Forget June meeting, August still ‘live’ for RBA rate hike –Morgan Stanley

The vast majority of economists aren’t expecting any surprises at tomorrow's June Reserve Bank of Australia (RBA) meeting. The RBA is expected to keep its official cash rate (OCR) on hold at 4.35%. However, the language of their statement and of RBA governor Michelle Bullock in her post-meeting press conference will be far more interesting for both markets and mortgage holders.

Most economists expect the RBA to maintain its default rhetoric of “vigilance against inflation risks”. But it’s their new cryptic (and my personal confuse the hell out of everyone favourite) “we’re not ruling anything in or out” that demands further clarification.

On that last point, it’s worth noting the RBA has gone to great pains in its last two meetings to warn us that Australian interest rates could either go up or down at this juncture of the battle against inflation.

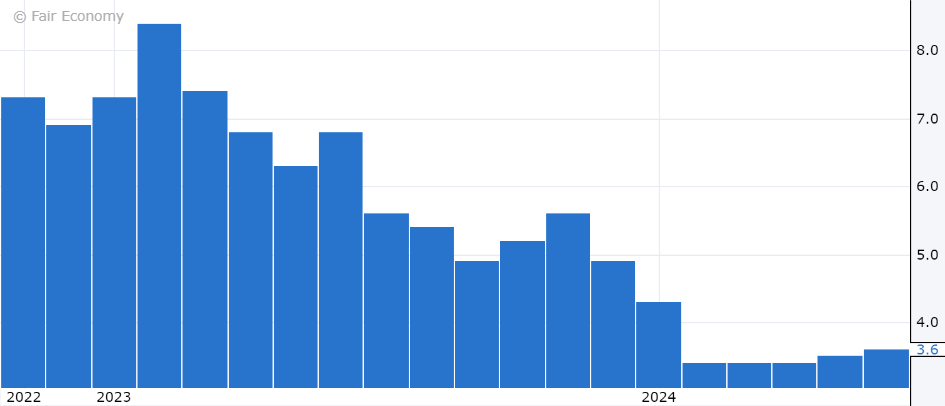

Fortunately for us, it’s a battle the RBA is generally winning. Australian inflation as measured by the consumer price index (CPI) is trending lower, and is gradually back towards the top end of the RBA’s 2-3% average target range.

Australian CPI y/y monthly series. Source: Forex Factory, Fair Economy, available here.

But the last two CPI prints, both upticks for the months of March and April, have thrown the cat among the pigeons on the RBA board. The last uptick, as reported here, shoved market expectations for the first interest rate cut out to October 2025 from the previous June.

Since then, there have been few data points pointing to an improved inflation outlook, with stronger than expected employment data last week showing a tight labour market, and a NAB business survey pointing to a sharp uptick in inflationary pressures among businesses.

Despite this, market pricing for the first rate cut has come in dramatically. This is mainly due to external factors to the Australian economy including particularly benign inflation prints in China and the USA last week.

Add to this, plenty of dovish commentary from US Federal Reserve Chairman Jerome Powell, and an interest rate cut from the European Central Bank, and it appears that regardless of the potentially worsening inflation situation in Australia, the global trend in official rates has turned the tide – and markets are tipping Australia is going to be dragged along.

