Game, set and match: The RBA delivers its first election rate hike since 2007

The Reserve Bank held its monthly meeting today, and what a time to be alive. For the first time since November 2010, the cash rate target has been lifted in Australia and for the first time since the reign of Glenn Stevens, the monetary authority has raised the rate during an election cycle.

The old, true, and tried reasoning of "don't hike during an election campaign to remain apolitical" seems to have gone completely out the window. And with good reason.

Since Australia printed a 5% headline year-on-year rise last week, inflation and rate rises have become the subject of endless chatter on markets and in the press. One personal favourite headline of mine was this one:

Too dramatic, I hear you say? Not necessarily.

Even the Victorian Labor government – ahead of its own state election later this year – is starting to dole out one-off cost of living subsidies to help its citizens fight inflation.

Market reaction

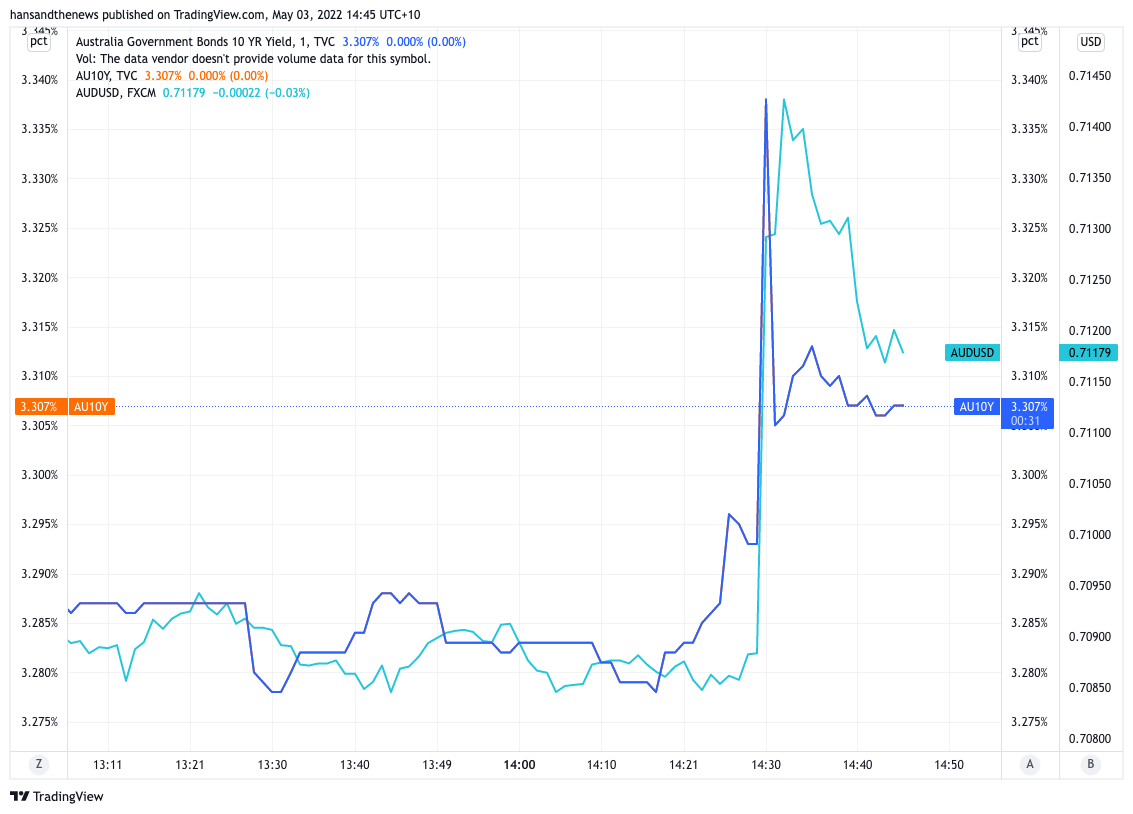

If you needed any indication markets were ready and raring to go for this meeting, just take a look at this price chart showcasing the moves in the Australian dollar and the benchmark bond yield following the decision.

