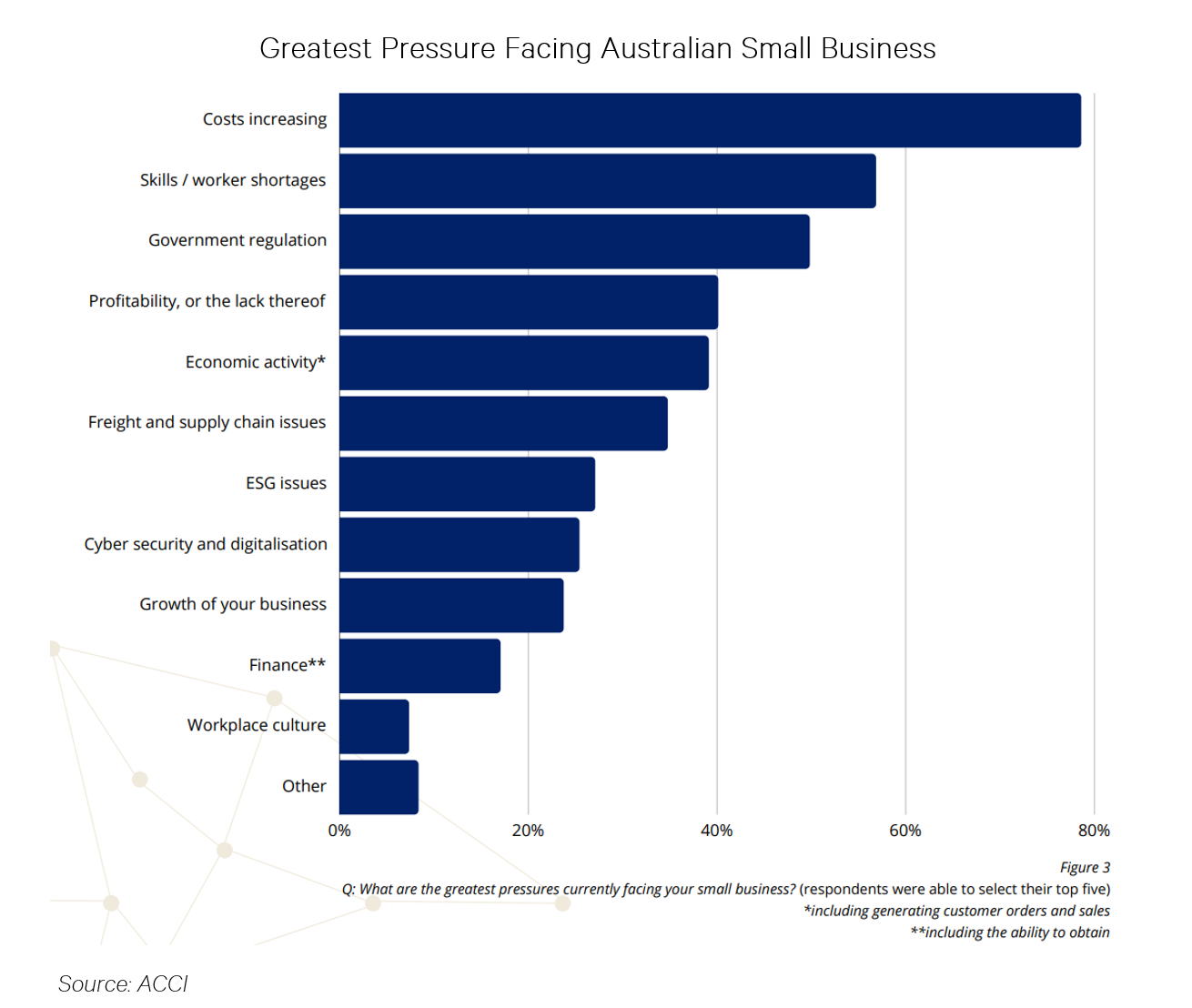

A factor which may in part explain lower business formation is the regulatory burden. While businesses complaining about having to deal with Government is a story as old as time, this year’s inaugural Australian Small Business Conditions Survey by the ACCI highlighted regulatory burden as the third greatest pressure facing business, and the second most significant expense. In a recently released Economic Growth Statement, the Victorian Government announced an up to 50% reduction in the number of state regulatory bodies by 2030. There are currently 37. Celebrating a policy taking it down to “only” 18 in 5 years’ time reads like a script from Utopia. Some level of innate complaining about Government would be normal, but third and second highest on the list of things to worry about feels exceptional.

Maybe Australia’s economic structure is to blame? We have long been known as the houses and holes economy. A reliance on mining for national income leaves us hostage to swings in global commodity prices in the aggregate and, concerningly, China’s property market in particular. Productivity improvements in mining are also difficult to achieve as existing deposits dry up and new sources are consecutively more difficult to find.

