Forecasting inflation on both sides of the Atlantic

.png)

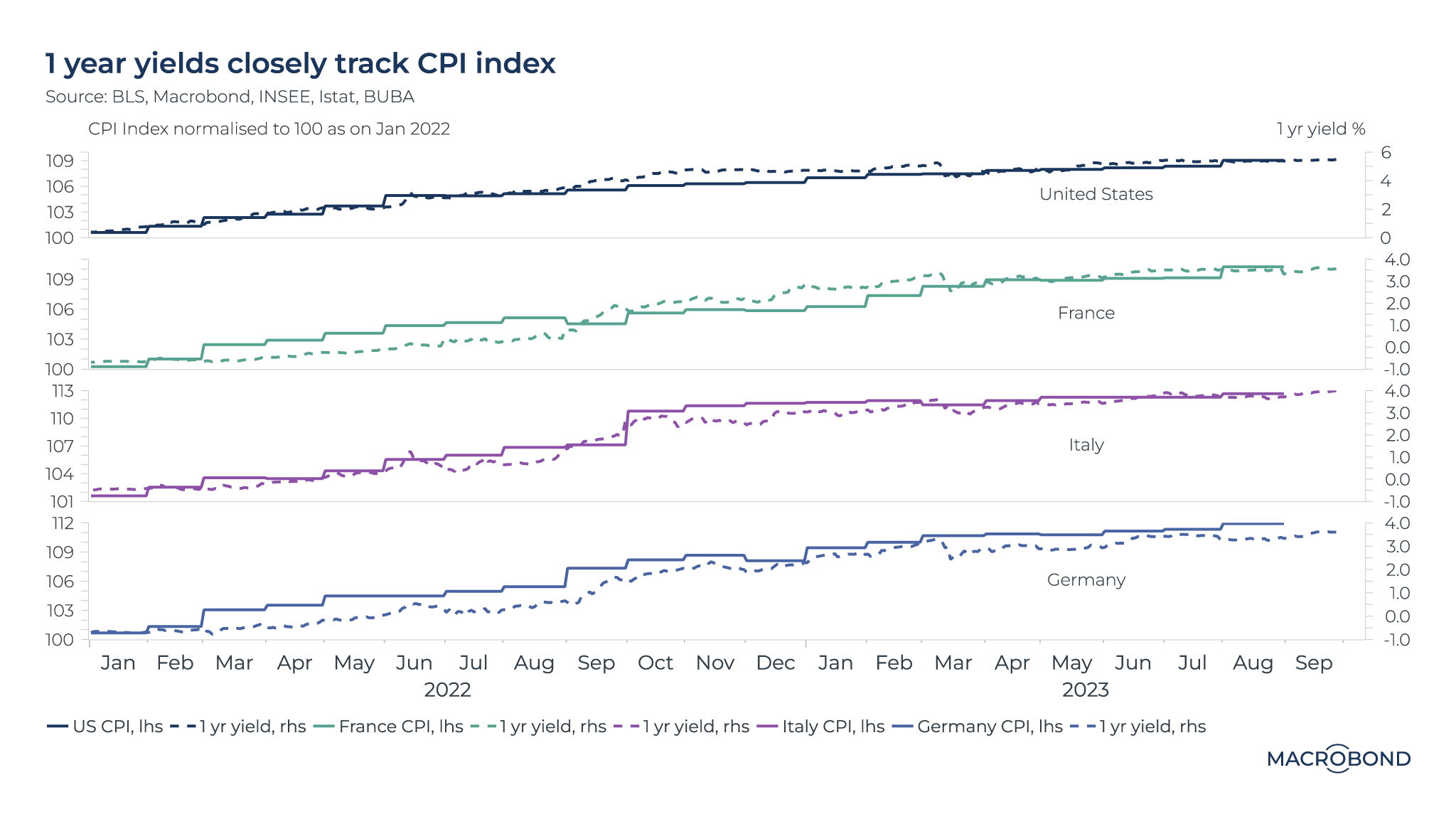

Monetary policy reaction functions target stable prices, maximum employment and moderate long-term interest rates conducive to balanced growth-inflation dynamics. Policy rates and hence yield curves evolve in line with these macro determinants - largely CPI. The shorter end of the curve is reactive to policy rate driven liquidity function while the longer end encompasses medium to long term growth and fiscal dynamics. The 1 year yield closely depicts the CPI index, normalised to 100 as of January 2022.

The high(er) for long(er) narrative prevails as seen in rising yields, despite policy rates seeming peakish. The data dependency optionality seems prudent to read inflation-related high frequency indicators with caution amid rising cost-push factors and sticky demand. Extrapolation of YTD inflation deceleration towards target rates seems unlikely, keeping the window for rate cuts closed in the near term.

US resiliency outweighs UK and EZ prospects: Fed raised its dot plot mindful of the upside risks to inflation. Impact of rate tightening transmission on overall demand has not materialised yet as seen in demand pull inflation numbers – the core PCE. In addition, cost push factors such as rising energy prices (crude, gasoline) and higher food prices can catch up in the headline. The comfort so far from rental and medical care inflation may wane. (Read more about the medical cost effect here.)

