Evening Wrap: ASX 200 sees soggy end to week, but gold and uranium stocks just magnificent

Today in Review

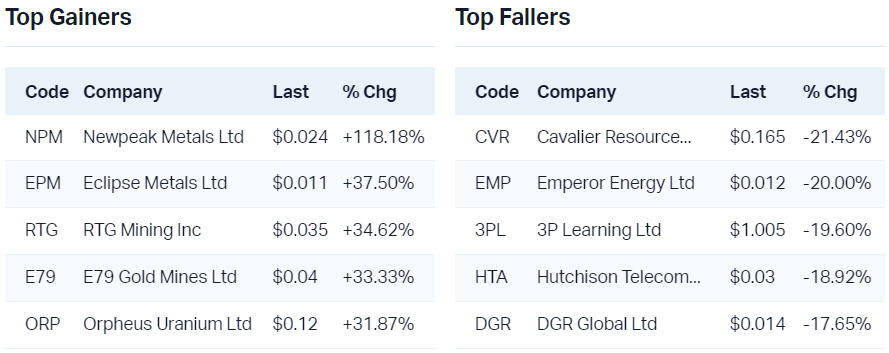

Markets

%20Intraday%20Chart%2012%20Apr%202024.png)

The S&P/ASX 200 (XJO) finished 25.5 points higher at 7,788.1, 0.29% from its session low and 0.33% from its high/low. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by a dismal 103 to 172. For the week, the XJO squeaked out a 14.8 point gain or just 0.19%.

The Gold (XGD) (+1.5%) sub-index was the best performing sector for the second time this week (bookending Monday's strong performance). It’s been there or thereabouts all week, though, and this is no surprise given continued strength in the gold price. The Gold sector was up 4.7% for the week.

Whilst not an official sub-sector, uranium stocks deserve a shout out today. They were quite magnificent with solid gains across each of the majors. The uranium price ticked up Thursday, only modestly, but as you'll see in ChartWatch, it could be setting up for an important move higher.

The next best major sector was Utilities (XUJ) (+1.2%), with daylight to Information Technology (XIJ) (+0.45%) and Health Care (XHJ) (+0.03%), which were the only other two of the eleven major ASX sectors to log gains.

The rest were down, with hardest hit again the interest rate sensitives of Consumer Staples (XSJ) (-0.93%), Consumer Discretionary (XDJ) (-0.75%), and Real Estate Investment Trusts (XPJ) (-0.72%). REITs took out the dubious honour of worst performing sector for the week, losing 2.1%.

ChartWatch

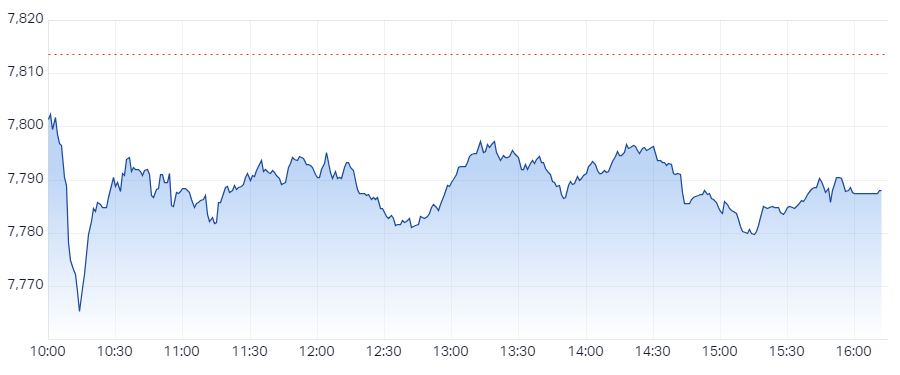

Uranium COMEX

We looked at uranium in last Thursday's Evening Wrap, noting it was "at a critical technical juncture". I noted ideally we wanted to see the uranium price close above the 89.40 point of supply to confirm the hold of the long term uptrend ribbon and commence a new price action uptrend.

Last night's rise sets another higher trough at 88, and moves the uranium price one step closer to sealing the deal.

The short term trend ribbon has converged with the current price, and a close above this important zone of dynamic supply would be an even greater signal the market has returned to a state of demand-side control.

A close below the 83.15 major point of supply would spell the end of this long term uptrend.

