Focus on quality and security selection to capitalise on the more generous yields

The return of meaningful price inflation was something that many had anticipated in recent years, but the circumstances and intensity of its resurgence caught most investors by surprise in 2022. From ultra-accommodative monetary policy to a post-pandemic demand surge to supply chain disruption to the Ukraine War’s impact on commodities prices, multiple forces drove inflation to 40-year highs. After initially viewing the changes as “transitory,” the U.S. Federal Reserve initiated an about-face. The central bank hiked rates tentatively at first with a 25-basis-point increase, but then accelerated to 75bps per meeting for most of 2022 before slowing to a 50bps hike in December. Meanwhile, after peaking at 9.1% in June, U.S. Consumer Price Index inflation receded to 7.1% in November, while core inflation eased to 6%. Impacts of the Fed hikes and a slowing economy are appearing in pockets of the U.S. economy, notably housing, technology and manufacturing.

In Europe, inflation has been even more acute amid energy shortages, though the European Central Bank has trailed the Fed in its tightening program. Developed markets generally have been moving to curtail liquidity, driving general consensus for a global recession this year—the extent of which is subject to considerable debate.

Looking into 2023, we believe that inflation will almost certainly retreat further from peak levels, although it is likely to remain well above norms throughout the year and into 2024. As expressed in their meetings and policymaker comments, central banks understand the need to maintain tight conditions in order to tame pricing pressures. So, although we could see just a couple more hikes, U.S. short rates are likely to remain high for some time. In other words, the world of zero interest rates that was so prevalent after the Global Financial Crisis is likely over.

What does this mean for markets? First, interest rates will probably trade within a much tighter range than in 2022, as inflation moderates and central banks hike at a more gradual pace. Second (and related to the first point), duration exposure should be less risky than it was in 2022, with the added benefit of far more generous yields providing a cushion against potential negative total return. Finally, fundamental concerns about credit are likely to increase, not just due to macro developments, but as a function of individual issuer dynamics and financial positions. As a result, individual credit exposures could be a key driver of portfolio outcomes, making security selection more important than ever in seeking to achieve investment success.

