Gold’s ascent to all-time highs

Gold has staged an impressive rally thus far in 2024, with the metal recently hitting an all-time high. We believe that recent price levels could be sustainable, potentially supported by likely Federal Reserve interest rate cuts, the possibility of a “higher for longer” inflationary environment, and recently robust physical market demand.

Key Takeaways

- Gold’s function as a store of value has stood the test of time, helping owners maintain their purchasing power over thousands of years.

- Gold’s year-to-date (YTD) rally to all-time highs was driven by both the physical and financial markets. Current prices may be sustainable, with the Fed funds futures market currently pricing in a high probability of interest rate cuts this year.(1)

Gold as a store of value

Gold’s long-term track record as a store of value is unmatched by any other asset, standing the test of time and preserving its value for thousands of years. The most pronounced example of this is the salary of Centurion soldiers under Roman Emperor Augustus, who were paid 38.58 ounces of gold per year.(2) This equates to nearly $94,000 today, which is roughly equivalent to the salary of a US Army Captain with six years of experience.(3,4)

Gold’s scarcity, as well as the metal’s physical characteristics, including its natural beauty, durability, and malleability, can help explain its lasting allure over time.

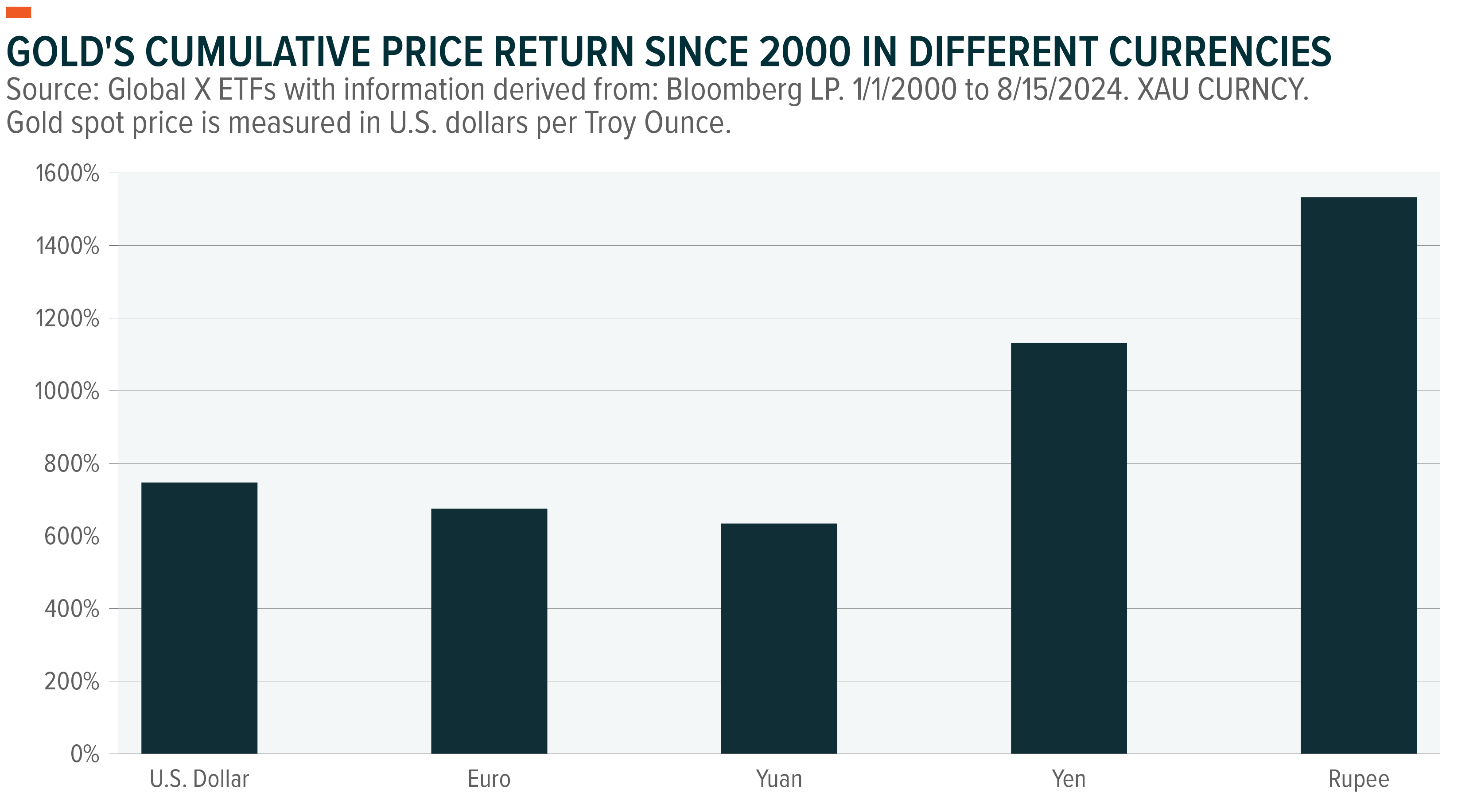

Gold, which was historically used as a means of trade or money, has also maintained its value despite all major currencies no longer being pegged to the metal, appreciating nearly 70x since the US abandoned the gold standard in 1971.(5) Although gold’s price appreciation in US dollar (USD) terms has been remarkable, its ability to protect purchasing power in other currencies is even more impressive, illustrated in the chart below. This track record as a store of value has also led to gold becoming a “flight to quality” beneficiary, often providing downside protection during times of economic, geopolitical, and financial uncertainty.

