Gold is at all-time highs – So why are gold miners underperforming?

Between the tensions in the Middle East tensions, the uncertainty around the US election's outcome, the global central bank rate-cutting cycle, and soaring demand for gold-backed ETFs, there is a lot to like about gold as an investment opportunity right now.

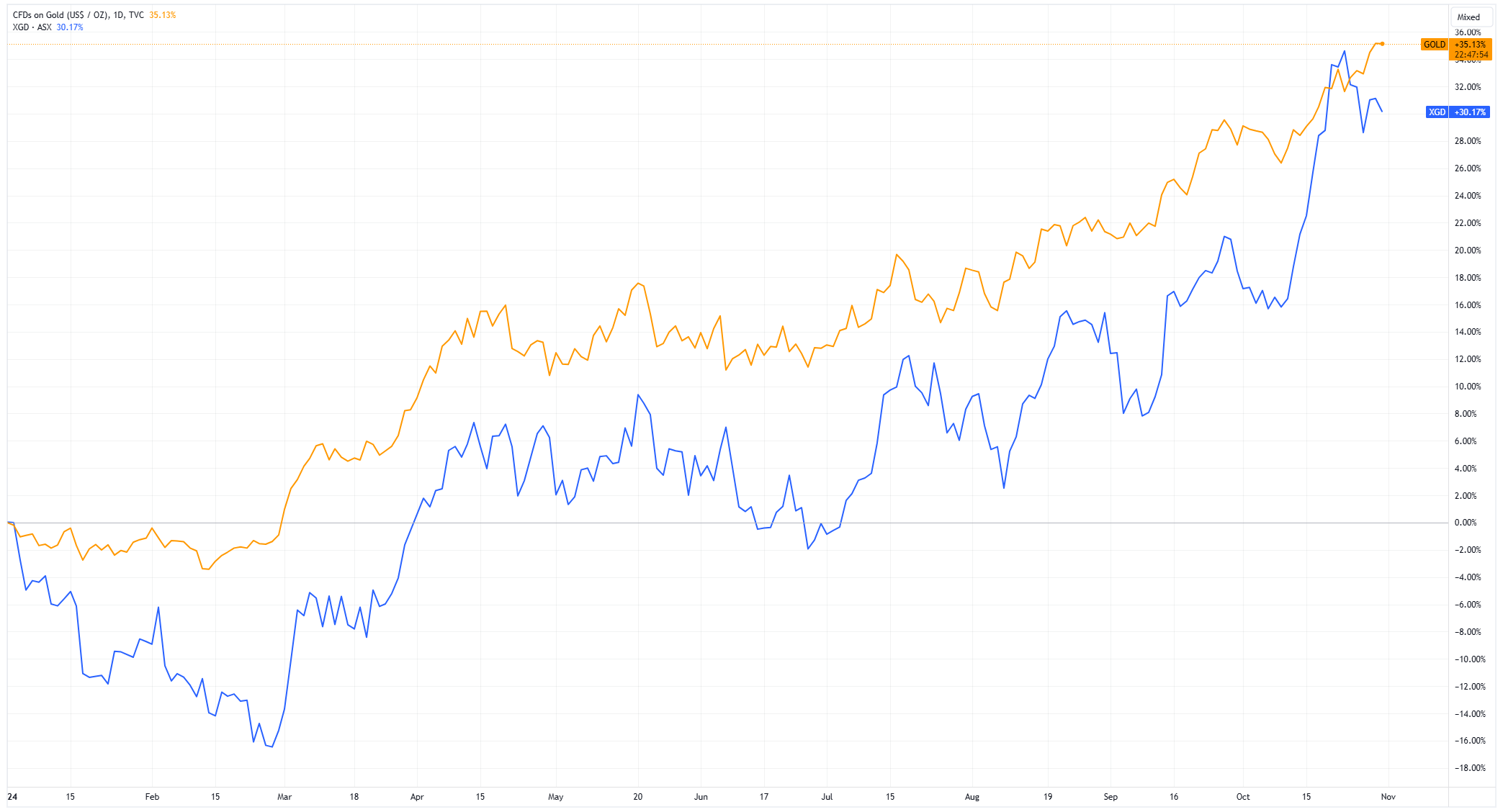

Bullion has rallied approximately 35% this year, reaching an all-time high of US$2,790 an ounce on Wednesday. Yet ASX investors have watched with frustration as gold mining stocks failed to match this impressive run.

As part of Livewire’s Alternatives in Focus series for 2024, I wanted to take a closer look at the divergence between gold prices and Australian gold miners, explore why mining stocks have underperformed, and discuss options for investing in physical gold.

Gold Miner Underperformance

The S&P/ASX All Ordinaries Gold Index has trailed behind the performance of physical gold by 10-15% for most of this year.

“The market has not rewarded gold miners with a rising commodity price as historically the sector has experienced significant increases in costs which have offset much of the benefit from higher revenues,” says Matthew Fist, Portfolio Manager of the Firetrail Australian Small Companies Fund.

“Simply put, free cash flows to equity holders have not benefited from a rising gold price.”

