Even historically low US housing sentiment can't keep this high-quality business down

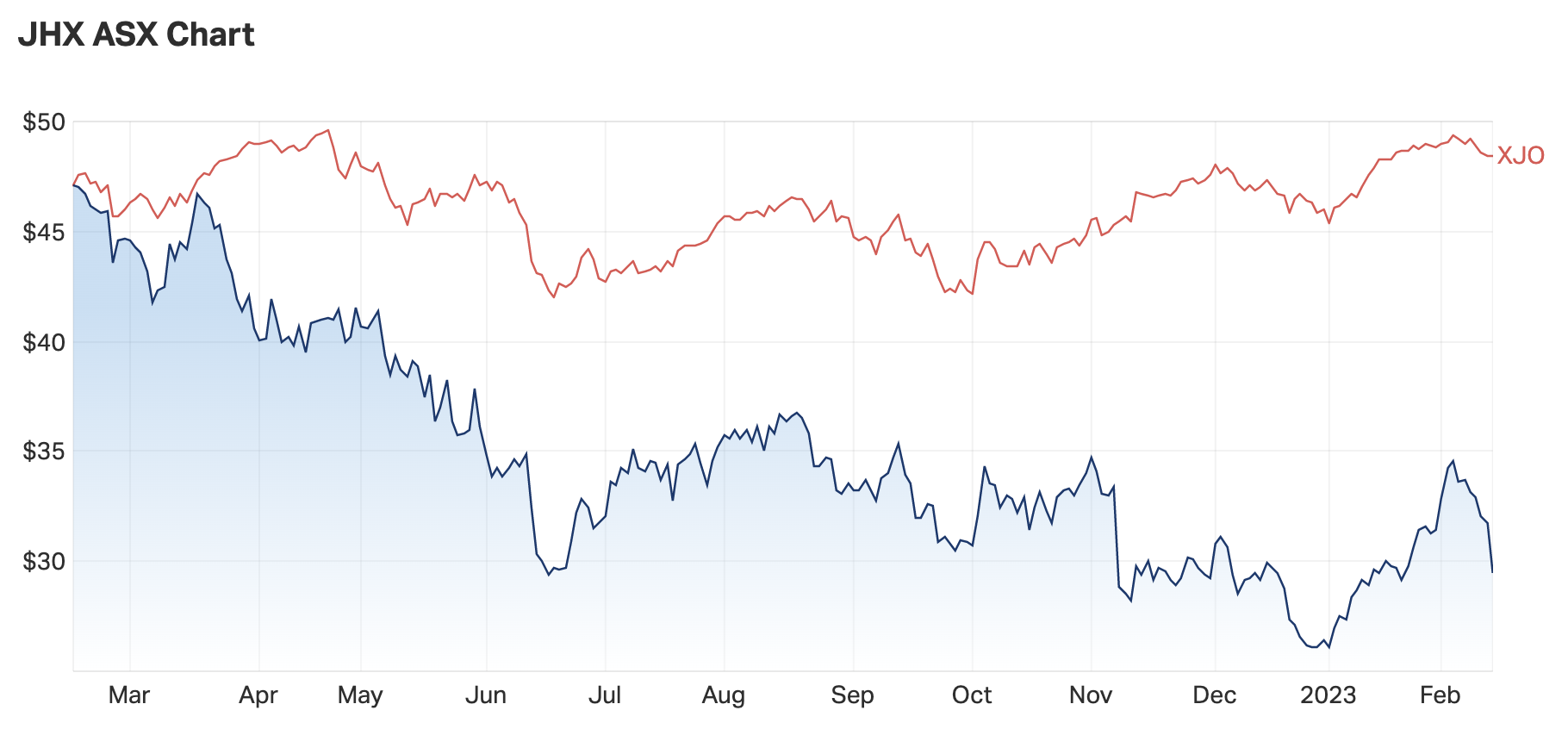

Companies can't escape the sectors in which they operate. So any building materials company with a major footprint in the US residential building sector is going to have a hard time amid a cyclical downturn driven by inflation and higher interest rates.

As Lazard's Dr Philipp Hofflin said recently: "Housing sentiment at the moment is lower than it was during the Global Financial Crisis, and that was a housing bubble."