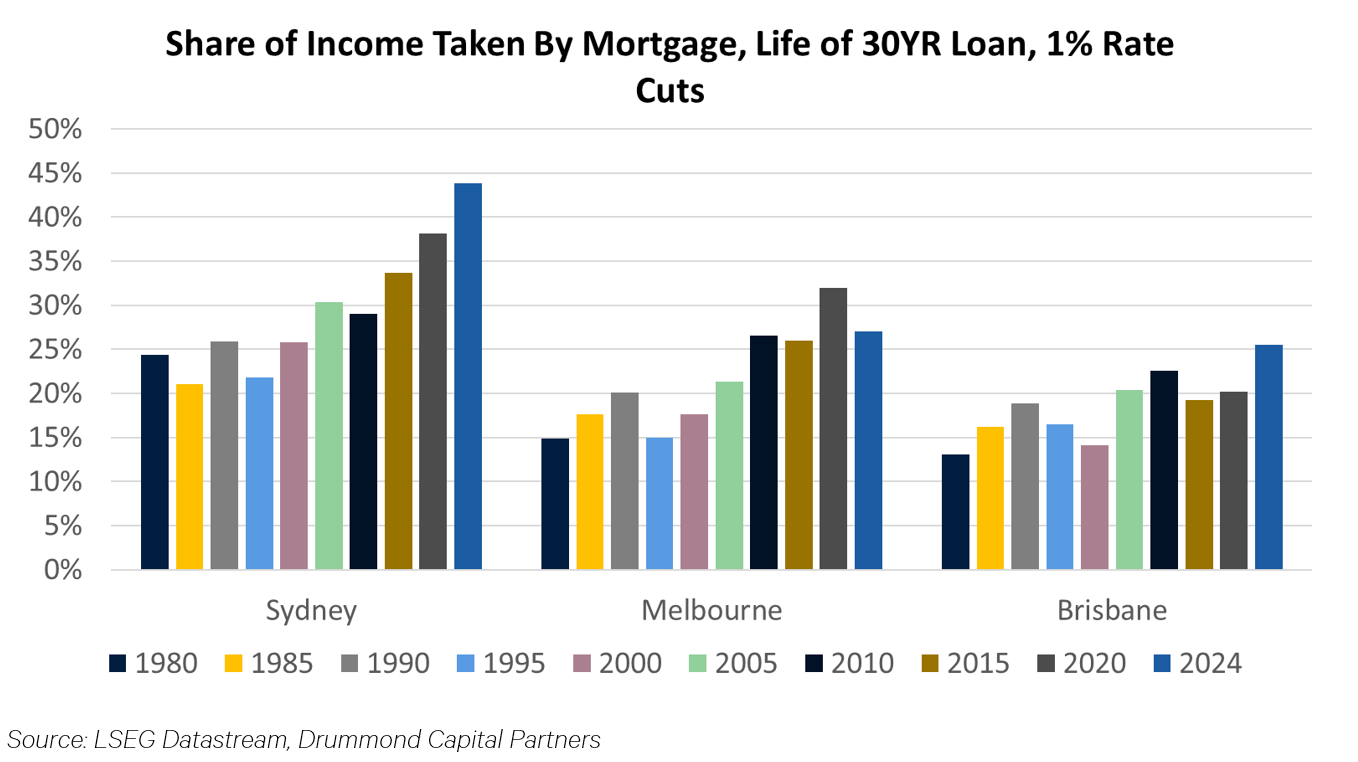

Our obsession with expensive property markets is surely a drag on productivity. High transaction costs prevent people from moving to a more appropriate dwelling or relocating closer to employment. Favourable tax treatment (particularly for the household residence) encourages investing in the most expensive home you can afford rather than other asset classes, which actually provide capital to companies in an economy. The terrible burden of paying for a dwelling ensures that young people in this country will be hobbled with lifelong debt repayments significantly higher than any previous generation, especially in Sydney, where an average household can expect to spend nearly 45% of their total gross income over the next 30 years on mortgage repayments to purchase the average dwelling. Perhaps this is an incentive to work harder? More likely the weight of a gargantuan mortgage stops the indebted from taking risks in employment or starting a business where they may have to take a pay cut for a few years. Where possible, young people will be forced to move into the regions, weakening the agglomeration (the productivity gains that come from concentrating economic activity, particularly labour) benefits of cities.

So, what is the trigger for change? There is no easy answer and perhaps there is nothing that can actually be done. Australia is not alone in its malaise. Indeed, the US stands out alone as the only major economy showing any sort of economic dynamism at present. It may be mostly interest rates. Maybe the economy will enjoy a revival if the RBA starts cutting next year? If it is really Government overreach crowding out the private sector, odds are we just live with that from now on. Governments don’t become less involved. Perhaps the nature of most economies as they mature is to glide towards something approaching the European experience. Not much growth, high taxes aiming to equalise the lived experience of the population, but inevitably still a substantial proportion of the population held back by lack of opportunity. The middle class get to enjoy long summer holidays, but have to spend them worrying that the next Government will do something stupid, like shutting down the country’s power supply.

Post Growth

With such a lacklustre economic backdrop, surely the Australian equity market is a bargain buy. Unfortunately, that is not the case. Australian equities are bizarrely expensive for a market with very little earnings growth over close to 10 years (see below). The IPO market in Australia has been dead since mid-2022 and it’s not hard to see why.