Market participants are assigning a 50-50 probability of a Fed rate hike by December 2023 given the US economy has remained less rate sensitive than the UK and Eurozone. Signs of a slowdown are evident in the UK, where retail sales and consumer spending sentiment have been contracting since 2022, while Germany is taking the blow from a contracting manufacturing sector and curbed household spending. The US, on the other hand, has remained resilient, gaining strength from consumer spending closer to pre-pandemic rate levels.

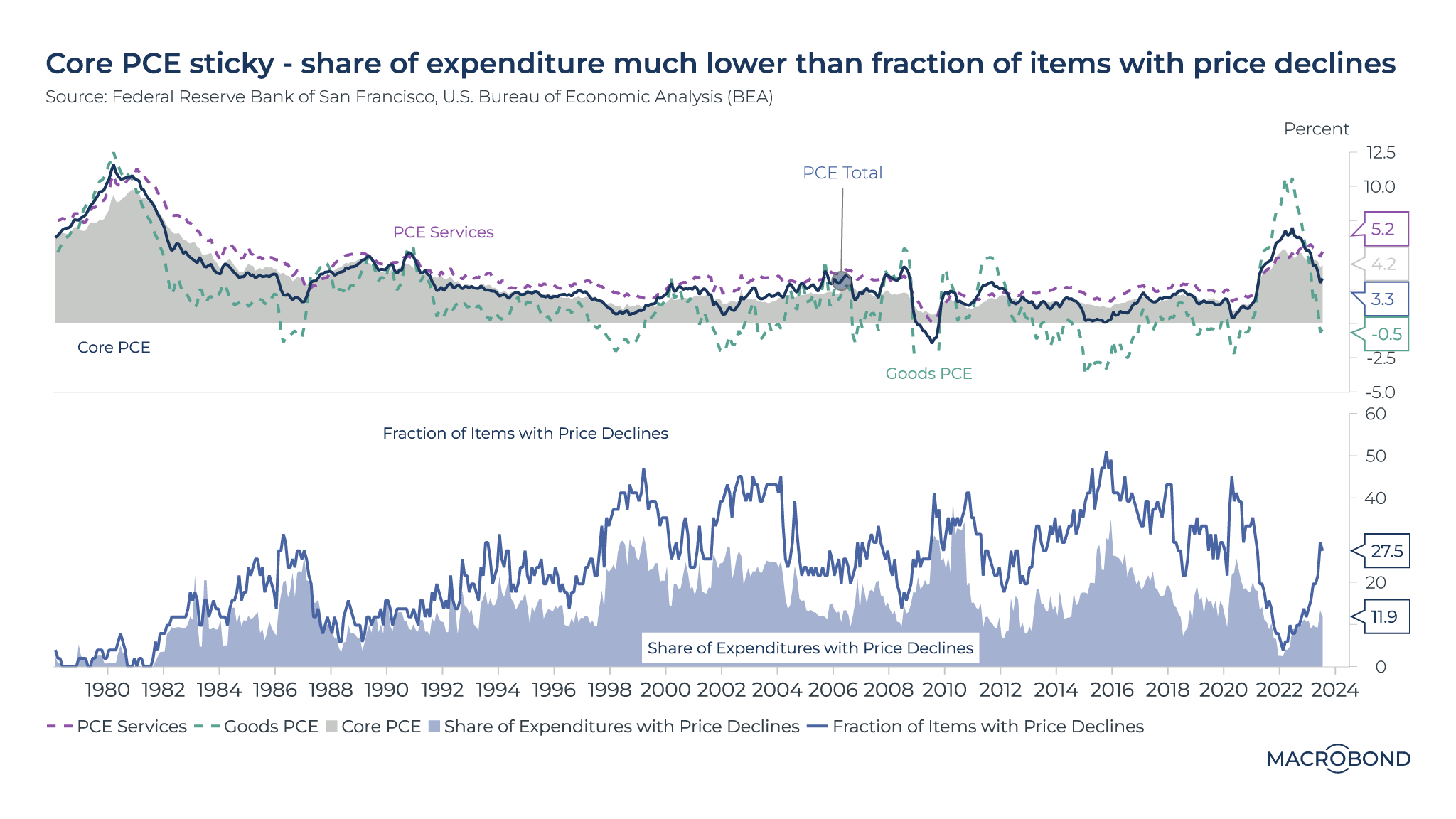

Higher yields reflect sticky inflation: Treasury yields at 15-year highs are reflecting the sticky core inflation and the 2 percent target being distant. PCE inflation figures indicate goods inflation supported lower trending headline rates since January, while services inflation and core inflation remained elevated.

Further, while 28 percent of items in the PCE are showing price declines, the expenditure share showing price declines remains low at 12 percent.

Comparisons are drawn to the 1980s Paul Volcker era: former Treasury Secretary Lawrence Summers stated it is "more likely than not" that the Federal Reserve will be surprised by the persistence of higher inflation and weaker-than-expected economic growth.