But you don't sell a good businesses just because it's in a cyclical downturn.

James Hardie's (ASX: JHX) first half results are a case in point. Despite the doom and gloom, its net sales are down just 4% on FY22, while adjusted EBIT was down 16%. And it has over US$100m in cash sitting in its coffers.

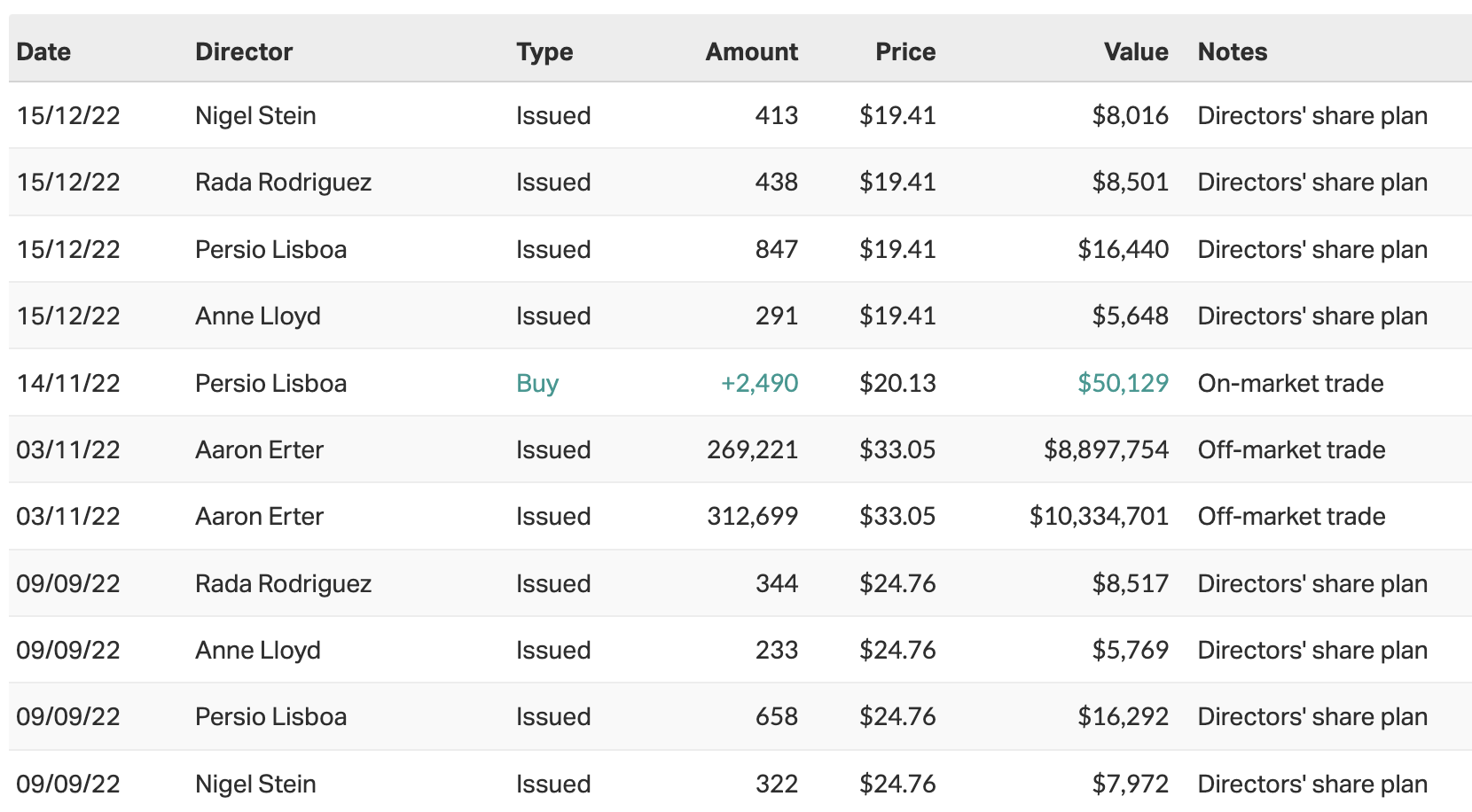

“Our team executed in the face of significant challenges to deliver strong financial results in fiscal year 2023," James Hardie CEO Aaron Erter said of the results.