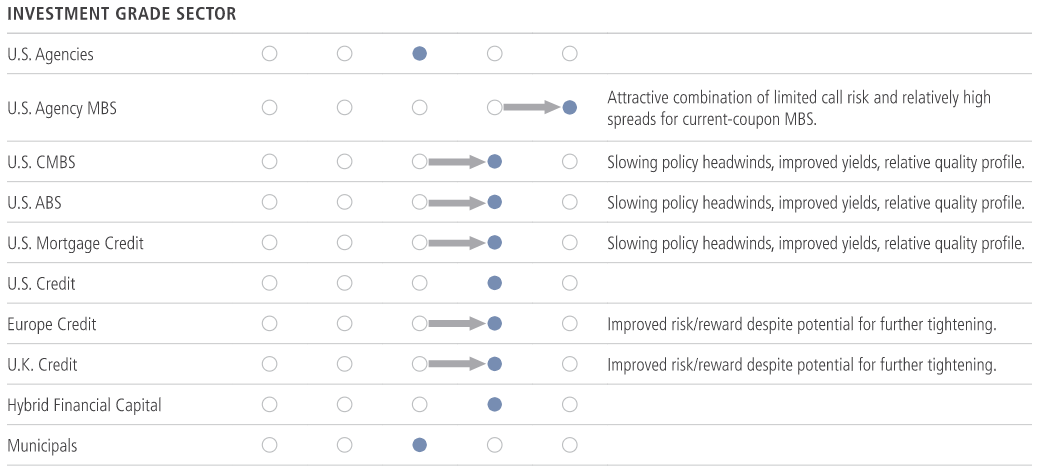

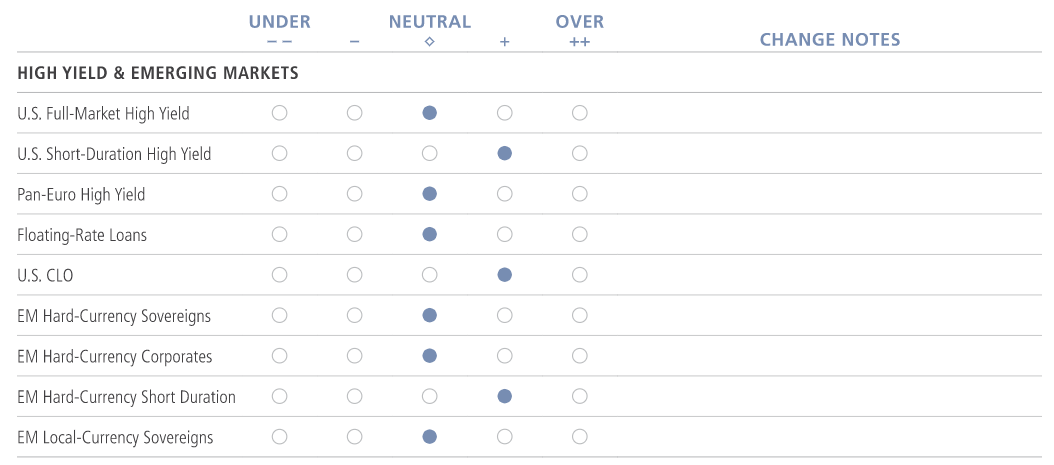

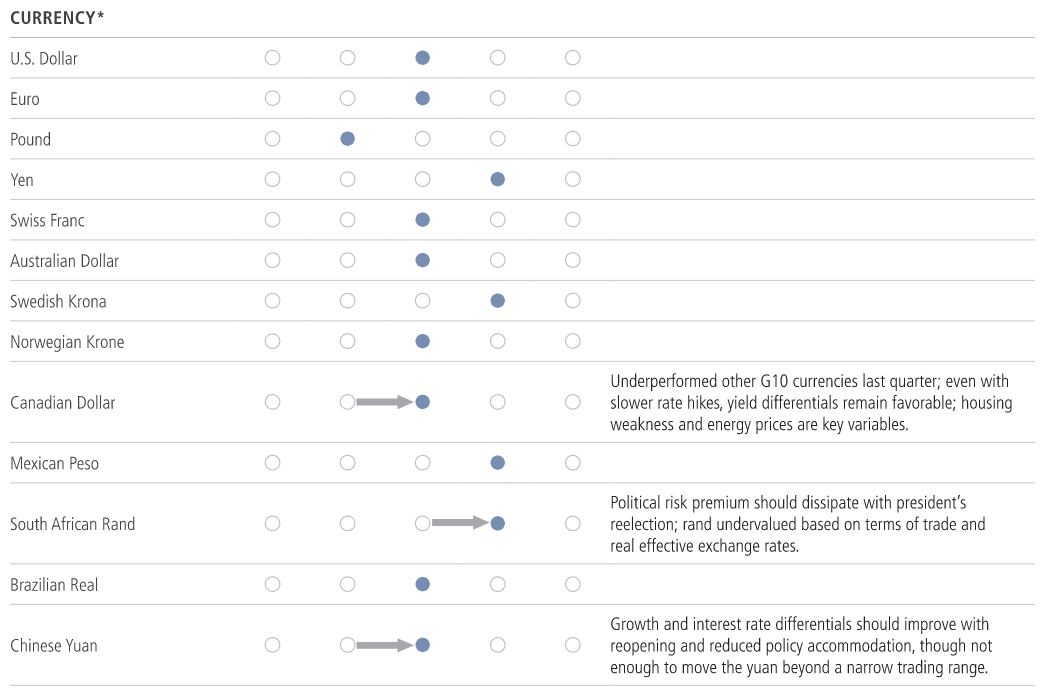

Below, we address some key themes we anticipate for fixed income in 2023. For a snapshot of our market views, see the table at the end of this page.

