Four key questions for ARB and its US expansion

On a recent trip to the US, we spent a considerable amount of time researching the US automotive aftermarket industry and understanding the potential long-term tailwinds that ARB Corporation (ASX: ARB), which is Australia’s largest manufacturer and distributor of 4x4 accessories, might face in the future. As such, listed below are four key questions we tried to address while in the US.

1) Is the 4WD market different to Australia, if so, how?

The most common new vehicle sold in the US in 2022 was the Ford F-Series, selling ~650k units, the preference for a bulky ute was not too dissimilar to Australia with the Toyota Hilux taking top spot locally. Although bigger, it might be somewhat surprising that the F-150 is only 56 centimes longer than the Hilux, see illustration below of a Toyota HiLux (in blue below) and a Ford F-150 shaded in the back.

Source – Carsized

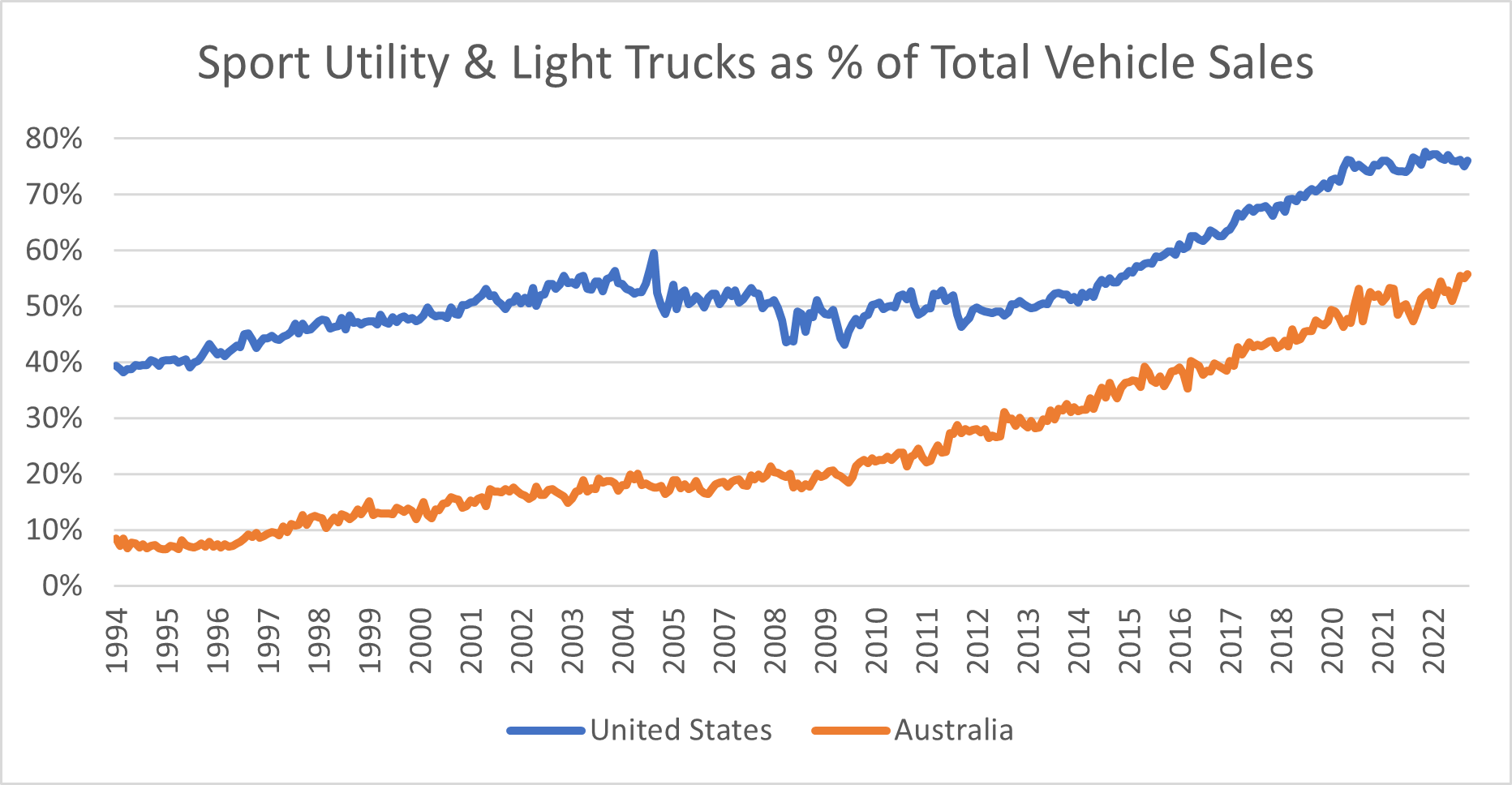

What’s worth noting is the popularity of sport utility and light trucks as a percentage of total vehicle sales, which is depicted in the below graph. Clearly, the US is well ahead of Australia in their preference but there are plenty of reasons to cite for a higher adoption of SUVs and trucks in the US compared to Australia. Some of these could include manufacturing and capability related factors, road specifications or even natural terrain. However, as noted in the below chart, Australia might only be 5-7 years behind the US in terms of adoption, however there are a few second order effects to consider.