"The team’s performance is reflected in strong Price/Mix growth in all three regions, including North America Price/Mix growth of +10%, Asia Pacific Price/Mix growth of +6% and Europe Price/Mix growth of +14%. The team’s success in driving high value product growth is underpinned by our superior value proposition."

To pick apart the company's first half performance, I reached out to Michael Ward, Senior Research Analyst at Tyndall Asset Management.

Ward offers a sage assessment of James Hardie's situation. That being, it's caught in the middle of today's tighter financial conditions, but that shouldn't take away from the quality of the business.

"We all know the quality of the business longer-term," Ward says.

"Yes, we’re in a cyclical downturn. And yes, there are questions around new management, but the reality is that it’s still a high quality business model."

James Hardie Key Results for H1

- Net sales of US$860.8m, down 4% from FY22

- Adjusted EBIT of US$165.4m, down 19% from FY22

- Adjusted Net Income of US$129.2, down 16% from FY22

- EPS of US$0.22, down 27% from FY22

- Cash on balance sheet of US$110.0 million as at 31 December 2022, down from US$125.0 million at 31 March 2022

- 2023 Adjusted Net Income guidance is US$600m to US$620m, down from US$650m to US$710m

- Net sales of its North America Fiber Cement business remained flat at US$645.4m, while and EBIT fell 5% to US$174.1 million

