Forecasting inflation Down Under and watching for pressure on the Aussie dollar

.png)

Australia’s central bank has made hawkish noises of late.

“The board has a low tolerance for a slower return of inflation to target than currently expected,” Reserve Bank of Australia policymakers said earlier this month.

They’re especially concerned about oil prices, given the turn of unrest in the Middle East.

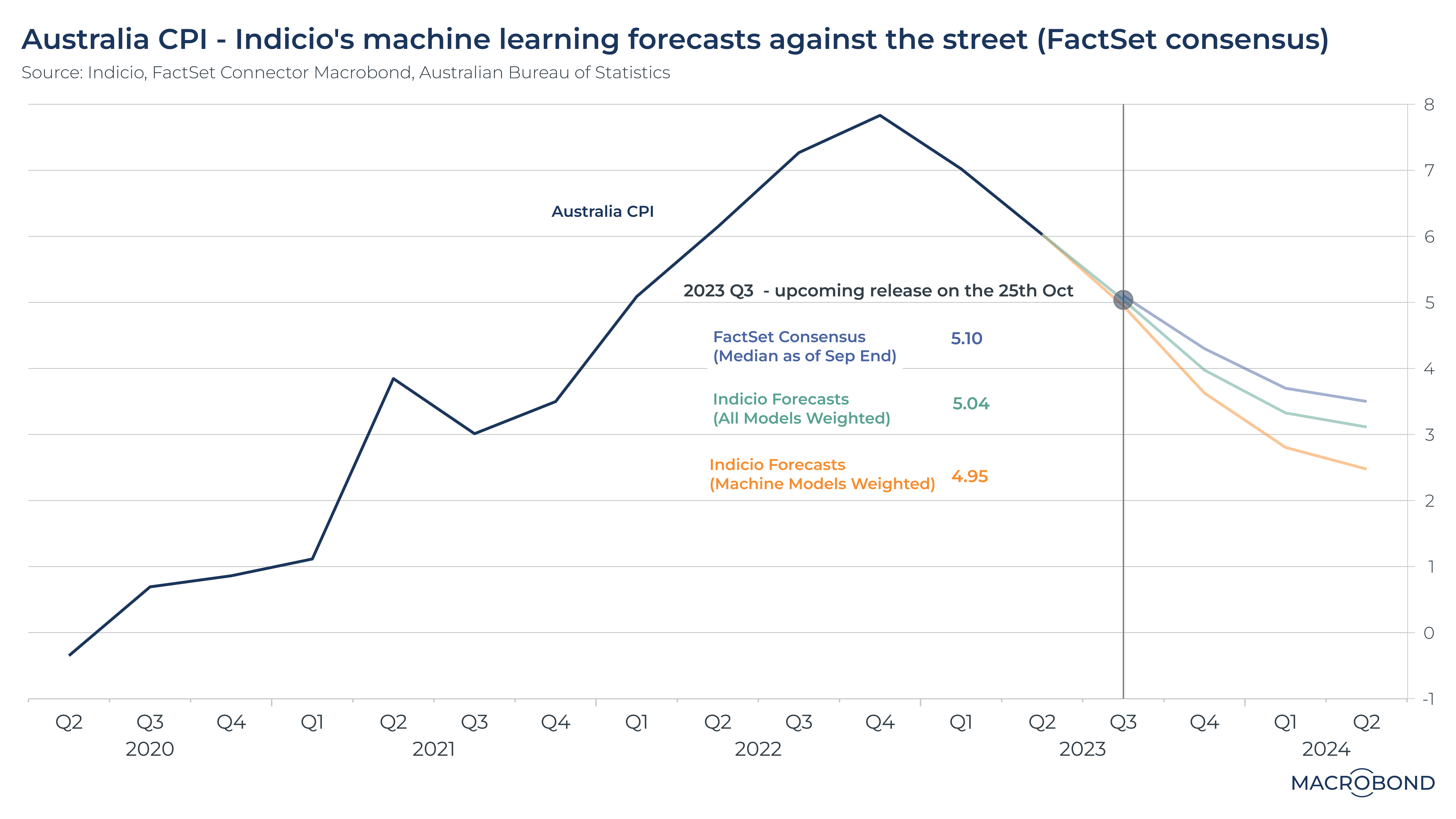

To generate a prediction for the Oct. 25 third-quarter consumer price index, we deployed univariate and multivariate forecasting techniques. This chart tracks the FactSet consensus estimate on CPI from the third quarter of 2023 to the second half of next year – and compares it with our models with Indicio.

Our models forecast that inflation will soon start falling significantly below the estimate. Even for third-quarter CPI, our model sees the print coming in between 5 and 15 basis points below the FactSet forecast.

If that trajectory continues, we could return to the RBA’s inflation target range of 2 to 3 percent in 2024.

