German flash manufacturing PMI rose to 45.4, US advance GDP slumped to 3.5% q/q

Let’s hop straight into five of the biggest developments this week.

1. New Zealand’s CPI fell to 0. 5% q/q

New Zealand’s inflation conundrum eased off substantially in the last quarter of 2023. CPI came in at 0.5%, in line with market expectations and a marked reduction from the previous 1.8%. The inference is that the RBNZ’s interest rate hikes are making headways to attain the central bank’s 1-3% inflation target despite the target being a long way off.

2. German flash manufacturing PMI rose to 45.4

The recovery in German manufacturing is gaining momentum at a faster rate than initial estimates. Despite remaining in contractionary territory, the flash manufacturing PMI jumped up to 45.4, the highest reading since February last year. This came as a surprise to markets that had priced in a measly improvement of 43.7 from the previous 43.3. Low energy prices largely underpin the surge in manufacturing activity.

3. Canada held interest rates static at 5%

The BOC left interest rates unchanged for a fourth consecutive meeting. The overnight rate held static at 5% just as markets had predicted, albeit with an overly dovish statement. With the once rampant inflation fizzling off and an environment of weakening growth, markets are still holding on to the expectation that the BOC will finally capitulate and cut rates in the second half of the year.

4. ECB left interest rates unchanged at 4.5%

The ECB sat on its hand to maintain its main refinancing rate at 4.5% for a second consecutive sitting. This was in line with market expectations and points to the overall thawing of inflationary pressure owing to the prevailing tight monetary policy. The ECB statement highlighted the fact that despite the energy-driven baseline rise, underlying inflationary pressure is on the decline.

5. US advance GDP slumped to 3.5% q/q

Growth in the US economy is slowing at a slower rate than previously thought. The advanced GDP growth for the last quarter fell to 3.5% from the previous 4.9%. This was however a much better posting than market expectations of 2%. While not as bad as forecasted, it is notable that the historically high-interest rates are beginning to stifle growth.

