Federal Reserve dot plot is conflicted and open to persuasion

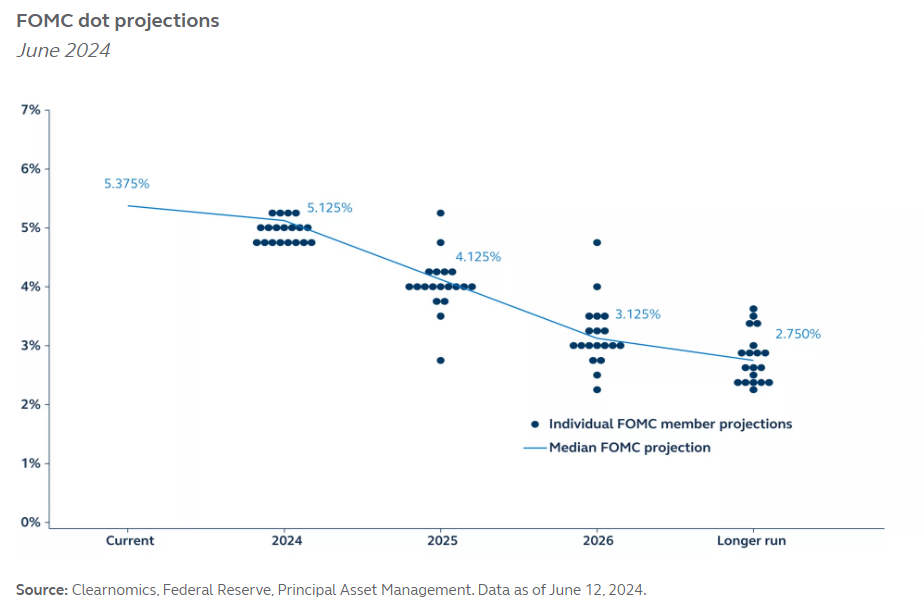

Recent focus has centered on the Federal Open Market Committee’s dot plot, which now suggests just one rate cut in 2024. However, a closer examination reveals the committee is divided, with more participants (8 out of 19) anticipating two rate cuts this year than those expecting only one (7) or none at all (4). A series of subdued inflation reports, along with further signs of a rebalancing labor market, could pave the way for multiple rate cuts this year.

The Federal Open Market Committee’s (FOMC) latest dot plot suggests that policymakers only see room for one policy rate cut this year. Yet, markets remain unconvinced, focusing instead on May’s softer-than-expected inflation data and assigning greater weight to the probability of two 25 basis point cuts in 2024.

After several months of seemingly plateauing inflation progress, the May CPI print delivered a very welcome surprise. Monthly core inflation fell to its slowest pace since October 2022, and core services ex-shelter—the Fed's preferred CPI measure—was negative for the first time since 2021. The market took note that if the next few reports are similarly weak, inflation is likely to undershoot the Fed's latest projections.

It’s also noteworthy that FOMC policymakers are, in fact, very conflicted themselves. Although the median dot signaled just one cut this year, the dot plot’s mode was actually for two cuts—of the 19 participants, four expect no cuts this year, seven expect just one cut, and eight expect two cuts. With the committee so evenly divided, additional soft inflation data could shift policy decisions to a more dovish outcome.

If the deceleration in price pressures continues, and is coupled with evidence of labor market rebalancing, that may be enough to open the door to earlier and multiple cuts this year. Our own forecast, for rate cuts in September and December this year, remains unchanged.