Four at-home "winners" that aren't reopening "losers"

Turbo-charged US economic growth underpinned by record levels of cash stimulus bodes well for global stock investors over the shorter term at least, says Ellerston Capital's portfolio manager Bill Pridham.

He cited a bullish forecast from US bank Wells Fargo that suggests the pace of GDP growth in 2021 will be the fastest since 1984, during an investor webinar on Tuesday.

“We went from a late-stage economic cycle in January-February last year to an early-stage cycle in just a couple of months,” Pridham said.

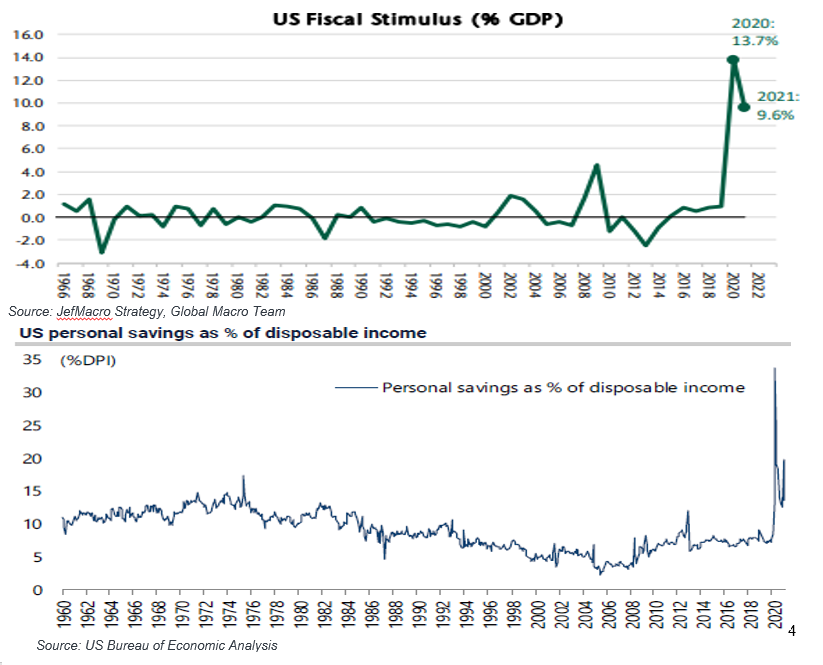

“With all the fiscal and monetary stimulus, we’re back to a mid-stage cycle again in the space of a few months. Economies and markets are moving at an accelerated rate, and that likely won’t change any time soon, and as investors, we need to address that.”

Pridham runs Ellerston’s small- and mid-cap focused Ellerston Global Mid Small Cap Fund. The global equity strategy holds an overweight exposure to North America, where more than half of Ellerston’s portfolio holdings are listed. Pridham is encouraged by what he sees in 2021 so far, citing buoyant household wealth levels backed by ongoing support from the US Federal Reserve.

US consumer net worth rose by 10% in 2020, hitting a new all-time high of US$130 trillion, said Pridham, again citing Wells Fargo data – mind-boggling given the lockdowns that shuttered entire industries and saw the sharpest market sell-off in decades last February and March.

Pridham also emphasised that US households have around US$2.2 trillion in cumulative savings. This is a cash stimulus that remains largely unspent due to stay-at-home orders, which is only now making its way into the economy as vaccination rates rise and the reopening progresses.

“Money velocity is at record lows, and that’s what is curtailing inflation to some degree at the moment…and over the pandemic period we also saw very little company CAPEX done,” Pridham said.

“And we’re already seeing companies start to announce their intentions to really ramp back up to previous levels and actually try to catch up from the underspend of last year, so we’ll probably see that continue to pick up over the next several quarters.”

What happens next?

The potential for inflation levels to start lifting is a key risk on Pridham’s radar. He points to US-listed firm Fastenal (NASDAQ: FAST), which supplies nuts and bolts to manufacturing companies across numerous industries, to demonstrate how this may start to play out.