Source - Factset

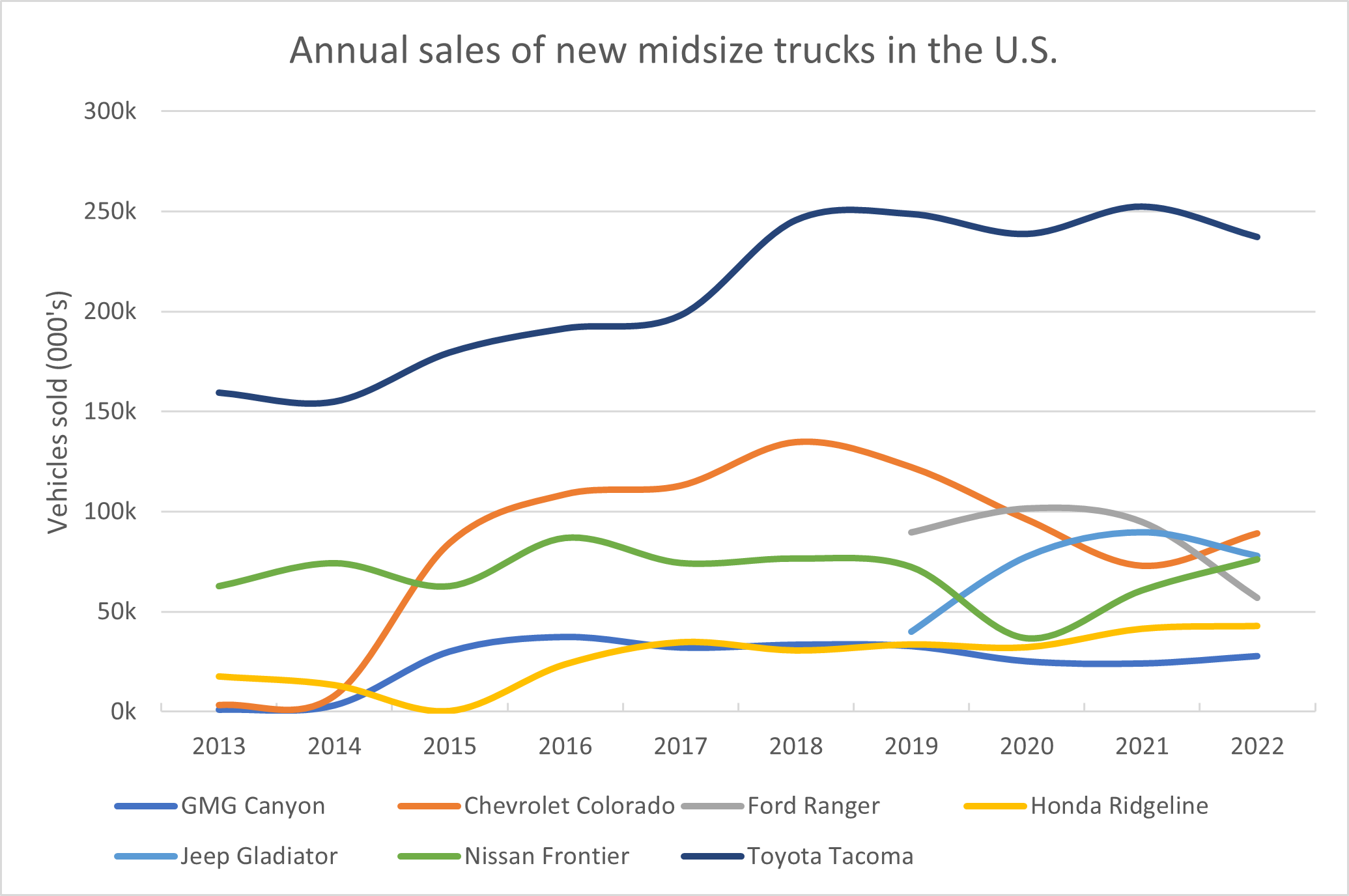

The preference for larger trucks like the Ford F-250 and F-350 (both larger than the F-150), are often seen to be “too big” for off roading due to smaller ground clearance and turning circle, plus being a much heavier vehicle. This is slightly different to Australia, which has historically had a preference for smaller, more manoeuvrable SUVs like a Toyota HiLux, Landcruiser or even the Ford Ranger, which is much more suitable for off roading. However there has been a shift in the US towards midsize trucks which is illustrated below.

Source - Edmunds

While it’s clear there is a preference for larger trucks, one other noticeable observation is the preference for lift and wheel/trye kits in the US compared to Australia. The preference not only shapes the carpark but also the retail experience. One stop on our trip was to a 4 Wheel Parts store in Salt Lake City, Utah which is a distributor of ARB products, and it is no surprise that one third of the store floor space was dedicated to wheels and tyres.

So why the preference for the big bulky raised truck in the US? During most meetings and conversations it was stated that it’s ‘all for show’ and often referred to as a ‘mall crawler’ (a car with all the accessories but just used to go shopping at the mall and drop the kids off at school). In comparison to Australia, the raised truck could be similar to a bullbar, which is designed to protect the radiator in the event of an accident with a large animal, but both Toyota and Ford stating pre-COVID ~80-90% of their models that can go off road, don’t. Hence the majority of the cars are just for ‘show’.

2) How does the current environment impact the US Automotive Aftermarket sector?

It was clear that from a macroeconomic point of view, the US is in a very similar place to Australia. Both have experienced record low levels of unemployment while inflation might not be back within the desired target range, the full impact of interest rate rises is starting to be felt. This won’t be news to anyone, however if you add supply chain issues and long wait times for cars into the mix a very conflicted market dynamic exists.

Anecdotally, most sales staff and executives flagged that sales had been impacted since the end of 2022 as consumer confidence declined and discretionary spending tightened. Having said this, several sales staff pointed to long lead times for new vehicles that was providing a cushion for any significant slowdown within the sector.

