Everything you need to know about today's RBA meeting

The first RBA two-day monetary policy meeting concludes today (Tuesday). For the first time, the Statement on Monetary Policy and forecasts are being released at the same time as the monetary policy decision. And we have the first post-meeting Governor press conference.

All these firsts flow from the (first) Review of the RBA, commissioned by the Treasurer in response to criticism of RBA operation and performance. The Government and RBA have agreed to almost all 51 recommendations, but some depend on legislative changes which will wait at least until the Senate Committee reports back (21 March).

Most recommendations simply catch the RBA up to other central banks and changes will only be obvious to RBA staff and watchers. We’re unlikely to notice any policy difference most of the time, but the improved framework should reduce the chance of policy errors. However, changes designed to improve the delivery and content of RBA communication could add more noise in the short term.

What doesn’t change

Importantly the RBA retains its independence and inflation target. Policy announcements will still occur on Tuesdays at 2:30pm. Monetary policy will still aim to have inflation between 2–3%, but with a greater emphasis on the midpoint than previously (which is likely to influence communication more than the policy setting). The RBA Board(s) will still consist of the Governor, Deputy Governor, Secretary to the Treasury and six external members.

Key changes

- Reduction to 8 Board meetings per year (from 11): the first Tuesday of the month in February, May, August and November, and the other four are on Tuesdays midway between those meetings.

- Creation of separate Monetary Policy and Governance Boards, but this requires legislation to be finalised.

More noisy communication?

There are some key changes on communication aimed to improve transparency, but in the near term as the market learns how to interpret, and the RBA learns how to deliver, this new communication there could be some extra ‘noise’. Key changes are:

- The Governor will give a press conference at 3:30pm after the Board’s decision at 2:30pm.

- Once legislation is passed and the new Monetary Policy Board is operational:

- Unattributed votes will be published

- Board members will give at least one speech or public engagement per year

- Board papers will be published after 5 years

Other changes include a more powerful internal communication office and changes to the preparation and communication of analysis and forecasts.

A more involved and activist Board

The Review implicitly criticised Board members for always accepting the RBA’s recommendation on policy. No doubt Board members will all have read this as a prod to sometimes disagree with the staff and Governor’s assessment and policy recommendation. In addition, greater individual responsibility comes with giving a speech on monetary policy, public voting records (even if unattributed, analysts will attempt to attribute them) and the post-meeting statement coming from the Board not the Governor. The Review recommended that Board members commit more time to their RBA duties (although still only one day per month, much less than other central banks) and the RBA has committed that Board members can attend an internal staff-led economic update.

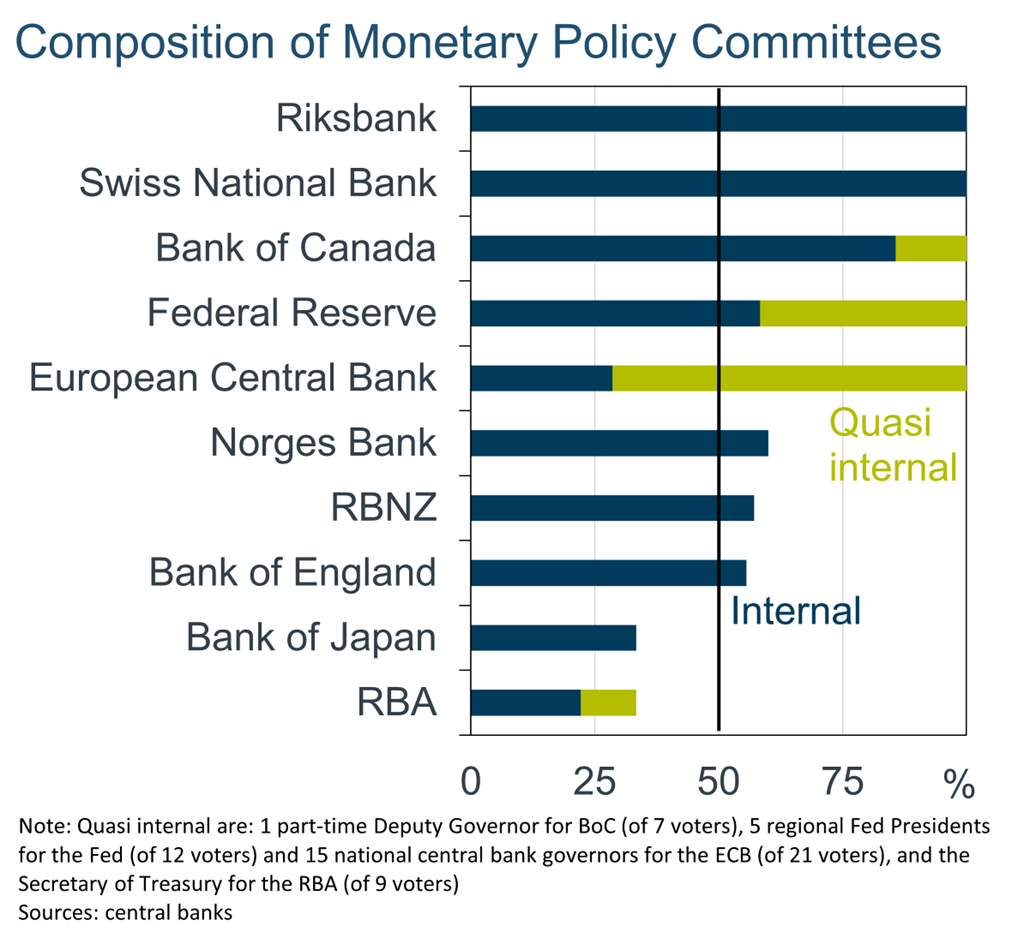

The RBA Board structure is unique

The dynamics of the RBA Board is critical given the RBA is unique among central banks in having a majority of policy committee members being part-time, external appointees (Figure 1).

- At the US Federal Reserve and European Central Bank (ECB) all are either internal staff or quasi-internal (Governors from Euro zone central banks, and Presidents of the regional Federal Reserves).

- The Bank of England, Reserve Bank of New Zealand (RBNZ) and Norwegian central bank (Norges) have external members, but the internal members are a majority.

- Only the Bank of Japan (BoJ) also has a majority of externally appointed members. But at the BoJ those external appointees all work full-time at the BoJ on policy issues.

Figure 1

3 topics