Economic implications for Australia out of the US election

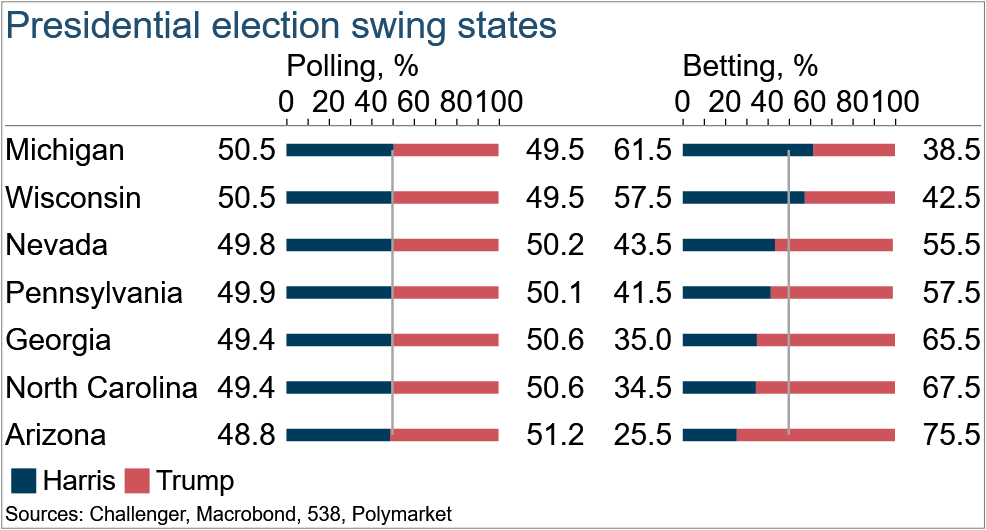

The US Presidential election will be determined by seven swing states. Polls have the outcome of a coin toss in each of those. Betting markets, however, are pointing to a Trump victory in five of the seven states. But betting markets have apparently been swayed by some large bets.

Polls were not great predictors in the 2016 and 2020 elections, and so pollsters have adjusted their methodologies. No doubt there will be a reckoning for either polls or betting markets, or both, after the election.

The US election outcome will have significant implications for the US and global economies. An open letter from 23 Nobel Prize-winning economists (half of all living winners) has endorsed the economic policies of Kamala Harris over those of Donald Trump.

They point to the benefits of her agenda for investment, employment opportunities, competition and entrepreneurship. In contrast, they point to higher prices, inequality and deficits from Donald Trump’s regressive tax cuts and tariffs.

