Global listed infrastructure – Shielding US tariffs

Recent announcements concerning U.S tariffs have created heightened levels of uncertainty which has manifested in greater financial market volatility.

Like real estate, the infrastructure sector is not directly affected by tariffs. Infrastructure, especially utilities, remains stable through economic cycles because it provides essential services.

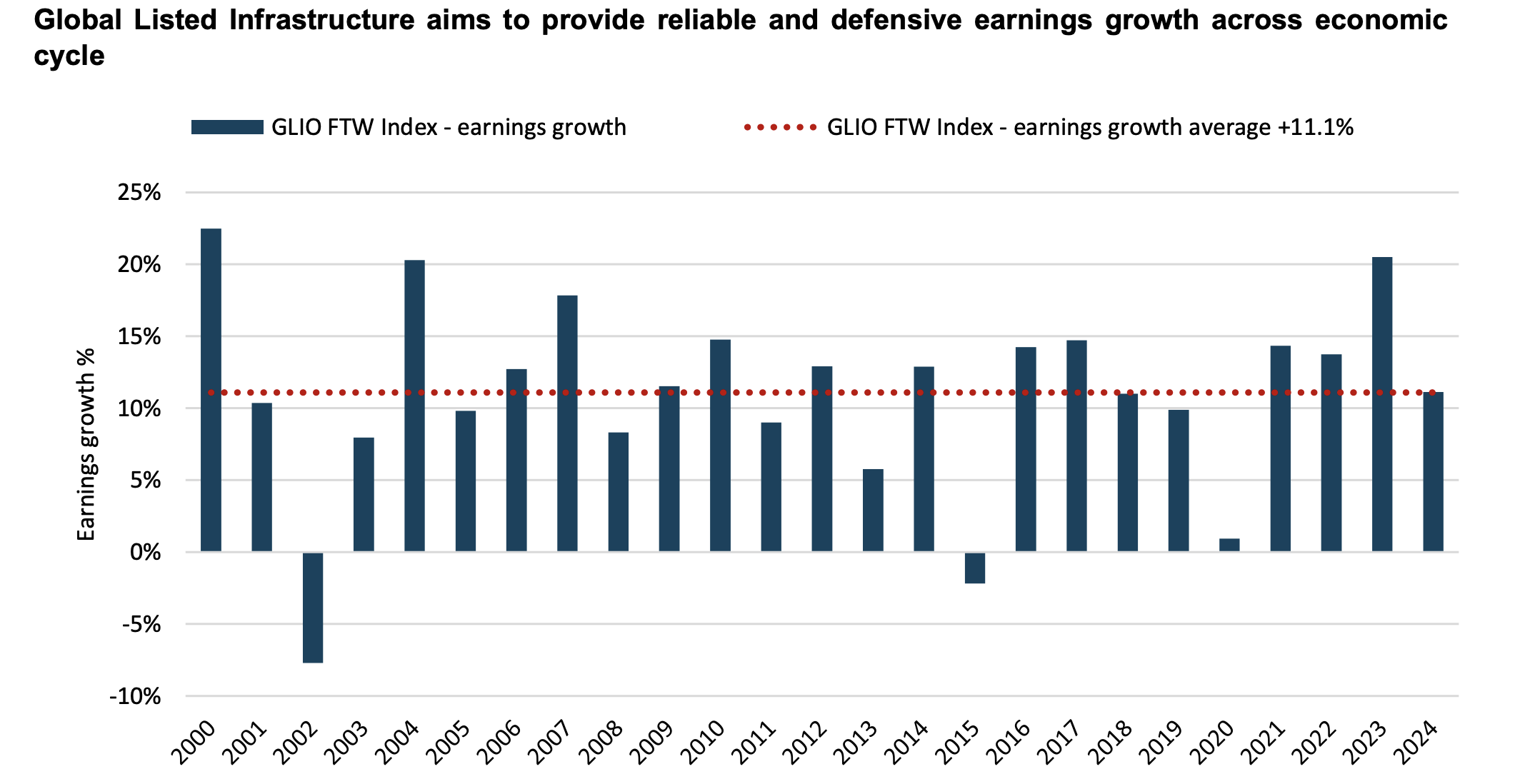

As shown in the chart below, the infrastructure sector has enjoyed years of consistent earnings growth, with the only disruption being the negative impact of Covid on airports and toll roads.