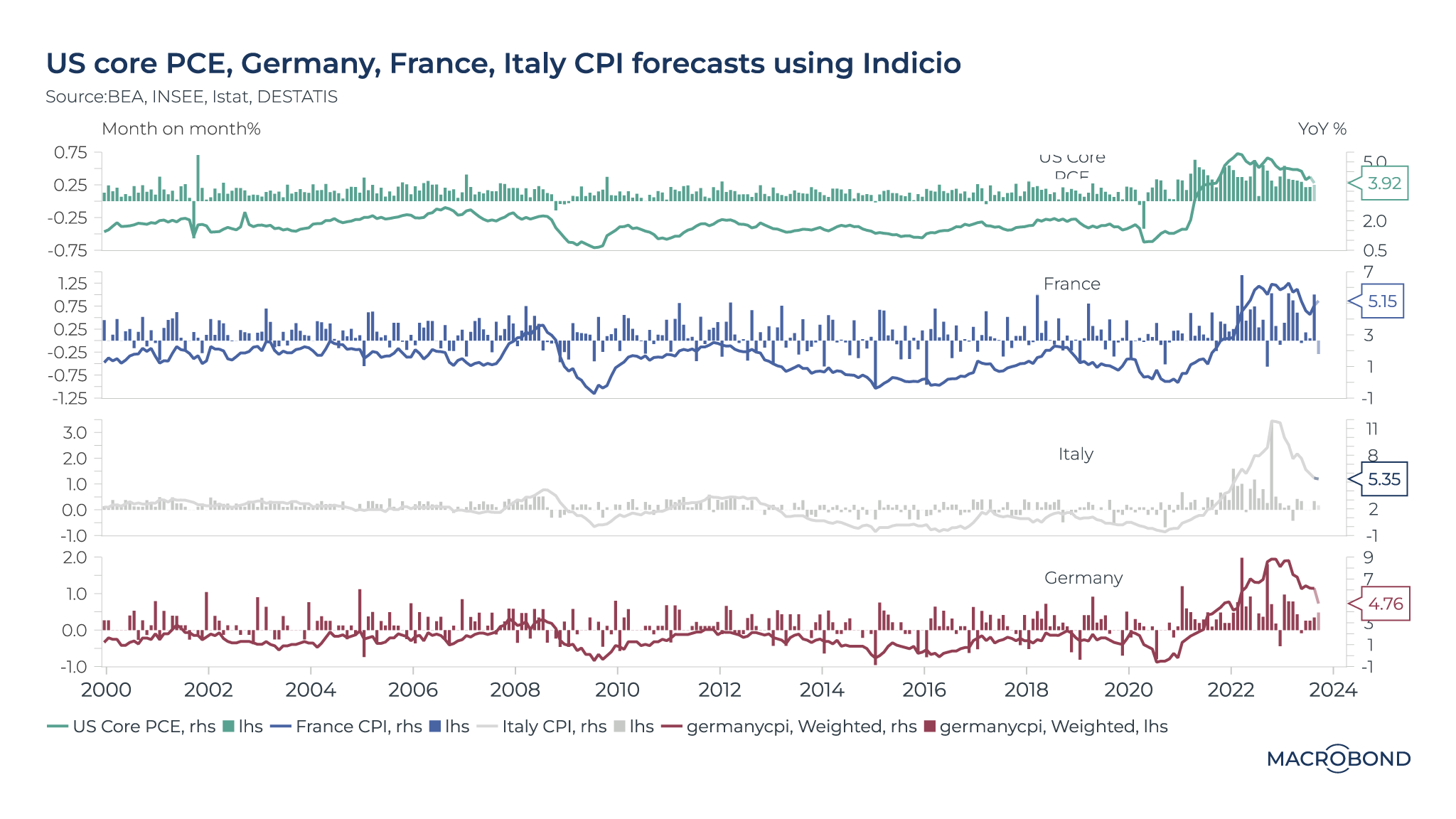

Near term inflation forecasts do not provide comfort.

Using Macrobond’s partnership with Indicio, we constructed models to predict the upcoming inflation figures in four countries scheduled to release them this week.

The models forecast US core PCE for August at 3.9 percent, Germany’s September preliminary CPI at 4.7 percent, France’s September preliminary CPI at 5.15 percent and Italy’s September preliminary CPI at 5.35 percent.

Our models factored in interest-rate sensitivity, growth dynamics, employment trends, wage pressures, consumer resiliency and forward-looking surveys to focus on demand-pull inflation and various commodities (energy, etc.) to account for cost-push factors.

The month-on-month growth remains positive, indicating continued inflation momentum for now. Over the next few months we remain cautious on the inflation front: upside risks from energy prices tracking a cold winter, tight supply in the energy market, recent labour strikes keeping wage pressures intact, and rising agricultural commodity prices may provide little respite.

Meaningful inflation deceleration remains contingent upon a slowdown in discretionary demand. Further comfort on the inflation front could come at a cost of dwindled pent-up savings, a housing market slowdown, an easing labour market and wages and overall weaker growth prospects. Rate tightening transmission is likely to be felt in varied cycles across geographies.

2 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)