Everybody hates lithium, is that a sign?

Over time, I've repeatedly seen that some of the best opportunities come in those parts of the markets where sentiment has hit rock bottom.

Sometimes, that happens to the entire market, like during the GFC, when the highest-quality stocks went on sale. CBA shares for $26.75, anybody?

Another example was when oil traded for negative US$37.63 a barrel in 2020 before going on an almighty recovery to trade above US$100 per barrel.

Right now lithium and lithium stocks are getting the silent treatment from investors and there are countless indicators of how negative sentiment has become. Take a look at ASX short sale data where Pilbara Minerals (ASX:PLS) is the most shorted stock by some margin with a 21.60% short.

A review of the 10 most visited commodity pages on Market Index shows that lithium has fallen from position #4 to #7 over the last 12 months but

Brokers are also bearish, with headlines like "Don't buy the lithium dip!" painting a challenging outlook with rebounding supply and demand headwinds.

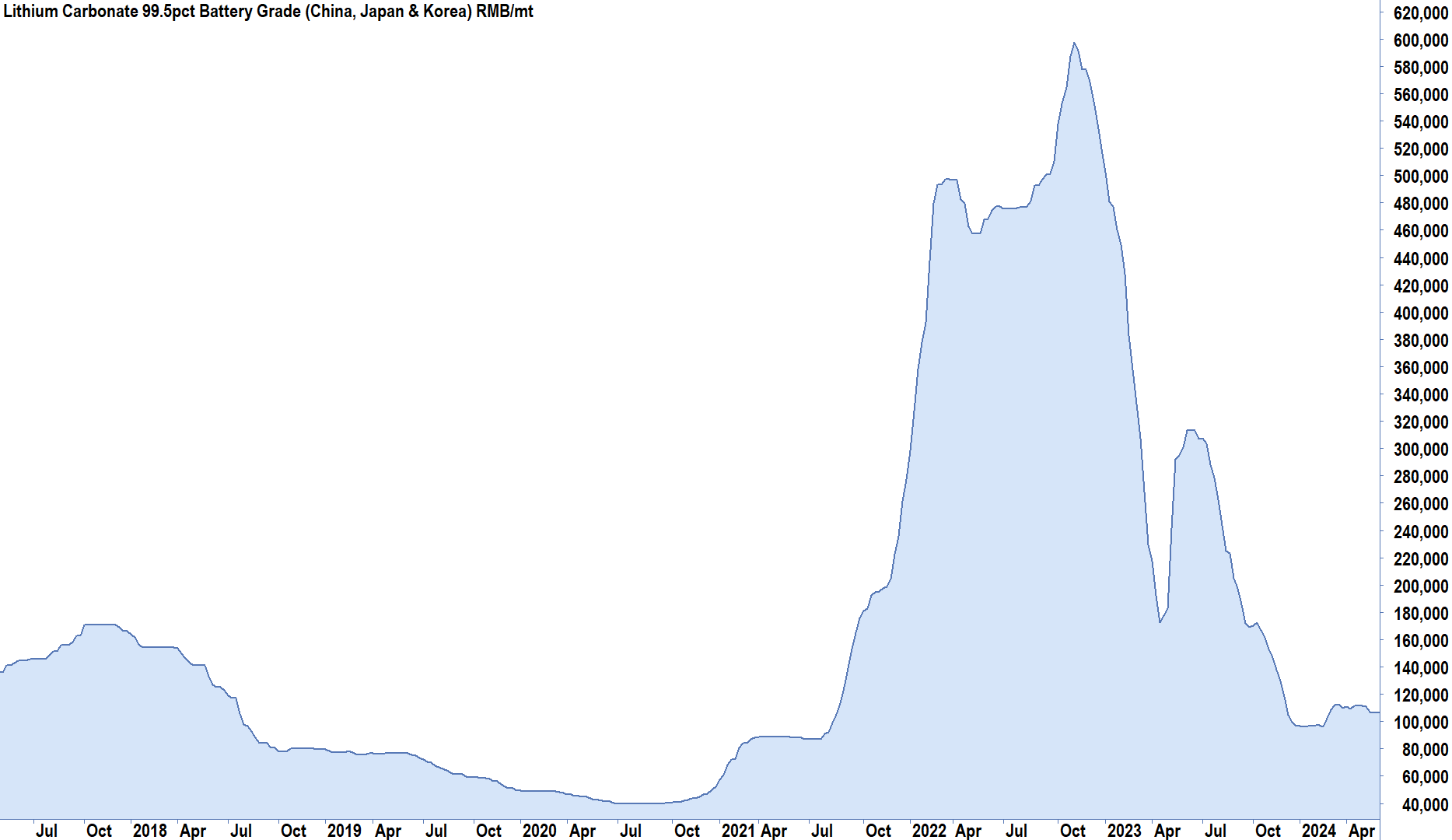

Even the technical picture looks terrible, with my colleague Carl Capolingua providing the following chart and a few words of his technical analysis.

"For Lithium, there wasn't a great deal of warning of the top outside of the sheer steepness of the decline from the late-2022 peak - but this is a signal in itself. The lithium carbonate price has levelled off, but its price action is akin to a 'bump along the bottom' scenario rather than a 'v-shaped rally'. I suggest the latter option is now off the table."

%20RMB-mt.png)

I recently co-hosted a panel session with the crew from Money of Mine that examined a selection of ASX lithium producers and developers in depth. Apparently, it was the biggest discussion on lithium they had hosted since last year; perhaps that's a sign in itself.

We were joined by Firetrail's Matthew Fist and Janus Henderson's Darko Kuzmanovic, two mining professionals turned money managers who both share their deep insights into the sector and a selection of stocks including Pilbara Minerals (ASX:PLS), IGO Ltd (ASX:IGO), Patriot Battery Metals (ASX: PMT) , Wildcat Resources (ASX:WC8) and copper producer Aic Mines (ASX:A1M).

This is part 1 of a two-part collaboration between Livewire and Money of Mine. To watch part 2, head on over to the Money of Mine YouTube Channel, where you'll find a wealth of exceptional content covering all aspects of the mining industry.

Time codes

- 0:00 - Introduction

- 5:29 - The value of having a mining background as an investor

- 7:30 - Stepping back to focus on the big picture

- 9:41 - What’s next for lithium?

- 10:32 - Does IGO (ASX:IGO) have an identity crisis?

- 14:26 - Should Pilbara (ASX:PLS) buy Patriot Lithium (ASX:PAT)?

- 24:46 - The outlook for copper and AIC Mines (ASX:A1M)

More from the Livewire Money of Mine collaboration

3 topics

6 stocks mentioned

2 contributors mentioned