The monopoly-like qualities of infrastructure assets allow these businesses to pass through any indirect tariff related cost increases to the ultimate consumer.

Our recent meetings with management of several infrastructure companies confirmed these qualities.

As it stands, 93% of the Resolution Capital Global Listed Infrastructure Fund - Active ETF portfolio (as at 31 March 2025) has inflation pass-through mechanisms either directly or indirectly.

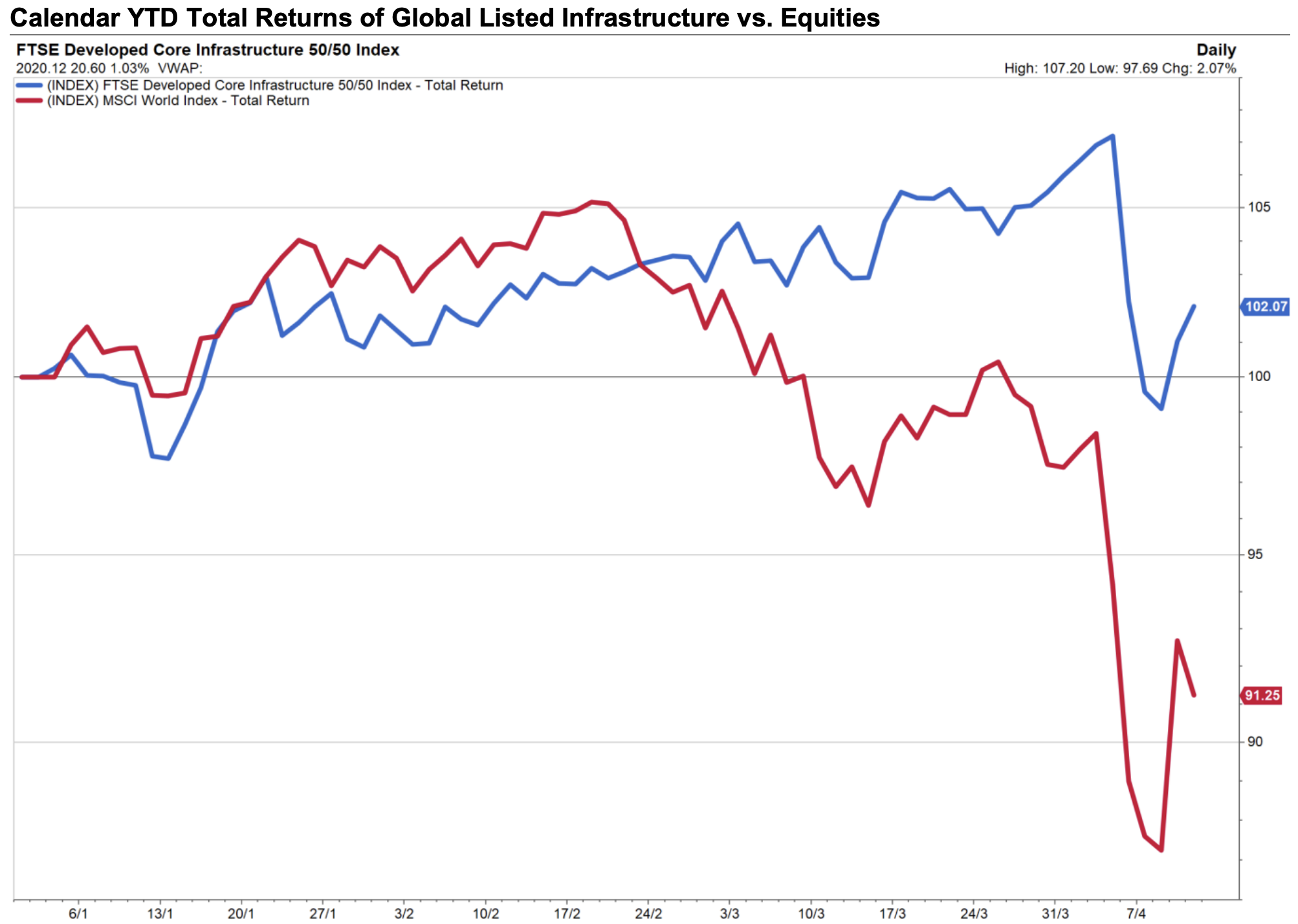

The defensive nature of the listed infrastructure sector is also highlighted in recent performance versus the broader equity market.