It isn’t easy being a gold miner. They face a wall of worries and risks including weather, mine collapses, machinery breakdowns, labour shortages, supply chain issues, cost inflation, environmental and regulatory risks and more.

Fist also attributes the underperformance to factors including i) poor capital discipline on M&A; ii) rising capital and operating costs; iii) reduced mine life and iv) undisciplined capital allocation decisions.

The All Ords Gold Index's underperformance peaked around late February and a brief review of company announcements will tell you why.

Western Australia faced unprecedented rainfall in the March quarter, forcing several miners to downgrade their production guidance and raise costs.

- Regis Resources (ASX: RRL) – 18 March: "In March a substantial and protracted regional rain event, with more than 50% of average annual rainfall month to date, has impacted operations." Regis cut its March quarter gold production forecast but reaffirmed its FY24 production guidance.

- Gold Road (ASX: GOR) – 14 March: "The substantial rainfall event has resulted in the closure of Laverton Shire roads that provide access to Gruyere and the suspension of mining operations over a portion of this period, with the likely resumption of open pit access expected next week." GOR eased its March quarter gold production forecast but reaffirmed FY24 guidance.

- Capricorn Metals (ASX: CMM) – 11 March: "The combined impact of these two weather events has been the loss of mining shifts totalling in excess of 8 full days of mining in the March 2024 quarter to date." Capricorn downgraded March quarter production figures and said it expects FY24 production to come in at the lower end of its guidance.

- Westgold (ASX: WGX) – 14 March: "Flooding has impacted some operations and impacted both surface and underground haulage ... Wet feed has contributed to crusher failures at both Fortnum and Tuckabianna over this period." Westgold said the events have impacted approximately 15,000 to 20,000 ounces of production in FY24. Westgold expects production to come in at the lower end of its FY24 guidance and costs to be at the top end.

The All Ords Gold Index briefly traded on par with gold prices last week but that was relatively short-lived after the world’s largest gold miner – Newmont (ASX: NEM) – reported a bleak first-quarter 2025 report and production outlook.

Newmont reported all-in sustaining costs of US$1,611 an ounce for the quarter or 10.3% above market expectations of US$1,445 an ounce. In the conference call, management said long-term gold production will average 6Moz [million ounces] per annum compared to prior forecasts of 6.6Moz.

The blowout costs drove top US-listed rivals like Barrick Gold and Agnico Eagle Miners lower on cost fears.

On Wednesday, UBS downgraded its Barrick Gold (NYSE: GOLD) – the world’s second-largest gold miner – citing “while gold price momentum remains positive, and we expect further upward revisions to consensus gold price forecasts, we see downside risks to volume and cost assumptions. As a result, we are downgrading Barrick Gold to Neutral ahead of its 3Q24 results.”

Find the best gold miners or just hold gold?

“If you believe gold prices will continue to rise over time, you can identify a well-run gold business and you can stomach the additional volatility, then gold miners are the better option,” says Fist.

“If, however, you want reduced risk and volatility or think the gold price will fall, then owning gold may be a safer (and less exciting) option.”

In other words – If you’re not a good stock picker, physical gold might be the better alternative. And the ASX has no shortage of gold-related ETFs.

| Ticker | Name |

| GOLD | Global X Physical Gold |

| PMGOLD | Perth Mint Gold ETP |

| ETPMAG | Global X Physical Silver |

| ETPMPM | Global X Physical Precious Metal Basket |

| BCOM | Global X Bloomberg Commodity Complex ETF |

| NUGG | Vaneck Gold Bullion ETF |

| GLDN | iShares Physical Gold ETF |

| QAU | BetaShares Gold Bullion ETF - Currency Hedged |

| GXLD | Global X Gold Bullion ETF |

The ETFs all offer gold exposure, with subtle differences including:

- Global X Physical Gold: Seeks to provide investment results that correspond generally to the price performance, before fees and expenses, of the Gold Price (PM fix) in Australian dollars ($A) with a 0.40% pa management fee

- Perth Mint Gold: Tracks the international price of gold in $A with a 0.15% pa management fee (lowest cost gold ETF on the ASX)

- Vaneck Gold Bullion ETF: Backed by physical Australian origin gold bullion bars (so tracks the gold price in $A) with a 0.25% pa management fee

- iShares Physical Gold ETF: The underlying assets of this ETF are backed by physical gold bars held in the vaults of J.P. Morgan in London, tracks the performance of gold in US dollars with a 0.18% pa management fee

When it comes to gold miners, Fist says "if costs are contained and the company has good capital discipline, gold miners should mathematically offer greater leverage to gold than an investment in the physical metal."

The landscape for gold miners has been mixed. While established emerging producers like Bellevue Gold and De Grey Mining have underwhelmed investors this year, standout performers have emerged. Notable success stories include Spartan Resources, buoyed by significant discoveries, and Catalyst Metals, which has leveraged its low-cost operations to deliver strong returns.

Where do you prefer to play in the gold space – physical metal, an established ASX producer, or the higher-risk junior? Let us know in the comments below.

2 topics

6 stocks mentioned

1 contributor mentioned