February Jobs Report shows a sanguine number... for now

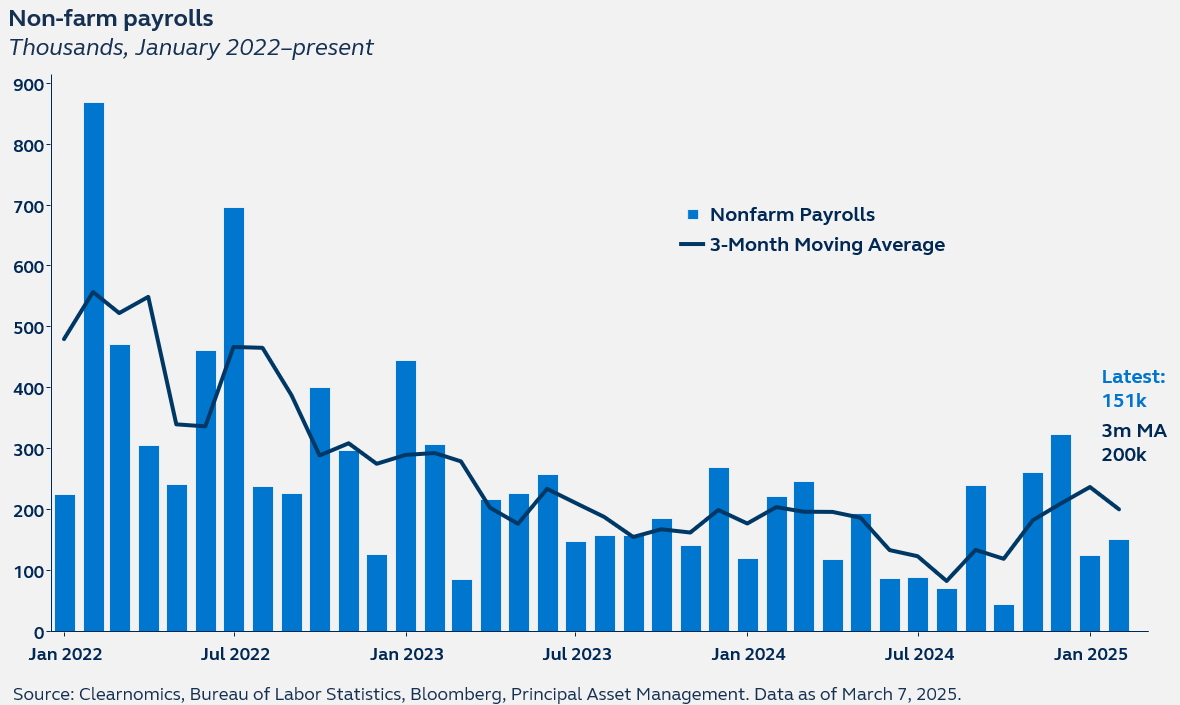

The February jobs report showed a 151,000-worker increase in payrolls, broadly in line with consensus expectations, defying fears of significant cracks in the labor market. Yet, while the worst fears were not met, the report did confirm that the labor market is cooling. Furthermore, with no shortage of headwinds confronting the U.S. economy, including federal government layoffs, public spending cuts, and tariff uncertainty-related inertia, the softening trend will likely persist and potentially deepen in the coming months.

Report details

- Total non-farm payrolls increased by 151,000 in February, slightly stronger than last month’s (downwardly revised) 143,000 gain. Consensus expectations had called for 160,000 payrolls, however, since recent days surveys had seen expectations drop to around 120,000 with one prominent analyst expecting just a 65,000 increase, today’s number comes as a significant relief to markets.

- Amidst the DOGE-related job cuts, government sector jobs were in the spotlight. Federal government payrolls fell by 10,000. Although a small number, federal job losses are likely to rise in the coming months, while any related reduction in contract spending could ultimately have a sizeable impact on the overall payroll numbers. Other sectors that cut jobs were leisure and hospitality, and retail trade, potentially suggesting weakness brewing in the consumer sector.

- The main drivers of employment were healthcare, financial activities, and transport and warehousing. Manufacturing added 10,000 jobs in February—a relief after losing jobs in the previous two months.

- The unemployment rate moved slightly higher, from 4.0% to 4.1%, even as labor participation fell to the lowest level in two years, with 546,000 leaving the labor force in February. Notably, the U6 measure of unemployment, which also includes people who are discouraged and underemployed, rose to 8%, its highest level in over three years.

- Average hourly earnings rose 0.3% in the month, which is in line with expectations and down from last month’s (downwardly revised) 0.4% increase.

Outlook

After the headlines of recent days, there were fears that today’s jobs report would reveal some deeply unsettling news about the health of the labor market, so the payrolls number has been met with relief—even as it confirmed a softening trend.

Yet, there are concerns that the labor market is on the verge of a sharp downward shift as government policies take effect and consumers begin to retrench. So, while today’s jobs report is not sufficiently weak to prompt Fed action at its meeting in two weeks, it does raise the prospects of a rate cut in the coming months. The economic backdrop and sentiment have taken a significant hit in the past few weeks. They will undoubtably require some Fed attention, even as inflation pressures potentially start to creep higher once again.