While there are no direct impacts from tariffs on the infrastructure asset class, the asset class is not totally immune.

Listed Infrastructure sub-sectors to watch

Indirect impacts differ by sub-sector, relating mostly to changes in flows of goods and people.

In the lead-up to the formal tariff announcement, we tilted the Resolution Capital Global Listed Infrastructure portfolio away from those sectors which we believe could be more impacted.

Within global listed infrastructure, transportation infrastructure could be more impacted over the long-term as complex supply chains adjust to tariffs. Even though the long-term implications are unclear, it is likely that reshoring of manufacturing in the U.S continues.

Ultimately this could benefit North American railroads such as Union Pacific Corp (NYSE: UNP) but we will wait for more clarity before factoring this into our base case forecasts.

Calendar-year-to-date, we have been increasing our position in the toll roads sector within transportation infrastructure because intra-urban road assets will be most insulated from both the short and long-term consequences of tariffs.

We believe our portfolio’s underlying infrastructure assets remain the most cost-effective and sensible way to serve American society’s critical needs. For instance, the reduction and then pause of tariffs, relating to Canadian crude oil is indicative of the crucial nature of energy flows via the established networks across North America.

Changing current energy flow is possible, but would lead to higher gas prices for U.S. consumers and could even lead to shortages in the near-term.

Long-term secular drivers such as the energy transition and digitisation remain in place and are drivers of real growth above inflation for related listed infrastructure.

Our key overweight position in U.S. electric utilities in the portfolio remains unchanged. Over the past year, we have been surprised by the incremental demand for electricity spearheaded by large corporates such as data centre hyperscalers for AI. This has led to growth investments by U.S. electric utilities which in turn, has led to earnings growth upgrades.

We recognise that hyperscalers are not immune to fluctuations in the economy so there is a question how secure are these growth prospects for utilities?

Taking into account tariffs and onshoring, there remains an underlying power shortage in the U.S. barring a significant economic contraction. Data centre planning is a multi-year and capital-intensive program for hyperscalers which recognise the critical need for power in their businesses.

Electric utilities and their regulators perform extensive due diligence and require serious commitments from large users. From a shareholders standpoint, utility capital investments are protected from the regulated business models once capex has been approved by the regulator.

