Earnings Shockers! These ASX stocks received the most upgrades and downgrades in August

As August earnings season fades into the background for another year, it’s time to assess which ASX companies delivered the best and worst results. In this article we’ve dug deep into our Broker Consensus archives, screening the data for the last 4-5 weeks to determine which stocks were the most loved, and which were the most shunned by the big brokers.

We have collated the data into four major categories:

- Stocks that enjoyed the greatest number of rating upgrades

- Stocks that suffered the greatest number of rating downgrades

- Stocks that enjoyed the greatest number of target price hikes in excess of 10%

- Stocks that suffered the greatest number of target price cuts in excess of 10%

So, exactly which ASX stocks did the brokers think were the biggest winners and losers from this August earnings season? Let’s dive in!

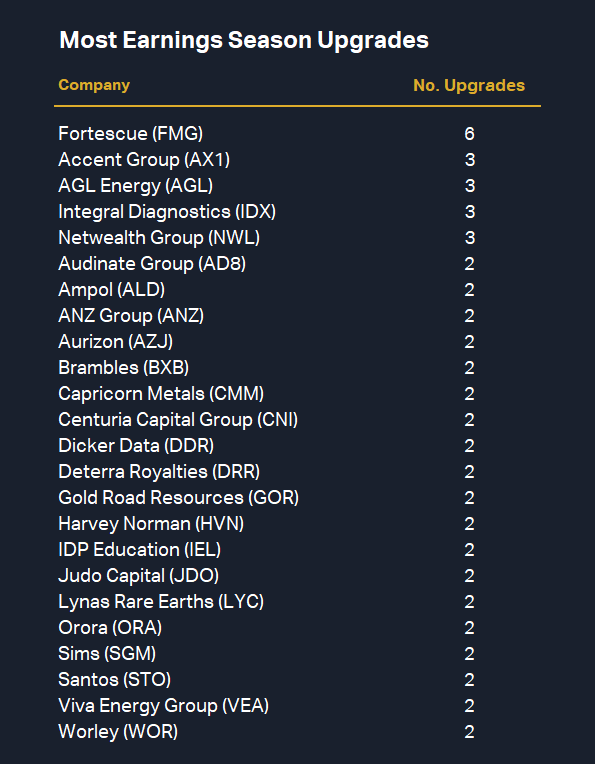

The most upgraded ASX stocks this earnings season

The brokers issued a total of 144 rating upgrades this earnings season.

Beleaguered iron ore miner (and green energy hopeful) Fortescue (ASX: FMG) took out top spot for the most upgraded ASX company during August earnings season with an impressive six upgrades. This is especially impressive considering the next best cohort were at three upgrades, and most companies only gathered two.

Having said that, there should be some context here – none of the major brokers had FMG at a BUY prior to its recent share price plunge – and Bell Potter and RBC Capital Markets were running at SELL (all others were at HOLD). Those two sell ratings are now a notch higher at hold, and nervous FMG shareholders may take heart from the fact that the other four brokers increased their ratings to buy/buy equivalents (e.g., “ADD” or “OVERWEIGHT”).

As previously mentioned, the list falls away a little from there, but honourable mentions should go to AGL Energy (ASX: AGL), Integral Diagnostics (ASX: IDX), and Netwealth Group (ASX: NWL).

One should not consider this table in isolation, however. It is important to also consider the rationale behind a group of rating upgrades (and downgrades), and how brokers also adjusted their price targets. For FMG, most brokers believed that the recent share price plunge had improved FMG’s valuation, but price targets were generally maintained or modestly lowered.

Stocks that were upgraded on poorly received results, i.e., those that triggered large post-earnings share price declines, included Audinate Group (ASX: AD8), Aurizon (ASX: AZJ), and Dicker Data (ASX: DDR). Generally, like FMG, these stocks were upgraded on “valuation grounds” rather than on perceived strong earnings growth. Brokers did see enough value in AD8’s and DDR’s shares to move their ratings to buy equivalents, but AZJ’s two rating upgrades were only to hold equivalents.

The problem for me with these companies, is that each also featured highly in the target price cuts greater than 10% table below. A stock that enjoyed both rating increases and price target increases was a rare commodity this earnings season. There are just three that deserve special mention based on this metric: IDX, Brambles (ASX: BXB), and Judo Capital (ASX: JDO).

