For the love of growth: How Michael Frazis finds 100-baggers

It's highly likely that over the past 12 months you have become acquainted with fresh-faced portfolio manager Michael Frazis.

After all, he has graced the pages of many a business-focused magazine and publication - as well as this very platform - after he shot to fame for his continued outperformance during tumultuous 2020.

Frazis Capital Partner's Frazis Fund beat both the S&P/ASX 200 and MSCI World Total Return Index by over 100% net in 2020. Over the past 12 months, the fund has generated returns of 188%.

But just like many of the other funds profiled in our Fresh Fundies series, Frazis' approach could be considered high risk. He is always 100% invested, he doesn't care for traditional metrics, and manic management or major market movements are unlikely to raise his brow.

What does spark his interest, however, is customer love and explosive growth. But what does that actually mean? In this wire, Frazis takes you through his unorthodox investment philosophy and provides five stock picks that boast growth potential of more than 50%.

The interview below is part of our Fresh Fundies series, focusing on newly launched funds (and their portfolio managers) with less than a three-year track record.

Over the next few weeks, we will be profiling:

- Emanuel Datt, Datt Capital

- Heath Behncke, Holon Global Investments

- Omkar Joshi, Opal Capital Management

- Jesse Moors and Nicholas Quinn, Spatium Capital

- Shaun Zhang, Snowball Asset Management

- Scott Williams, Fiftyone Capital

- Ben Rundle, Hayborough Investment Partners

Fund at a glance: Frazis Fund

Fund Manager: Michael Frazis

- Asset class: Global growth equities

- Objective: 10x net return over 10 years. This is a target only and the Fund may not be successful in achieving this objective.

- Minimum investment: $100,000 for new investors.

- Investment outlook: Five years +

- Suitable for: Wholesale and sophisticated investors from Australia and overseas (except the US)

- Launch date: 1 July 2018

- Performance since inception: 30% p.a (as of March 2021).

- Management fee: 1.5% (plus GST net of RITC) per annum of Net Asset Value.

- Performance fee: 20% of the Unit Return in the relevant calculation period and subject to the applicable High Watermark.

Take us through how you built your fund from scratch to set it up for long-term success?

We focus on winners, rather than turnarounds. We all have the innate human desire to be smart, to catch a recovery, to see what nobody else can, to catch the bottom or the top. This is fine. We need smart people figuring out when the next turn is coming, when a struggling company is about to perform brilliantly. And that's valuable, good work. But it's not our focus in the Fund.

We optimise more for returns than anything else, which is surprisingly rare in this industry. Managers face immense pressure to optimise for other factors - turnover, drawdowns, volatility. Every time you add a new variable you muddy the waters.

And if we look back at the companies that really worked for us, every quarter they beat, every quarter they grew. The stock prices would bounce around like you won't believe, but every three months these companies would be bigger, better and stronger. So we are looking for companies with consistent growth.

Investing in ultra-growth companies is a very different skill set to that required to identify turnarounds or companies that are 25% undervalued. It requires a different mindset with a different analytical toolset.

We’ve learned the hardest possible way over the years not to second guess the market. We stay roughly 100% invested no matter what. We don't try to time the market. We've got ~50 companies with a median market cap of over $10 billion growing at over 100%, and that’s quite unique.

Which brings me to another important point: you can’t ignore these companies as they are taking share of wallet from the rest of the market.

This is a mathematical fact. Global GDP is growing in the low single digits but these companies are growing at 100% at the expense of the rest of the market. We own 50 companies like this, and there’re at least another 50 on our watchlists with similar metrics. It’s critically important for investors to have exposure to this part of the market. It’s a very challenging arena and poses its own risks, but there will be years like 2020 where these kinds of ultragrowth companies will be the best performers in the market – by a long way.

Our outperformance didn’t just come from our portfolio companies maintaining 100% growth rates – it also came from the fact these companies took market share from the rest of the index.

Sometimes you can see this. For example, the way Afterpay (ASX:APT) created tens of billions of dollars of value over a period where the major banks lost tens of billions. Or how Tesla (NASDAQ:TSLA) created hundreds of billions of dollars of value over a period where auto manufacturers really struggled. Or how Amazon (NASDAQ:AMZN) and Shopify (NYSE:SHOP) created hundreds of billions of dollars of value at the expense of traditional retailers.

Other times it’s not clear who the loser is, though you know there must be one out there.

I wouldn’t necessarily recommend someone copy what we do. There are a lot of pitfalls in these areas. We do a lot of life sciences investing, which is really complicated if you're not a specialist. These kinds of companies attract a lot of speculation and it's very easy to get things wrong. Any company can cut prices in half and grow explosively, for example. And there are plenty of companies that actually do this (WeWork is an example most will be familiar with).

What are the strategies and techniques that set you apart from other fund managers?

Most investors, myself included, followed the same path in learning their craft. Everybody reads the same books and idolizes the same heroes, whether it's Buffett, Peter Lynch, or Graham, and the message is clear: look for free cash flow and buy a dollar for fifty cents. There is an implication that the best returns come from scouring through small caps to find ‘undiscovered gems’.