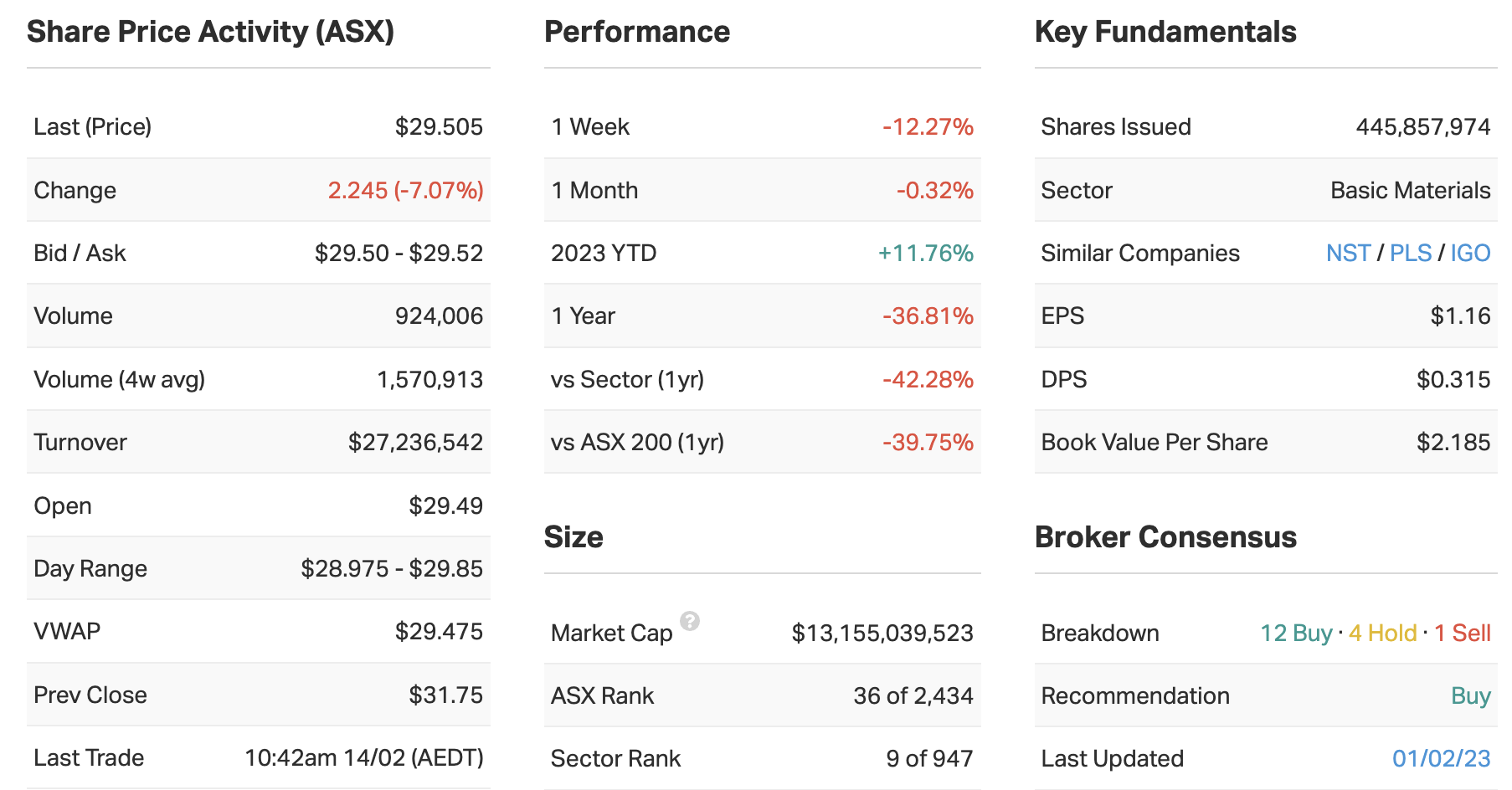

Key company data for James Hardie

What was the key takeaway from this result?

Ultimately it was a resetting of expectations by management around a few things. Firstly around market conditions and secondly around longer-term expectations for the business and where it’s headed strategically.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

The reaction is appropriate and maybe a touch underdone. Maybe what it is telling you is that there’s market weakness, there’s a deteriorating outlook and higher costs in the inflationary environment. We’re seeing that not just in the US, but across all regions.

There’s also some uncertainty around the longer-term margins the business can achieve. Realistically they’ve downgraded their wording around margin expectations. Previously they were saying 25-30% and they now say 25% plus. In terms of the appropriateness of the reaction, you’re looking at consensus downgrades for 2024 down 10%. The reaction is close but maybe it could be a little bit stronger than it has been.

Were there any major surprises in this result that you think investors should beware of?

I think it’s around their comments from last quarter where they said there was a change in building practices that affected their volumes. They seem to have rolled that back. I don’t think it’s a surprise to people, but I do think that it’s interesting that after supply chains have collapsed, building practices have returned to normal.

What is a bigger surprise is Cemplank being rolled out to the bigger builders in the US. That was a product they’d previously stepped away from. It’s a lower-priced product that will potentially impact their average pricing.

Some of the longer-term rhetoric we heard from management today is more consistent with what we used to hear from James Hardie, rather than what we heard from the previous management of James Hardie.

Would you buy, hold or sell JHX on the back of these results?

Rating: HOLD

I wouldn’t be a buyer. I’d stay the course and HOLD. I wouldn’t trim either, there’s been so much pain that you wouldn’t rush to get rid of it.

We all know the quality of the business longer-term. Yes, we’re in a cyclical downturn, and yes, there are questions around new management, but the reality is that it’s still a high-quality business model.

You probably have some time to step into the market to buy it. In the short term it’s going to be tough – there are questions around inflation, questions around volume, and longer-term there are some questions around the targets the new management is going to set. And against that backdrop, consensus expectations should be lower.

What’s your outlook on JHX and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

It’s a pretty simple business model – volume, price and cost. Realistically it’s going to be more of the same, perhaps a touch weaker on the volume front. And again, that will be across all regions.

But longer term, you’d tend to focus on the housing deficit you have in the US and Australia. In the US, more importantly, there are probably 800,000 homes that are in deficit. James Hardie is in a position to take advantage of that given its business model. But we’re not going to see much of that benefit flowing through in the next 12 months.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

I’m not going to give you a 1-5 because we’re bottom-up investors rather than macro investors. The reality is that growth stocks are trading at a significant premium to value stocks, and that started to unwind in 2022 and we expect that to continue through 2023.

You’d have to be cautious about today’s market.

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

3 topics

1 stock mentioned

1 fund mentioned

2 contributors mentioned