1. Volatility Seems Likely to Fade

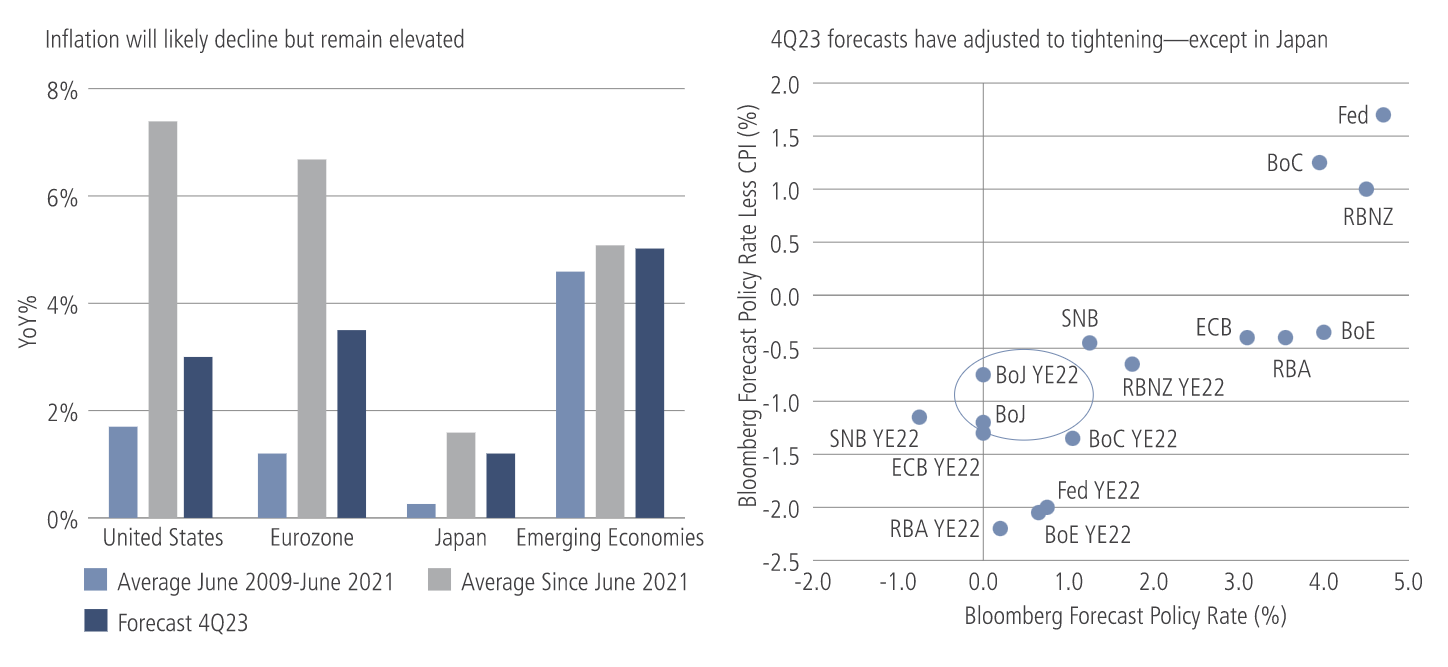

After a year of massive global monetary tightening, we see a deceleration of inflation that is likely to continue throughout the year, with the U.S. and euro area looking at roughly 3% and 3.5% annualized core inflation rates, respectively, toward the end of 2023—much improved, but still above target levels. A notable outlier may be Japan, where forecasters appear to anticipate little upward policy adjustment even with the Bank of Japan’s recent shift in its yield-curve control policy and potential pressure for it to do more. Of course, a key wild card more broadly is whether the mixed picture in economic dynamics could lead to more inflation than anticipated—and thus more difficulty in the financial markets. This is not our base case, but it needs to be considered as we press into still uncertain territory.

Adapting to a New Rate/Policy Mix

Source: Bloomberg. Monthly year-over-year averages for the U.S. and eurozone through November 2022. Emerging is quarterly year-over-year averages through 3Q22. Forecasts as of December 25, 2022.

2. Look to Services to Gauge U.S. Inflation

The Fed continues to face a complex inflation picture. As narrow supply chain- and commodity-driven inflation segued into broader goods, housing and services inflation, the central bank was forced to change course abruptly, leading to its most intense tightening campaign in history. Today, COVID-related stimulus still needs to be squeezed out of the system, while generous fiscal outlays continue to operate as an offset to tighter monetary policy. The labor market remains a challenge, as workforce departures have contributed to a labor shortage, inhibiting productivity and adding to wage pressures.