Market update

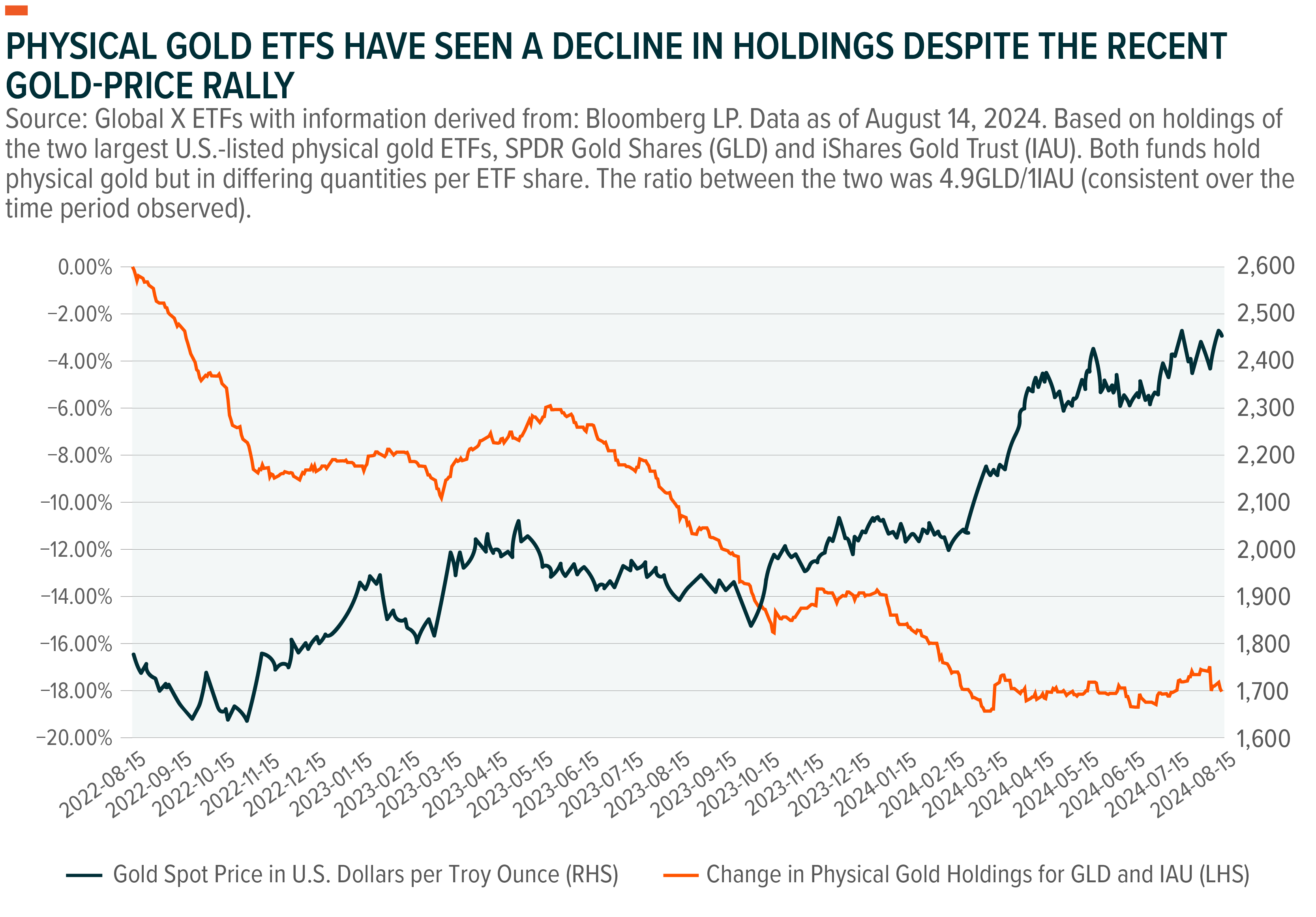

The gold market has defied expectations thus far in 2024, rallying in the face of the Federal Reserve’s higher for longer monetary policy stance. This strong price appreciation also occurred despite US investors selling, with the two largest US-listed physical gold ETFs seeing decreases in their number of physical gold holdings over the previous two years.(6) We see this price appreciation being driven by a mix of both the physical and financial markets. First, physical market demand has remained robust, with major central banks, such as the People’s Bank of China (PBOC) and the National Bank of Poland, being large buyers of the bullion.(7) Although we have seen the PBOC slow purchases over recent months, which is not unprecedented given the strong YTD rally, the central bank remains committed to increasing gold’s share of its reserves, which stood at 4.9% in June versus the global average of 16%.8 In addition to global central bank demand, we have also seen strong retail buying across many geographies, especially in Asia.

This strong physical market demand has helped offset the aforementioned selling pressure from US-listed physical gold ETFs.

On the financial market side, gold’s historical inverse relationship with real interest rates also provides insight into the rally.(9) On the surface, the decline in US YOY inflation seen in the first half of 2024 pushed real rates higher, which should have weighed on the price of gold. However, we believe the market is looking beyond this, pricing in a higher-for-longer inflation scenario, with the Federal Reserve potentially embarking on an easing cycle. This should push real yields lower and possibly add to the sustainability of the gold rally. Heightened geopolitical tensions could also be adding to the bullion’s appeal, with its “flight to quality” attribute providing diversification to portfolios.

Conclusion

Gold’s extensive track record as a store of value is unmatched, providing potential portfolio diversification during times of economic uncertainty and heightened geopolitical risk. Despite the strong year-to-date rally, we think the potential for Fed rate cuts, a higher-for-longer inflation environment, and robust physical market demand all point to potential price sustainability.

Global X Physical Gold (ASX: GOLD) invests in physical gold via the stock exchange.

Global X Gold Bullion ETF (ASX: GXLD) invests in physical gold via the stock exchange at a low management fee for long-term investment.

1 topic

2 stocks mentioned

2 funds mentioned