Should dovish inflation data prompt the RBA to “pause” instead of raising rates, this could be great news for the performance of various risk assets.

However, this would create a scenario where the Aussie dollar might continue to suffer.

Risks for the currency

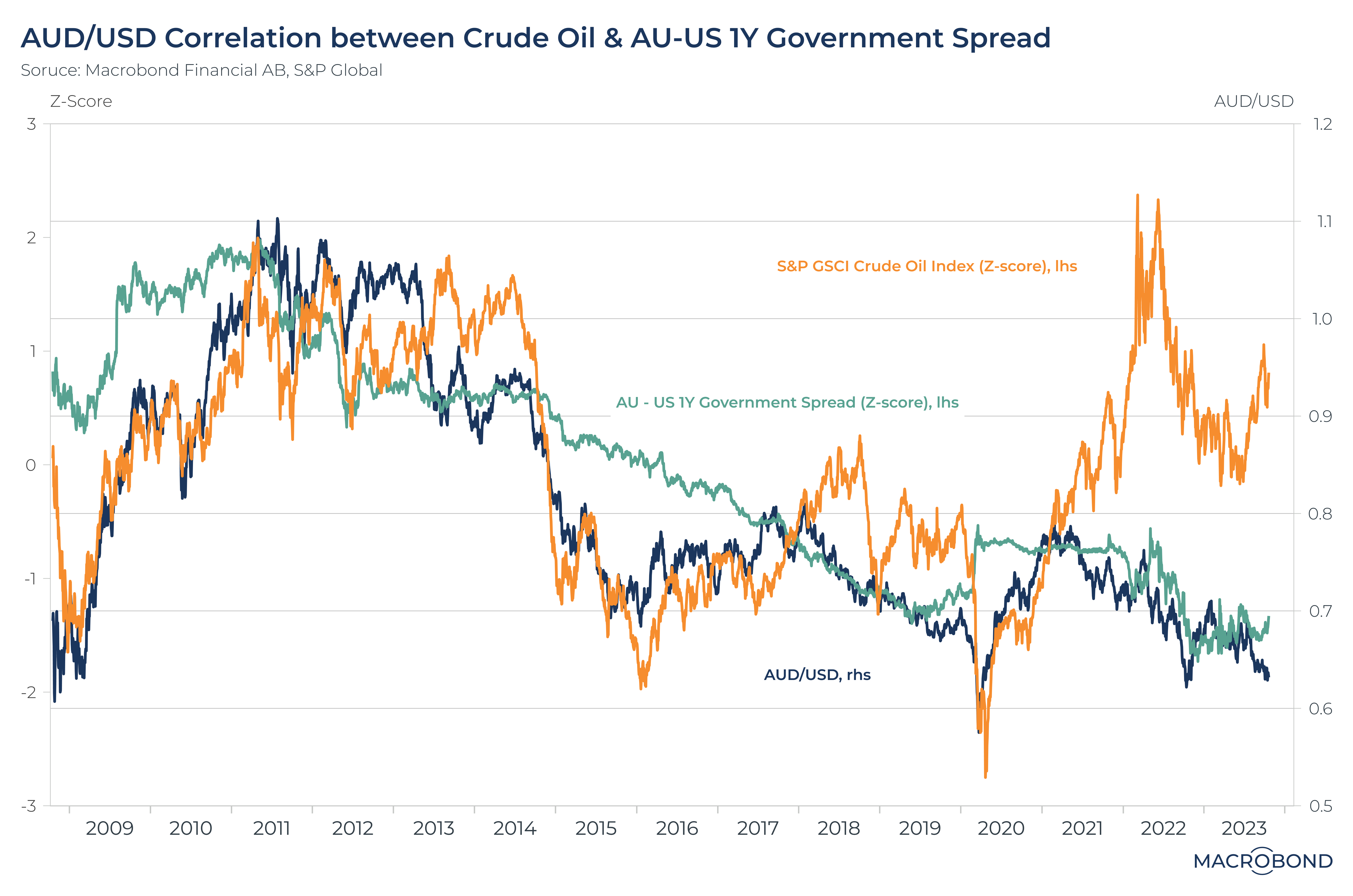

As our following chart shows, the AUD (in blue), once at parity with the USD, has been on a downward trend for a decade.

The Aussie dollar is usually known as a “commodity currency” due to its sensitivity to prices for key exports, such as iron ore and natural gas. While the nation is not a major exporter of oil, this chart uses crude prices (in orange) as a proxy for commodities, given oil’s historic correlation with the AUD.

However, that historical correlation is not what it used to be. Since the start of 2021(and arguably in 2018-19), AUD/USD is much more correlated with the spread between US and Australian short-term bond yield curves (in green).

.png)

In summary, Australians should watch out for not only slowing inflation but its knock-on effects.

3 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)