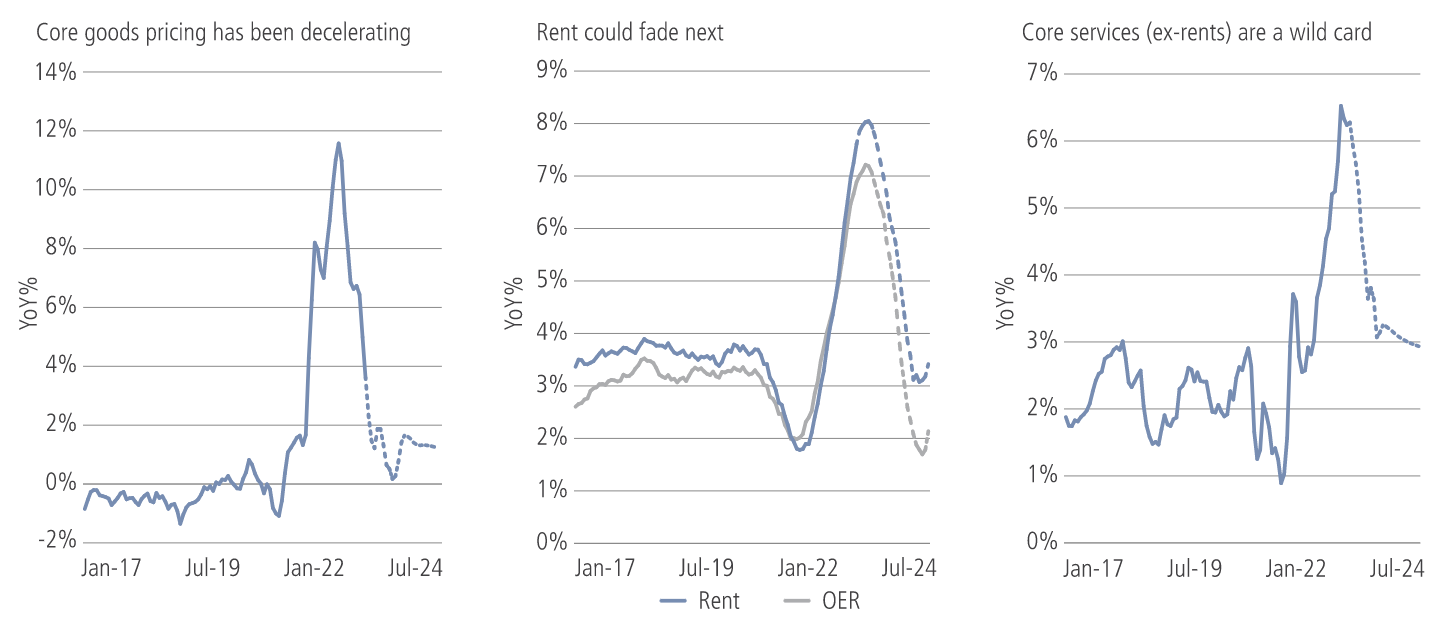

Looking at the components of CPI, we believe that policymakers have reason to feel confident about goods inflation, which has largely been tamed since the initial pull-forward of demand during pandemic lockdowns. Shelter, which saw rapid increases with stimulus payments and rock-bottom interest rates, seems likely to turn next amid higher mortgage rates and economic slowing, although given the length of lease agreements, rents tend to be relatively slower to decline. Most uncertain at this point is services (ex-rents) inflation, which is notoriously sticky and may be reinforced by structural elements of the modern economy. Compared to past periods, goods sectors, which are most directly affected by economic weakness, make up a much lower proportion of the overall workforce. To the extent that services hold up well, that increases the likelihood of an economic soft landing, but may make it more difficult to reduce associated wage gains enough to pull inflation down to Fed targets.

One Down, Two to Go

Source: Neuberger Berman calculations and forecasts, Bloomberg. Actual data as of November 2022.

3. Tail Risk in Japan

In December, the Bank of Japan unexpectedly tweaked its yield curve control policy, raising its “cap” on the 10-year Japanese government bond from 0.25% to 0.50%. The central bank explained that the move was intended to “improve market functioning and encourage a smoother formation of the entire yield curve” while maintaining accommodation. It also kept its -0.1% overnight policy rate level and announced plans for further bond-buying in the same meeting. In essence, the BoJ broadened the leeway for market moves, but maintained its status as a monetary outlier, keeping policy loose while others tighten.