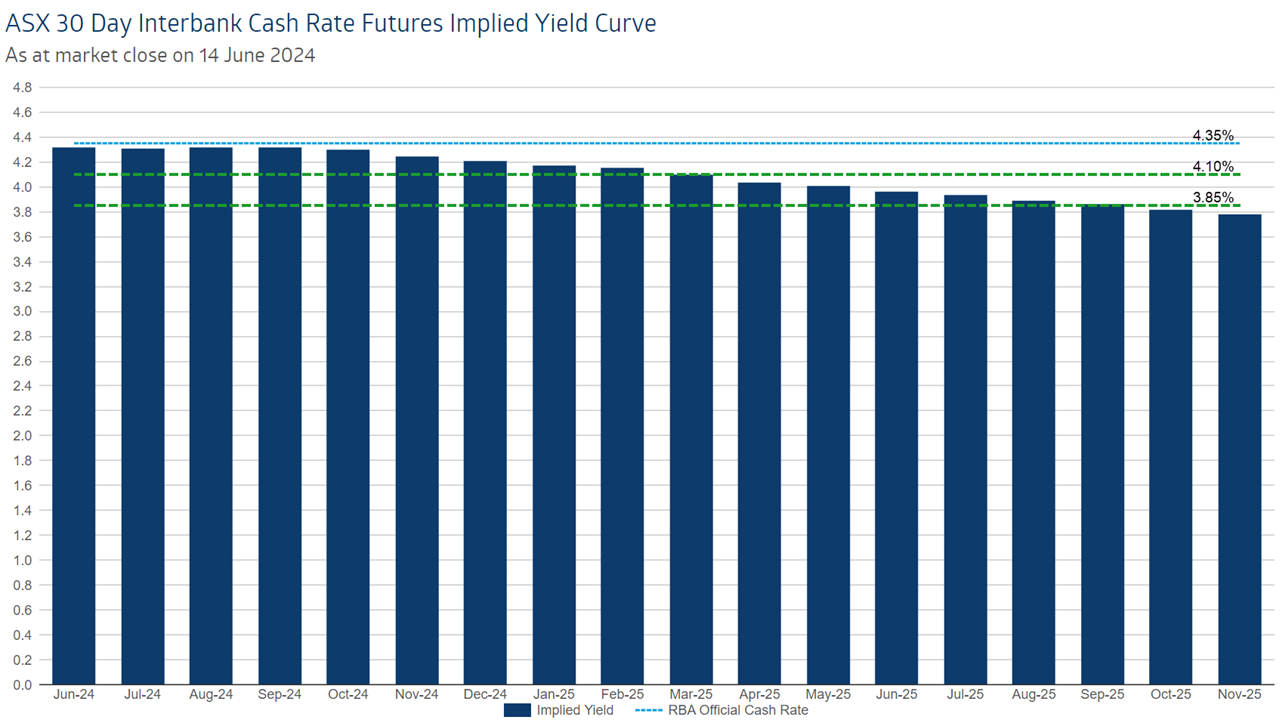

The 30-day cash rate futures implied yield curve heading into tomorrow’s meeting is dramatically different from the one we saw immediately after April's CPI shocker. The small chance of a rate hike previously shown is now gone – that's encouraging – but the biggest change is in first cut timing.

30-day cash rate futures implied yield curve. Source: ASX, available here.

The previous first cut timing of October 2025 has been drawn forward to March – an astonishing seven months earlier. Even better, markets have even gone from expecting no chance of a second cut by October 2025, to fully factoring one in. The yield curve now ends at 3.78% next November.

Broker views

Market pricing for an early 2025 rate cut appears to be converging with several major broker forecasts.

Citi suggests that despite its recent tough talk, the RBA doesn’t really want to hike rates. “We doubt the RBA would want to increase interest rates again. This would disproportionally hurt households already struggling under tight financial conditions”, Citi said in a recent research note.

UBS holds a similar view there’s a very low probability the next move in Australian interest rates is up, tipping the next move will be a 0.25% cut in February next year. Rates could fall quickly from there if UBS’s forecast for the OCR to reach 3.35% “by the end of 2025” is correct. This implies potentially four 0.25% cuts between February and December.

Morgan Stanley is also tipping February 2025 for the first 0.25% cut. They differ from Citi and UBS however, by acknowledging there remains some degree of risk the RBA will hike again – albeit it is a very modest one.

The RBA doesn’t meet in July, so the next meeting isn’t until August. It’s a “live” meeting, suggests Morgan Stanley (live is the term usually applied by economists to indicate the possibility of a change in rates, in this case a hike).

It would take a really bad second quarter CPI print due at the end of July for the RBA to hike in August, notes Morgan Stanley: “Near-term risks are for further tightening with the August meeting live, but this would require an upside surprise in Q2 CPI, which we don't expect.”

Markets, brokers, and tomorrow, the RBA

I’ve shown you what the market thinks, what the brokers think, and tomorrow, we’ll get it straight from the horse’s mouth! Well, kinda.

Markets are excellent at telling us what they think through pricing. Brokers are generally very clear about their views in their research notes. Unfortunately, however, the RBA has a habit of carefully crafting their language to hedge their bets and keep us guessing (well, ever since former RBA governor Philip Lowe’s famous “no rate hikes until 2024” call, that is!)

This article first appeared on Market Index on Monday 17 June 2024.

5 topics