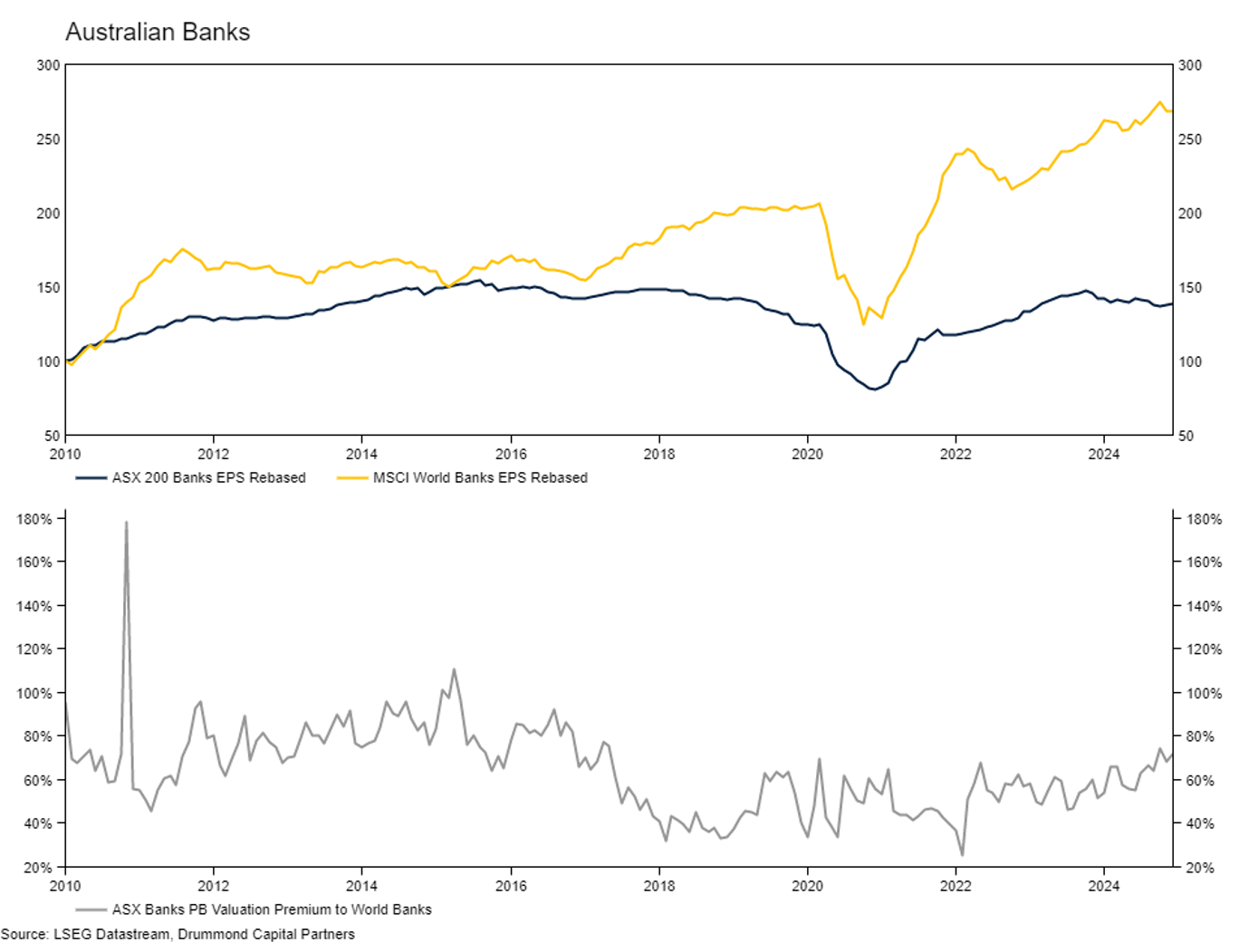

What about the banks? Piggybacking on the housing dominated economy, you would think domestic banks would be printing earnings hand over fist. Again, unfortunately not. Australian bank earnings have been trending lower for a decade. They have been materially outperformed from an earnings perspective by global banks, and still trade at a nearly 80% valuation premium. They represent around a quarter of the Australian equity market and it’s hard to make the case that Australian households aren’t completely tapped out when it comes to mortgage debt. How can they grow earnings at this point?

The saving grace (if you can call it that) of the Australian equity market is the sheer weight of capital that gets thrown at it from the superannuation system. If 11.5% of the country’s wage bill gets allocated to superannuation (which it should), and 23.4% (average superannuation fund allocation) of that goes into Australian equities, that is around a 3.6% lift in market capitalisation all else equal every year.

Portfolio Positioning

We have long believed in the concept of US exceptionalism. The best companies in the world are generated there and for good reason. In contrast, Australian equities are becoming harder and harder to love. Australian equities do have attractive defensive characteristics and for Australian investors franking credits can be attractive. Still, with the economy and earnings growth very weak with few short-term prospects for improvement, and high valuations, we recently reduced our Australian equities exposure and moved the portfolios underweight the asset class.

2 topics