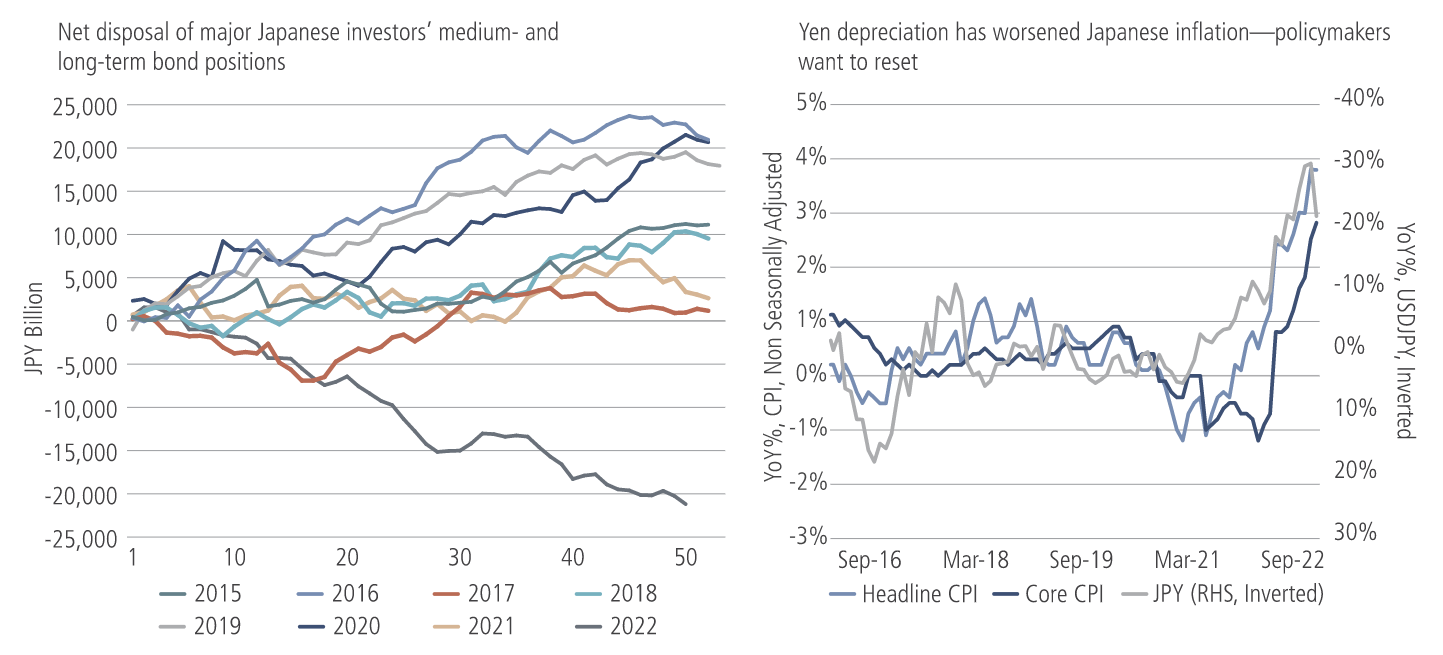

That said, the BoJ is under pressure to follow other central banks given cost-of-living increases in Japan and the movement of investment capital elsewhere to follow more generous yields. Indeed, 2022 saw a net disposal of medium- and long-term bond positions by major Japanese investors. All told, we would anticipate gradual movement toward higher rates over time. This could stabilize fund flows, but also reduce interest on the part of Japanese investors in overseas fixed income assets—creating, in turn, a modest dampening of overall demand for global fixed income over the coming years.

Course Correction?

Source: Bloomberg. Flow data through December 16, 2022. Inflation and yen data through November 2022.

4. An Appealing Opportunity Set

With much of the Fed’s heavy lifting in the rearview mirror, we anticipate that 2023 will see quieter fixed income markets. This could create significant opportunity to capture higher yields with limited risk, especially given the added yield cushion that last year’s setbacks have created.

