Easing inflation: A clear path to a September cut

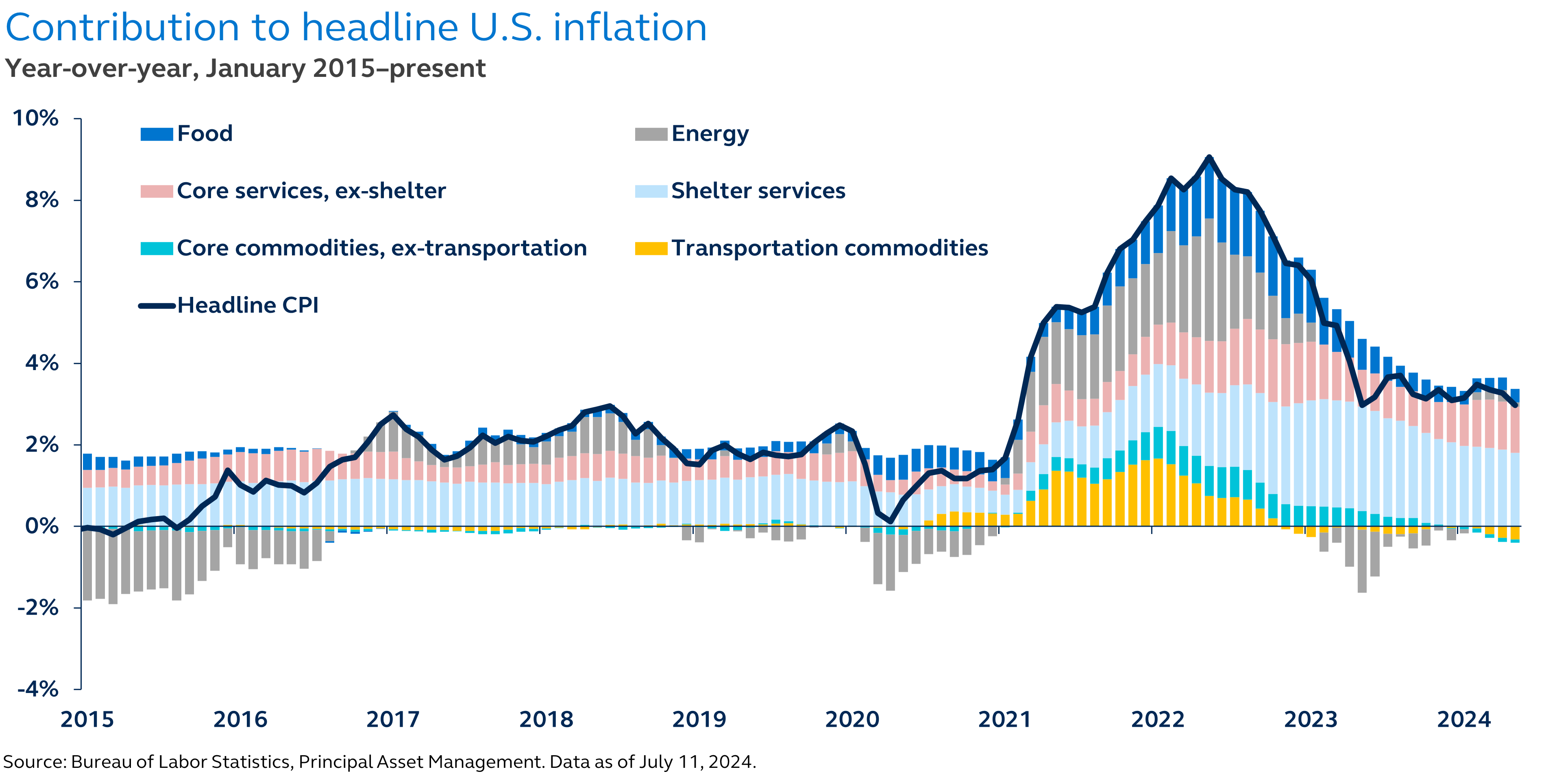

The June CPI reading significantly increases the likelihood of a Federal Reserve rate cut in September. This marks the second consecutive month of weaker-than-expected inflation data, with June showing the first negative monthly headline inflation print since May 2020 and the smallest core inflation increase since August 2021. The data indicates a broad weakening in price pressures, providing strong and consistent evidence that inflation is on a downward trend. If these signs continue, the Fed is likely to soon begin their policy easing cycle.

Global inflation progress continues to capture investor attention, with many economies tentatively resuming what has been a long “last mile” of inflation deceleration toward central bank targets. Notably, June's CPI report marks a significant step in the right direction for the United States. Headline CPI fell to -0.1% month-on-month, the first negative print since May 2020, while core inflation posted its smallest increase since August 2021 at 0.1%. After a series of hotter-than-expected readings earlier this year, these results provide a convincing sign that inflation is resuming its downward path.

A notable contributor to June’s CPI decline was shelter inflation, which finally showed a long-awaited easing. Owners’ equivalent rent posted its smallest increase since August 2021, while the Fed's favored supercore measure, which excludes shelter from core services, registered its second consecutive decline.

On a three-month annualized basis, core CPI is now down to 2.1%, which is close to the Fed’s likely “comfort zone” that would open the door to rate cuts. Despite the encouraging data, a rate cut in July is out of the picture—The Fed still needs more evidence of sustained disinflation. However, a September rate reduction appears increasingly probable if these trends continue.

While global inflation remains a complex issue, June’s U.S. CPI report offers a hopeful sign that inflationary pressures are weakening, potentially paving the way for a more favorable economic environment and a long-awaited shift in monetary policy.