Get 8% pa net yield from rated bank bonds that beats stocks and property

After years of near-zero cash rates and bond yields, today's fixed-income market is creating a whole gamut of opportunities (and threats for alternatives that cannot compete).

10-year Aussie government bond yields hit 4% this week after the RBA lifted its cash rate to 4.10% with the spectre of much more to come. It is likely the central bank will consider hiking rates towards 5% in the coming months to tackle the nascent wage-price spiral that is fuelling Australia’s inflation crisis.

The RBA now accepts that there is a potentially high probability that these record interest rate increases will push Australia into recession, killing many businesses in the process.

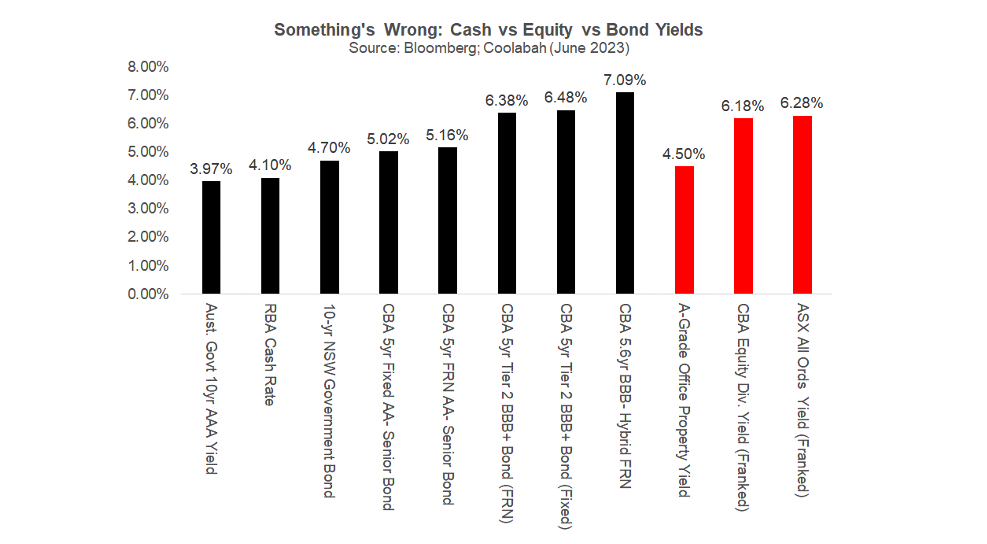

Highly-rated bonds issued by Australia's biggest banks can fetch you a cash running yield of as much as 6.5% pa today, more than the dividend yield you get on riskier CBA shares (even after accounting for the franking credits on shares).

The return of risk-free cash rates of 4-5% also creates challenges for other asset-classes. Commercial real estate and residential property are still paying unattractive yields of around 4-5%, less than you earn on riskless term deposits.

And illiquid and risky “private debt” and “high yield” bonds, which can offer yields above bank bonds, involve lending to higher risk companies that can go bust, resulting in the debt going into default. Global corporate defaults in 2023 are already the highest since 2010.

In recent years, we have seen Aussie investors lose most, if not all, of their money when investing in Virgin Airlines’ high-yielding senior bonds and Credit Suisse’s high-yielding hybrids, both of which were wiped out.

So, how can you find attractive yields without taking unacceptable risks?

That's where Coolabah Capital Investments come in. Our 38 person team situated Sydney, London and Melbourne, including 12 traders/portfolio managers and 12 analysts, is dedicated to finding and exploiting mispricings in the safer parts of the global bond market with the goal of generating superior total returns for our investors without exposing you to more risk than is necessary.

Last year we identified that the senior-ranking and Tier 2 bonds issued by Australia’s major banks were historically cheap. By further harnessing low-cost gearing, we built a new strategy, called the Coolabah Floating-Rate High Yield Fund, which is currently yielding 8.0% pa net of fees via exposure to senior-ranking and Tier 2 bonds issued by leading Australian banks .

This portfolio is floating-rate and benefits from higher interest rates. It also has an average A- credit rating and offers daily redemption rights. It does not invest in hybrids, sub-investment grade bonds, private debt, or equities.

And it was recently rated “Recommended” by the researcher Zenith, which commented that “leveraging investment grade securities can produce superior Sharpe Ratio outcomes relative to investing in sub-investment grade, longer-dated corporate securities, where there is higher default and mark-to-market volatility risk”. (Please read the PDS to better understand the risks, and note that past performance does not assure future returns.)