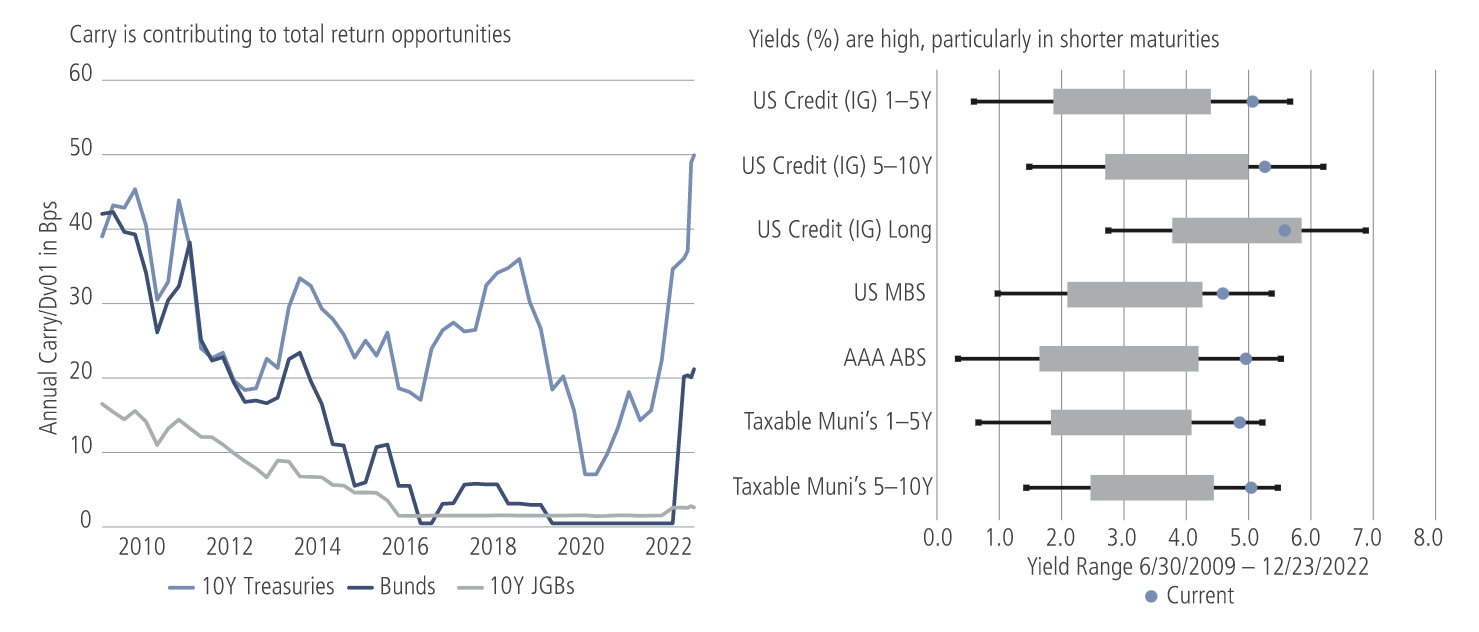

The focal point of our enthusiasm is the investment grade market. For years, investors needed to push the envelope on duration and credit risk to make up for the exceptionally low yields provided by government and other high-quality issues. To illustrate, with nearly 50bps per dollar duration of annual carry in 10-year U.S. Treasuries, their total return opportunity hasn’t been greater in over a decade. Meanwhile, the additional spreads provided by many quality corporate bonds and other strong credits translate into their highest absolute yields since the Global Financial Crisis.

High Quality Stands Out

Source: Bloomberg. Quarterly values for dollar duration (Dv01) until September 2022 and monthly thereafter, through November 2022. Yields as of December 23, 2022.

5. Still, Fundamental Credit Risk Is Rising

Despite potential for economic deterioration this year, the picture for default risk is relatively benign. Corporate leverage remains generally lower and cash levels higher than prior to the pandemic. New issuance patterns have been less aggressive, both in their use of proceeds and ratings cohorts. Moreover, given ultralow yields in recent years, many companies were able to extend their maturities at low interest rates prior to the current Fed tightening campaign; as such, relatively few names will be maturing in 2023 and 2024.