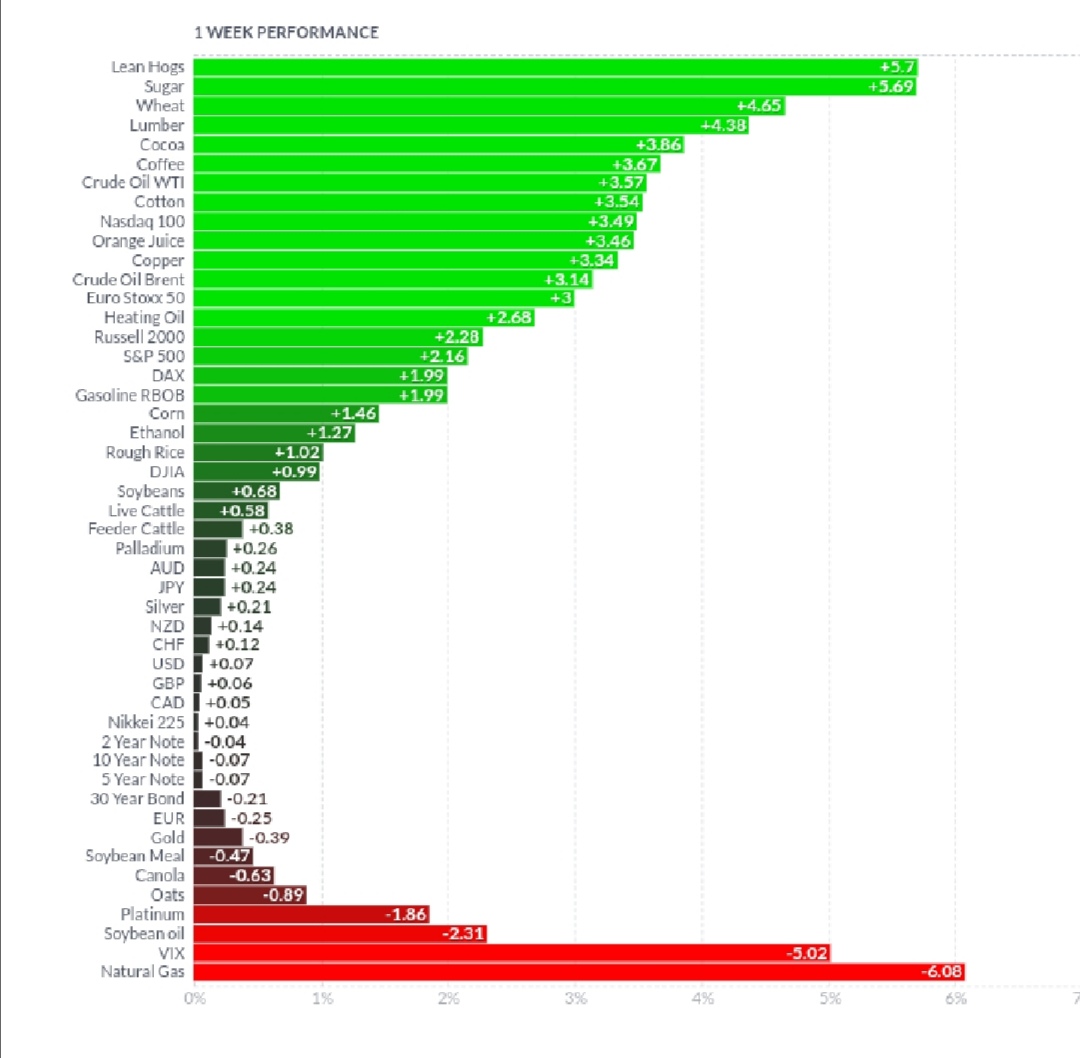

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

The VIX fell sharply as markets discounted the geopolitical risk from the raging conflict in the Middle East as demand for commodities soared. Greed was widespread as market participants went out of their way to leverage high-risk- high-return investments. Global indices were boosted in the process with the Euro Stoxx 50 leading the fray with a +4.3% gain. Sugar, wheat, cocoa, and coffee were up on supply fears with the El Nino weather pattern portending adversity to output, while cotton was up on heightened demand due to seasonality. The energy complex remained strong on supply headwinds after the US escalated airstrikes on Houthi positions in Yemen coupled with a reduction in output from the USA. Currencies and treasuries were the biggest losers on capital fright to higher-yielding investments.

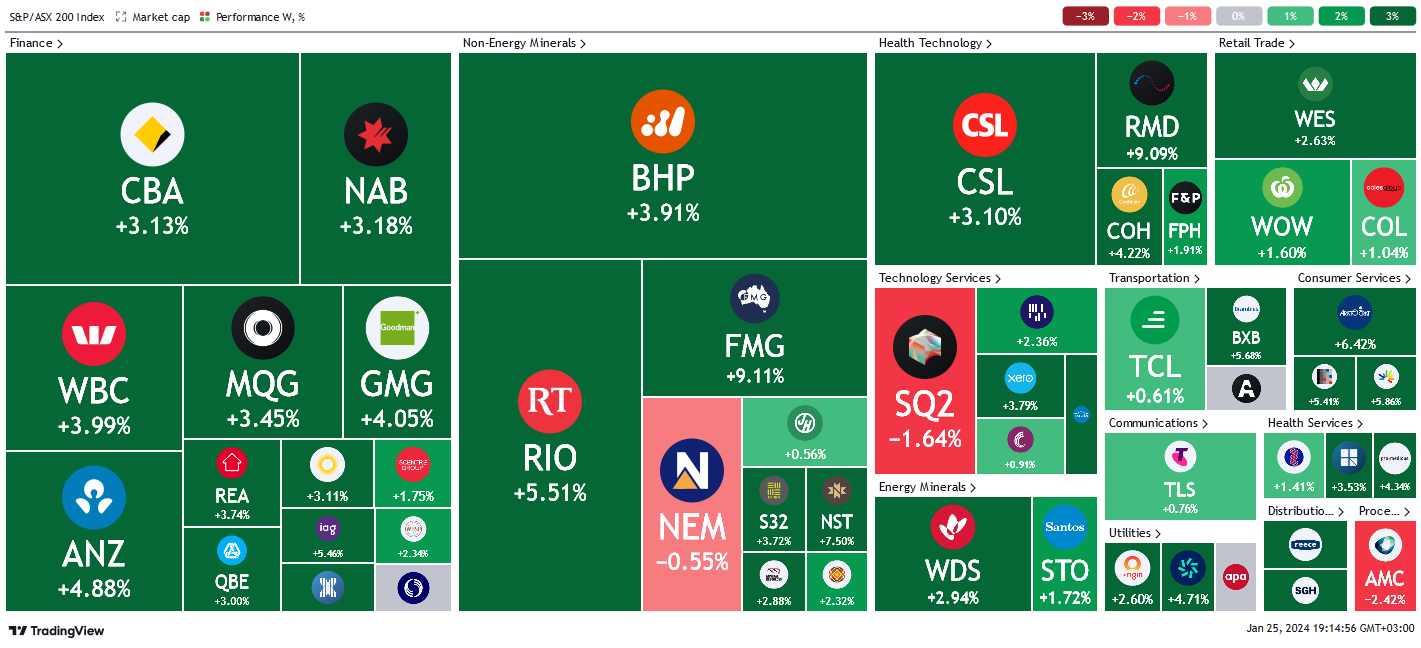

Here is the week's heatmap for the largest companies in the ASX.

The ASX is back with a bang this week, rebounding strongly to recoup most of last week’s losses with most sectors accruing solid gains. The financial sector led to a remarkable comeback with all stocks in the green without exception. IAG and GMG led the charge with gains of +5.46% and 4.05% respectively. Nonenergy miners were not left behind in the bullish bonanza with virtually all stocks but one sitting on impressive profits. FMG and NST outbought the index as bulls ran to see the stocks close +9.11% and +7.50% up. NEM was the only laggard in the sector to close flat at – 0.54%. Healthcare tech stocks were another clean sweep with all stocks up. Retailers, tech services, energy miners, transporters, consumers, utilities, and distributors fired on all cylinders to wrap up a bullish week.

5 topics

5 stocks mentioned