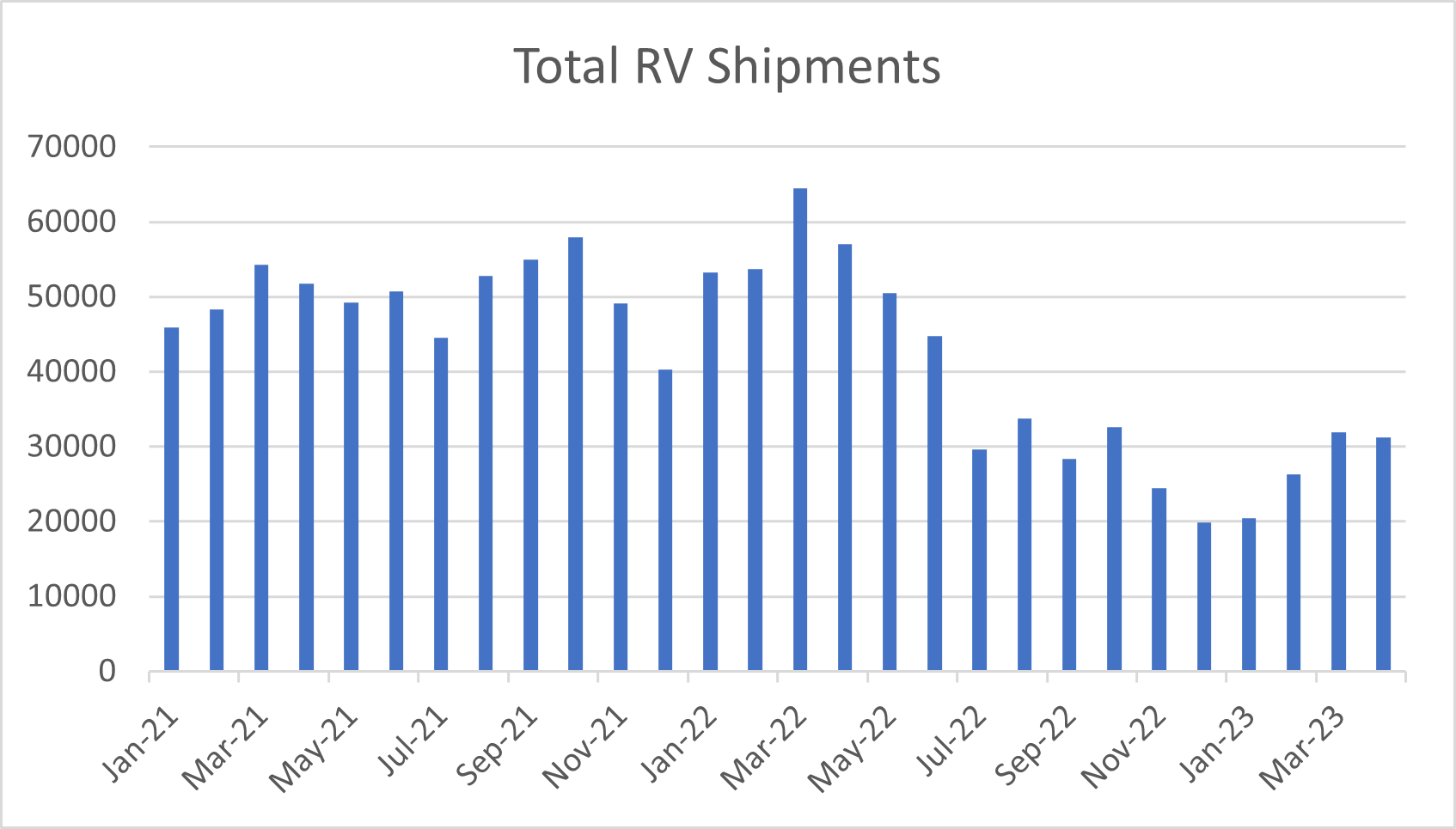

The above trend can’t be applied to all aspects of the 4WD/outdoors space, as the RV/Camper market which saw a large spike in demand as international borders were closed, somewhat similar to the car market, is now seeing dramatically lower volumes post COVID.

Looking at data from the RV Industry Association in the US, shipments for the first 4 months of 2023 are down ~50% vs compared to last year.

Source – RV Industry Association

The RV market could be a canary in the coal mine for the rest of the Automotive sector and as Don Clark, President of Grand Design RV, a subsidiary of Winnebago Industries put it “I think we’re going through a resettling stage where many of you took on products in some cases just because of the volume of people (consumers) who were discovering the RV lifestyle (over the past couple of years)… and even though the economy is slowing, I think we’re getting back to a new norm, whatever that’s going to be.”