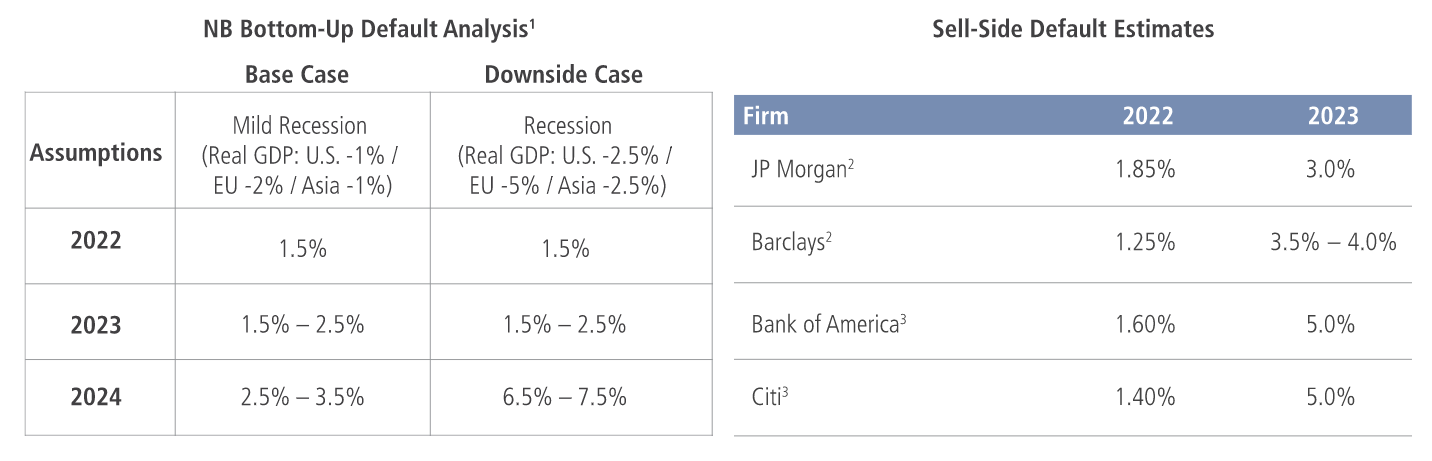

That said, general consensus is for an increase in high yield defaults this year, particularly if the recession turns out to be worse than anticipated. Defaults are likely to see further deterioration in 2024, again below historical norms, as more issuers face maturity deadlines.

What does that mean for portfolio positioning in credit markets? Credit differentiation will rise as the impact of higher rates and a slower economy filter into actual corporate earnings and outcomes. We expect credit markets to morph from something that was more tied to “macro” outcomes in 2022 to something more tied to fundamental outcomes.

U.S. High Yield Default Expectations

Source: Neuberger Berman, J.P. Morgan, Bank of America, Citi and Barclays. Data as of October 31, 2022. 1 Represents NB bottom-up default analysis. Base case assumptions include 2023 U.S. real GDP of -1%, EU real GDP of -2%, and Asia real GDP of -1%. Downside case assumptions include 2.5% real GDP contraction in U.S., 5% real GDP contraction in the EU, 2.5% real GDP contraction in Asia. 2 JP Morgan and Barclays default estimates are based on bottom-up analysis. 3 Bank of America and Citi default estimates are based on top-down analysis.

Anticipating a Smoother Ride

The fixed income environment has taken a sharp turn over the past year. Central bank balance sheets are moving in reverse while rates have risen sharply off ultra-accommodative lows. At the same time, inflation has been sloping downward, although still at levels unacceptable to central banks. For investors, the result may be a less volatile flight pattern, with the ability to dial back emphasis on inflation or correlation bets and instead focus on earning income—particularly in higher-quality names and shorter maturities. Opportunities will also be available in lower-quality areas of the market, but with an emphasis on security selection amid an unsettled economy.

Market views

Strengthen your portfolio with flexibility

In today’s low yielding environment and uncertain markets, we think maintaining flexibility and adopting a dynamic approach across different fixed income sectors, particularly the spectrum of credit, is an effective way to enhance returns. Find out more here.