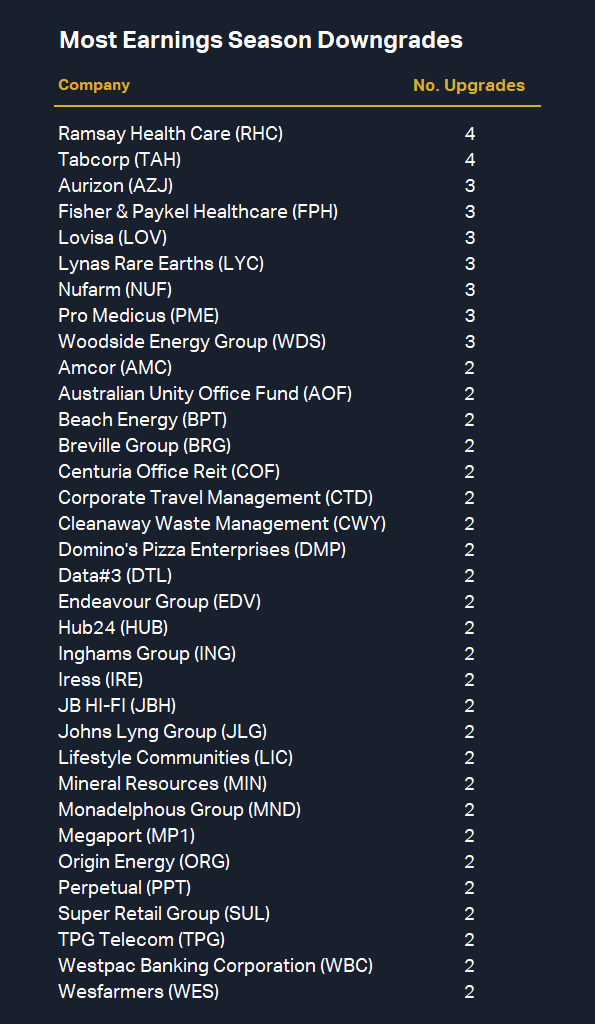

The most downgraded ASX stocks this earnings season

The brokers issued a total of 158 rating downgrades this earnings season. Companies that found themselves in this list generally fell into two categories:

1. Positive result: Therefore enjoyed a big share price gain post-earnings, and therefore the broker no longer felt its shares represented attractive value;

2. Disappointing result: Therefore the company’s earnings outlook had deteriorated, and therefore warranted a rating downgrade.

Again, it’s important to also consider the broker’s price target response here. Stocks in Category 1 might have seen their rating cut, but generally they were rewarded with large price target increases. These included Amcor (ASX: AMC), Breville Group (ASX: BRG), Fisher & Paykel Healthcare (ASX: FPH), Hub24 (ASX: HUB), JB HI-FI (ASX: JBH), Lynas Rare Earths (ASX: LYC), Pro Medicus (ASX: PME), Super Retail Group (ASX: SUL), and Wesfarmers (ASX: WES).

Stocks that found themselves in Category 2, that is, their ratings were cut due to poorly received results and they also suffered large price target cuts, could arguably be considered the “worst of the worst” from this earnings season.

On this metric, the most dubious broker reactions were pointed towards: Ramsay Health Care (ASX: RHC), Tabcorp (ASX: TAH), Aurizon (ASX: AZJ), Nufarm (ASX: NUF), Woodside Energy Group (ASX: WDS), Beach Energy (ASX: BPT), Corporate Travel Management (ASX: CTD), Domino's Pizza Enterprises (ASX: DMP), Inghams Group (ASX: ING), Johns Lyng Group (ASX: JLG), Lifestyle Communities (ASX: LIC), Mineral Resources (ASX: MIN), and Megaport (ASX: MP1).

One could interpret this list as “down, but not yet representing compelling value”.

