FOII - Fear of Investing in India

Typically, investors who are considering single country exposures, are worried about volatility driven by local market nuances that they are not well versed in. Be it a governance concern in India, war in Russia, differentiated political system in China or an election in Turkey. Investors tend to be more tolerant of economies and markets that they feel they have a handle on i.e. US, Western Europe and UK, Japan and Australia, given a similar political system, rule of law and corporate mindset.

When it comes to investing in Emerging Markets investors tend to prefer to put the "fear of the unknown" into one basket and trust/outsource the decision of country and stock selection to broad based experts. These experts "miracoulously" apply their trade and navigate multiple economic and political systems, varied market regulations and regulators, corporate ethos of large conglomerate or family holdings from hubs like New York, London, Paris, Sydney and Singapore.

In an asset class like Emerging Markets, underlying economies are non-homogenous and in an era of deglobalisation, are unlikely to be travelling in the same direction. This makes it hard to have a compelling case to invest in a basket of all 24 countries, possibly "washing out" the benefits with some "good" and "bad" dynamics.

Single country exposures return profiles are heavily influenced by their currency and the cross currency comparison with the AUD. This can increase the volatility associated with investing in the region. Particularly, individual emerging market currencies or even the entire basket, can be vulnerable due to capital flight and concentrated economic/sectoral exposure.

However, in a world of increasing deglobalisation where return dispersion amongst countries increasing, investors are missing out on growth opportunities and the benefits of diversification by making allocations to broad offerings which can dilute their logic (capital growth and diversification) for seeking the allocation in the first place.

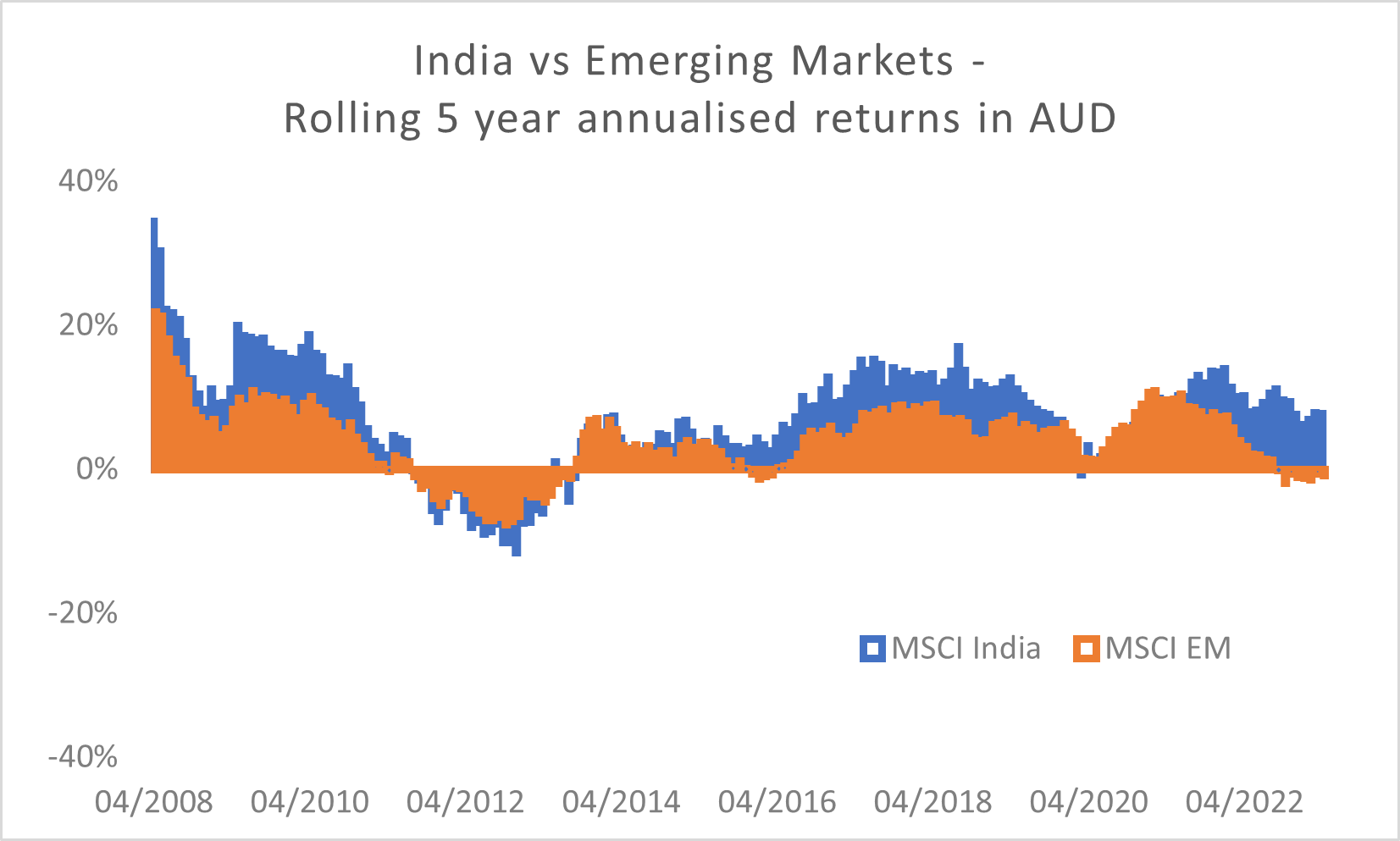

The chart above highlights that allocating to a country like India (as an AUD based investor) makes a stronger case than the broader Emerging Markets, due to the underlying fundamentals of the country i.e. young and aspirational population, strong macro fundamentals and well positioned corporate balance sheets.

