From rates bear to earnings bear: These are the stocks that will survive the second cliff

It’s often said that what goes up, must come down. With regard to global markets, what went up in 2021 and 2021 has come down, way down.

The Nasdaq Composite is down almost 35% from its November high, while the Dow Jones Industrial Average is down almost 20% from November.

There’s no doubt that this has been due to rate fears, itself a corollary of inflation.

But what if I was to tell you that this is the first of several drawdowns.

What will drive the next one? Earnings (or, rather, the lack thereof).

To find out how this will all play out, I reached out to two global fund managers – Mary Manning from Alphinity Investment Management and Nick Thomson from Lakehouse Capital.

They also offer up some stock picks that have the key attributes needed to survive the second round earnings onslaught.

From rate bear to earnings bear

We might already be dealing with the second type of bear. Or maybe that means we’ve got two bears on our hands, which can’t be good.

According to Manning, global stocks are already in an earnings downgrade cycle.

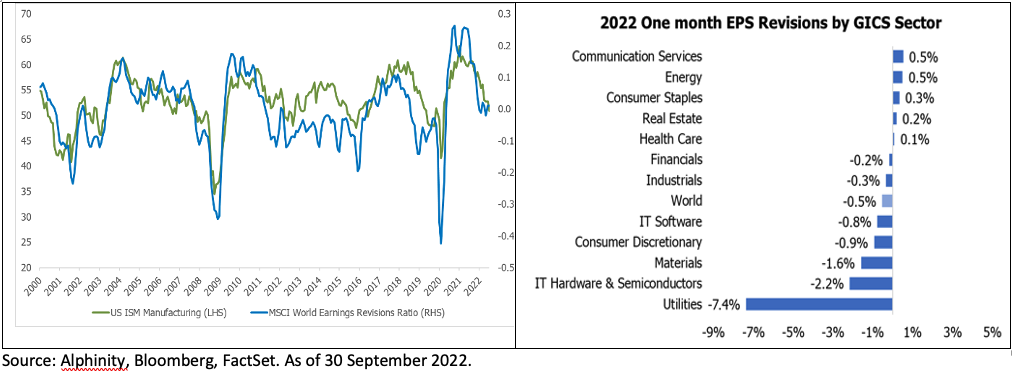

Manning makes the point with the below charts.

The first chart above shows that the MSCI World Earnings Revision Ratio peaked in second half of 2021. The second chart shows that over the last month, very few sectors are getting positive EPS revisions while multiple sectors are seeing significant downgrades.

“The bigger question is if the earnings bear market is going to enter a new phase,” says Manning.

Manning says that many of the earnings downgrades in first half of 2022 were characterized by margin compression due to input cost inflation.

“Increasingly, companies are citing demand weakness and inventory issues as a source of earnings misses and weak guidance. The translation effects associated with a strong USD pose additional earnings risk for multi-national companies (MNCs) based in the US.”

Thomson agrees that earnings multiples are down, but could fall again once weaker demand filters through.

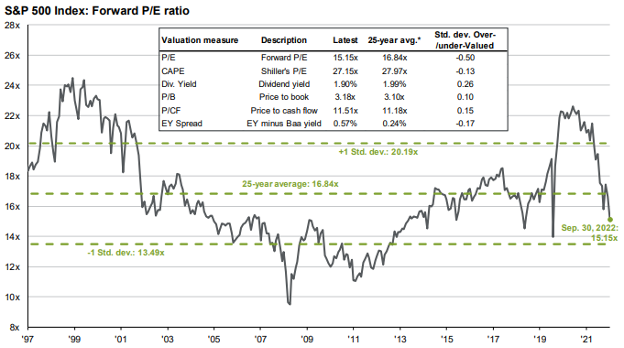

“As the below chart shows, the S&P 500 is trading roughly 10% below its 25-year average price to forward earnings multiple, though we note forecast earnings could step down if economic conditions deteriorate, and reset this forward-looking metric in the process.”

If the rate hikes do what they’re designed to do, demand will fall. And with that, operating conditions.

“Operating conditions are likely to become much more challenging for businesses going forward as they face persistent (albeit moderating) inflation and demand destruction kicks in following the rapid increase in interest rates,” says Thomson.

Go for moats

While the drawdowns are broad-based, some companies are well equipped to weather the storm.

“Investors must be selective,” says Thomson.

“It will be critical to own businesses with quality fundamentals: such as pricing power, secular growth and relatively inelastic demand, as those businesses will be best placed to neutralise the impact of inflation and continue growing despite broader economic weakness.”

Thomson highlights Visa (NASDAQ: V) is an example that ticks all the boxes.

“The company boasts a strong network effect as the world's largest payment processor.

“The combination of an attractive industry structure (effectively a duopoly with Mastercard), a product that is mission-critical to both customers and merchants and the ongoing secular shift towards digital payments provides a foundation that should enable them to keep driving growth, no matter what the economic conditions."

In terms of inflation protection, "their ‘toll booth’ like business model, whereby revenue is a percentage of the dollar value of all transactions crossing their ecosystem, also ensures they are well placed in the event that inflation proves to be more persistent than expected.”

Manning agrees on the importance of pricing power and resilient demand.

“When input prices rise due to inflationary pressures, companies that can pass those increases through with little or no impact on demand are relative winners,” she says.

Examples of stocks with pricing power are LVMH (MC FP) and Mercedes Benz Group (MBG GR).

"It is not a coincidence that both stocks are considered luxury. Luxury consumers are much less price sensitive.”

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

1 stock mentioned

2 contributors mentioned