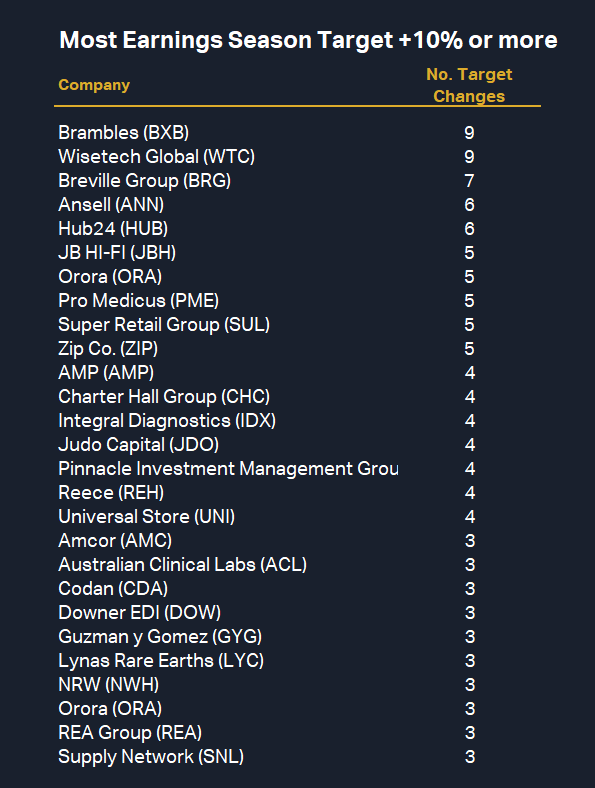

The ASX stocks with the most target hikes in excess of +10%

These are the stocks that delivered the greatest positive earnings surprises this August earnings season. As previously mentioned, BXB is a standout, not only because it tops this list, but because it also snagged a couple of rating upgrades.

Wisetech Global (ASX: WTC) is another interesting case. It also enjoyed an impressive nine price target increases of greater than 10%, but ratings responses were more muted. It received one rating upgrade (to OVERWEIGHT from NEUTRAL from JP Morgan) and one rating downgrade (to HOLD from OUTPERFORM from CLSA). This means that brokers were largely just behind the curve on their targets for WTC, but not on their ratings.

BRG, Annsell (ASX: ANN), HUB, JBH, Orora (ASX: ORA), PME, SUL, and Zip Co. (ASX: ZIP) each also deserve a special mention for garnering five price target increases of greater than 10%.

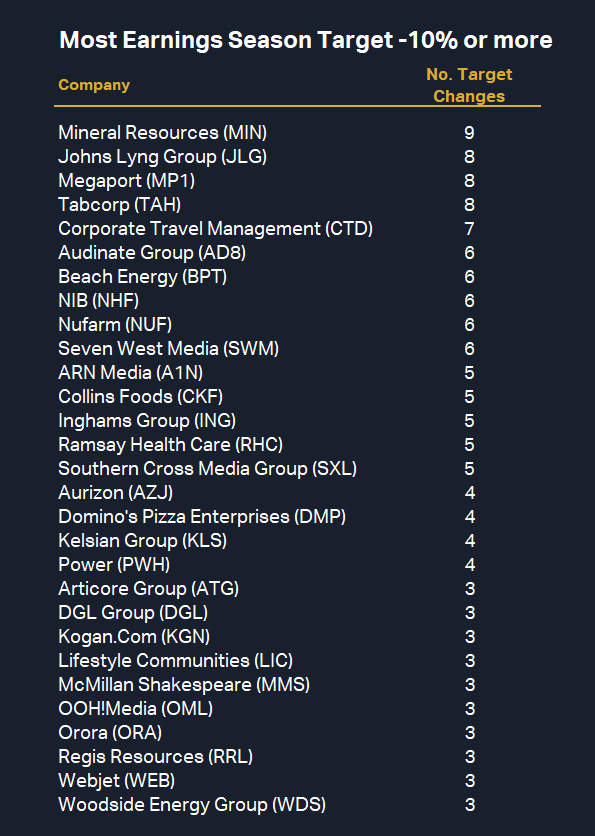

The ASX stocks with the most target cuts in excess of -10%

We close with a cohort of the most disappointing stocks from August earnings season, and this list reads like a roll call of the ASX’s worst performers over the last 6 months. There’s a couple of ways to interpret this list: Either companies in this list surprised brokers with worse than expected earnings, or brokers were far too optimistic in their earnings estimates for these companies.

The first explanation places the blame on the companies and the second blames the brokers. I’ll let you decide which is more appropriate!

What I can say with absolute confidence, is that the above table is also a roll call of my Feature Downtrends lists from my daily ChartWatch Scans. Similarly, stocks like BXB, WTC, BRG, ANN, HUB, JBH, PME, SUL, ZIP, AMP, AMC, UNI, GYG, NHW, REA, and SNL were regulars in my Feature Uptrends lists. So, if we learned anything else this August earnings season, it was that the trend really was your friend, both in terms of share price and broker response.

This article first appeared on Market Index on Friday 6 September 2024.

5 topics

20 stocks mentioned