In fact evidence on the last 20 years indicates that on 75% of rolling 5-year periods the MSCI India has trumped MSCI EM. This also equates to a return of 11.4% p.a. vs 5.9% p.a. over the 20 year period.

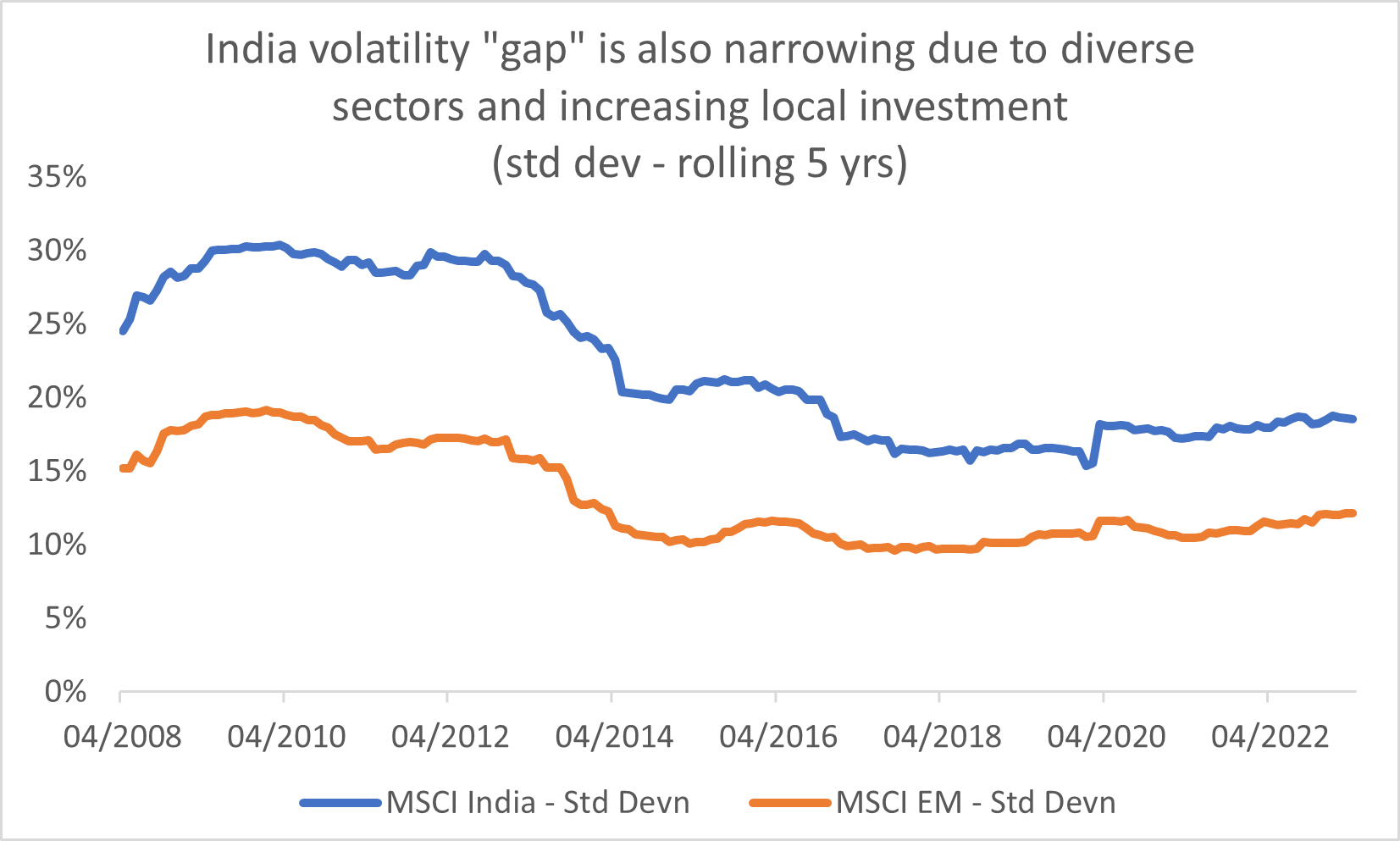

An objection frequently raised is the volatility (standard deviation) around investing in a single country like India compared to investing in a broader allocation like Emerging Markets. Several feel its easier to justify allocating money to a broader group as the "blame" can be passed onto the outsourced expert (i.e. manager) in the event of failure. We assess this hypothesis below:

We can see that India is indeed more volatile, from a standard deviation perspective, relative to Emerging Markets over time. However, there are some interesting aspects to consider on this:

- The volatility of investing in India's equity markets is receding towards the volatility of investing in Emerging Markets over time. Some of the reasons for this include increasing local investment (with local investors now having the same weight as foreign investors in market cap) as well as a less volatile currency (supported by strong forex reserves and improving macro).

- Most of the higher volatility is associated with upside capture of India's market relative to Emerging Markets i.e. upside volatility is not a bad thing!

- The correlation of Indian equities to Australia equities and Developed Market equities is far lower than Emerging Market equities correlation to the same asset classes. This is because India is a commodity importer which makes a strong case for inclusion (based on lower correlation diversification) in AUD domiciled portfolios.

4 topics