But the fact is that many of the best-performing stocks displayed none of these traditional characteristics. This includes Tesla, Afterpay, Netflix, Amazon, Google, all the software companies, all the renewable companies, all the life sciences companies, all those incredible 10x, 20x and >30x return opportunities.

Our strategy stems from answering a simple question: how do you actually identify these companies early? What's common to those companies? What did they look like at the beginning of their journey? And if you start thinking that way and put aside the dogma and the cliches and the Warren Buffett stuff and start from first principles, you start to see things a little differently. That's how we got to our focus on true customer love and explosive growth.

And there are really good reasons why those companies have a huge amount of consumer demand. The best companies in the world today are investing in human capital, research and development, and sales and marketing.

These are all expenses. Conventionally investment managers focus on free cash flow and earnings per share. But that approach rules out every good fast-growing technology company, because all of those companies will spend all of their fresh cash flow on those cost items… and reap immense rewards.

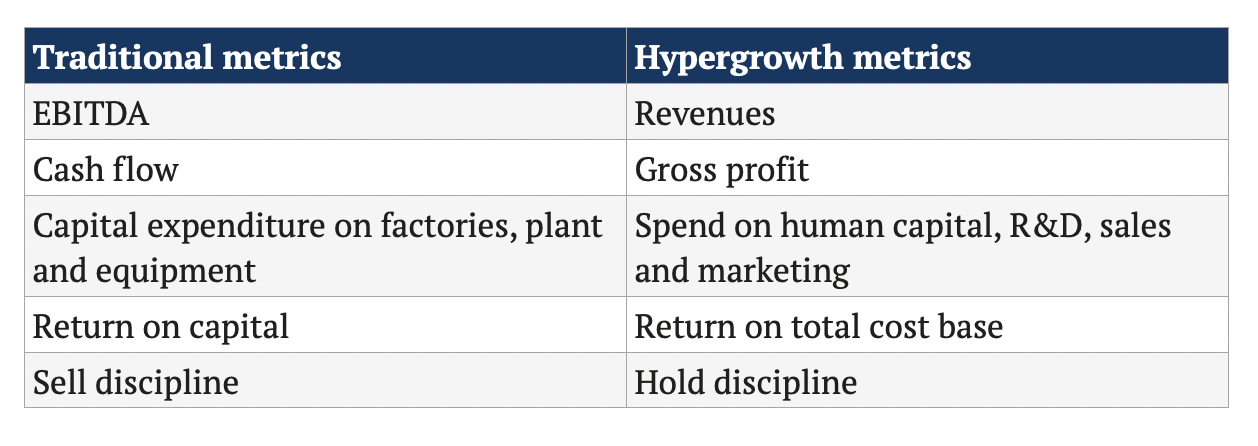

This is a very different mindset with a whole new way of looking at financial statements, and a whole new set of possible mistakes. There are different questions you have to ask management. The due diligence process is completely different. See below:

Another difference we’ve noticed about our approach is we don't weight management the same way most investors do. Management is a very one-sided way of looking at things. This can be valuable, but when it comes to making the actual investment decision, we think the data is far more. The numbers are more important and we will happily invest in a fast-growing company with an eccentric CEO. We also put far more weight on our interviews with customers, suppliers, and ex-employees, rather than the number one salesperson for the company. They’re too charming and we are too easily charmed.

Where are you seeing opportunities right now?

There are heaps of opportunities. For example, the electric vehicle market in China has really fired up. And this is a country that urgently needs to reduce pollution in its cities and its leadership can actually make things happen in a way that doesn't happen in the US. Some foreign companies will sell electric vehicles in China, but we expect the Chinese will mostly be buying Chinese vehicles. So it's a huge growth area. And the best opportunity is likely the companies with luxury offerings that can command premiums, like Nio (NYSE:NIO) and Li Auto (NASDAQ:LI).

The second growth area is life sciences. A lot of people are familiar with Moderna (NASDAQ:MRNA), which has proven out their mRNA approach, has all kinds of trade secrets and IP protection, and is in the process of generating tens of billions of dollars of revenue from their coronavirus vaccine. This will fund their whole platform and allow them to spin out treatment after treatment after treatment. Alnylam (NASDAQ:ALNY) is similar, only with a focus on RNAi and liver diseases. This is another platform stock with rapidly growing revenues from existing treatments that will fund their entire pipeline. In this context by platform, we mean a core technology that allows the generation of treatment after treatment. A very different risk/reward to typical binary biotech companies that Australian investors will be all too familiar with.

There are a few interesting companies growing explosively listed on the ASX. Afterpay (ASX:APT), Cettire (ASX:CTT), and new IPO Camplify come to mind.

Want to learn more about other newly launched funds?

Like this wire to let me know you enjoyed it. Hit follow so that you are notified of the seven other fresh fund manager profiles coming your way.

If you know of a newly launched fund that you think should be covered in this series - or if you are a portfolio manager who has recently launched a fund yourself - send us an email at content@livewiremarkets.com.

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

2 stocks mentioned

4 contributors mentioned