The ASX 200 is not pictured here but it erased all its early gains immediately after the decision was released to the market... a market that still thinks the terminal rate of the RBA will fall in around 2.5%.

Economists were clustered around a 0.15% increase in the cash rate, which would have seen the benchmark at 0.25%. Instead, they have increased by 0.25% to a comparatively hawkish 0.35%. The bank also hiked the interest rate on Exchange Settlement balances from zero percent to 25 basis points, thus increasing the cost for the big banks to keep capital in their accounts at the monetary authority.

Nick Bishop of Bishop and Fang said the revised forecast for inflation "cements a string of misjudgments from the RBA. To avoid hiking at this meeting would have further damaged credibility."

"The question remaining is how central banks can save face, and avoid recession."

Roll out the highlight reel

In its statement, the Board said now was the right time to begin withdrawing some of the extraordinary monetary support that was put in place to help the Australian economy during the pandemic.

Even more importantly, the central forecast for headline inflation has soared big time to around 6 percent - with underlying inflation of around 4.75 percent by the end of 2022.

These figures are also expected to not come down until mid-2024 - and it also comes from the same central bank that thought inflation would not even reach the target band by 2024 until very recently.

Finally - the part that will get tongues really wagging in households across the nation - the return to "normal" inflation "will require a further lift in interest rates over the period ahead." Just as significantly, it's not given guidance as to the pace of those hikes, making it even more challenging for households.

So what does today's historic move from Martin Place do for our economic trajectory?

Sarah Hunter, KPMG

While the size of the hike was unusual the drivers were not, with the Governor flagging rising inflationary pressures and the strength of the domestic economy as signals that it is time to begin normalising monetary policy settings.

Looking ahead, it’s clear that further rate rises are on the horizon – at KPMG we’re expecting at least three more before the end of the year to take the cash rate to 1-1.25%. The financial system will also have to adjust to Quantitative Tightening, albeit in a passive capacity, with the Board announcing that they will allow maturing bonds to roll off their balance sheet.

Scott Haslem, Crestone Wealth CIO

For investors, rising rates can be a headwind for equities. However, the spectre of rising rates has been well known for some time, and equities often do quite well in the early stages of policy tightening, when the market recognises the reason that rates are rising typically reflects a strong underlying economy, and thus company earnings.

That said, rising rate expectations have had, and will continue to have, significant impacts on equity sector strategy in the months ahead. In the other direction, with 10-year Aussie government bonds yielding over 3.3% for a near-capital protected investment, rising interest rates should make designing well-diversified portfolios somewhat easier as fixed income once again can assume the role of defensive ballast.

Notwithstanding the late start to normalising interest rates, policy retains the opportunity to deliver a ‘soft landing’, or at least, avoid recession. This will require a keen focus on lifting rates relatively quickly over the coming year, but at the same time, choosing times to pause, observing the lagged impacts of monetary policy, and ensuring mistakes aren’t made in the other direction through overtightening.

Looking ahead

There are three key dates coming up for the Reserve Bank before its next get-together/conclave meeting. One is very obvious to economists while the other is very obvious to everyone else.

For economists, elections don't always change the needle for their calls or trades. Partially because politics is a volatile beast and partially because polling day is more tail risk than a central concern. Morgan Stanley had this to write in its macro client note yesterday:

"As seen in 2010, minority government settings can lead to stalled and compromised fiscal intent and reaction. something not factored into growth or earnings outlooks, we would suspect."

That's one thing always worth keeping an eye on. The other two are blockbuster economic releases – the quarterly wage price index on May 18th. This will be particularly crucial to the Reserve Bank as it has said (repeatedly) it wants to see wages growth rise sustainably over the next few months for its policy stance to materially change. At first, it said that it was waiting for this print to raise rates but after today, even that's out the window.

The other date which will be very important is June 1st - a rare Wednesday before the first Tuesday in every month where the national accounts (aka GDP) are handed down. Has the slow return of the services economy along with booming commodity exports going to push economic growth to a four-handle?

The RBA's own projections certainly think so. Then again, they also were way off on inflation.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best macro strategists, economists, and fixed income fund managers. If you have questions of your own or guests we should chat to, flick us an email: content@livewiremarkets.com

4 topics