Iron Ore 62% SGX

Another follow up here, I last covered Iron Ore in Monday's Evening Wrap. There I sounded the bell on a major development in the demand-supply environment, a long white candle.

I said to watch closely the price action in the zone of supply between 109.25 and 111.95. Today's candle sees us smack-bang in the middle of this zone. The strong demand-side candle suggests there isn't a great deal of supply there after all.

A close above 111.95 should confirm a new price action uptrend, and set the Iron Ore price up for a test of the dynamic supply at the long term downtrend ribbon around 117.50-118.

The zone between the 3 April peak at 104 and the 10 April trough at 105.60 is now demand. As long as the price continues to close above this level, the short term momentum remains up.

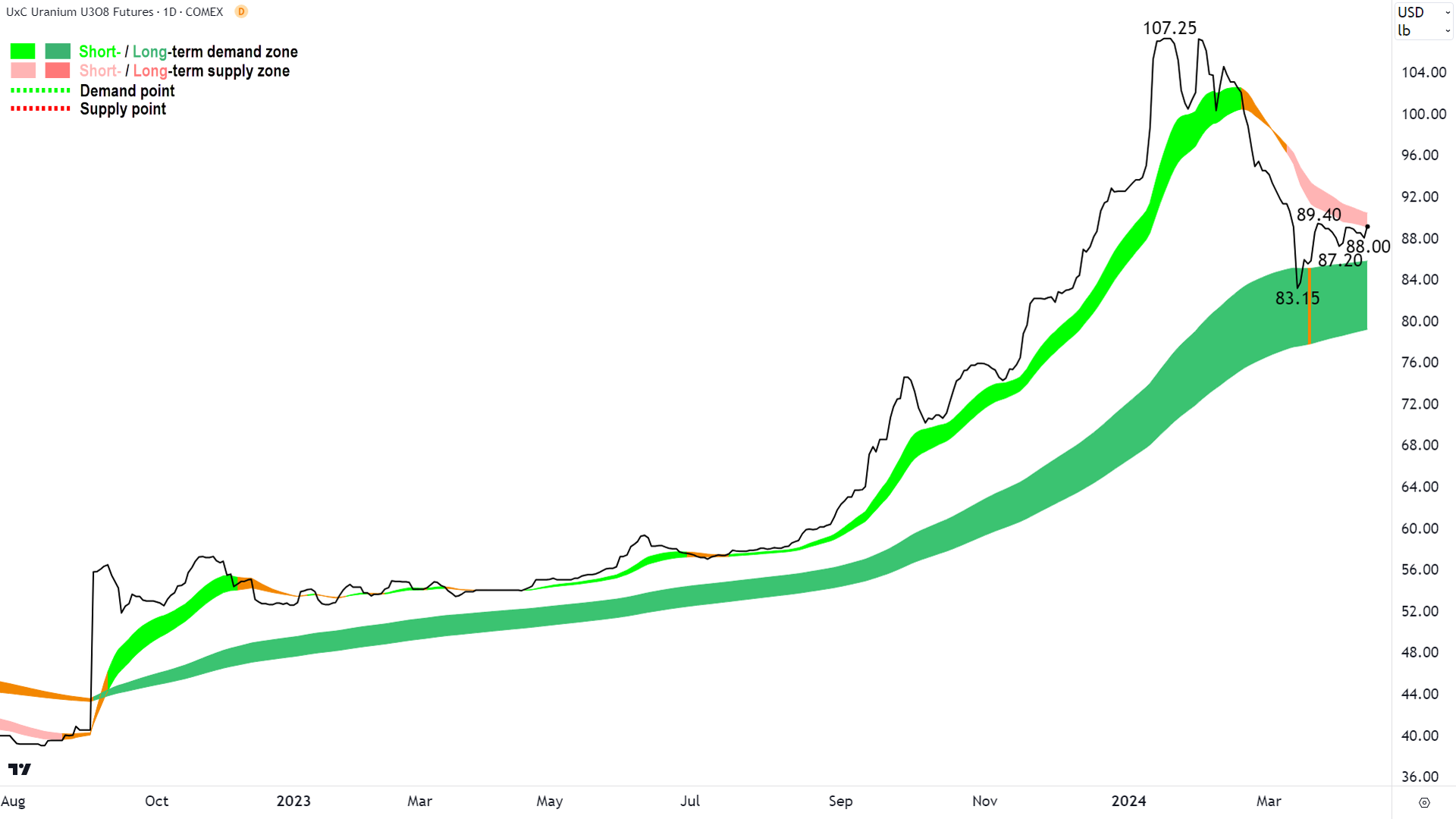

Firefly Metals Ltd (ASX: FFM)

.png)

Today's reader request is Firefly Metals. I note a strong short term uptrend and a long term trend which is nearly transitioning from down to up.