At a recent shareholder update, Fastenal's management indicated it started rolling out price increases in first-quarter 2021. This may seem quite late, given the economic effects of the pandemic first hit more than 12 months ago. But as Pridham explained, “material cost inflation” – the rising costs of raw materials that companies use to create their products – is only now really starting to bite. This is because companies like Fastenal have only now started exhausting their pre-pandemic inventory of materials purchased at lower prices than are available now. To preserve their margins, they now need to start charging more for products.

Source: Federal Reserve Bank of St. Louis

And Fastenal isn’t alone in feeling this effect, which is rolling out across product providers in numerous market segments. “This will be a common occurrence…it’ll be another quarter or two until you start to see the real impact of inflation and see the real numbers coming through,” said Pridham.

Will this affect company valuations?

“Right now the market thinks that’s transitory…I’m not too sure what’s going to happen there, we’ve got very little edge in that regard,” said Pridham. But his concern is that the market may start to get worried once this higher inflation effect becomes clear: “It’s something we’re watching quite carefully.”

Multiple compression – which occurs when company earnings increase but share prices don’t rise in response – is often a feature of markets shifting from early-stage to mid-stage, explained Pridham.

“The biggest earnings growth numbers will probably cycle through in the second quarter,” he said. This coincides with the comparison of the March-to-June period from a year earlier when the pandemic effect was at its worst as many economies were shut down. “We’ll see some incredibly big growth numbers in some industries on the back of that.”

“But then following that, you’re going to be cycling some strong improvement numbers, so that means your absolute growth rate number probably comes down a touch," Pridham said.

“You’re still going to grow, but it’s not going to be those big growth rate numbers you’ve seen over the last few quarters.”

This will create multiple compression, which is something we’ve already seen with the likes of online collaboration platform Zoom (NASDAQ: ZM), which Pridham referred to as “the posterchild of at-home winners.”

“The stock went ballistic through this period, but in October it peaked,” he said. Zoom’s share price then flattened, just ahead of Pfizer’s groundbreaking announcement of positive vaccine efficacy results from late-stage trials. This in turn saw the shift from at-home stocks rising toward more reopening-oriented plays.

“And since October, Zoom is down over 40%. They’re still growing at an incredible clip, yet their multiple has been compressed, and I think we’ll see that across several of those industries.”

But this effect will be offset by companies that are growing faster than that multiple compression; that are reopening winners not just at-home winners, explained Pridham.

Coming back to his earlier point about the huge amount of pent-up cash burning holes in pockets, Pridham discussed some of the specific companies his team holds to play rising consumer spending. These include:

- PVH Corp (NYSE: PVH), a clothing manufacturer that owns Van Heusen, Tommy Hilfiger, Calvin Klein and other apparel brands

- Outdoor accessories company Yeti Holdings (NYSE: YETI)

- Bedding manufacturer Tempur Sealy International (NYSE: TPX), which was an at-home winner but is still targeting revenue growth of 15-20% in 2021

-

Bed Bath & Beyond (NASDAQ: BBBY), whose product lineup includes domestic homeware and appliances along with baby merchandise via subsidiary Buy Buy Baby.

Pridham and his team are also increasing exposures to companies they believe will benefit from US President Joe Biden’s latest tranche of stimulus, which is targeting infrastructure.

Some of the key companies cited by Pridham in this regard include:

- Wilscott (NASDAQ: WSC), which owns 45% of the modular office market in the US

-

Keysight Technologies (NYSE: KEYS), one of just three companies globally that runs testing and diagnostics on 5G, electric vehicle batteries and charging stations

-

Anritsu, a Japanese telecommunications electronics equipment tester critical in the rollout of the 5G quality assurance

-

Kion Group, a German company that manufactures forklift trucks and other materials-handling equipment

- US-based factory automation software firm PTC (NASDAQ: PTC)

- French testing, inspection and certification company Bureau Veritas

- XPO Logistics (NYSE: XPO), a US transportation and logistics company operating in 30 countries.

Want to learn more?

The Ellerston Global Mid Small Fund invests in between 20 and 40 Securities with a global mid-small cap bias. These securities are much larger than you think. The Fund, if represented as one stock, would be in the top 50 on the ASX with average market cap close to US$8bn. For further information, please visit the Ellerston website.

5 topics

2 contributors mentioned