Fade the Fed: Why it's time to buy bonds and hold equities

There is a saying in markets: Don’t fight the Fed. It is a good adage. But sometimes the market gets the Fed's message wrong. The reaction to the Fed’s latest 0.75% rate hike is opening up opportunities for investors over the next 12-18 months. And we think that is happening because the Fed’s message is being misinterpreted.

What is the Fed’s message?

The Fed’s 0.75% September hike was in line with market consensus. The Fed’s dot plot projections and the statement suggest up to 1.25% more rate hikes by year-end. We think that is at the upper end of plausible outcomes. But one thing is clear – the Fed’s message from Jackson Hole should still be heeded. And that message is this:

Rates will go to moderately restrictive territory. And rates will remain restrictive for some time.

Why does the Fed need to hike to restrictive territory?

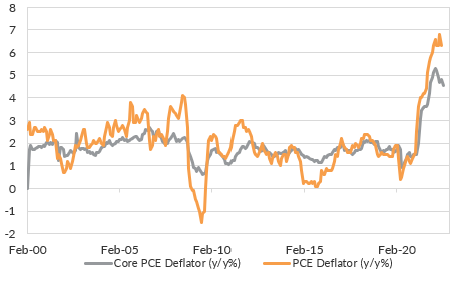

Inflation remains above the Fed’s target. The Fed’s preferred inflation measure is the core PCE Deflator. These data will not be released until next week. Chart 1 shows Core PCE inflation is 4.6%, more than double the Fed’s target. However, the trend is lower than the February peak. And higher Fed Funds rates will continue to slow growth and slow inflation.

Chart 1: The Fed’s preferred measure

of inflation has peaked and is slowing.

What is restrictive?

The Fed meeting did not say what rate level is restrictive. We think a policy rate of 3.00% is neutral. 3.00%-4.00% is moderately restrictive. Above 4.00% is quite restrictive.

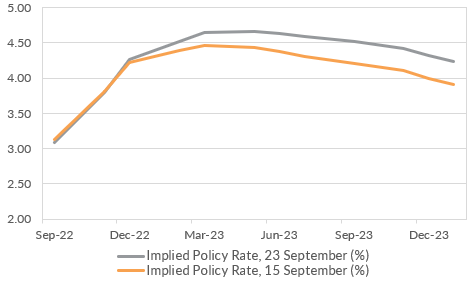

We have now entered moderately restrictive levels. Chart 2 shows the market expects the Fed to move rapidly to quite restrictive levels. And then expects the Fed to begin cutting rates soon after.

Chart 2: Markets are anticipating quite restrictive policy

settings from the Fed.

Why does the Fed have fewer rate hikes to deliver?

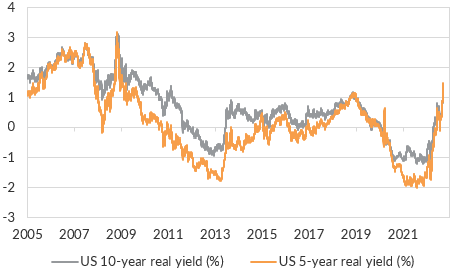

The Fed Funds rate is one measure of the tightness of monetary policy. We also focus on the real yield. And right now, real yields have surged across the yield curve.

Chart 3 shows an eye-wateringly quick move higher in 5-year and 10-year real yields to above 1.30%. The entire real yield curve is now above 1.25%. We expect that will quickly weigh on economic activity and inflation. And that means the Fed will probably be able to pause rates closer to 4.00%. It could then hold rates at that level for some time.

Chart 3: Surging real yields across the curve will restrict

economic growth and inflation.

How long might the Fed hold rates at restrictive levels?

The Fed has given no indication on how long it will leave rates at peak restrictive levels. But over the last 5 hiking cycles, the average is almost 11 months. The maximum was 18 months in 1997. The minimum was 5 months in 1995. This is in stark contrast to current market pricing.

We think the Fed will have the policy rate above core PCE inflation by year-end. Then it leaves the policy rate around 3.75%-4.00 well into 2023. This is very typical of the Fed’s historic reaction function. It will extend the economic cycle beyond 2023. That is going to have important implications for asset prices.

How can I position my portfolio given the market’s reaction to the Fed?

US 10-year Treasury yields have surged above 3.70%. This is an attractive combination of yield, downside protection and diversification. If the Fed does pause by year-end, then term premia may compress. That will offer some capital appreciation. Conversely, if the Fed follows market pricing, and there is a recession, then exposure to US duration will provide important downside protection for portfolios.

The equity market is less of a two-way bet. The S&P500 is currently more than 20% off its peak. In our view, that is pricing roughly a 50% chance of recession next year.

A recession is a clear downside risk. But if the Fed does pause, US equities have significant upside through 2023.

This is a lower conviction view. And so we have retained our modest overweight to US equities, but have not added exposure.

It is a pause, not a pivot

The Fed has delivered a clear message on the policy outlook. But markets have priced a pathway that is at odds with that message, and at odds with the Fed’s historic reaction function.

In contrast, we expect the Fed to deliver on that message. And that message is:

Rates will go to moderately restrictive territory. And rates will remain restrictive for some time.

In that case, the current market selloff is providing opportunities for investors. Portfolios will benefit from adding to duration in their diversified portfolios, and from holding onto their equity exposures.

Never miss an insight

If you’re not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia’s leading investors.

And you can follow my profile to stay up to date with other wires as they’re published – don’t forget to give them a “like”.

4 topics