The price action is good with rising peaks and rising troughs indicating a buy the dip mentality among market participants.

The candles are predominantly white, which indicates accumulation – the candles on Wednesday, Thursday, and today are particularly indicative of strong demand-side control.

The price has recently closed above the 0.78 point of supply, and there's little in the ways of major points of supply until 0.945.

The nearest zone of demand is 0.715-0.74.

There's nothing in the technicals to indicate the prevailing trends can't continue, and as long as the price continues to close above 0.715 the momentum here is likely strong.

The short term trend is intact while the price continues to close above the short term trend ribbon.

(If you would like to submit a ChartWatch reader request, you can email me at carl@livewiremarkets.com or hit me up on Twitter/X @carlcapolingua)

Economy

Today

There weren't any major economic data releases in our time zone today

Later this week

Saturday

00:00 USA University of Michigan Consumer Sentiment (79.0 forecast vs 79.4 previous)

Latest News

ChartWatch: ASX copper producers, sure they’re soaring, but is the trend still your friend?

Insiders are adept at buying when their stock is cheap - So who has been making moves?

Is there still upside to uranium? (and 4 stocks fundies are buying)

2 ASX sectors and a stock that no longer deserve their "dividend darling" reputations

Interesting Movers

Trading higher

+10.8% Chalice Mining (CHN) - No news, fourth straight day of gains, likely short covering, volume is above average, short term trend is now up 🔎📈

+8.2% Lotus Resources (LOT) - No news, broad uranium sector strength on improving uranium price, similar move up in global sector leader Cameco in New York, rise is consistent with prevailing short and long term uptrends 🔎📈

+7.9% Austin Engineering (ANG) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+7.0% Bravura Solutions (BVS) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.9% Alkane Resources (ALK) - No news, broad gold sector strength, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+6.9% EQT Holdings (EQT) - EQT receives final approval for sale of Irish business, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.8% Regis Resources (RRL) - No news, broad gold sector strength, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.7% Bannerman Energy (BMN) - No news, broad uranium sector strength on improving uranium price, similar move up in global sector leader Cameco in New York, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.7% Deep Yellow (DYL) - No news, broad uranium sector strength on improving uranium price, similar move up in global sector leader Cameco in New York, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.3% Ora Banda Mining (OBM) - No news, broad gold sector strength, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.2% Droneshield (DRO) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.2% Red 5 (RED) - No news, broad gold sector strength, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.0% Genex Power (GNX) - Genex enters into binding TID with J-Power, rise is consistent with prevailing short and long term uptrends 🔎📈

+5.2% Boss Energy (BOE) - No news, broad uranium sector strength on improving uranium price, similar move up in global sector leader Cameco in New York, rise is consistent with prevailing short and long term uptrends 🔎📈

+4.9% Kingsgate Consolidated (KCN) - No news, broad gold sector strength, rise is consistent with prevailing short and long term uptrends 🔎📈

+4.8% Alligator Energy (AGE) - No news, broad uranium sector strength on improving uranium price, similar move up in global sector leader Cameco in New York, rise is consistent with prevailing short and long term uptrends 🔎📈

Trading lower

-15.8% Avita Medical Inc (AVH) - Continued negative response to yesterday's AVITA Medical Updates Expected First Quarter 2024 Revenue, fall is consistent with prevailing short term downtrend, long term trend is transitioning from up to down 🔎📉

-7.5% Domino's Pizza Enterprises (DMP) - Strategy Day Presentation, fall is consistent with prevailing short and long term downtrends 🔎📉

-7.3% The Star Entertainment Group (SGR) - Trading Update, fall is consistent with prevailing long term downtrend 🔎📉