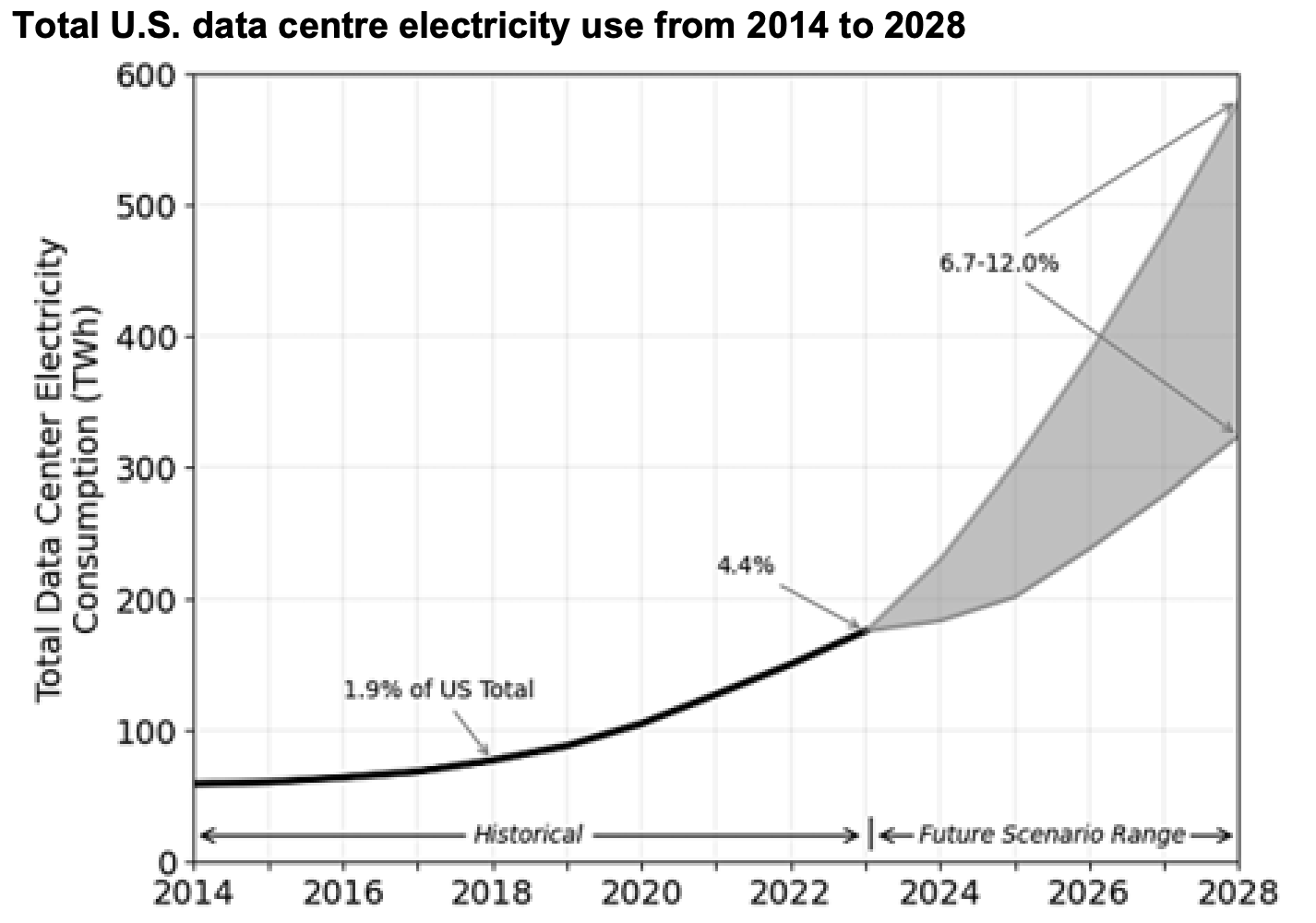

We believe we have been conservative in our projections for electricity growth and do not extrapolate the additional demand in electricity beyond five years The impact of data centres alone is significant as illustrated in the chart below.

While AI is a large draw on electricity demand, there are other nascent applications which draw on power as well as drivers such as electrification which are not in our current forecasts.

Balance sheet strength

More broadly across infrastructure, balance sheets remain appropriately geared to take advantage of growth opportunities. Net debt to earnings (EBITDA) for the benchmark (FTSE Developed Core 50/50 Infrastructure) stands at 4.1x.

There is a conservative level of interest coverage by underlying cashflows generated by these assets given the defensive nature of infrastructure. We expect equity raisings to be limited to investments into growth opportunities. These are done efficiently in North American utilities which programmatically increase their shares by low single digit percentages every year.

Our forecast earnings growth for the sector of 8% per annum over the next three years is unlikely to change materially regardless of the tariff settings and increasingly likely reduction in economic growth and broad equities corporate earnings.

Time to consider allocating to global listed infrastructure

Global listed infrastructure is an asset class in which its attractive characteristics remain intact, despite the high level of market volatility.

We continue to see that the growth tailwinds in the asset class will play out providing above-inflation growth for a defensive asset class.

Furthermore, valuations in global listed infrastructure have been marked-to-market for current interest rates, and we believe the long-term growth outlook remains underappreciated.

2 topics

1 stock mentioned