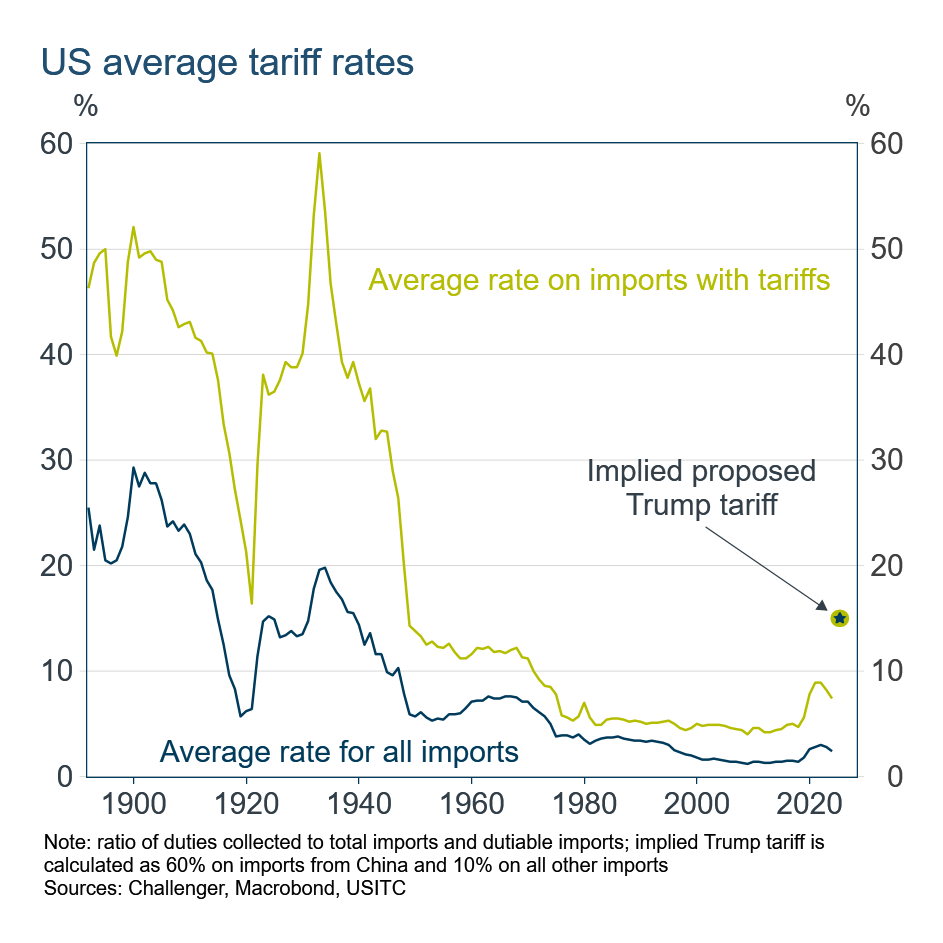

Notably, Donald Trump has proposed a 60% tariff on all imports from China and a 10% tariff on all other imports (even from allies such as Australia). Tariff changes could be implemented by the President without legislation and so are less dependent than other policies on which party holds the balance of power in Congress.

This tariff proposal would result in a 15% average tariff on US imports. That would far exceed tariffs in the post-WWII era, although would still be much lower than the pre-war protectionist era. Higher tariffs would increase domestic prices and increase inefficiency, as well as likely induce retaliatory tariffs from other countries, reducing economic growth.

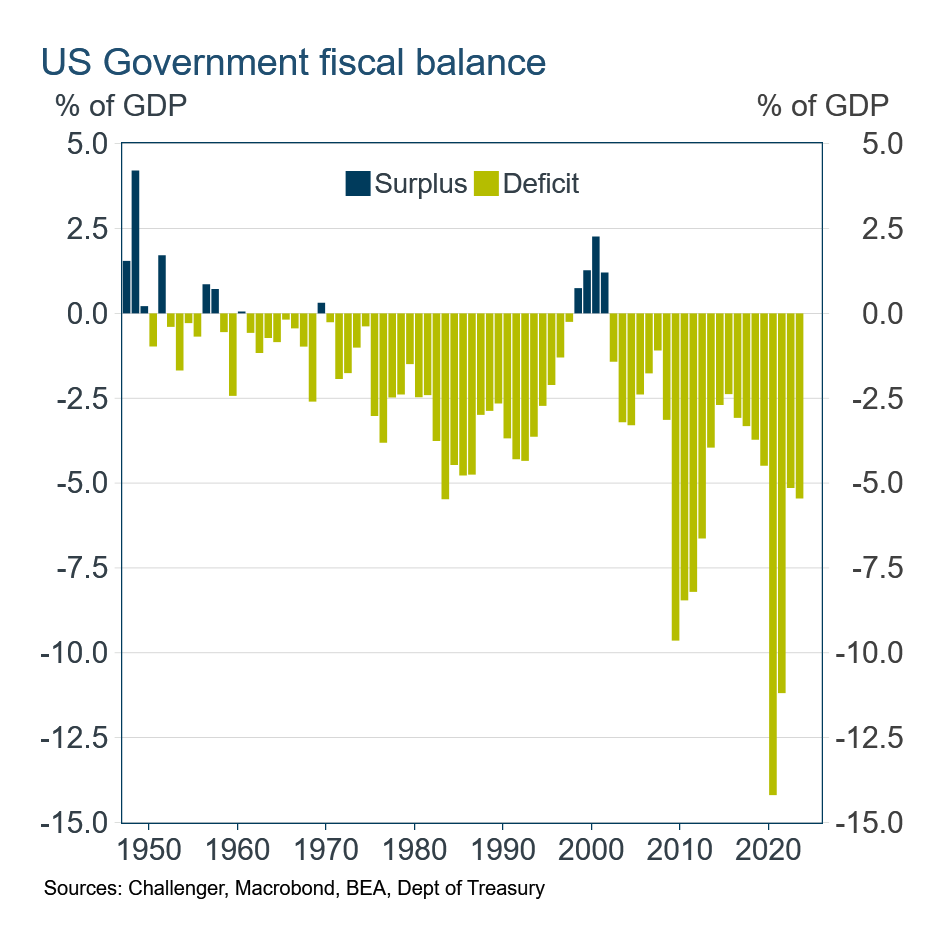

Neither candidate has advocated fiscal discipline in their election commitments. In a tight race, both have made promises that would increase spending and reduce revenue. While many proposals lack specific details, and some seem to change day by day, or even speech to speech, most analysts have tallied larger increases in fiscal deficits from Trump’s proposals.

But no matter the outcome, it’s hard to see fiscal discipline being the winner from a starting position of the US Government deficit already being 5% of GDP. More US debt points to higher US bond yields, although markets have been remarkably accommodating of US debt and deficits. The question is, for how long?

1 topic