-6.9% Cettire (CTT) - Q3 FY24 Trading & Market Update, fall is consistent with prevailing short term downtrend, big black candle, close at low, and close to closing below long term downtrend ribbon 🔎📉

-6.8% Winsome Resources (WR1) - Pullback after strong rally post yesterday's Exploration drilling discovers 61.5m at 1.62% Li2O

-4.9% Ioneer (INR) - No news, struggling to get through the long term downtrend ribbon 🔎📉

-4.5% Vulcan Energy Resources (VUL) - Pullback after strong rally post yesterday's First Lithium Chloride produced from Optimisation Plant

-4.2% Strike Energy (STX) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

Broker Notes

Abacus Group (ABG) retained at Outperform at Macquarie; Price Target: $1.21

Australian Finance Group (AFG) retained at neutral at Macquarie; Price Target: $1.47

Eagers Automotive (APE) retained at neutral at Citi; Price Target: $13.85 from $13.90

Arena REIT/Units (ARF) retained at Outperform at Macquarie; Price Target: $3.96

Autosports Group (ASG) retained at buy at Citi; Price Target: $3.05 from $3.15

Charter Hall Group (CHC) retained at Outperform at Macquarie; Price Target: $15.54

Centuria Industrial REIT (CIP) retained at Outperform at Macquarie; Price Target: $3.66

Charter Hall Long Wale REIT (CLW) retained at Neutral at Macquarie; Price Target: $3.62

Centuria Capital Group (CNI) retained at Neutral at Macquarie; Price Target: $1.70

Charter Hall Retail REIT (CQR) retained at Neutral at Macquarie; Price Target: $3.61

Dexus Industria REIT/Units (DXI) retained at Outperform at Macquarie; Price Target: $3.00

Dexus (DXS) retained at Neutral at Macquarie; Price Target: $7.38

Fleetpartners Group (FPR) retained at buy at Citi; Price Target: $4.20 from $3.60

GPT Group (GPT) retained at Outperform at Macquarie; Price Target: $4.61

Goodman Group (GMG) retained at Outperform at Macquarie; Price Target: $34.84

Growthpoint Properties Australia (GOZ) retained at Outperform at Macquarie; Price Target: $2.50

Healthco Healthcare and Wellness REIT (HCW) retained at Outperform at Macquarie; Price Target: $1.45

Homeco Daily Needs REIT (HDN) retained at Neutral at Macquarie; Price Target: $1.26

HMC Capital (HMC) retained at Neutral at Macquarie; Price Target: $6.76

James Hardie Industries (JHX) downgraded to neutral from outperform at Macquarie; Price Target: $62.40 from $68.20

Mader Group (MAD) retained at at Bell Potter; Price Target: $7.60

Mirvac Group (MGR) retained at Outperform at Macquarie; Price Target: $2.38

McMillan Shakespeare (MMS) retained at buy at Citi; Price Target: $22.50 from $21.80

Monash IVF Group (MVF) initiated at sector perform at RBC Capital Markets; Price Target: $1.50

National Storage REIT (NSR) retained at Neutral at Macquarie; Price Target: $2.34

-

Northern Star Resources (NST)

Retained at neutral at Citi; Price Target: $14.50

Retained at outperform at Macquarie; Price Target: $17.00

Netwealth Group (NWL) retained at underperform at Macquarie; Price Target: $16.75 from $15.30

Origin Energy (ORG) retained at outperform at Macquarie; Price Target: $9.97 from $9.29

Orica (ORI) retained at outperform at Macquarie; Price Target: $19.05 from $18.82

Peter Warren Automotive Holdings (PWR) retained at neutral at Citi; Price Target: $2.40 from $2.45

Qualitas (QAL) retained at Outperform at Macquarie; Price Target: $2.89

Region Group (RGN) retained at Neutral at Macquarie; Price Target: $2.30

Scentre Group (SCG) retained at Neutral at Macquarie; Price Target: $3.03

Smartgroup Corporation (SIQ) retained at buy at Citi; Price Target: $11.55 from $11.00

Telix Pharmaceuticals (TLX) retained at at Bell Potter; Price Target: $14.50

Vicinity Centres (VCX) retained at Neutral at Macquarie; Price Target: $1.92

Scans

This article first appeared on Market Index on Friday 12 April 2024.

5 topics

18 stocks mentioned