3) What does a successful retail presence look like?

Recently at Ford Motor Company’s Capital Markets Day they stated the US aftermarket accessories industry is worth USD $8bn, with the average spend on aftermarket products from a Bronco owner being USD $1,700. Clearly a huge opportunity for ARB, but is it simple and straight forward?

Recently under new management, 4 Wheel Parts which is a distributor of ARB product, has changed strategy as they were previously following a strategy to expand their store network with long-term aspirations to double their footprint but are now reducing their store count. At the same time, the new owners have closed their wholesale distribution division which had partnered with ARB. This change in strategy has impacted sales, an issue ARB is addressing.

From an ARB point of view, we noted a wide representation of products across the store in Salt Lake City but a limited variety and range given 4 Wheel Parts is more like a Burson or Repco, focusing more on a typical “mall crawler” than a typical ARB store locally, which focuses on the off-roading and camping die-hard. From a competitor perspective, as pictured below, SmittyBilt products, owned by the same owners as 4 Wheel Parts, were prominent.

The other store on our trip was Expedition Superstore in Salt Lake City, which was very different to 4 Wheel Parts, and could almost be described as a camping and accessories store, similar to an Anaconda or an Adventure Kings store in Australia. Again, ARB was well represented in store, albeit there was no "bar wall".

On the retail side, it’s early days for ARB in the US, given their newly announced Seattle store does not open until early 2024. However, ARB’s eCommerce site will open in 3Q23 and will to address certain headwinds, as reflected by the CEO’s comments.

“By having direct access to the customer, we'll hopefully learn to better understand the products and the way our customers are using their vehicle so that we can build, design, and supply products to those customers more in line with the needs of the US market.” Lachlan McCann, CEO, ARB Corporation, 1H FY23 Earnings Call.

4) What does a successful Original Equipment (OE) partnership look like?

Fox Factory which is a global leader in design and manufacturing suspensions for bikes, All-Terrain Vehicles (ATVs), and on/off road vehicles have two divisions that provide good insights and reference points for ARB in the OE space.

Located in Gainesville, Atlanta, their 115,000 sqm factory which houses 1,800 staff working 4 shifts, 24 hours, 7 days a week is very impressive in terms of sheer size and scale, and also a great example of a well-oiled machine that produces ~30-40k suspensions per week. For Tuscany Motors, which is located in the ‘RV Capital Of The World’, they are an outfitter that build custom upgrades to ~17,000 utes per year.

For ARB, Fox’s OE (original equipment) relationships with Ford Motor Company on cars like the Raptor is a great example of a partnership model that avoids the retail segment, as Fox Suspensions are fitted at the time of manufacturing and not post the initial sale.

This is somewhat similar to Tuscany that takes direct shipment of chassis from the OE, before adding substantial upgrades which could include new wheels, tyres, lift and potentially a super charger. The end product is sold into the premium end, with the average truck retailing for USD $125-150k.

It is worth mentioning that ARB has already established strong relationships with OEMs (original equipment manufacturers) in the US. This includes the Ford Licensed Accessory (FLA) program and while not officially named, ARB have been working with Toyota in particular for their new Tacoma (equivalent to the Australian HiLux), which is one of the most popular mid-size trucks in the US, selling ~215,000 last year.

NAOS Key Takeaways

In our view, it’s a long road ahead for ARB in the US and at this point in the cycle we would prefer to monitor the following key areas going forward:

- Any signs of weakness from the consumer, especially after record rate rises.

- Change in preference of mid trucks/SUVs, especially in the US given the release of several new models e.g. Toyota Tacoma and Ford Bronco

- Given the closure of 4 Wheel Parts wholesale distribution division, details of ARB’s new distributor and corresponding strategy for the US wholesale segment.

- Details of any new OE arrangements plus any changes/alterations to the existing Ford and Toyota agreements.

5 topics

1 stock mentioned