For those worried about a recession and the RBA eventually cutting interest rates, we recently made available a fixed-rate bond strategy that benefits from declining government bond yields that would normally emerge during in a recessionary climate.

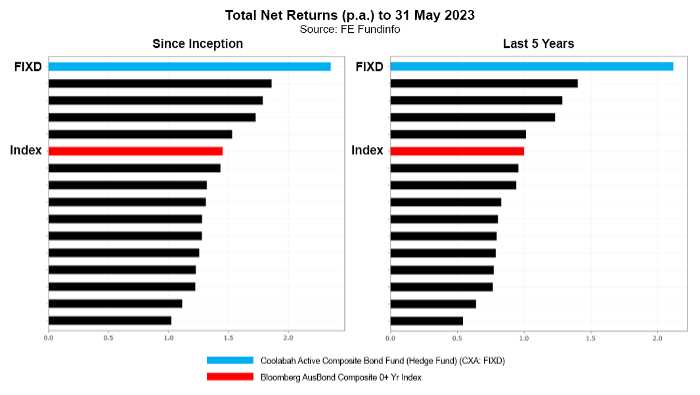

Our Active Composite Bond Strategy (a hedge fund available via CBOE under the ticker “FIXD”), which was launched for a super fund client in March 2017, is currently yielding 6.1% pa net of fees and has importantly outperformed all key peers and the Composite Bond Index since its inception after retail fees.

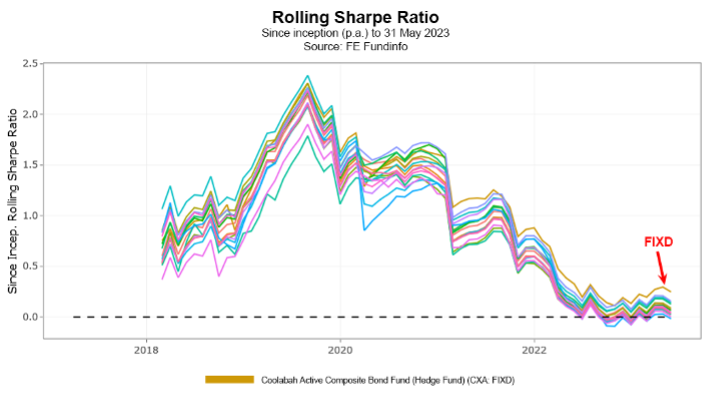

Crucially, FIXD has also beaten both the index and peers after fees on a risk-adjusted return basis as measured by its since inception Sharpe Ratio. It is rated “Recommended” by the researcher Lonsec. (Please read the PDS to better understand the risks, and note that past performance does not assure future returns.)

In this Fund in Focus, I'll share with you globally our unique approach to investing in today's bond and credit markets. I'll also tell you about the two new funds we have launched - the Coolabah Floating Rate High Yield Fund and the Coolabah Active Composite Bond Fund (Hedge Fund) (FIXD).

Timestamps:

- 0:00 - Introduction

- 0:28 - Introduction to Coolabah Capital Investments

- 2:05 - Coolabah's investment process and performance record

- 4:44 - The rise of risk-free yields

- 5:24 - The Coolabah Floating Rate High-Yield Fund

- 7:40 - The Coolabah Active Composite Bond Fund

Looking for higher income?

The Coolabah Floating-Rate High Yield Fund is currently yielding 8.0% pa net of fees with geared exposure to senior and Tier 2 bonds issued by primarily Australia’s four biggest banks. This portfolio is floating-rate and benefits from higher interest rates. It also has an average A- credit rating and offers daily redemption rights. It does not invest in hybrids, sub-investment grade bonds, private debt, or equities. And it was recently rated “Recommended” by the researcher Zenith. (Please read the PDS to better understand the risks, and note that past performance does not assure future returns.)

For those worried about a recession, we recently made available a fixed-rate bond strategy that benefits from declining government bond yields that normally emerge in a recessionary climate. Our Active Composite Bond Strategy (a hedge fund available via CBOE under the ticker “FIXD”), which was launched for a super fund client in March 2017, is currently yielding 6.1% pa net of fees and has outperformed all key peers and the Composite Bond Index since its inception after retail fees. It is rated “Recommended” by the researcher Lonsec. (Please read the PDS to better understand the risks, and note that past performance does not assure future returns.)

For more information about our income solutions please visit our website.

2 topics